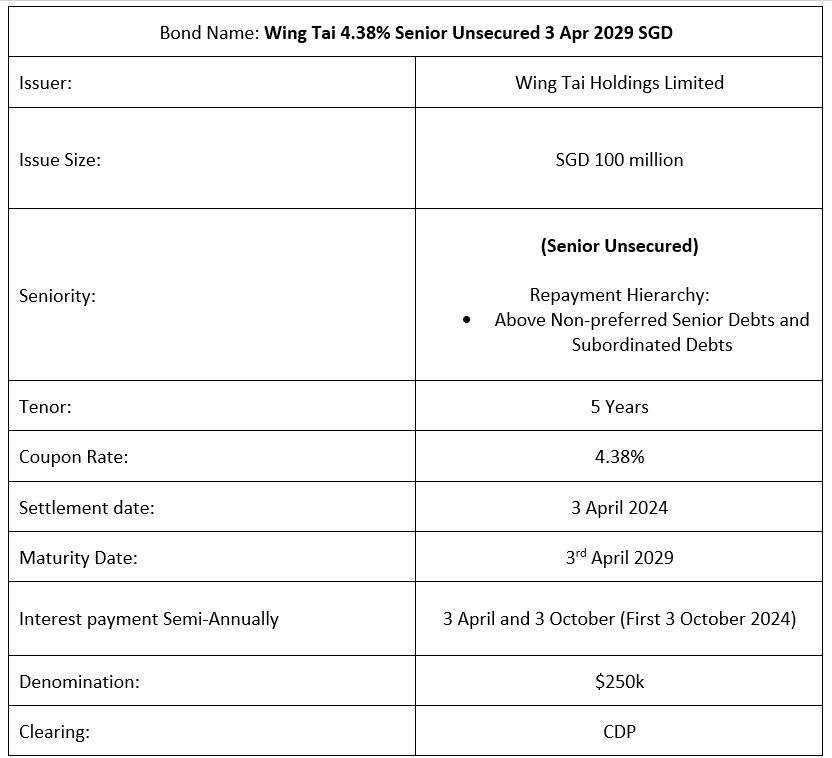

Wing Tai recently announced the issuance of its Senior Unsecured notes at final price guidance of 4.38%. These bonds come with a semi-annual coupon payment scheduled on the 3rd of April and the 3rd of October each year, with the first coupon payment commencing on the 3rd of October 2024. This new issuance is non-rated and the proceeds from these bonds will be used to finance working capital requirements, investments of the Issuer and its subsidiaries, and to refinance its existing borrowings.

Company Overview

Some may know Wing Tai Holdings Limited as a property developer company but do you know that the company also has subsidiaries that provide retail services? Some established brands in their retail lines include Adidas, Uniqlo, Furla, G2000 and MANGO. Wing Tai Holdings Limited is incorporated and domiciled in Singapore and is listed on the Singapore Exchange Securities Trading Limited ticker (SGX:W05) with a market capital of $1.07bn as of 26 March 2024.

1H2024 Financials

Wing Tai’s 1H24 total revenue came in at $97.7m, which is 63% lower YoY than 1H23, which is $260.7m. This lower revenue was attributable to the lower contribution from its development properties sector, as the revenue for the current period was largely attributed to the progressive sale recognition from The M @ Middle Road and the sale of residential units in Jesselton Hills in Malaysia. However, The M @ Middle Road has obtained a Temporary Occupation Permit (TOP) as of 30 August 2023, and it has been fully sold. Therefore, the group should expect to collect fewer outstanding bills moving forward from this project. Additionally, the Hong Kong residential market continued to be dampened by high interest rates, and its office market continued to experience pressure on rental levels and high vacancy. Hence, Wing Tai’s share of profits of associated and joint venture companies was slightly lower at $32.2m in 1H24 from the $33.4m in the corresponding period due to lower contribution from Wing Tai Properties Limited in Hong Kong. However, higher contributions from its Uniqlo joint ventures partially offset this decline.

Moving on to its liquidity position, the group’s cash and cash equivalent improved by +65% YoY from $412.8m in 1H23 to $683.7m in 1H24, which translates to a gearing (Net Debt/ Equity attributable to equity holders of the company) of 0.087 times in 1H24 and improvement from 0.282 times in 1H23.

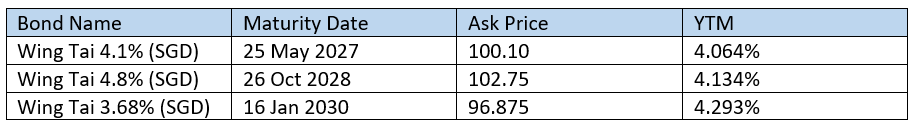

If we look at the pre-existing bonds of Wing Tai:

These new 4.38% notes are priced reasonably, giving off a slightly higher yield than the other outstanding Wing Tai’s senior bonds currently trading on the market. Hence, if investors wish to lock in a 4.38% yield for another 5 years then this new issuance is worth the look.

Bond Overview