Terms and Conditions for SGX Clients Global Trading Campaign

Terms & Conditions

1. Eligibility criteria:

- Retail Clients that are ONLY trading the Singapore Market

- Last Traded Singapore Market from 1 Jan 2024 to 30 July 2025

- Last Traded Foreign Shares before 1 Jan 2024

- Account Opened before 1 Jan 2025

- The promotion is exclusively for clients who received the EDM titled '<ADV> Trade Beyond Borders & Earn Stock Coupons🌍 💸' on 22 August 2025 or '<ADV> Don’t Miss Out: Win up to S$50 Stock Coupons with Your Next Trade!' on 9 September 2025 or '<ADV> Still Hesitating? S$50 Stock Coupons Await!' on 2 Oct 2025 or '<ADV> Don’t Wait — Win S$50 When You Trade!' on 30 0ct 2025

2. Rewards:

Tier 1:

- Completes 2 to 4 BUY trades and completes relevant forms (W8-Ben, RWS, Fractional RDS) within 14 calendar days from the date that the email was sent to receive:

- S$20 Stock Coupon + Exclusive Limited One-Time TA webinar by PSPL Global Markets US Dealing Team

or

Tier 2:

- Completes at least 5 BUY trades and completes relevant forms (W8-Ben, RWS, Fractional RDS) within 14 calendar days from the date that the email was sent to receive:

- S$50 Stock Coupon + Exclusive Limited One-Time TA webinar by PSPL Global Markets US Dealing Team

*BUY Trades refer to Stocks, ETFs

*Client can only receive either Tier 1 or Tier 2 Rewards. For example, if the client completes 5 eligible trades, he/she will only receive the Tier 2 rewards.

3. Activation and Crediting of Rewards

- Only applicable to ONLINE trades through POEMS’ suite of platforms.

- Exchange fee, other charges, and GST are payable by Customers.

- Trade Reward:

- Customers are required to download and log in to POEMS Mobile 3 App to receive the Trade Reward once they have fulfilled the requirements.

- Customers are required to claim the Tier 1 or 2 trade Reward on POEMS Mobile 3 App within 30 days of becoming eligible. Failure to do so will result in forfeiture of the Reward/s.

*S$20 or S$50 Stock Coupons:

- How to Use:

- Activate – ‘Swipe to Activate’ to apply the Coupon.

- Trade – After activating your Stock Coupon, place an eligible trade.

- Rebate Credited – Once the trade is completed successfully, S$20 or S$50 will be credited to your Account within 2 working days.

- Eligibility Criteria:

- Buy stocks and ETFs

- Foreign Markets only. Foreign Markets are defined as non-SGX (Singapore Stock Exchange) trades.

- Cash trades only

- Online trades only

* The S$20 or S$50 US Stock Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 30 days from the date of issuance.

- Once activated, the Coupon cannot be deactivated or reissued.

- The S$20 or S$50 US Stock Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- The S$20 or S$50 rebate, up to the contract value, will be credited to the eligible Account within 2 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If there are multiple Stock Coupons active, the one that has a nearer expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- Customers who have redeemed this promotion will not be eligible for similar promotions in the future.

- If the Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$20 or S$50 rebate, regardless of which Account the Coupon was activated in.

For example:

The customer has Account A and Account B. The Customer activates the Coupon in Account A, but later performs a successful, eligible trade using Account B. In this case, Account B will be awarded the S$50 rebate.

- This Promotion does not apply to:

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

4. Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

5. By redeeming this item from your Rewards page, you acknowledge that you have read and consented to these Terms and Conditions.

6. Days refer to calendar days.

7. The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

8. This advertisement has not been reviewed by the Monetary Authority of Singapore.

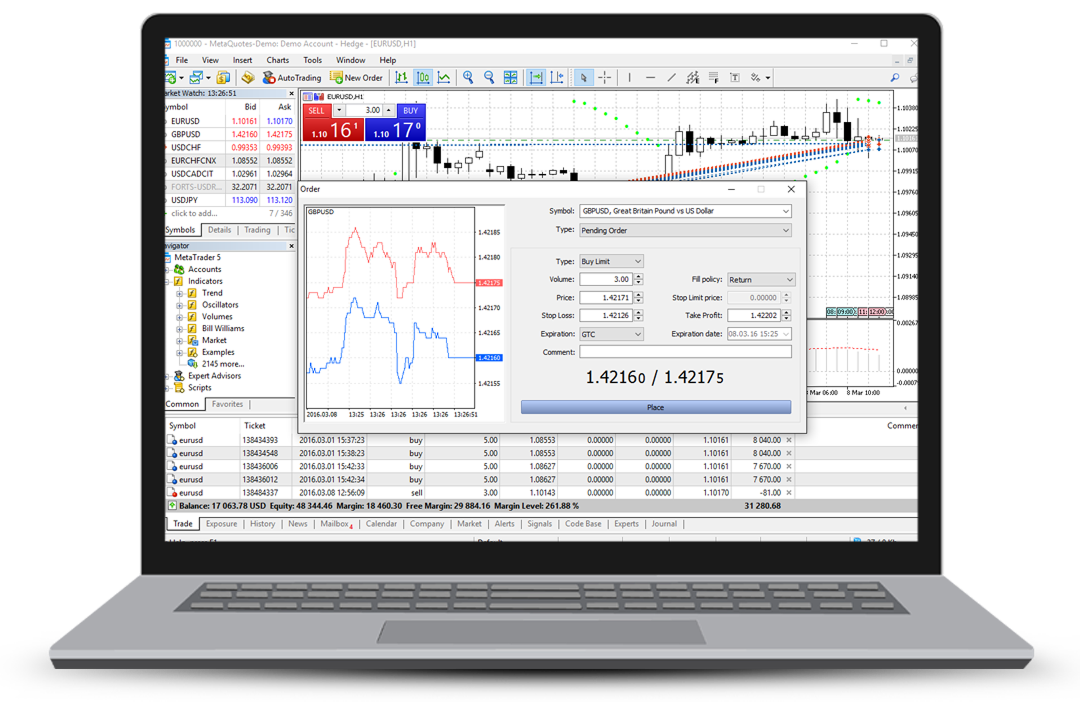

CFD MT5 draft

Trader Faster, Smater and Better.

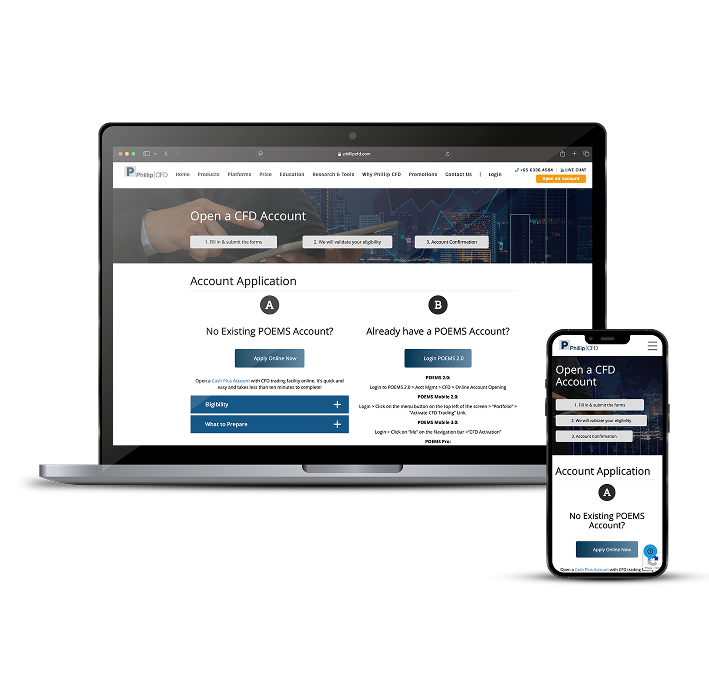

Open Account Try DEMO

A Powerful Platform for Both New and Experienced Traders

Enjoy the perks of trading CFD with POEMS CFD, combined with all latest features of the new POEMS CFD MT5 platform.

Low-cost trading with no commission

Get more from your trades with 0 commissions on index and FX products.

Trade Better with More Clarity

No additional spread

Don’t make any guesses with your trades – see what you need to make the best decisions.

*For equities CFD only

Direct Market Access

Go direct to the market for faster, more seamless executions of trades.

*For Singapore market only

Complementary real-time exchange prices

Analyse trends better with live updates of market data to help you always stay on top of your trades.

*For Singapore market only. Complimentary US prices only for non-professional traders

Comprehensive Trading Tools and Features

for Maximum Versatility

Chart Trading

Place market and pending orders straight onto charts, keeping a clear view of the market while making your trades.

Algorithmic Trading

Trading robots help you analyse trends and execute high-frequency trade operations automatically with unmatched precision and efficiency.

Social Trading

Learn from the best and copy the deals of successful traders in real time or create your own signals for others to subscribe to.

