Pre-Market Trading: All You Need to Know June 17, 2022

Pre-market trading is part of extended-hours trading, where investors conduct trading activity outside the market’s official opening hours primarily conducted over private Electronic Communication Networks (ECNs) which facilitates the trades as only private systems can operate during extended trading hours.

Key Takeaways:

- Pre-market trading hours in the US are 4.00am to 9.30am Eastern Time (ET). Pre-market activity is often used as an indicator for regular trading activity, though there are fewer people who are actively buying or selling stock.

- It is useful to trade in the pre-market since breaking news, company earnings reports, and mergers that heavily influence the market are often announced outside the regular trading hours.

- It is important to note that due to the nature of pre-market trading, the price fluctuations and trade executions are more volatile. As such, it may not always be a good reflection of the current momentum in the regular market.

What is pre-market trading?

Pre-market trading is exactly what it sounds like: trading before the opening bell of the market, prior to official exchange hours. Pre-market timings vary across different regions and exchanges, but usually begin at least an hour before the official opening. The major US exchanges hold pre-market trading hours from 4.00am to 9.30am ET.

The pre-market movement of stocks is a good indicator of what to expect in the regular trading session. Though the volume of trades is understandably lower, a change in volume and price may help investors understand the direction and strength they can expect ahead of the official market open.

Why engage in pre-market trading?

1. Opportunities for early reactions to news and announcements

Companies don’t usually make announcements during regular trading sessions but before the market opens and after the market closes. Pre-market trading allows investors to leverage on news before other traders who must wait for the official market open.

Economic data and indices, which affect trading activity, are also often released during the pre-market timing of around 8.30am. During rare times of extreme market volatility, the extended market hours will also be the first to reflect or price in the event related to breaking news, allowing investors to manage their positions by making trades.

Most commonly, the news include fiscal reports, quarterly earnings release and acquisition announcements (the latter of which happens so often at the start of the work week that it has been termed ‘Merger Mondays’).

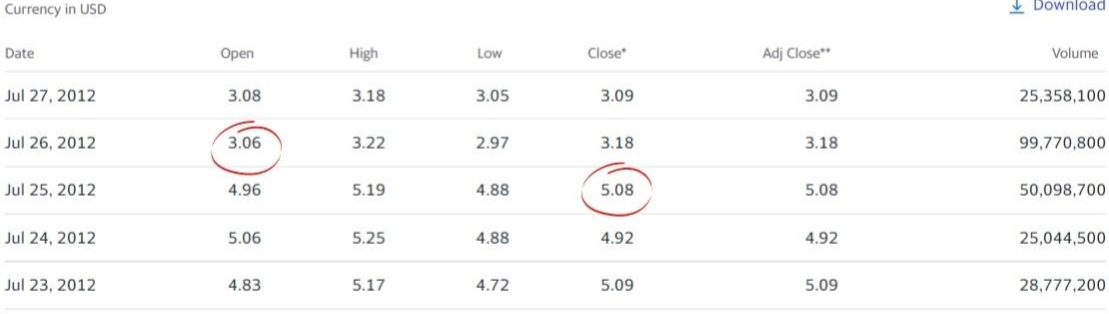

Market reactions to such news and announcements can cause big swings in prices, producing significant price gaps relative to the last market close: for example, one of the most extreme changes occurred when game-developer Zynga’s quarterly earnings release in 2012 caused a historical 40% drop in afterhours trading.

Fig 1. Zynga’s (Nasdaq: ZNGA) price drop in July 2012 during afterhours trading

Fig 1. Zynga’s (Nasdaq: ZNGA) price drop in July 2012 during afterhours trading

Though not as drastic, these changes after earnings reports or bourse filings are quite common. After Netflix (Nasdaq: NFLX) announced its disappointing earnings for the final quarter of 2021, its shares experienced a steep drop of over 50 points, only minutes after the market closed and the news was released.

Fig 2. Netflix (Nasdaq: NFLX) shares at 4:05pm on January 20, 2022.

Fig 2. Netflix (Nasdaq: NFLX) shares at 4:05pm on January 20, 2022.

