2 Reasons to Invest in Healthcare Stocks June 12, 2017

Ever thought of healthcare as an investment? Healthcare stocks can form an integral part of one’s portfolio for its

1) resilient earnings; and

2) potential organic earnings growth due to healthcare cost inflation. In Singapore, there are 2 fundamental trends that define the upside of the healthcare industry.

1) Aging Population and Longer Life Expectancy

During 2005, population in Singapore that are aged 65 and above was 270,000. That number has close to double to 440,000 in 2015 and is expected to reach 900,000 by 2030. With the advancement of medical technologies, life expectancy of Singapore citizens has also increased to 82.9 years based on the latest numbers provided by Singstat. Furthermore, statistical studies by Ministry of Health have also shown that the number of hospital admission increases with age.

2) Higher Earning Power

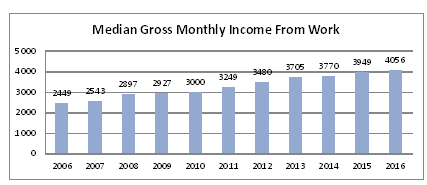

According to the numbers provided by the Ministry of Manpower, the median gross monthly income for Singapore residents has grown consistently over the years. With increasing income and insurance policies covering private hospitalisation expenses, those seeking medical attention may likely turn to private sources for more personalised services and shorter waiting time.

Source: http://stats.mom.gov.sg

Source: http://stats.mom.gov.sg

In addition, Singapore is ranked as the 4th healthiest country based on the 2017 Bloomberg Global Health Index. Apart from local spending, this is a pull factor for wealthy individuals around the Asian region to choose Singapore as a potential medical destination.

Over the past 5 years, the SGX All Healthcare Index grew at an average of 10.8% from 922.87 (14 June 2012) to 1,423.13 (12 June 2017). SGX All Healthcare index tracks the performance of healthcare equipment, healthcare supplies, healthcare distributors, healthcare services, healthcare facilities, pharmaceuticals, office services & supplies, and healthcare REITs.

The following are examples of healthcare companies or investment trusts that are traded on the Singapore Stock Exchange.

| Name | Sector | Dividend Yield | Price to Earning |

| Raffles Medical Group | Integrated Healthcare Provider | 1.46% | 34.3 |

| HMI | Hospitals | 0.33% | 91.3 |

| Talk Med | Specialised Services (Medical oncology, Stem Cell Transplant) | 2.81% | 28.5 |

| Singapore Medical Group | Specialised Services (Ophthalmological, Orthopedic, Oncology, Gynecological and others) | – | 80.9 |

| UG Healthcare | Healthcare Glove Manufacturer | 2.40% | 16.1 |

Source: SGX stockfacts, based on 9th June 2017

| Name | Exposure | Dividend Yield | Price to Earning | Price to Book |

| ParkwayLife REIT | Singapore, Japan | 4.72% | 17.126 | 1.533 |

| First REIT | Indonesia | 6.44% | 23.765 | 1.218 |

Source: SGX stockfacts, based on 9th June 2017

Valuing a growth stock is never easy. Healthcare stocks are generally priced at a premium with low dividend yield. While medical tourism in Singapore is facing stiff competition from its neigbours, investors should look at the overall strategies like product mix or expansion into overseas markets when evaluating investment opportunities.

If you wish to know more information about stocks, you can speak to your designated Trading Representatives or a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Michael Tay

Equity Dealer

Mr. Michael Tay currently provides dealing services to over 17,000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd. Michael is a strong believer of value investing, focusing on companies with strong fundamentals and good dividend policy. Apart from his dealing role, he often provides training seminars on Fundamental Analysis topics to further enrich his clients’ financial knowledge. Michael holds a Bachelor Degree of Finance from the SIM University (UniSIM) and was awarded the CFA Singapore Silver Award in 2012.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It