One-click Trading

Execute trades seamlessly with a single mouse click and maximise your opportunities to profit by entering the market exactly when you need to.

Advanced Analytical Tools

Identify the best opportunities for your trades with a whole suite of tools to evaluate patterns and generate buy and sell indicators.

Why Trade with POEMS

Why Trade with POEMS

Dedicated dealing team for every POEMS CFD account opened

Expect round-the-clock, first-class support tailored to your needs, regardless of your trading volume.

Free access to our suite of educational materials

Sharpen your skills for well-informed investment strategies with all our educational resources at your fingertips.

Industry leader for 50 years

Presence in 15 countries worldwide

MAS regulated broker

Segregated funds for security

What's Happening

Find out the latest updates and promotions for POEMS CFD MT5

Trading Central Indicator for POEMS CFD MT5

You can now trade directly on the charts and set timely alerts for selected patterns with the Trading Central Indicators.

POEMS CFD MT5 Trade For Reward Programme

Calling all frequent traders! Trade on POEMS CFD MT5 and receive attractive rewards! The more you trade, the more rewards you earn!

POEMS CFD MT5 Welcome Bonus Promotion

Your S$30 Welcome Bonus Awaits You. Simply open a POEMS CFD MT5 account and fund in S$2000 to get your welcome bonus now!

View More PromotionWhat’s New with POEMS CFD MT5

Need help setting up your POEMS CFD MT5 account or getting started with trading? Access the User Guide for step-by-step guidance and download the MT5 installation file to begin

| Features |  |  |

| Research Tools | Research tools contains:

| Research tools contains:

|

Strategy Tester Refers to back testing of scripts | ||

| Algorithm Trading |

| |

| Multiple Asset Classes |

|

|

| Algorithm Trading | ||

| One-click Trading | ||

| Mobile App | ||

| Price Alerts | ||

| Chart Trading | ||

| Advanced Order Types |

|

|

Set up & Trade with POEMS CFD MT5

Need help setting up your POEMS CFD MT5 account or getting started with trading? Access the User Guide for step-by-step guidance and download the MT5 installation file to begin

View User Guide Download MT5 Installation FileGain Access to Trading Central Indicators with POEMS CFD MT5

Support your market analysis and trading strategies using insights from Trading Central indicators

Round-the-clock Intraday Market Scanning

Real Time Chart Pattern Recognition

Timely Alerts for Selected Patterns

Trade Directly on the Charts

Chart Pattern Quality Indicators

Download Trading Central Indicators View Trading Central Indicators User Guide

FREQUENTLY ASKED QUESTIONS

What is POEMS CFD MT5?POEMS CFD MT5 is known as MetaTrader5 (MT5). The institutional multi-asset platform provides outstanding trading possibilities and technical analysis tools. Additionally, it enables the use of automated trading systems (trading robots) and copy trading.

What are the markets / exchanges supported on POEMS CFD MT5?Please refer to the markets/exchanges supported on POEMS CFD MT5 here.

Toggle TitleIs POEMS CFD MT5 free for use?Yes, there are no charges/fees incurred when using POEMS CFD MT5. All you need is a POEMS account with CFD facility to use the platform.

What are some differences between MT4 vs MT5?MT4 focuses on Forex trading and offers limited access to other financial markets. On the other hand, MT5 provides access to a wider range of assets, including Forex, Stock, Commodities and Cryptocurrencies.

MT5 is considered a more advanced and versatile platform in contrast to MT4, offering a wide array of assets and analytical tools.

Do I need to open a new CFD account for POEMS CFD MT5?No, you can use your existing Phillip CFD account to opt-in for a POEMS CFD MT5 account.

What are the documents required to open an account?No additional documents are required if you are an existing Phillip CFD client.

Can I change my password on POEMS CFD MT5 App?Yes, you can change your password.

Simply login to MT5 platform > Tools > Options > Server > Change.

Can I update my contact details through the POEMS CFD MT5 App?No, you have to update your contact details through POEMS 2.0.

How do I log out from the POEMS CFD MT5 App?To log out of your POEMS CFD MT5 account, go to File > Exit.

Is there any Demo account for me to try out on POEMS CFD MT5?Yes, you can open a POEMS CFD MT5 Demo account here to try out the platform and its features.

Who can I contact if I need help?If you require assistance, please do not hesitate to reach out to your Trading Representatives (TRs). Alternatively, you can email cfd@phillip.com.sg or call us at +65 6336 4564.

Important Notice

CFDs may not be suitable for customer whose risk tolerance is low. Customers are advised to understand the nature and risks involved in margin trading. Any CFD offered is not approved or endorsed by the issuer or originator of the underlying security the issuer or originator is not privy to the CFD contract. Phillip Securities Pte Ltd reserves the right to amend the published information without prior notice. You are advised to read carefully and understand the Risk Disclosure Statement and CFD Risk Fact Sheet before undertaking transactions in CFDs. As CFD is a Specified Investment Product (SIP), retail customers are subject to the relevant assessment for trading/investing in SIPs. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Copyright © 2025. Brought to you by Phillip Securities Pte Ltd (A member of PhillipCapital) Co. Reg. No. 197501035Z. All Rights Reserved.

The following are all the terms & conditions that you must read, understand and agree to when trading CFDs with us.

FAQ and TCs for Welcome Gifts

Welcome Gifts

T&Cs for Welcome Gifts:- Eligibility criteria:

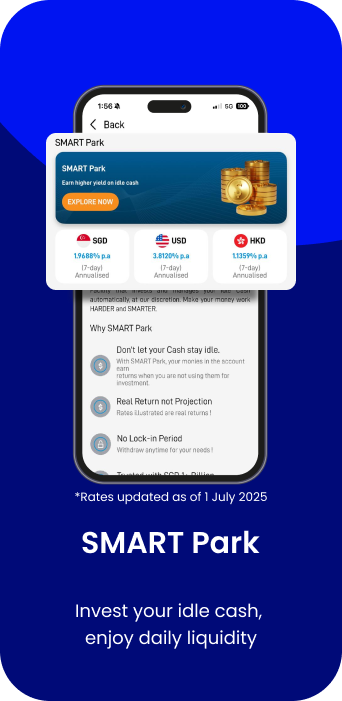

- Customers who open a Cash Plus Account, opt-in to Excess Funds Management Facility (SMART Park), and are new to Phillip Securities Pte Ltd (“PSPL”) from 28 July 2025 to 31 August 2025.

- Customers who do not opt-in to Excess Funds Management Facility (SMART Park) within 14 days of Account Opening will not be eligible to receive the Welcome Gifts.

- Rewards:

- Account Opening:

- Zero US Commissions for 30 days

- 0% Sales Charge on Unit Trust

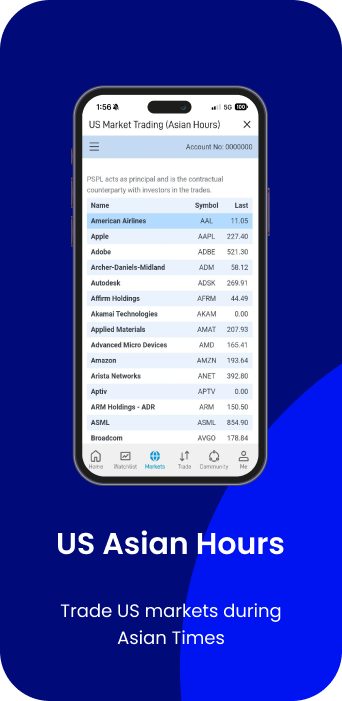

- Free Live Prices for SGX and US Asian Hours

- Free Live Prices for US (NASDAQ, NYSE, AMEX), MY (BURSA), TH (SET), HK (HKEX), and US Options for non-professionals. Please opt in here.

- Free SGX Enhanced Market Depth Access until 30 November 2026

- Fund & Trade:

- Fund in with at least S$3,000 within 14 days of Account opening (“Initial Capital”), hold the funds for at least 30 days, and execute at least 3 BUY Trades within 30 days from Account opening to receive:

- Amazon Fractional Share (Worth S$50)

- Fund in with at least S$10,000 within 14 days of Account opening (“Initial Capital”), hold the funds for at least 30 days, and execute at least 5 BUY Trades within 30 days from Account opening to receive:

- Amazon Fractional Share (Worth S$50)

- Microsoft Fractional Share (Worth S$100)

- Bonus:

- Fund in with at least S$50,000 within 14 days of Account opening (“Initial Capital”), and hold the funds for at least 50 days to receive:

- S$50×3 US Stock Coupons (Worth S$150)

- Prices of the Free Shares are based on dollar-value.

- BUY Trades refer to Stocks, ETFs, and Unit Trusts EXCEPT for US Fractional Shares.

- Initial Capital must remain in the Account for at least 30/50 days. It can be used for BUY trades, but it cannot be withdrawn or transferred.

