3 Hong Kong Index CFDs: Ride the Chinese Tech Wave (Part 1) August 27, 2021

What this report is about:

- China’s crackdown on technology companies has created much unease in markets.

- Its technology sector remains attractive, given the country’s ambition to become a leading innovative country.

- Against headwinds for Chinese equities and challenges faced by foreign investors in picking Chinese stocks, get exposure to the sector through our newly launched Hong Kong Tech Index CFD.

In our article on 25 March 2021, we discussed the potential winners and losers of the Hang Seng Index’s biggest revamp in its 51-year history. Since then, there have been major changes in China’s and Hong Kong’s stock markets. In this Part 1 of our 2-part series, we focus on their impact on the technology sector.

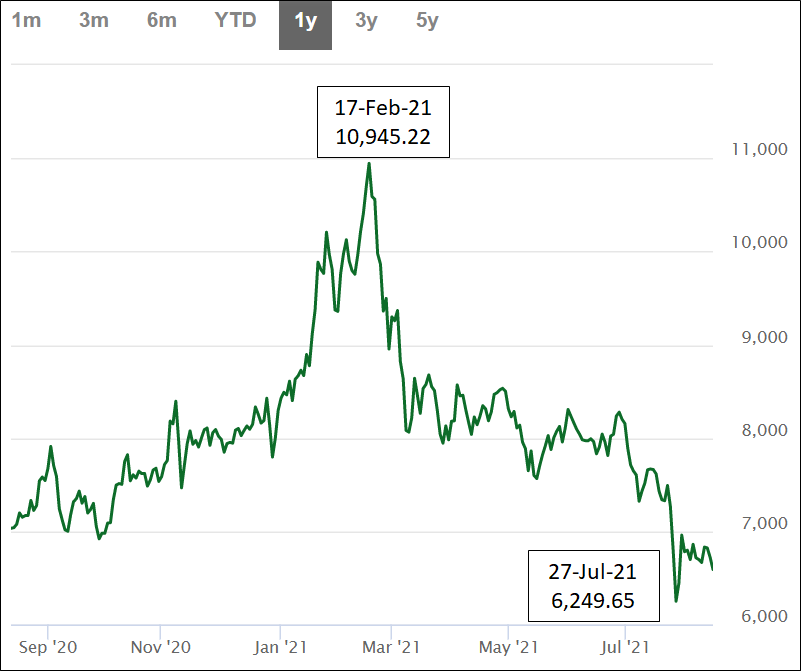

China’s ongoing crackdown on technology companies has created much fear and unease in the market. The Hang Seng Tech Index, which features the 30 largest technology companies listed in Hong Kong, dropped 42.9% from a high of 10,945.22 on 17 February 2021 to a low of 6,249.65 on 27 July 2021.

Despite its huge tumble and ongoing regulatory risks, investors are still very keen to have exposure to the technology sector in China.

Attractiveness of the China and Hong Kong technology sector

1. One billion Internet users

The China Internet Network Information Center estimated that at the end of December 2020, China had 989mn Internet users. This was almost three times the entire US population. Primarily on mobile phones, 782mn of these users shopped online while more than 900mn streamed videos online. With a growing Chinese middle-income population, many of the colossal Hang Seng Tech Index constituents, whose valuations are currently attractive, still have substantial room for growth.

2. Unicorns

A unicorn company is a privately-owned start-up valued at more than US$1bn. There were 251 unicorn companies in China as at December 2020, out of a total of 590 worldwide, according to Greatwall Strategy Consultants in April 2021[2]. The majority of them, if successfully listed, would fall under tech stocks and could be screened for inclusion in the Hang Seng Tech (HSTECH) Index. With current negative sentiment on listing in the US, many of these unicorns could be motivated to list on the Hong Kong Stock Exchange (HKEX).

