3 Singapore-based sectors to consider in inflationary times June 10, 2022

Introduction

Inflation is a big worry for investors with 2022 bringing forth the highest levels of inflation seen in decades. In the United States, inflation rate was recorded at 8.3% Year-on-Year (YoY) in April after rising to 8.5% the previous month1.

CNBC News reports that a decline in numbers could indicate that inflation in the US is showing signs of cooling down, after being at a 40-year high since December. However, economists are sceptical and believe that there is no way to be certain how inflation develops from here.

Households are feeling the pinch of rising prices and the largest price hikes for April were seen in airfares, shelter, food (which include meat and bread) and new vehicles2.

Closer to home, Singapore’s core inflation for April continued to rise to 3.3% — the highest level unseen since February 2012 — just a month after it reached a 10-year high of 2.9% in March. This was mainly attributed to higher food, retail, transport, electricity and gas prices. Singapore’s consumer price index, or overall inflation, was recorded at 5.4% YoY in April, remaining the same as the previous month3.

On 25 April 2022, the Monetary Authority of Singapore and the Ministry of Trade and Industry said in a joint statement that core inflation was expected to rise further in the coming months before external inflationary pressures mitigate towards the end of the year4.

Going beyond the US and Singapore, inflation has also worsened worldwide.

Central banks in advanced economies normally target inflation at 2%, however the United States, Britain and European countries have recorded annual inflation rates of over 5%, leading to an all-time high level of inflation last seen in the 1980s. Furthermore, more than half the countries in emerging economies have inflation rates higher than 7%5.

As countries struggle to bring inflation under control, let’s take a look at three Singapore-based sectors (and companies) investors can consider in their bid to hedge against inflation.

Banks

The US Federal Reserve has hiked its short-term interest rate and is expected to raise rates several more times this year to combat inflation6.

With that in view, investors should note that banks thrive when interest rates increase as they stand to benefit from a boost in their net interest margin and net interest income7.

Therefore, investing in bank stocks is a good option for retail investors.

As Singapore’s benchmark interest rates are mostly in line with movements in the Federal Funds Rate, Singapore’s financial sector is expected to benefit from the rising interest rate cycle as the US Fed aims to tackle record high inflation8.

DBS

This Singapore bank has been a pillar of stability and has reported a record-high net profit of S$6.8 billion for FY2021.

In 1Q2022 however, Singapore banks suffered a fall in net profit due to lower non-interest income because of a volatile market9.

Research Analyst from Phillip Securities, Glenn Thum says that DBS saw loan growth of up to 8% YoY and deposits growth of 9% YoY for 1Q2022. Separately, total allowances for 1Q2022 increased YoY to S$55million but credit costs were maintained at 15 basis points (bps), similar to recent quarters.

Also on the downside, DBS’s fee income dropped 7% YoY due to weaker market sentiment. Net interest margin declined 3bps YoY. Net interest income rose 4% YoY, but was moderated by flat Net Interest Margins.

Overall, Glenn maintains an accumulate recommendation for DBS10 .

OCBC

Glenn said in his latest report that OCBC’s Net Interest Income (NII) increased by 4% YoY and saw loan growth of 8% YoY for 1Q2022.

At the same time, allowances dropped 73% YoY to S$44million and credit costs increased by 31bps on the back of a better credit environment.

Glenn further states that OCBC’s management expects more lending opportunities in the wholesale segment and sustainable financing. OCBC also has lower provisions and expects higher interest income once the economy gathers pace11.

Consumer staples

Consumer staples tend to perform well even during times of economic uncertainty, as you have to buy essential products. In the event you have to cut back, discretionary purchases such as restaurant meals and luxury items take the brunt. With that in mind, let’s take a further look at some companies in this sector.

Sheng Siong Group Ltd

Singapore based supermarket chain Sheng Siong has around 65 outlets across Singapore, making it one of the biggest in the country. It has a wide array of merchandise specialising in household goods and necessities, as the company saw a 6% YoY increase in revenue for 1Q2022.

Phillip Securities Research said on 29 April that the company’s gross margin continues to rise due to a larger mix of fresh food (meat and seafood)12.

Moreover, Sheng Siong is aiming to open 3 to 5 more outlets per year over the next 3 to 5 years around HDB housing estates with plans to establish 17 locations across those estates in the next 3 years.