- The deposit must be fresh cash funds transferred from the Customer’s bank account, and does not include funds transferred within PSPL Accounts, cash dividends, sales proceeds or Account credit transactions.

- Customers must ensure that their Net Cumulative Deposit amount does not fall under S$3,000/S$10,000/S$50,000 to be eligible for the Fund & Trade and/or Bonus Reward based on the tier respectively.

- Net Cumulative Deposit refers to accumulated deposit amount, calculated from the day the Customers make and maintain their initial deposits for 30/50 days. Capital gains and losses are excluded.

- The calculation of Net Cumulative Deposit is done daily. All withdrawals made during the holding period will reduce the Customers’ daily Net Cumulative Deposit.

- Once the daily Net Cumulative Deposit falls below S$3,000, the Customers will no longer receive any Rewards. If the daily Net Cumulative Deposit falls below S$10,000 but remains at or above S$3,000, Customers will only be eligible for Tier 1 Rewards.

- Amalgamated trades (BUY or SELL Trades of the same counter listed on SGX and HKEx respectively, that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash, SRS, or CPF) with the same Account) are considered as one trade. This is due to the fact that we only charge one commission for such trade orders. Please refer to https://www.poems.com.sg/faq/trading/general/what-is-amalgamate/ for more information and available markets.

BUY or SELL trades of the same Unit Trust that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash, SRS, or CPF) with the same Account are considered as one trade. Same trading day refers to orders placed from T-1 after 3:01pm to T day at 3pm.

- Fund in with at least S$3,000 within 14 days of Account opening (“Initial Capital”), hold the funds for at least 30 days, and execute at least 3 BUY Trades within 30 days from Account opening to receive:

- Account Opening:

- Activation and Crediting of Rewards

- Account Opening Rewards:

- Zero US Commissions for 30 days

- Only applicable to ONLINE trades through POEMS’ suite of platforms.

- Exchange fee, other charges, and GST are payable by Customers.

- Eligible Customers will be awarded the Zero US Commission reward within 3 working days upon Account Opening.

- Customers will receive an email notification once the Zero US Commission has been activated on their Account.

- PSPL will not be liable to compensate for any commission charges incurred on US trades prior to the activation of the Zero Commission reward.

- 0% Sales Charge on Unit Trust will be granted upon Account opening.

- Free Live Prices for SGX and US Asian Hours will be granted upon Account opening.

- Free Live Prices for US (NASDAQ, NYSE, AMEX), HK (HKEX), and US Options for non-professionals.

- Login to POEMS 2.0 web > ‘Market Data & Rewards’ > ‘New Subscriptions’ > tick the boxes for the Live Prices > complete the subscriber agreement and submit > click ‘Submit New’ > Enter your password for confirmation.

- Login to POEMS Mobile 3 App > Me Tab > Market Data under Forms, section > Subscribe US (NASDAQ, NYSE, AMEX), MY (BURSA), TH (SET), HK (HKEX), and US Options

- Free subscription for SGX Enhanced Market Depth Access would be granted automatically.

- Zero US Commissions for 30 days

- Tier 1 or 2 Fund & Trade Reward:

- Customers are required to download and login to POEMS Mobile 3 App within 30 days of Account Opening, in order to receive The Tier 1 or 2 Fund & Trade Reward, once they have fulfilled the requirements.

- Customers are required to claim the Tier 1 or 2 Fund & Trade Reward on POEMS Mobile 3 App within 30 days of becoming eligible. Failure to do so, will result in forfeiture of the Reward/s.

- Free Fractional Shares:

- Upon redeeming the free US Fractional Share Coupon/s on the POEMS Mobile 3 App > Me Tab > My Rewards Inventory, the free US Fractional Shares will be credited into the eligible Customers’ Account within 10 working days.

- Customers must complete the following items in order to receive the free US Fractional shares into their Account within 30 days from Account opening:

- Bonus Reward:

- S$50×3 US Stock Coupons:

- How to Use:

- Activate – ‘Swipe to Activate’ to apply the Coupon.

- Trade – Place a trade on the Stock Coupon that meets the Eligibility Criteria.

- Rebate Credited – Once the trade is completed successfully, S$50 will be credited to your Account within 2 working days.

- Eligibility Criteria:

- Buy stocks only

- US Market only (Fractional Shares are applicable as well)

- Cash trades only

- Online trades only

- The S$50 US Stock Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 30 days from the date of issuance.

- Once activated, the Coupon cannot be deactivated or reissued.

- The S$50 US Stock Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- The S$50 rebate, up to the contract value, will be credited to the eligible Account within 2 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If there are multiple Stock Coupons active, the one which has a nearer expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- If the Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$50 rebate, regardless of which Account the Coupon was activated in. For example:

- Customer has Account A and Account B. Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$50 rebate.

- This Promotion is not applicable to:

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- By redeeming this item, you acknowledge that you have read and consented to these Terms and Conditions.

- How to Use:

- S$50×3 US Stock Coupons:

- Account Opening Rewards:

- Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion. - By redeeming this item from your Rewards page, you acknowledge that you have read and consented to these Terms and Conditions.

- Days refer to calendar days.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Customers who have any existing Accounts with PSPL

- Customers who have closed any Accounts with PSPL before

- Corporate Accounts and Joint Account holders

- All employees of PSPL’s entities and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

- This Weekly Gifts promotion will run every Tuesday from 29 July 2025 to 1 September 2025, with a new Stock Coupon offered each week.

- The Weekly Gifts Coupons will be credited to the first 50 unique Customers each week who meet all the following conditions:

- Open a Cash Plus Account

- Opt-in to Excess Funds Management Facility (SMART Park)

- Are new to Phillip Securities Pte Ltd (“PSPL”)

- Download and log in to the POEMS Mobile 3 App within the same week that the Account is opened

- Weekly Gifts:

- Week 1: Nation Builders Week (29 July 2025 to 4 August 2025)

- S$50 Sembcorp Industries (U96) Stock Coupon

- Week 2: Home & Heartland Week (5 August 2025 to 11 August 2025)

- S$50 CapitaLand Integrated Commercial Trust (C38U) Stock Coupon

- Week 3: Transport Hub Week (12 August 2025 to 18 August 2025)

- S$50 ComfortDelGro (C52) Stock Coupon

- Week 4: Sustainable Future Week (19 August 2025 to 25 August 2025)

- S$50 ST Engineering (S63) Stock Coupon

- Week 5: Financial Hub Week (26 August 2025 to 1 September 2025)

- S$50 SGX (S68) Stock Coupon

- Week 1: Nation Builders Week (29 July 2025 to 4 August 2025)

- Crediting of Rewards:

- Eligible Customers will receive their Coupon in the “Me” tab > Rewards > My Rewards Inventory on the POEMS Mobile 3 App.

- Coupons will be credited in the week following the qualifying activity. Example: If Customer A opens a Cash Plus Account on 29 July 2025 and logs into the POEMS Mobile 3 App on 30 July 2025, and is among the first 50 eligible Customers that week, they will receive the Week 1 Coupon, which will be credited starting 5 August 2025, and can be used during Week 2 (5 to 11 August 2025).

- An email notification will be sent to the eligible Customers’ email address that is registered with POEMS in the following week based on the Account date they opened.

Weekly Gifts Eligible Period Redemption & Trading Period for Eligible Customers 1 U96 29 Jul to 4 Aug 5 Aug to 11 Aug 2 C38U 5 Aug to 11 Aug 12 Aug to 18 Aug 3 C52 12 Aug to 18 Aug 19 Aug to 25 Aug 4 S63 19 Aug to 25 Aug 26 Aug to 1 Sep 5 S68 26 Aug to 1 Sep 2 Sep to 8 Sep - How to Use:

- Activate – Tap the ‘REDEEM’ button to apply the Coupon to your next eligible trade.

- Trade – Place a trade on the counter specified on the coupon only.

- Rebate Credited – Once the trade is completed successfully, S$50 will be credited to your Account within 10 working days.

- Eligibility Criteria:

- Buy stocks only

- Counter specified on the Coupon only (Fractional Shares are applicable as well)

- Cash trades only

- The Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 30 days from the date of issuance.

- Once redeemed, the Coupon cannot be deactivated or reissued.

- The Stock Coupon will be applied to the first successful eligible trade executed, after the Coupon redemption and before its expiry.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the Coupon will be forfeited, and no rebate will be issued.

- Each Customer is eligible for only one Weekly Gifts Stock Coupon.

- If there are multiple Stock Coupons active, the one that first expires will be used by default. If the Coupons are of the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- If Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$50 rebate, regardless of which Account the Coupon was activated in. Example.

- Customer has Account A and Account B, Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$50 rebate.