3. China’s 14th Five-Year Plan

China’s 14th Five-Year Plan (2021-2025) is different from its predecessors in that it does not emphasise GDP growth. Rather, it emphasises – in terms of chapters dedicated – domestic socio-economic development (14%) and supporting innovation and technological advancements (14%)[3].p>

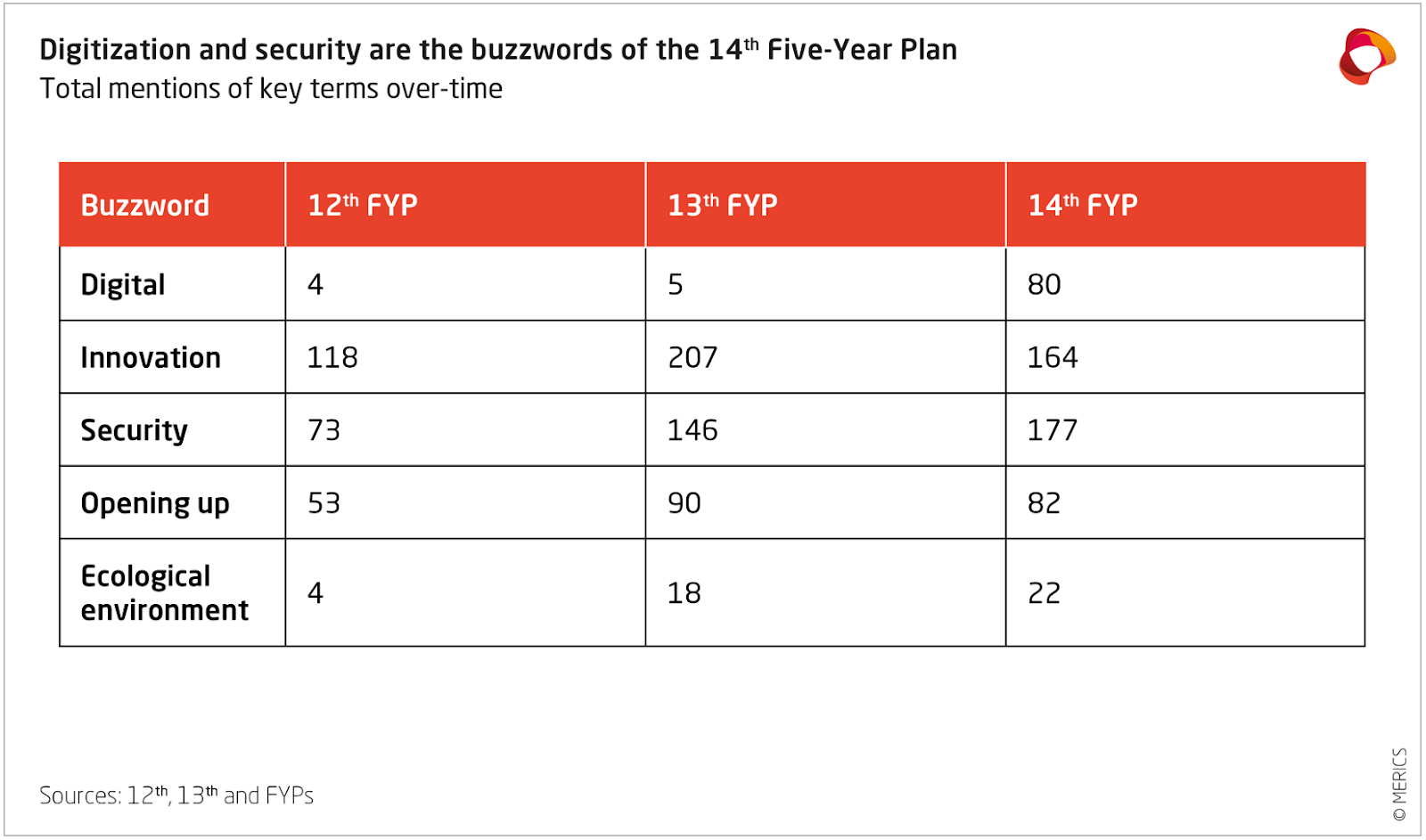

Compared to its 13th Five-Year Plan, there is significantly higher emphasis on digitalisation[3]