2. Gauge for breakouts or breakdowns during normal trading hours

The price range of a stock during Pre-Market trading can give traders a sense of its price support and resistance during regular trading hours, as well as potential price breakouts or breakdowns. Changes in prices and trading volumes during these hours can foreshadow the rest of the day’s market movements.

As shown in the previous chart, the afterhours drop in Zynga’s shares predicted a much higher volume of Zynga’s shares that were traded on 26 July 2012. More people entered the market to buy or sell Zynga shares.

3. Access to longer trading hours

Pre-market trading allows you to place trades immediately to manage your positions without having to wait until the day’s open. Investors can place trades at their convenience as the trading window is longer. Other traders are restricted to regular trading hours and will hence have to limit their trade strategy.

Monitoring extended hour trading allows risk management in terms of trade positioning. There are many opportunities to gain an upper hand in the regular market if one engages in pre-market trading. Ultimately, pre-market participants should be able to act swiftly to market news.

Risks in Pre-Market trading

1. ECN Limitations

Pre-market trading can only be executed with Limit Orders through the broker or ECN being used. You may not be able to complete a trade with another investor if you are on different ECNs.

In the same vein, the prices you see in pre-market trading are restricted to the ECN you use. Unlike regular market prices, which consolidate the prices, the pre-market prices are fragmented due to usage of separate ECNs and can thus be misleading to the actual consolidated price.

2. Lower liquidity and greater volatility

As mentioned earlier, the presence of only a few market participants makes the pre-market more volatile than regular trading. The less trading volume for some stocks makes it more difficult to execute some trades. Some stocks may not trade at all during off-hours.

Greater volume introduces continuous trading rather than huge price swings. The lower volume makes price fluctuations more pronounced, making prices fall or rise much more steeply since it is not moderated by other players.

3. Not always reliable indicators of regular trading sessions

Pre-market price trends can be deceptive. Even if you track pre-market prices across different platforms, there is still a chance that the market may go the opposite direction when it opens. The pre-market, while often a decent indicator, is not a solid indicator of regular market movement.

Thus traders should always be careful when trading the pre-market. Due to its inherent limitations, pre-market trading presents both opportunities and risks. Investors need to weigh the pros and cons before entering into a pre-market trade.

What are the differences between pre-market and regular trading?

The table below captures some of the differences between pre-market and regular trading sessions.

| Characteristics | Pre-Market | Regular |

| Liquidity and volume | Low | High |

| Bid-ask spread | Wide | Narrow |

| Susceptible to higher or lower price gaps (refer to chart A above) | Yes | Generally no |

| Price movements | Prices are determined by a small collected group of investors which may be heavily influenced by market news. E.g. Earnings release | Proper supply and demand of price movements dictated by all market participants which ensures orderly price movement. |

| Market participants | Predominantly institutional investors | Both institutional and retail investors |

Can I trade in the pre-market? How?

Yes, you can! US pre-market prices on POEMS are available from 04:00 to 9.30 Eastern Standard Time (EST). You may refer to the below table to see the corresponding time in Singapore.

| Pre-market start time | Pre-market end time | Regular market start time | Regular market end time | |

| US Eastern Standard Time (EST) | 04:00 | 09:30 | 09:30 | 16:00 |

| Singapore time (daylight saving) | 16:00 | 21:30 | 21:30 | 04:00 |

| Singapore time (non-daylight saving) | 17:00 | 22:30 | 22:30 | 05:00 |

Pre-market orders can be placed from 04:00 EST onwards and will be valid up till market opening at 09:30 EST. Pre-market quotes are also only available in this time period. Any unfilled orders will be carried forward to the regular trading session.

To begin trading in the pre-market, click here. If you have any more questions, please do visit our FAQ on US pre-market trading.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Ying Jie (Dealer), Jonah Sim Hong Chee (Dealer) & Lee Yong Heng (Dealer)

Ying Jie is a US Equity executive in the Global Markets Team and specializing in US and Canadian markets. He is proficient in trading using Technical Analysis, placing emphasis on supply and demand, and price action.

Jonah Sim is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He graduated from University of Essex with a Bachelor Degree in Banking and Finance.

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It