- This Promotion is not applicable to

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- This Fund & Flourish Promotion is only valid for those who qualify for the Welcome Gifts promotion (opened a Cash Plus Account and opt-in to Excess Funds Management Facility (SMART Park) from 28 July 2025 to 31 August 2025 and funded at least S$3,000 within the 14 days of Account Opening).

- Net Cumulative Deposits must be made from 1 September 2025 to 30 September 2025 to qualify, both dates inclusive.

- Customers are required to hold their fresh funds in the month of September 2025 to qualify for the Stock Coupons.

- Receive Stock Coupons:

- Net Deposit S$10,000 – S$50 US Stock Coupon

- Net Deposit S$20,000 – S$50×3 US Stock Coupons

- Net Deposit S$30,000 – S$50×6 US Stock Coupons

- Stock Coupon:

- The Stock Coupon will be credited into the eligible Customers’ Account in the POEMS Mobile 3 App > Me Tab > My Rewards Inventory, within 30 days of the end of the campaign.

- How to Use:

- Activate – ‘Swipe to Activate’ to apply the Coupon to your next eligible trade.

- Trade – Place a trade on any stock or ETF that meets the Eligibility Criteria.

- Rebate Credited – Once the trade is completed successfully, S$50 will be credited to your Account within 2 working days

- Eligibility Criteria:

- Buy stocks only

- US Market only (Fractional Shares are applicable as well)

- Cash trades only

- The S$50 US Stock Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 90 days from the date of issuance.

- Once activated, the Coupon cannot be deactivated or reissued.

- The S$50 Stock Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- The S$50 rebate, up to the contract value, will be credited to your Account within 2 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$50 rebate, regardless of which Account the Coupon was activated in.

- For Example, Customer has Account A and Account B. Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$50 rebate.

- Rewards for the Fund & Flourish promotion are not stackable, and will only be credited to one valid deposit. For example, Customer makes a total fresh fund of S$50,000 (S$20,000+S$10,000), the Customer will still only receive the S$50×6 Stock Coupons instead of both S$50×6 + S$50×3 Stock Coupons.

- Initial Deposit must be kept in the Account to qualify for the Coupon(s)

- Fund transfer between Accounts are not eligible for the Fund & Flourish promotion. Only Transfers made via PayNow and Banks will be considered.

- This S$20 SGX-Listed Coupons will be credited to the first 500 unique Customers who meet all the following conditions:

- Open a Cash Plus Account between 23 June 2025 and 27 July 2025 to celebrate our 50th Anniversary.

- Open a Cash Plus Account between 28 July 2025 and 31 August 2025 in celebration of Singapore’s National Day.

- Opt-in to Excess Funds Management Facility (SMART Park)

- Are new to Phillip Securities Pte Ltd (“PSPL”)

- Download and log in to the POEMS Mobile 3 App within the same week that the Account is opened

- Crediting of Rewards:

- Eligible Customers will receive the $20 SGX-Listed Coupon in the “Me” tab > Rewards > My Rewards Inventory on the POEMS Mobile 3 App.

- Coupons will be credited in August 2025 and the S$20 rebate, up to the contract value, will be credited to your eligible Account in September 2025 following the successful eligible trade for those who open a Cash Plus Account between 23 June 2025 and 27 July 2025.

- Coupons will be credited in September 2025 and the S$20 rebate, up to the contract value, will be credited to your eligible Account in October 2025 following the successful eligible trade for those who open a Cash Plus Account between 28 July 2025 and 31 August 2025.

- Eligibility Criteria:

- BUY stocks & ETF only

- SG Market only

- Cash trades only

- A minimum contract value of S$2000

- The S$20 SGX-Listed Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Coupon will expire 30 days from the date of issuance.

- Once activated, the Coupon cannot be deactivated or reissued.

- The S$20 SGX-Listed Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the Coupon will be forfeited, and no rebate will be issued.

- Each Customer is eligible to redeem one S$20 SGX-Listed Coupon.

- If there are multiple Stock Coupons active, the one which has a nearer expiration date will be used up first by default. If the Coupons have the same expiry date, the Coupon that was activated first by the Customer will be used by default.

- If the Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$20 rebate, regardless of which Account the Coupon was activated in. For eExample:

- Customer has Account A and Account B. Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$20 rebate.

- The S$20 SGX-Listed Coupon will be found under the Rewards Inventory in the POEMS Mobile 3 App > Me Tab > Rewards Inventory. The Coupon will remain valid for 30 days upon issuance in the inventory.

FAQs

I am an existing Customer of Phillip Securities Pte Ltd (PSPL) and do not own a Cash Plus Account. Am I eligible for the Welcome Gifts if I open a new Cash Plus Account within the promotion period?No. Only Customers who are new to PSPL and have opened a Cash Plus Account within the promotion period are eligible.

When will I receive the Account Opening Rewards upon successful Account opening?The Rewards for 0% Sales Charge on Unit Trust, Free Live Prices for SGX & US Asian Hours & HKEx, and SGX Enhanced Market Depth access will be automatically activated upon successful Account opening.

For the Zero US Commission Reward, it will be activated within 5 working days upon successful Account opening. You will receive an email notification once it has been activated.For Free Live Prices for US (NASDAQ, NYSE, AMEX), HK (HKEx) and US Options, you will be required to activate the feature on POEMS 2.0 Web and/or POEMS Mobile 3 App.

- Login to POEMS 2.0 web > ‘Market Data & Rewards’ > ‘New Subscriptions’ > tick the boxes for the Live Prices > complete the subscriber agreement and submit > click ‘Submit New’ > Enter your password for confirmation.

- Login to POEMS Mobile 3 App > Me Tab > Market Data under Forms section > Subscribe HK (HKEx), US (AMEX, NASDAQ, NYSE), and US Options.

Yes. You will be eligible to receive the Tier 1 Free Fractional Shares Reward if your combined deposits total at least S$3,000 within 14 days of Account Opening and provided that you also executed the 3 BUY eligible Trades (Stocks/ETFs/Unit Trusts) within 30 days of Account Opening.

What if I did not opt-in to US Fractional Shares & acknowledge the disclosure, or did not submit the W-8 BEN form and/or the Risk Warning Statement (RWS) after I had fulfilled the requirements (funded and traded) within the promotion period? Am I still qualified to receive the free US Fractional shares?No. You are required to opt-in to US Fractional shares & acknowledge the disclosure, complete and submit these two forms: W8 BEN form and the RWS form to redeem the free US Fractional Shares on the POEMS Mobile 3 App.

To opt-in to US Fractional Shares & acknowledge the disclosure, please login to POEMS Mobile 3 App > Me Tab > Fractional Opt-in.

For the W8 BEN and RWS forms, please submit them from POEMS Mobile 3 App > Me Tab > Account > Forms.

When will I receive the Free US Fractional Shares Reward upon fulfilling the requirements, opted- in to US Fractional Shares & acknowledged the disclosure, and submitting the W8 BEN form & RWS form?To receive your Free US Fractional Shares Reward, please login to the POEMS Mobile 3 App and navigate to ‘Me’ Tab > ‘Rewards’ to redeem them. After you have redeemed the Rewards, the Free Share will be credited to your Account within 10 working days.

Which BUY trades are eligible to receive the Free Fractional Shares?Eligible BUY Trades include Stocks, ETFs, and Unit Trusts EXCEPT for US Fractional Shares.

Amalgamated trades (BUY or SELL Trades of the same counter listed on SGX and HKEX, respectively, that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash, SRS, or CPF) with the same Account are considered as one trade. This is due to the fact that we only charge one commission for such trade orders. Please refer to https://www.poems.com.sg/faq/trading/general/what-is-amalgamate/ for more information and available markets.

BUY or SELL trades of the same Unit Trust that are placed on the same trading day on POEMS Trading Platforms using the same payment mode (cash, SRS, or CPF) with the same Account are considered as one trade. The same trading day is orders placed from T-1 after 3:01pm to T day at 3pm.

How does the Weekly Gifts promotion work?This promotion is only valid for the first 50 unique Customers who redeemed the Weekly Gifts Coupon on POEMS Mobile 3 App > Me Tab > Rewards and will be on a first come first serve basis. Each Customer is only eligible to participate/redeem ONCE for this Weekly Gifts promotion. E.g. Customer A participated/redeemed in week 1, he/she is unable to participate/redeem in other weeks.

How does the Fund & Flourish promotion work?- Customers are required to make a fresh fund with net cumulative deposits of at least S$10,000, S$20,000, S$30,000 into their Cash Plus Account from 1 September 2025 to 30 September to qualify for the Stock Coupons. E.g. Customer A makes a fresh fund of S$5,000 on 2 September 2025, top up another S$17,000 on 16 September 2025, and holds the funds in September 2025, he/she is eligible for the S$50×3 Stock Coupon (S$20,000 tier) and will be given the Coupons by end of October 2025.

Note that only Transfers made via PayNow and Banks will be considered.

Phillip Prestige

At PhillipCapital,

we curate bespoke strategies

for your financial journey.