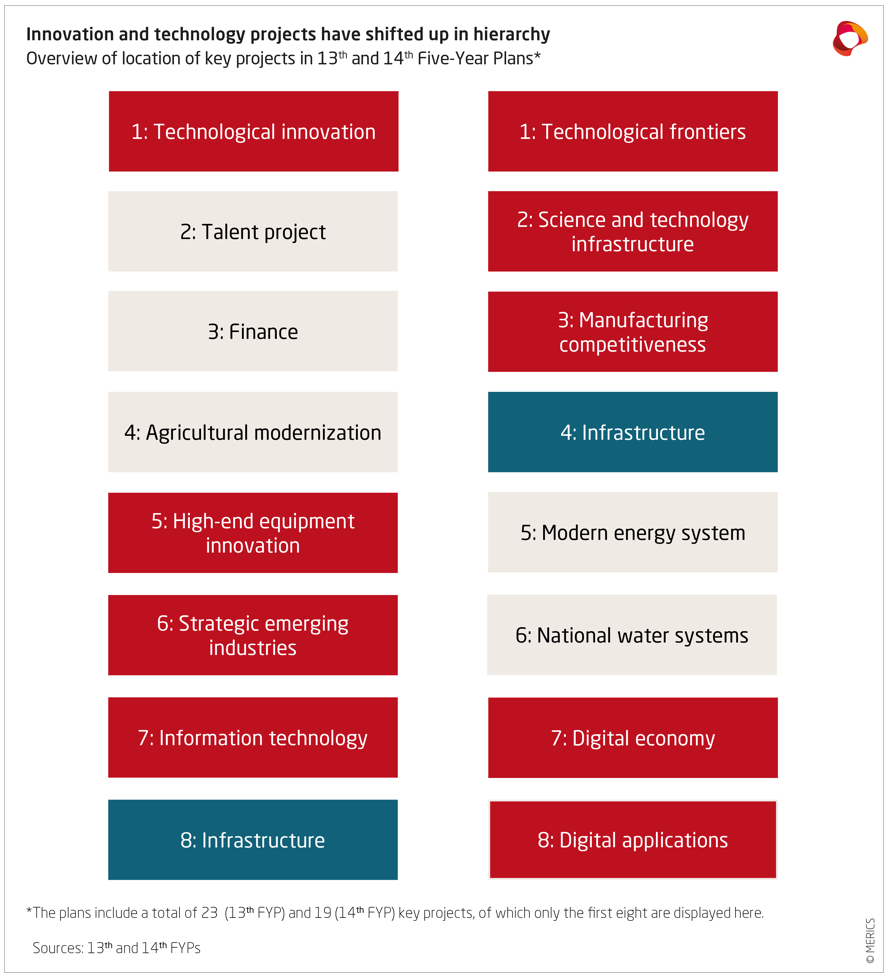

Special projects in innovation and technology have been given higher priority by the 14th Five-Year Plan.[3]

China’s ambition is to become a leading innovative country by 2035. As such, further fiscal policies, grants and subsidies can be expected to boost its technology sector.

Headwinds for Chinese equities.

However, there are also headwinds for Chinese equities.

Global headwinds

Relentless trade restrictions, international sanctions and the threat of delisting Chinese government-linked and technology companies from US exchanges have increased the risks of US-listed Chinese entities.

- Trade war and tech cold war.

Four years and more of a US-China trade war[4], under two different US Presidents, have exerted considerable pressure on Chinese companies, particularly the tech players. This has increased their share-price volatility.

Major events directly affecting Chinese companies in 2021.

- Threat of US delisting of Chinese companies

As of 5 July 2021, the value of all 245 Chinese companies listed directly or as American Depositary Receipts on US stock exchanges was around US$2tr. This formed a hefty 15% of the total market capitalisation of the Shanghai and Shenzhen stock exchanges, at US$13tr. [5][6]. Should the threat continue to escalate, such negative sentiments in the U.S. could substantially benefit Hong Kong as an alternative listing destination for Chinese companies.

Domestic headwinds

- Increased regulatory oversight of tech giants

China’s Internet regulators are tightening their grip on tech giants’ business structures and operations. Alibaba, Tencent, Meituan, and DiDi Global have all not been spared. They are among the latest scrutinised recently. .

China’s greatest display of its determination to rein in its tech behemoths was its 11th-hour scuttling of Ant Group’s IPO last November, citing risks to consumers from Ant’s online banking structure.

China has been mainly targeting monopolistic behaviour such as forced exclusivity on e-commerce, social and streaming platforms. Forced exclusivity refers to Internet platforms’ restrictions on their online vendors, celebrities or influencers from cross-selling or marketing on competing platforms. This is deemed anti-competitive and an impediment to innovation.

China’s Internet giants have also been accused of the compulsory collection and abuse of consumers’ personal and consumption data.

Casualties include:

- DiDi Global – Put under a data-security probe.

