In Singapore, our government offers bonds such as Singapore Government Securities (SGS), Treasury Bills (T-Bills), and even Singapore Saving Bonds as an avenue for investors who wish to grow their idle funds by taking on very little risk. However, as this is a relatively safe investment, it usually comes with a lower return. Similarly, the Central Bank of the United States (US) also offers government bonds for investors to purchase to raise funds to finance its operations. US Treasuries are considered to be among the safest investments in the world, as they are backed by the full faith and credit of the US government. As of 1st August 2023, the credit rating of US government was Aaa/AA+/AA+ (Moody’s/S&P/Fitch).

There are several types of Treasury securities being offered by the US government, including Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds). T-bills are short-term securities with maturities of one year or less, T-notes have maturities ranging from two to ten years, and T-bonds have maturities of more than ten years. Treasuries are widely used as benchmark investments by individuals, institutions, and governments around the world.

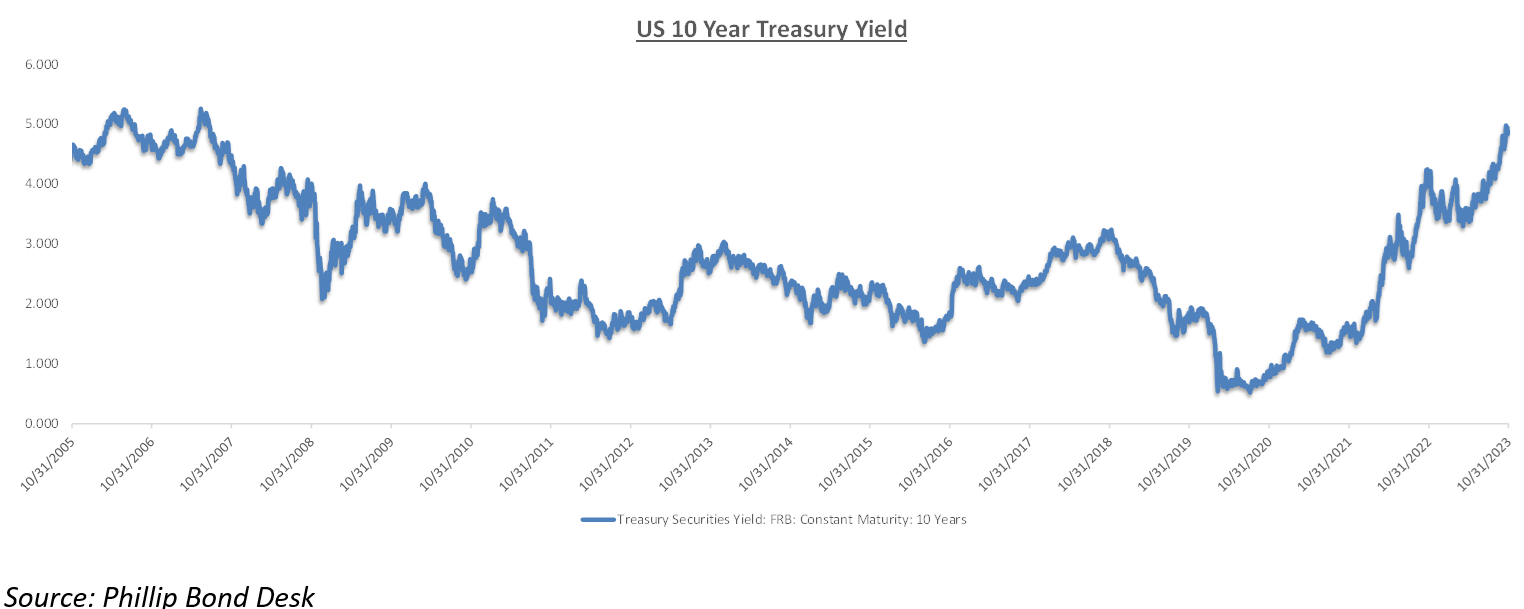

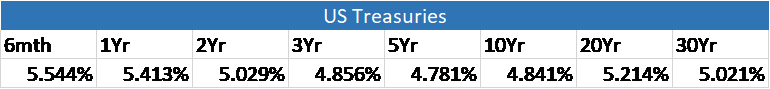

With the current high-interest rate environment that we are experiencing, bond yields have been climbing higher than before. The US 10-year Treasury Yield is a widely used benchmark/indicator for many investors due to its liquidity, duration, and transparency. It is usually used as a risk-free rate comparison for a 10-year investment. On 19th October 2023, the US 10-year Treasury yield crossed 5% for the first time in 16 years (since 2007) due to a higher for longer rate outlook by its Central Bank (Federal Reserve) and also a sell-down of government bonds to cover widening deficits. However, this yield has fallen slightly at the point of writing hovering around the 4.8% range.