Phillip Prestige

Connect with us to find out more*Refer to the T&Cs for full eligibility details.

Unlock a World of Distinction with

Phillip Prestige

Privileges Curated Only for You

As a Prestige member, you gain privileged access to preferential rates, exclusive rewards, and invitations to private networking events. Every privilege is crafted to reflect our deep commitment to discretion, excellence, and the legacy we build with you.

Your Exclusivity, Our Commitment

Travel Privileges, RedefinedEnjoy the freedom of choice with bespoke travel privileges.

Select between two complimentary LoungeKey Passes or two luxury limousine transfers, reserved exclusively for Phillip Prestige members.Phillip Prestige Exclusive EventsAs a Phillip Prestige member, you’ll gain access to exclusive, member-only events. These curated experiences transcend access, offering unparalleled networking opportunities, thought-provoking insights, and meaningful connections with industry leaders and like-minded peers.

Every event is a reflection of our commitment to refinement, discretion, and the elevated standards that define the Phillip Prestige experience.

Bespoke Trust & Legacy PlanningSecure your legacy with the confidence of bespoke trust solutions. As a Phillip Prestige member, you are invited to a confidential, no-obligation consultation with our seasoned trust specialists, to safeguard your wealth and shape your lasting legacy.

With deep expertise and a personalised approach, we craft tailored trust and estate planning strategies to protect, preserve, and seamlessly pass on your assets, ensuring your ambitions endure across generations.

Dedicated Financial Services toGrow Your Wealth

At Phillip Prestige, we partner with you to craft bespoke wealth strategies, thoughtfully designed to build, manage, and elevate your financial success.

As your goals are unique, so should your approach to wealth. Our seasoned specialists combine deep market insight with a personalised approach, delivering tailored solutions to grow your wealth today and secure your legacy for generations to come.

Our Curated Suite of Financial Products

Bonds

Enjoy exclusive rewards on your first bond investment

Contracts for Differences (CFD)

Access preferential rates on long-term finance charges

FX Conversion

Preferential rates* for >S$200,000 equivalent conversion

Life Insurance

Secure your future plan and enjoy rewards with your first life insurance policy

Managed Accounts

Unlock exclusive privileges when you invest with a Phillip SMART Portfolio

Margin

Complimentary access to airport lounge

Securities Borrowing & Lending (SBL)

Benefit from exclusive borrowing rates

Secured Personal Loans

Preferential loan processing fees

Trust Service

Preferential setup fees

Unit Trust

Enjoy exclusive privileges with your first unit trust investment

Speak to your dedicated specialist to explore your exclusive preferential rates or connect with us here

Explore our FAQ to learn more about the terms and conditions of our suite of Prestige products.

Our Curated Suite of Financial Products

Bonds

Enjoy exclusive rewards on your first bond investment

Contracts for Differences (CFD)

Access preferential rates on long-term finance charges

FX Conversion

Preferential rates* for >S$200,000 equivalent conversion

Life Insurance

Secure your future plan and enjoy rewards with your first life insurance policy

Managed Accounts

Unlock exclusive privileges when you invest with a Phillip SMART Portfolio

Margin

Complimentary access to airport lounge

Securities Borrowing & Lending (SBL)

Benefit from exclusive borrowing rates with

Secured Personal Loans

Preferential loan processing fees

Trust Service

Preferential setup fees

Unit Trust

Enjoy exclusive privileges with your first unit trust investment.

Speak to your dedicated specialist to explore your exclusive preferential rates or connect with us here

Explore our FAQ to learn more about the terms and conditions of our suite of Prestige products.

Your Partner in Finance

Full Service Broker & Wealth Advisory

Trusted Broker for over 50 years

5,000+

Employees

1M+

Clients Worldwide

USD 2.5B+

Shareholder Funds

USD 65B+

Assets Under Management (AUM)

Find out more about us

Regulated & Secure

Fully licensed and regulated in 15 Global Locations

Get In Touch

FAQ

1. What is Phillip Prestige?

Phillip Prestige is an exclusive by-invitation only membership offered by Phillip Securities Pte Ltd (PSPL) to eligible Members. It offers access to a specially curated suite of privileges and services that is available only to Members.

2. How do I become a Phillip Prestige Member?

Phillip Prestige membership is strictly by-invitation only. Eligible Members are determined based on internal qualifying criteria and will be automatically invited and enrolled into the programme.

3. What privileges and services does Phillip Prestige offer?

Phillip Prestige offers access to a specially curated suite of exclusive privileges and services. Details can be found here.

PSPL reserves the right to modify or withdraw any of the privileges and benefits at its sole discretion.

4. What happens if I no longer meet the internal criteria?

Members who do not meet the internal criteria at the time of review may be excluded from redeeming any programme privileges.

5. Who is not eligible for Phillip Prestige?

The following customers are not eligible unless approved by PSPL management:

- Corporate Accounts, B2B Accounts holders, and Joint Account holders.

- PSPL account holders whose accounts are suspended, cancelled, or terminated.

- Employees of all PhillipCapital Group and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

Note: For Joint Accounts, only the first-named account holder is eligible to participate in the Programme.

6. Do I need to contact my licensed representative(s) to enjoy Prestige privileges?

Yes, Members must contact their licensed representative(s) to access most privileges except for complimentary lifestyle privileges.

7. What complimentary lifestyle privileges do I receive as a Phillip Prestige Member?

As a Phillip Prestige Member, you are entitled to one of the following each calendar year:

• Two (2) LoungeKey airport lounge passes, OR

• Two (2) one-way limousine airport transfers to or from Singapore Changi Airport which may be utilised as a round-trip (e.g. one arrival and one departure transfer) or as two separate one-way transfers.

8. Can I choose both lounge access and limousine transfers within the same year?

No. Once you have redeemed the first benefit (either lounge or limousine), the choice is final and cannot be changed within the same calendar year.

9. How do I redeem my LoungeKey airport lounge passes?

Step 1: Member must first email talktophillip@phillip.com.sg with the following details:

- Full name of the Phillip Prestige Member. (First and last names must match passport details)

If an additional LoungeKey digital pass is required for another individual, their full name must also be provided as per passport details. - Number of LoungeKey digital passes required.

- The email must be sent from the registered email address with PSPL.

(PSPL will only send the LoungeKey digital pass(es) to the Members registered email address.)

Step 2: Redemption requests will be acknowledged within five (5) working days, subject to verification of membership.

Step 3: Upon successful verification, LoungeKey digital pass(es) will be sent via email from LoungeKey within 48 hours to the Members registered email.

Step 4: Once received, Member may present the LoungeKey digital pass(es) at any lounge counter for access to the Airport Lounge.

To locate a participating lounge, visit: loungefinder.loungekey.com/en/PhillipCapital

10. How do I redeem my Limousine Airport Transfers?

Step 1: Member must first email talktophillip@phillip.com.sg with the following details:

- Full name of the Phillip Prestige Member.

- The email must be sent from the registered email address with PSPL.

(PSPL will only send the redemption code to the Members registered email address.)

Step 2: Requests will be acknowledged within five (5) working days, subject to successful verification of Phillip Prestige membership.

Step 3: Upon receiving the redemption code, Member must proceed to the official booking portal at https://system.tbrglobal.com/limo/phillipprestige and submit the code to complete the limousine airport transfer booking. Each code may be used to book both one-way transfers at once or on separate occasions.

11. What preferential fees and rates do Phillip Prestige members enjoy?

As a Phillip Prestige member, you will enjoy preferential rates and fees across a range of financial services, including:

- Share Borrowing and Lending (SBL): Access to preferential borrowing rates for SGX-listed securities.

- Foreign Exchange (FX) Conversion: Enjoy preferential FX rates with Multi-Currency Facility.

- Secured Personal Loans: Reduced loan processing fees on financing solutions.

- Contracts for Differences (CFD): Lower long finance charges for selected equity and index CFDs.

- Trust Services: Discounted trust setup fees.

Please note that all privileges are subject to specific terms and conditions. For full details, please refer to the Phillip Prestige Programme Terms and Conditions.

12. Are there any welcome gifts or rewards for new investments or products?

Yes. Phillip Prestige members are eligible for one-time welcome rewards when you invest or purchase for the first time in the following products:

- Unit Trust Investments (Advisory and Non-Advisory account)

- Life Insurance Policies (Regular and Single Premium)

- Phillip SMART Portfolio Accounts

- Wholesale Bond Transactions

Please note that each reward is subject to specific terms and conditions. For full details, please refer to the Phillip Prestige Programme Terms and Conditions.

13. Are there any complimentary services related to trust planning?

Yes. Phillip Prestige members are entitled to complimentary trust consultation with our estate planning specialists. This personalised session helps you assess how trust structures can support your long-term wealth preservation and succession planning.