Lastly, same-store sales grew by 4.7% YoY for 1Q2022 which makes this supermarket chain an intriguing investment option13.

Reopening plays

Investors can also consider sectors in Singapore that will benefit from borders reopening and markets returning to normalcy after the easing of COVID-19 restrictions.

Singtel

One such company is Singtel, Singapore’s largest telco that provides tech related services and offerings to clients in applications, engineering and infrastructure. Singtel saw an increase in earnings in Australia as revenue hiked 4% YoY on the back of Average Revenue Per User (ARPU) and subscriber growth. The popularity of Optus mobile plans among consumers which provides 5G speed and on-demand product features has also contributed to the rise in revenue.

Similarly in India, Singtel saw a 12% increase in 4G subscribers and a rise in earnings was driven by a 23% increase in ARPU.

Check out the Phillip Securities Research report on Singtel below:

Singtel also reported its Singapore ARPU rising 2.6% YoY, despite facing a 3% decline in the mobile customer market share in Singapore. The company attributes that to the fall in foreign workforce and believes it would be able to recapture some of its losses once the economy opens up and foreign workers return to the country14.

CapitaLand and Integrated Commercial Trust (CICT)

CICT is a counter which can benefit from both the return of employees to the office sector and the retail sector welcoming more tourists.

CICT’s office occupancies grew 1.9% Quarter-on-Quarter (QoQ) in the 1QFY2022 and the company is now in negotiations with ByteDance to fill up Capital Tower. Successful negotiations could bring occupancy of Capital tower back to 94%.

With rent reversion expected to be positive in 2022, office spaces such as Capital Tower, Asia Square Tower and CapitaGreen amongst the few could generate more revenue for the company in the coming months.

With borders reopened, malls such as Bugis Junction, Plaza Singapura and Funan are expected to gain increased footfalls and a rise in consumer spending15.

Check out the Phillip Securities Research report on CICT here:

https://www.stocksbnb.com/reports/capitaland-integrated-commercial-trust-recovery-in-full-swing/

ETFs

If you are not keen on equities, you may want to consider investing in ETFs to benefit from some of the sectors mentioned.

| Ticker | ETF Name |

| ES3 | SPDR® Straits Times Index | G3B | Nikko AM Singapore STI |

| OVQ | Phillip Sing Income |

To check them out, visit: https://www.poems.com.sg/etf-screener/

The top 10 holdings for each ETF mentioned is listed below.