As of 27 October 2023

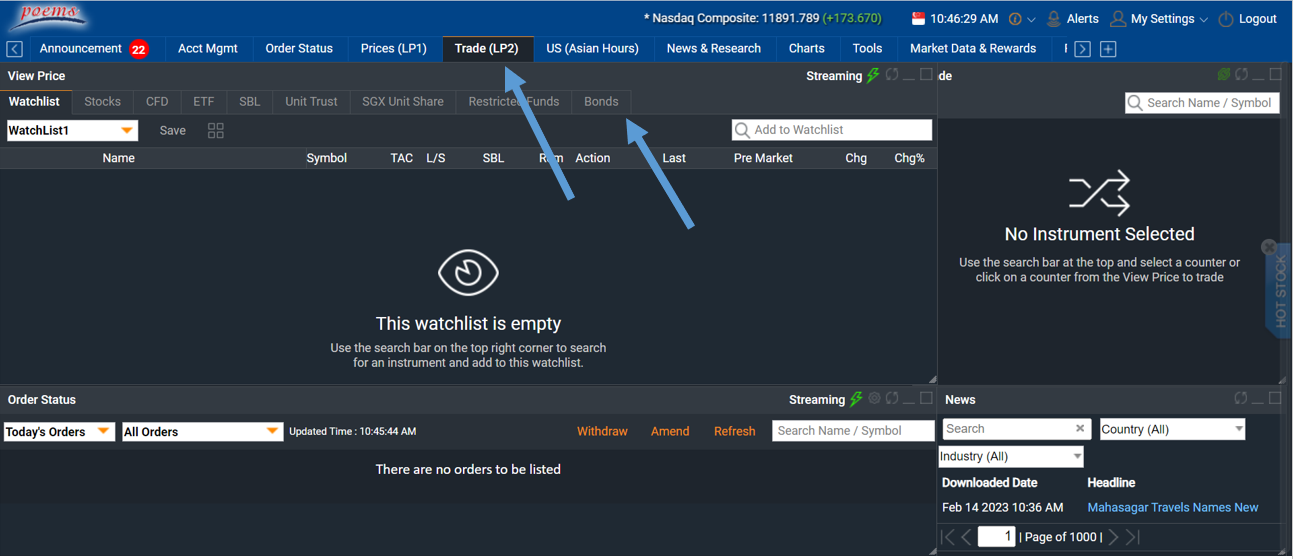

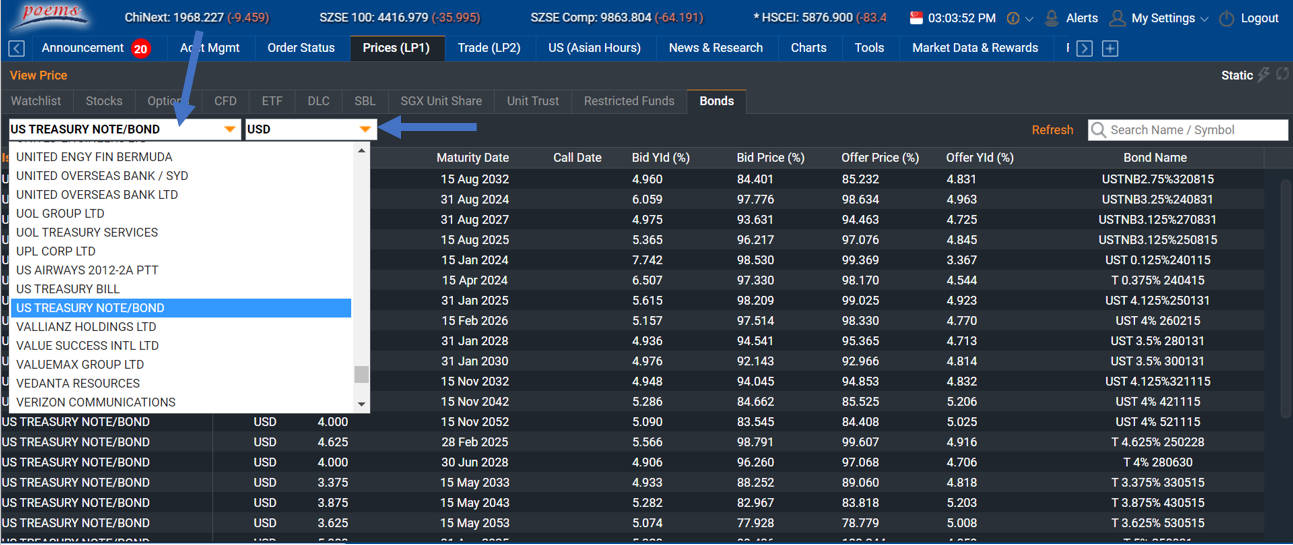

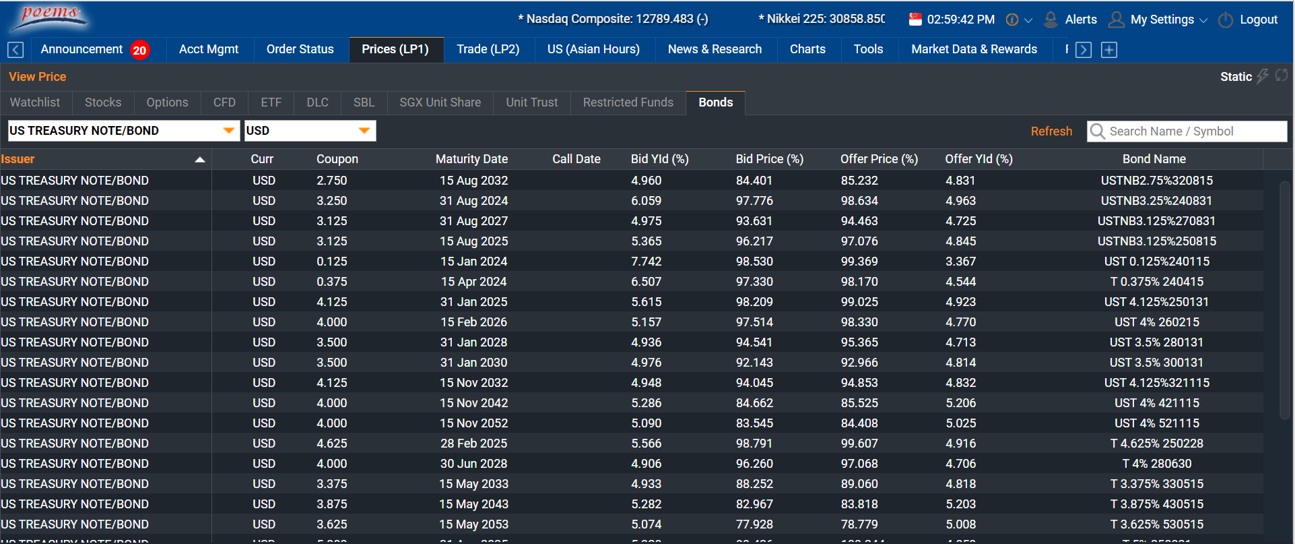

Investors looking to seize the opportunity presented by the current high-yielding US Treasuries in the prevailing interest rate environment can access this treasury exposure through Phillip Securities. We facilitate this exposure by providing secondary trading of US Treasuries on our wholesale bond market.

(How to locate US Treasury on POEMS 2 Web)

Step 1

Step 2

Step 3

The minimum size to trade US Treasury on our wholesale bond market would be US$200,000 with a custody fee of 0.05% p.a. More detailed information can be found on our Treasury Product Page alongside a comprehensive video guide on how you can locate and trade US Treasuries on our POEMS 2 web platform.

An alternative that investors may look at for exposure to the fixed-income US treasury space would be Bond Exchange Traded Funds (ETF). However, do note that for bond ETFs these funds also do incur a management fee which is also known as the expense ratio for the fund. Some of the more widely traded bond ETF are:

TLT

TLT is the ticker symbol for the iShares 20+ Year Treasury Bond ETF. It tracks an index of US Treasury bonds with remaining maturities of 20 years or more and is traded on the New York Stock Exchange (NYSE). TLT is usually used by investors who wish to speculate on longer-term interest rate directions. The total assets under this fund constitute US$40.38tn, an average daily volume of approx. 37 million and an expense ratio of 0.15%. Do note that TLT is more sensitive to interest rate directions as it comprises longer-duration bonds within its fund.