14. Do Phillip Prestige members receive any complimentary refreshments?

Yes. Phillip Prestige members enjoy complimentary beverages at our Phillip Investor Centre, located at Raffles City Tower Level 6.

15.What is the entitlement for complimentary LoungeKey airport lounge passes for using PSPL’s margin facility?

Eligible Members who utilise our margin facility and fulfil specific qualifying criteria are entitled to three (3) complimentary LoungeKey airport lounge visits per quarter. This benefit is independent of the lifestyle privileges offered under the Phillip Prestige programme.

16. Can I bring a guest to the airport lounge?

Yes, you may redeem one of your two complimentary passes for a guest. The guest name must be provided during redemption, and you must accompany the guest when entering the lounge. Both passes must be redeemed under your membership entitlement.

17. What if my name or guest name is given incorrectly upon my LoungeKey Pass airport lounge redemption?

Please ensure the full names match passport details exactly. Incorrect information may result in unsuccessful lounge access, and the digital pass will be considered used and non-refundable.

18. What if I didn’t receive my LoungeKey pass email?

First, check your junk/spam folder for an email from LoungeKey If you still can't find it, contact us at 6531 1551 or email talktophillip@phillip.com.sg.

19. Who do I contact if I have issues at the lounge?

You may contact LoungeKey support at:

• UK: +44 (0) 208 865 0767

• Hong Kong: +852 3071 5062

• USA (Dallas): +1 469 334 4174

Full LoungeKey terms: https://portal.loungekey.com/en/phillipcapital/conditions-of-use/

20. How long is my redemption code valid for?

The validity of your redemption code will be stated in the email you receive after redemption. Please refer to that email for the expiry date and ensure your transfers are booked and completed before the code expires.

21. Can I use the complimentary limousine airport transfers outside of Singapore?

No. The complimentary limousine airport transfer service is strictly applicable only to and from Singapore Changi Airport. Usage at overseas airports is not covered under this benefit.

22. Can someone else use my limousine airport transfer on my behalf?

No. The entitlement is non-transferable. The Phillip Prestige Member must be a passenger in the limousine during the transfer.

23. Can I book both one-way transfers at the same time?

Yes. Each redemption code provides two (2) one-way transfers, which may be booked together (e.g., arrival and departure) or separately, depending on your travel plans.

24. What happens if I cancel or don’t show up for a booking?

If you cancel or amend a booking less than 24 hours before the scheduled pick-up, or fail to show up, one (1) one-way transfer entitlement will be forfeited.

A full cancellation fee may also apply. Please refer to the T&Cs for more details on cancellation and no-show policies.

25. Are child/booster seats available for young passengers?

Yes. You may request a child/booster seat at SGD 27.00 per seat. It is mandatory by law in Singapore for children below 1.35m in height to be secured in an appropriate seat.

Note: Please request the seat in advance during the booking process.

26. Can I bring pets on board?

No. Pets are strictly not allowed, even if they are in travel crates or carriers.

27. Can I make stops or detours during my transfer?

No. The complimentary transfer is for direct airport pick-up or drop-off only. Additional stops, detours, or excess waiting time are not included.

28. Can the terms of the Phillip Prestige change?

Yes, PSPL reserves the right to modify or terminate Phillip Prestige at any time. Members will be notified of significant changes. Continued participation after notification of any changes will imply acceptance of the revised terms by the Members.

29. How can I exit or re-join the Phillip Prestige Programme?

If you wish to exit the Phillip Prestige Programme, you may opt out at any time by contact our customer service at +65 6531 1551 or send us an email at talktophillip@phillip.com.sg. Alternatively, you can also reach out to your licensed representative for assistance. Upon opting out, you will no longer be eligible for the exclusive privileges and services offered by Phillip Prestige.

Should you wish to re-join the Programme after opting out, please contact your licensed representative directly. Re-enrolment of the programme will be subject to eligibility under prevailing criteria at the time of review.

30. Who do I contact for Airport Limousine booking issues?

For booking assistant, you may email TBR at res.asia@tbrglobal.com or contact 24/7 Customer Support Hotline:

• Singapore: +65 6950 0410

• Hong Kong: +852 5804 2960

Full TBR terms: www.tbrglobal.com/terms

31. Who can I contact for enquiries about the Phillip Prestige programme?

For any questions or assistance regarding the Phillip Prestige programme, you may:

• Contact our Prestige customer service hotline at +65 6531 1551

• Email us at talktophillip@phillip.com.sg

• Alternatively, you may reach out to your licensed representative directly for personalised assistance.

Terms & Conditions for Phillip Prestige

We reserve the right to terminate or otherwise amend and change this programme at any time without prior notice at its sole and absolute discretion.

FAQ

1. What is Phillip Prestige?Phillip Prestige is an exclusive by-invitation only membership offered by Phillip Securities Pte Ltd (PSPL) to eligible Members. It offers access to a specially curated suite of privileges and services that is available only to Members.

2. How do I become a Phillip Prestige client?Phillip Prestige membership is strictly by-invitation only. Eligible Members are determined based on internal qualifying criteria and will be automatically invited and enrolled into the programme.

3. What privileges and services does Phillip Prestige offer?Phillip Prestige offers access to a specially curated suite of exclusive privileges and services. Details can be found here. PSPL reserves the right to modify or withdraw any of the privileges and benefits at its sole discretion

4. Does the membership have an expiry date?Members who do not meet the internal criteria at the time of review may be excluded from redeeming any programme privileges.

5. How often is my membership reviewed?The following customers are not eligible unless approved by PSPL management:

- Corporate Accounts, B2B Accounts holders, and Joint Account holders.

- PSPL account holders whose accounts are suspended, cancelled, or terminated.

- Accounts of employees of all PhillipCapital Group and its partners (e.g., trading representatives, financial advisors) and their immediate families (e.g., spouse and children).

Yes, PSPL reserves the right to modify or terminate Phillip Prestige at any time. If there are significant changes to the terms, Members will be notified. Continued participation after notification of any changes will imply acceptance of the revised terms by the Members.

7. How can I exit or re-join the Phillip Prestige Programme?If you wish to exit the Phillip Prestige Programme, you may opt out at any time by contacting our customer service team at +65 6531 1551 or by sending us an email at talktophillip@phillip.com.sg. Alternatively, you can also reach out to your licensed representative for assistance. Upon opting out, you will no longer be eligible for the exclusive privileges and services offered by Phillip Prestige.

Should you wish to re-join the Programme after opting out, please contact your licensed representative directly. Re-enrolment of the programme will be subject to eligibility under prevailing criteria at the time of review.

8. Do I need to contact my licensed representative(s) to enjoy Prestige privileges?Yes, except for complimentary lifestyle privileges, Members are required to contact their licensed representative(s).

9. What preferential fees and rates do Phillip Prestige members enjoy?As a Phillip Prestige member, you will enjoy preferential rates and fees across a range of financial services, including:

- Share Borrowing and Lending (SBL): Access to preferential borrowing rates for SGX-listed securities.

- Foreign Exchange (FX) Conversion: Enjoy preferential FX rates with Multi-Currency Facility.

- Secured Personal Loans: Reduced loan processing fees on financing solutions.

- Contracts for Differences (CFD): Lower long finance charges for selected equity and index CFDs.

- Trust Services: Discounted trust setup fees.

Please note that all privileges are subject to specific terms and conditions. For full details, please refer to the Phillip Prestige Programme Terms and Conditions.

View More

Terms & Conditions for Phillip Prestige

We reserve the right to terminate or otherwise amend and change this programme at any time without prior notice at its sole and absolute discretion.

Margin

Enjoy exclusive rewards on your first bond investment

Contracts for Differences (CFD)

Access preferential rates on long-term finance charges

FX Conversion

Preferential rates* for >S$200,000 equivalent conversion

Life Insurance

Secure your future plan and enjoy rewards with your first life insurance policy

Managed Accounts

Unlock exclusive privileges when you invest with a Phillip SMART Portfolio

Margin

Complimentary access to airport lounge

Securities Borrowing & Lending (SBL)

Benefit from exclusive borrowing rates

Secured Personal Loans

Preferential loan processing fees

Trust Service

Preferential setup fees

Unit Trust

Enjoy exclusive privileges with your first unit trust investment

DLC Promo

Score Free Trips to

Paris & Zurich, and

S$20 Cash Credits when you Trade SocGen & UBS DLCs!

Score Free Trips to Paris & Zurich, and S$20 Cash Credits when you Trade SocGen & UBS DLCs!

Be the Top Trader to win Air Tickets to Paris & Zurich!

From 4 August 2025 to 31 October 2025

Be the Top Trader by Total Traded Value in SocGen DLCs and Win a Pair of Return Tickets to Paris, valid for travel until June 2026.

- Requires a minimum traded value of S$100,000 during the campaign period.

- Both BUY and SELL trades are applicable

Be the Top Trader by Total Traded Value in UBS DLCs and Win a Pair of Return Tickets to Zurich, valid for travel until June 2026.