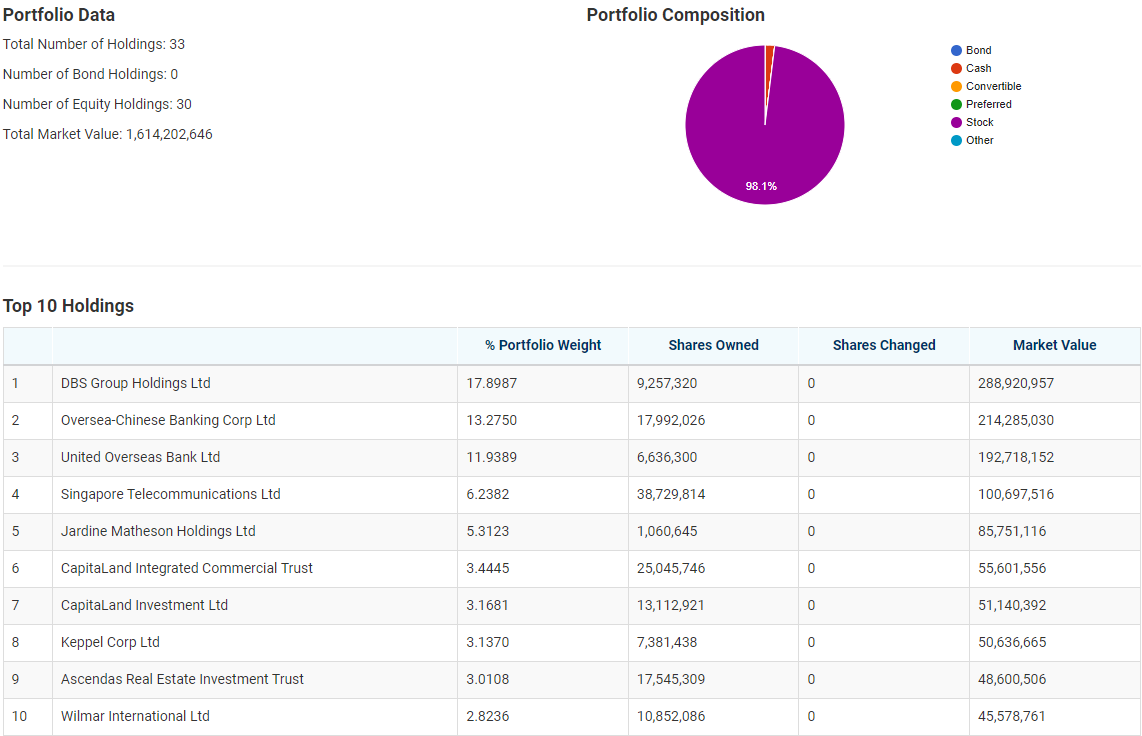

SPDR® Straits Times Index (ES3)

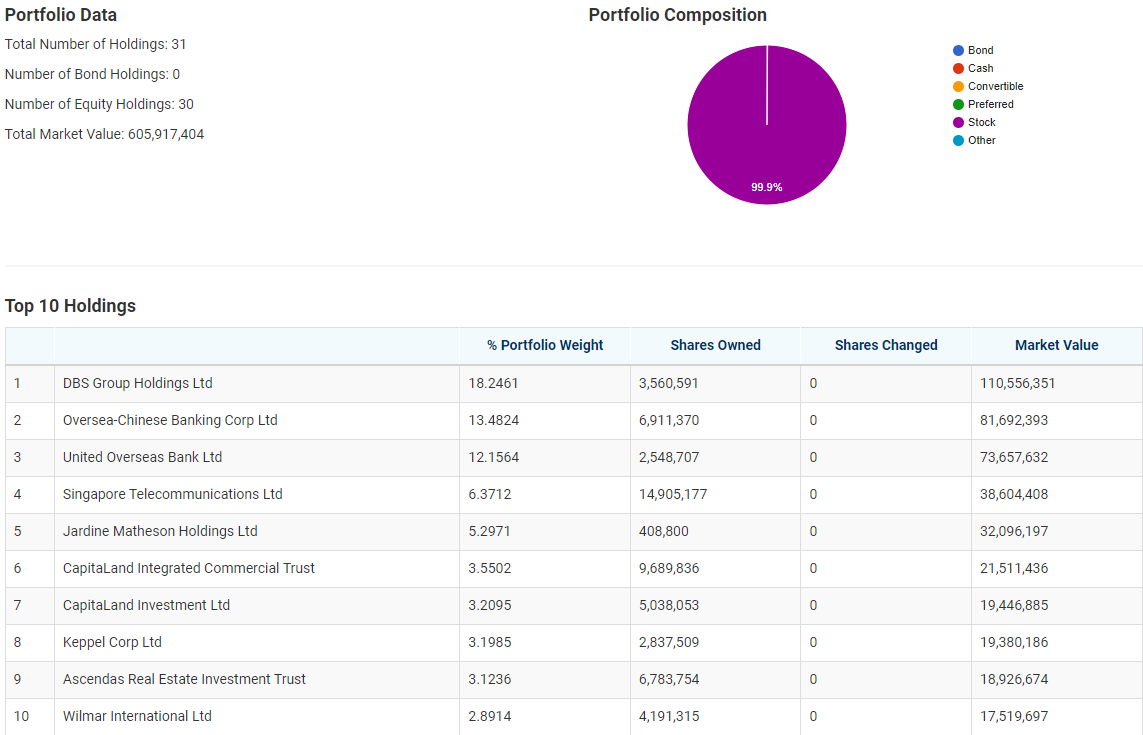

Nikko AM Singapore STI (G3B)