BIL

BIL is the ticker symbol for the SPDR Bloomberg 1-3 Month T-Bill ETF. It tracks an index of all publicly issued zero-coupon US Treasury bills with a maturity of at least 1 month, but less than 3 months. It is traded on the New York Stock Exchange (NYSE) and is usually used by investors who wish to speculate on near-term interest rate directions. The total assets under this fund constitute US$35.5tn, an average daily volume of approx. 7.9 million and an expense ratio of 0.14%. BIL is less volatile than longer-term bond ETFs, meaning that its price is less likely to fluctuate wildly.

IEF

IEF is the ticker symbol for the iShares 7-10 Year Treasury Bond ETF. It tracks an index of US Treasury bonds with remaining maturities between seven and ten years. It is traded on NASDAQ and is usually used by investors who wish to speculate on medium-term interest rate directions. The total assets under this fund constitute US$27.2tn, an average daily volume of approx. 9.1million and an expense ratio of 0.15%. IEF would be a balance between TLT and SHY.

In conclusion, there exist numerous avenues through which an investor can gain access to the fixed-income market. Whether it involves participating in the wholesale market or utilizing bond funds on the exchange, the underlying assets still revolve around bonds. As such, investors should always maintain vigilance over their investments and periodically assess their portfolios to ensure alignment with their investment objectives.