- Requires a minimum traded value of S$100,000 during the campaign period.

- Both BUY and SELL trades are applicable

Claim your S$20 DLC Coupon on POEMS Mobile 3 App Rewards

Valid to redeem and trade from 4 August 2025 till 31 October 2025

Claim your S$20 DLC Coupon on POEMS Mobile 3 App Rewards

Valid to redeem and trade from 4 August 2025 till 31 October 2025

Eligibility

- Redeemable with ONE POEMS Coin on POEMS Mobile 3 App Rewards

- Applicable for BUY Trades only

- Successful trade refers to the purchase of any SocGen and UBS DLC that are listed on SGX

- Each Customer is only eligible to redeem one S$20 DLC Coupon using the POEMS coin during the Promotion period.

Scan the QR Code to Redeem the S$20 DLC Coupon!

REDEEM NOWFrequently Asked Questions

Am I required to register first before I participate in the top trader promotion?No, registration is not required. Your Account will be automatically tracked when you execute eligible trades during the campaign period.

If I happen to be the top trader for both SocGen and UBS DLC at the end of the campaign, am I eligible to receive both air tickets to Paris and Zurich?Yes, if you are the top traders for both SocGen and UBS DLC during the campaign period you are eligible to receive both rewards.

If you are the top traders for the promotion, you will be notified via email or phone within ONE month after the end of the promotion period.

Redemption details will be provided in the notification. Please ensure that your contact details with POEMS are up to date to avoid any delays.

I am a Cash Trading Account holder. Am I eligible to enjoy this promotion?No, Cash Trading Account holders are not eligible for this promotion. You may consider opening an eligible Account type or converting your Cash Trading Account to a Cash Management Account.

Terms & Conditions

T&Cs- This promotion is valid from 4 August 2025 to 31 October 2025, and is open to new and existing Customers of Phillip Securities Pte Ltd (“PSPL”).

- Promotion Details:

- Top Trader Promotion:

- Win a pair of return tickets to Paris, valid for travel until June 2026:

- Eligibility:

- Be the top trader by total traded value in SocGen DLCs

- Requires a minimum traded value of S$100,000 during the campaign period.

- Both BUY and SELL trades are applicable

- Eligibility:

- Notification:

- You will be notified via email or phone within one month after the end of the promotion period.

- Win a pair of return tickets to Zurich, valid for travel until June 2026:

- Eligibility:

- Be the top trader by total traded value in UBS DLCs

- Requires a minimum traded value of S$100,000 during the campaign period.

- Both BUY and SELL trades are applicable

- Eligibility:

- Notification:

- You will be notified via email or phone within one month after the end of the promotion period.

- Win a pair of return tickets to Paris, valid for travel until June 2026:

- S$20 DLC Coupon:

- Eligibility Criteria:

- BUY trades only

- SocGen and UBS DLC trades only

- Cash trades only

- Online trades only

- This Coupon, exchangeable with 1 POEMS Coin, can be redeemed for a S$20 Cash Credit upon successful eligible trades.

- The S$20 DLC Coupon is listed on the POEMS Mobile 3 App Reward Shop and availability will be on a first come first serve basis.

- Each Customer is only eligible to exchange one S$20 DLC Coupon with ONE POEMS coin during the Promotion period.

- The 1 POEMS Coin used to exchange for this Coupon will not be refunded once the Coupon is exchanged.

- This Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- This Coupon will expire 30 days from the date of exchange. You are required to redeem the Coupon and execute the eligible trade within the 30 days.

- This Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon redemption and before its expiry.

- The S$20 rebate, up to the contract value, will be credited to the eligible Account in the month of November 2025 after redeeming the coupon and completing Successful Trades.

- If the Coupon is not redeemed and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- If the Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$20 rebate, regardless of which Account the Coupon was activated in. For example: Customer has Account A and Account B. Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$20 rebate.

- Eligibility Criteria:

- Top Trader Promotion:

- Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item from your Rewards page, you acknowledge that you have read and consented to these Terms and Conditions.

- Days refer to calendar days.

- The following Customers are NOT eligible for this promotion unless approved by the management of PSPL:

- Closed Account with PSPL during the promotion period

- Cash Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff and Financial Adviser Representatives.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

Recruitment of Investment Specialist

Your Career. Our Legacy.

Build the Future with Phillip Securities

Be Part of a Legacy Trusted by Generations

Ready to build Your legacy with us?

Join the Phillip Securities Investment Specialist Programme-a structured career conversion journey designed to equip you with the skills, confidence and real-world experience to thrive as a licensed specialist in Singapore's dynamic financial markets.

Benefits from our unique high-touch, high-tech approach:

- Personalised mentorship including guidance from one of our top remisiers

- Hands-on training to sharpen your market insights

- Cutting-edge digital tools to accelerate your growth and leadership empowerment

Ready to build Your legacy with us?

As an Investment Specialist, your role includes:

Supporting clients in trading and investment strategies

Delivering market insights and financial updates

Offering suitable solutions across equities, funds and managed portfolios

Building long-term client relationships based on trust and performance

Your Career, Your Ascent Future Aspirations You Can Expect Your Career, Your Ascent Future Aspirations You Can Expect

The role of an Investment Specialist is more than a job - it's a launchpad into a fulfilling and dynamic career in finance. With us, your journey can evolve into broader opportunities within the finance industry.

Potential Career Progression Paths include:

-

Senior Investment Specialist / Team Lead

Guide junior specialists and manage higher-value portfolios -

Guide junior specialists and manage higher-value portfolios

Work with internal teams to develop advanced investment solutions -

Relationship Manager / Wealth Manager

Focus on holistic wealth advisory for high-net-worth clients -

Branch Manager / Business Development Lead

Lead strategic growth initiatives and talent development

Build a respected personal brand in the financial community

Gain exposure to regional and global markets

Grow a stable, high-quality book of clients

Develop specialized knowledge in asset classes, structured products, or portfolio construction

What Sets Our Investment Specialist Programme Apart

-

Mentorship by Experienced Specialists

Receive direct guidance from industry veterans through our structured mentorship programme -

Structured Learning

Follow a guided, three-phase journey that blends classroom learning soft skills coaching and hands-on experience -

Real Industry Exposure

Collaborate with seasoned investment specialists, attend industry events, and start building your client base with full training support -

Monthly Allowance

Receive a monthly allowance during the training phase to support your professional development -

Fast-Track to Licensing

Clear the required examinations and become a licensed trading representative ready to launch your career

Phase 1

Foundations & Certification

- 3-month intensive training on products, platforms, operations, and regulations

- Clear required examinations (e.g. CM-CMP, RES1, RES5)

- Start client acquisition activities under supervision

Phase 2

Sales & On-the-Job Training

- Receive your trader code and take full ownership of your clients

- Gain on-the-ground experience through roadshows and daily equity operations

- Enhance your communication and client-handling abilities with dedicated soft skills training

Phase 3

Continuous Growth

- Ongoing upskilling through advanced product training and market updates

- Continued mentorship and business-building support

Passionate about investments, equities, and the financial markets or the finance industry as a whole

Analytical, self-driven, and committed to delivering exceptional client service

Diploma or degree holders from any discipline (finance-related qualifications are a plus)

Hear From Our Investment Specialists

Being an investment specialist allows me to stay at the forefront of market trends and economic shifts. I am driven to continuously learn about new and innovative investment solutions across global markets. This empowers me to support individuals in achieving their capital growth

Bryan Tan

Senior Financial Services Manager

I’ve always understood the importance of building long-term financial security and am keen to share my knowledge to help others grow their wealth. Phillip Securities offers a wide range of products, research, and support — all of which I know will help me deliver real value to my clients.

Anthony Chin Principal

Investment Specialist

I became a Remisier with Phillip Securities because of its strong brand, trusted platform, and client-first culture. It has allowed me to deliver real value to investors while building long-term relationships. The support here empowers me to grow with confidence every day.

Joey Choy

Principal Investment Specialist

Being an investment specialist allows me to stay at the forefront of market trends and economic shifts. I am driven to continuously learn about new and innovative investment solutions across global markets. This empowers me to support individuals in achieving their capital growth

Bryan Tan

Senior Financial Services Manager

I’ve always understood the importance of building long-term financial security and am keen to share my knowledge to help others grow their wealth. Phillip Securities offers a wide range of products, research, and support — all of which I know will help me deliver real value to my clients.

Anthony Chin

Principal Investment Specialist

I became a Remisier with Phillip Securities because of its strong brand, trusted platform, and client-first culture. It has allowed me to deliver real value to investors while building long-term relationships. The support here empowers me to grow with confidence every day.

Joey Choy

Principal Investment Specialist

Get the full picture at our upcoming Career Talks!