- Tencent’s WeChat – Suspended new user registration for security compliance.

- Meituan – For antitrust violation and other business practices.

This shake-up has resulted in sharp market corrections and elevated risks for the Chinese tech sector. The flip side of it is that forward P/E valuations for big tech names like Tencent and Alibaba have fallen to the low 20’s. This makes them much more affordable to investors looking for exposure to the Hang Seng tech sector.

Challenges faced by foreign investors.

Despite attractive stock valuations, many foreign investors find it challenging to invest in China’s A-share and Hong Kong’s H-share markets, for the following reasons:

• Language barrier and accessibility to information – Limited language proficiency in business Chinese, insufficient access to information and lower transparency of economic and financial data are natural impediments to research and investment in Chinese markets.

• Most foreign investors lack an understanding of Chinese consumers, particularly for the products and services of high-growth companies in competitive industries. Many listed Chinese tech conglomerates are holding companies for these high-growth firms, some of which are privately-owned unicorn companies.

• Trading complexities – The Hong Kong-China Stock Connect, first started in 2014, allows investors to cross-trade eligible shares listed in China and Hong Kong. Although this initiative has greatly boosted the liquidity of eligible China and Hong Kong listings, differences in macroeconomic policies, foreign exchange, trading hours, limited stock eligibility and settlement dates add to the trading complexities for investors and traders.

Hong Kong market’s appeal

Attractive valuations, developed financial markets, robust regulatory policies, strong corporate governance, high market liquidity, stability of currency, ease of access and a diverse universe of securities are some of the reasons traders and investors remain attracted to the HKEX.

In addition, global trade and tech wars against China are expected to benefit HKEX as it becomes a haven for Chinese companies and unicorns seeking secondary listings or IPOs.

Given the strength of China’s domestic online consumption and the government’s exceptional support for technology and innovation, the Chinese tech sector remains poised for a multi-year bull run. The recent sell-off, thus, could provide unprecedented opportunities to hop onto its bandwagon.

Get exposure through newly-launched Hong Kong Tech Index HKD10 CFD.

Investors who wish to get exposure to the technological and innovative sector but face challenges picking stocks can consider our latest Hong Kong Tech Index HKD10 CFD.

Our Hong Kong Tech Index HKD10 CFD tracks the Hang Seng Tech Index, which represents the largest Chinese technology firms listed in Hong Kong. As of 30 June 2021, back-tested data of the HSTECH Index showed a positive performance of 63%, outperforming the flat Hang Seng Index over a 3-year period [7].

However, against current strong volatility in the Chinese tech sector, investing in the sector may remain a roller coaster ride in the short term. Here’s how our Hong Kong Tech Index HKD10 CFD can help you:

- Trade in both directions -Both long and short.

- Diversification through a free-float market-weighted index – This reduces risks and costs of owning individual equities.

- Hedging tool – Long-term investors can hedge against short-term volatility which would be elaborated in Part 2 of our series.

There are other synergistic benefits such as pair trading strategies of using Hong Kong Tech Index HKD10 CFD with correlated Indices, which we shall cover in Part 2 of the article series. In Part 2, we will go through China’s economy, main features and key selling points of all 3 of our latest Hong Kong based Index CFDs! Do stay tuned for it!

For more information on our Hong Kong Index CFDs, visit our website here.

Reference:

- [1] https://www.hsi.com.hk/eng/indexes/all-indexes/hstech

- [2] https://www.chinadaily.com.cn/a/202104/27/WS6087b8c5a31024ad0babac33.html

- [3] https://merics.org/en/short-analysis/chinas-14th-five-year-plan-strengthening-domestic-base-become-superpower

- [4] https://www.phillipcfd.com/us-china-trade-war-part-2/

- [5] http://www.szse.cn/English/

- [6] http://english.sse.com.cn/

- [7] https://www.hkex.com.hk/Products/Listed-Derivatives/Equity-Index/Hang-Seng-TECH-Index-Futures-and-Options/Hang-Seng-TECH-Index-Futures?sc_lang=en#&product=HTI

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Kah Chee

Assistant Manager, Dealing

Kah Chee graduated from Nanyang Technological University with a Bachelor’s Degree in Accounting. With more than 10 years of experience as a full time, professional investor and trader specialising in the Hong Kong and US markets, he employs fundamental and technical analyses with experience in a multitude of financial instruments.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It