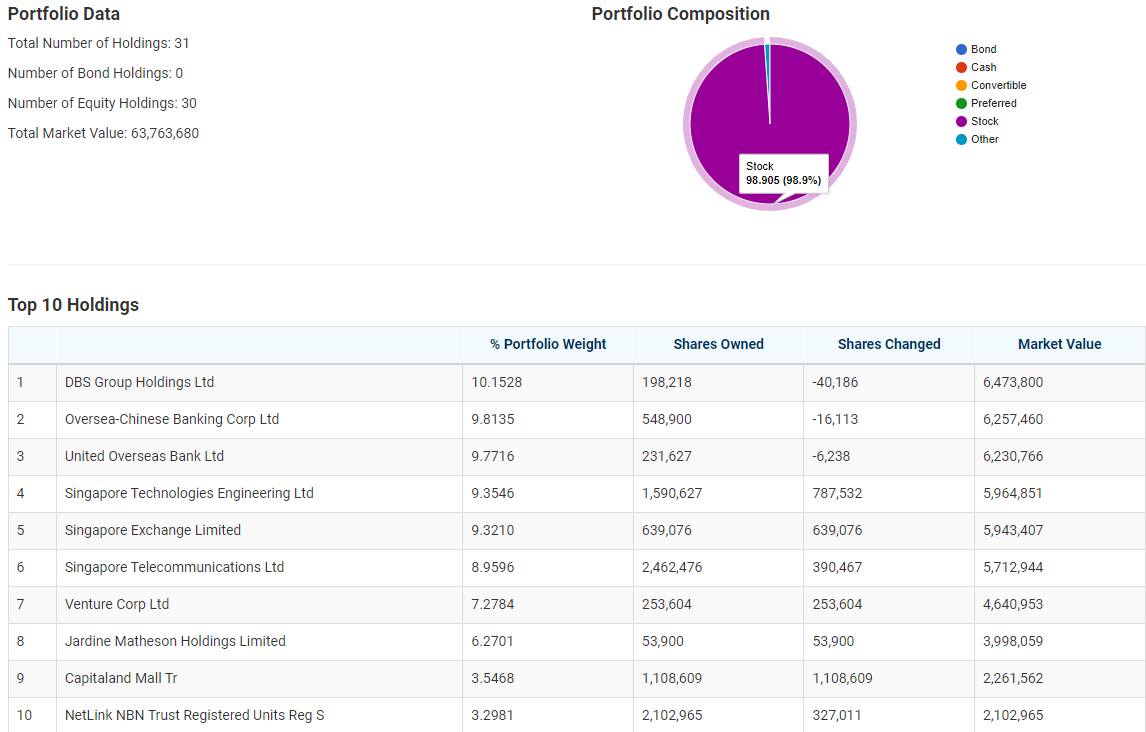

Phillip Sing Income (OVQ)

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

- [1]https://www.usinflationcalculator.com/inflation/current-inflation-rates/#:~:text=The%20annual%20inflation%20rate%20for%20the%20United%20States,inflation%20over%20the%2012%20months%20ended%20May%202022

- [2]https://www.nbcnews.com/business/economy/inflation-numbers-april-2022-cpi-data-rcna28194

- [3]https://www.channelnewsasia.com/business/singapore-cpi-inflation-mas-mti-increase-record-april-2022-fastest-10-years-2700456

- [4]https://www.straitstimes.com/business/economy/singapore-inflation-jumps-to-10-year-high-in-march-on-higher-food-services-and-transport-prices

- [5]https://www.nytimes.com/2022/04/12/business/global-inflation.html

- [6]https://edition.cnn.com/2022/03/17/success/rising-interest-rates-investments-and-savings/index.html

- [7]https://thesmartinvestor.com.sg/3-singapore-blue-chip-stocks-to-buy-if-the-market-crashes-tomorrow/

- [8]https://sg.finance.yahoo.com/news/dbs-uob-cdg-st-engineering-184944080.html

- [9]https://thesmartinvestor.com.sg/interest-rates-are-rising-which-of-the-3-singapore-banks-should-you-pick/

- [10]https://www.stocksbnb.com/reports/dbs-group-holdings-ltd-earnings-in-line-despite-lower-fee-income/

- [11]https://www.stocksbnb.com/reports/oversea-chinese-banking-corp-ltd-lower-allowances-and-higher-net-interest-income/

- [12]https://www.stocksbnb.com/reports/sheng-siong-group-ltd-reopening-minus-and-inflation-plus/

- [13]https://www.stocksbnb.com/reports/sheng-siong-group-ltd-reopening-minus-and-inflation-plus/

- [14]https://thesmartinvestor.com.sg/singtel-doubles-its-final-dividend-5-highlights-from-the-telcos-fy2022-earnings/

- [15]https://www.theedgesingapore.com/capital/brokers-calls/uob-kay-hian-lifts-cicts-tp-250-amid-positive-outlook-office-and-retail

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Shamir Thair

Shamir Thair is a Content and Community Executive with POEMS Marketing.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It