Discover where a future in finance can take you at our upcoming Career Talks. Whether you're a fresh graduate or exploring a mid-career switch, this is your opportunity to hear directly from industry professionals, learn about our Investment Specialist Programme, and find out how Philip Securities empowers individuals with resources to thrive.

Reserve a SpotReady to make your mark in finance?

Unlock your potential, grow with industry-leading support, and become part of a legacy built on ambition and excellence.

Domant Clients Revival Plan Draft

From Dormant to Dynamic

— It’s Time to Move Again.

We know life gets busy. Markets move fast, and sometimes trading takes a backseat. While you may have forgotten about us for a while, we’ve never forgotten about you.

It’s time to reignite your investing journey with us.

Reignite Your Journey with POEMS.

Advance with PhillipCapital.

or click me!

It’s our birthday but you get the gifts!

Simply scan the QR code or click the URL to enter our

POEMS Mobile 3 app and receive

(worth S$50)

AND

The first 50 to deposit S$5000

will earn an extra S$50 in cash rebates!

The first 50 to deposit S$5000

will earn an extra S$50 in cash rebates!

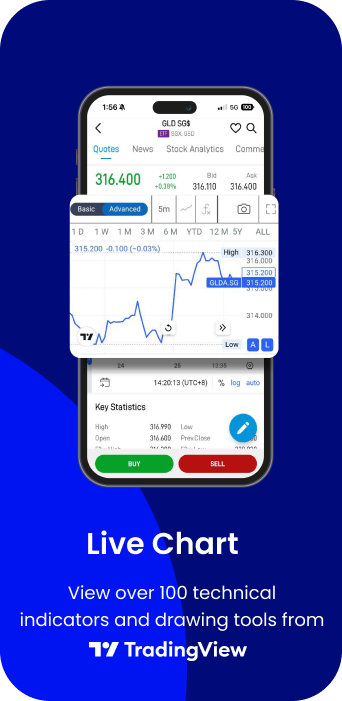

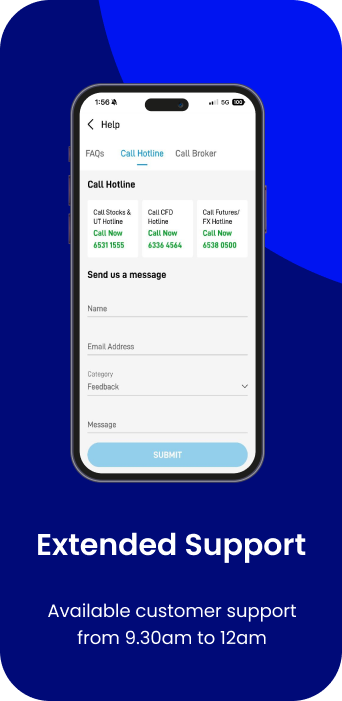

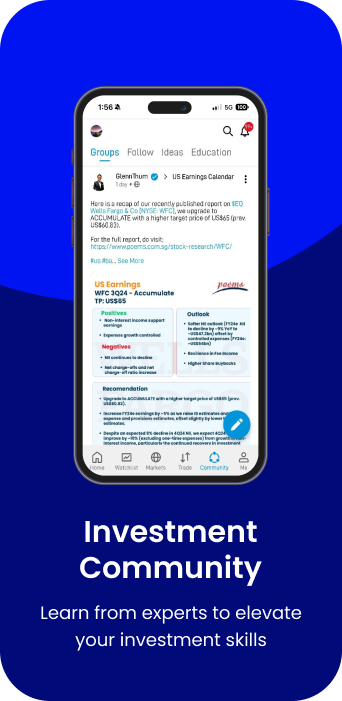

What’s new on POEMS Mobile 3?

Thank You For The 50 Years Together

Terms and Conditions

S$25 Stock Coupons- The two S$25 US Stock Coupons are exclusive to selected Customers. The Stock Coupons will be credited into the eligible Customers’ Account in the POEMS Mobile 3 App > Me Tab > My Rewards Inventory.

- How to use:

-

- Activate – ‘Swipe to Activate’ to apply the Coupon to your next eligible trade.

- Trade – Place a trade on a stock or ETF that meets the Eligibility Criteria.

- Rebate Credited – Once the trade is completed successfully, S$25 will be credited to your Account within 2 working days.

-

- Eligibility Criteria:

- Applies to BUY trades on stocks and ETFs only.

- US market only

- Cash trades only

- Online trades

- The minimum contract value to use the Stock Coupon is

- US$1,000 for the US Market

- S$1,000 for the SG Market

- Each S$25 US Stock Coupon is valid for one-time use only and is non-refundable, non-transferable, and cannot be exchanged for cash.

- The Stock Coupons will expire 30 days from the date of issuance.

- Once activated, the Stock Coupon cannot be deactivated or reissued.

- The S$25 US Stock Coupon will be automatically applied to the first successful eligible trade executed, after the Coupon activation and before its expiry.

- The S$25 rebate, up to the contract value, will be credited to the Eligible Account within 2 working days following the successful eligible trade.

- If the Coupon is not activated and/or a successful eligible trade is not executed within the validity period, the coupon will be forfeited, and no rebate will be issued.

- Each Customer is eligible for only two S$25 US Stock Coupons.

- If there are multiple Stock Coupons active, the one which has an earlier expiration date will be used up first by default. If the Coupons have the same expiry date, the coupon that was activated first by the Customer will be used by default.

- If the Customer holds multiple trading Accounts, the Account that performs the first successful eligible trade will receive the S$25 rebate, regardless of which Account the Coupon was activated in.

- For example:

- Customer has Account A and Account B. Customer activates the Coupon in Account A, but later performs a successful eligible trade using Account B. In this case, Account B will be awarded the S$25 rebate.

- This Promotion is not applicable to

- Cash Account, Share Financing, & SBL Account(s)

- Joint Account(s)

- PSPL institutional Customers and corporate Customers

- PSPL and its associated entities and subsidiaries (direct or indirect), e.g. Staff, Trading Representatives and Financial Adviser Representatives.

- Phillip Securities Pte Ltd (“PSPL”) reserves the right at any time in its absolute discretion to (i) amend, add to, and/or delete at any time of these Terms & Conditions without prior notice (including eligibility and qualifying terms and criteria), and all Customers shall be bound by such amendments, additions and/or deletions when effected, or to (ii) vary, withdraw, and/or cancel any items or the promotion itself without having to disclose a reason, and without any compensation or payment whatsoever. PSPL’s decisions on all matters relating to the promotion are final and binding on all Customers.

- PSPL and its affiliates and their respective employees and agents shall not be liable to any person for any loss, damage, injury, costs or expenses incurred, suffered, borne or arising from this promotion.

- By redeeming this item from your Rewards page, you acknowledge that you have read and consented to these Terms and Conditions.

- Days refer to calendar days.

- By taking part in the promotion, you agree and consent to PSPL sending relevant information to third-party service providers to facilitate the delivery and redemption of the Rewards.

- In the event of a dispute over the Customer’s eligibility to participate in this promotion, PSPL’s decision will be final.

- This advertisement has not been reviewed by the Monetary Authority of Singapore.

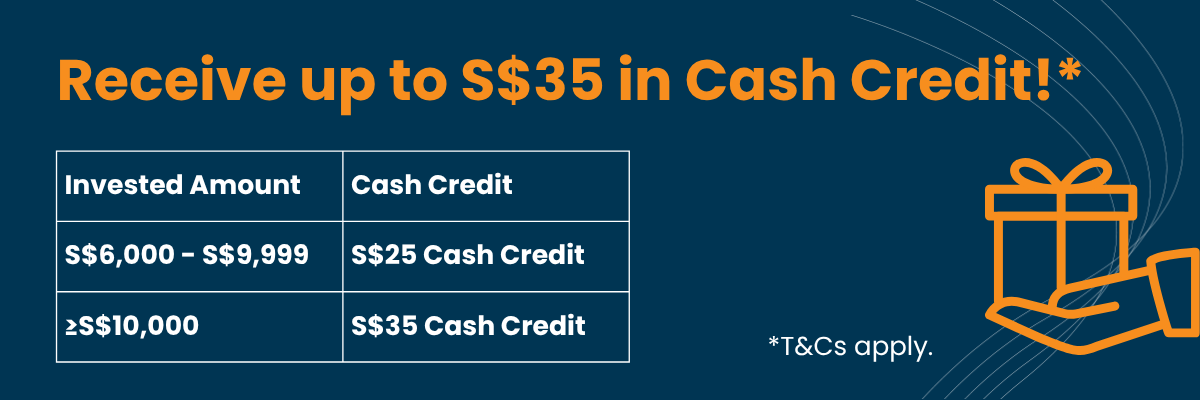

- The S$5,000 has to be deposited within a month from the start of the campaign period, from 17 Nov to 21 Dec 2025.

- The S$50 cash credit is limited to the first 50 eligible users who successfully deposited the S$5,000 during the promotion period.