4 key risks threatening the Santa Claus rally December 30, 2021

- The Santa Claus rally is a sustained bullish market movement which usually occurs during the last week of the year and continues into the New Year.

- This year’s Santa Claus rally may be threatened by

- Inflation Risk: Sustained increase in prices which may lead to a more hawkish Fed

- Supply chain disruption: Sustained disruption leading to supply lagging increased demand

- COVID-19 spread: Uncontrolled spread of the disease or a new variant which proves to be more transmissible and has immunity against the current vaccines

- US-China relations: Worsening ties between the two countries and increased trade friction which worsens the trade flow

- The biggest risk facing the market now is the discovery of Omicron COVID-19 variant, but the market is still fundamentally strong and may have sustained strength for a year-end rally

The term Santa Claus rally1 is used to describe a phenomenon in the stock market where there is a sustained bullish movement in the market during the last week of the year continuing into the New Year. This is usually brought about by general optimism in the market during the festive season, which is associated with increased consumer spending that boosts economic activities and carries the market to higher levels.

Traders use the rally as a gauge of the market sentiment for the next year. A strong performance may signify a bullish market next year, while a lacklustre performance could mean that the bears are in control of the market at the start of the new year.

This year’s Santa Claus rally may have started early with the indices trading near record levels. The S&P 500 reached a record high of 4,743 points on 22nd November and has since traded near this record level.

Fig 1. S&P 500 traded at record level on better-than-expected economic data

Fig 1. S&P 500 traded at record level on better-than-expected economic data

The discovery of the new COVID-19 variant Omicron2 and a more hawkish Fed have spooked the market. But the issue now is whether this early Santa Claus rally has the strength to sustain the bullish movement into the New Year, or will it be corrected by the many risks that plague the economy.

Let’s take a look at some of the bigger risks threatening this rally.

Inflation risk

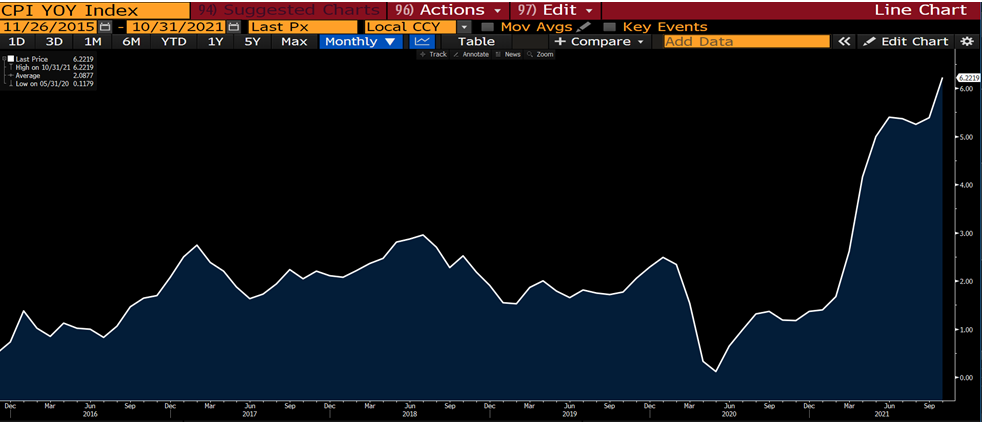

Fig 2. Consumer Price Index(CPI) rising at historical rate

Fig 2. Consumer Price Index(CPI) rising at historical rate

The risk that everyone, from retail and institutional investors to the Fed, is keeping a close eye on is Inflation. The current inflation phenomenon is largely driven by demand and supply imbalances.

In October 2021, the US consumer price index jumped 6.2%, which is the biggest inflation surge in more than 30 years3.

The personal consumption index: the preferred inflation gauge for the Fed was 4.1% higher YoY, which is the highest jump since January 19914.

This inflation will put a dent in the economy by affecting companies’ profits due to higher input costs and lower consumption per unit of dollar as purchasing power decreases.

Some may argue that US President Joe Biden’s spending plans, which are a series of investments into the economy, will exacerbate the price levels in the US and make inflation spike further. The multitrillion-dollar US government spending looks to flood the economy with money and make inflation worse.

The inflation picture is being worsened by the recent developments on the oil front. The inter-governmental cartel of oil and its allies; OPEC+, is passive about producing more oil to meet increased demand from the market even as the winter season approaches5.

With oil prices surging to their highest levels since 2014, OPEC+ is still adhering to its current production plan to increase oil production by 400,000 barrels per day each month.

High oil prices will inevitably cause a spike in inflation. However, the exogenous shock of countries imposing travel restrictions and a potential shutdown will ease the demand for oil and will put downward pressure on oil prices.

This is evident from how, following the discovery of the new COVID-19 variant, Omicron, a few countries re-imposed travel restrictions which sent oil prices tumbling below $70/barrel.

With inflation surging, there is a belief that inflation is more permanent6 now and not as transitory as what Fed chair Jerome Powell and Treasury Secretary Janet Yellen previously emphasised. Recently, Powell dropped the “transitory” tag in one of his speeches7 when inflation numbers rose at record pace.

The Fed may now be forced to wrap up the tapering sooner and bring forward its schedule for rate hikes.

In the latest testimony by Fed chair Powell, he said that the current strength of the economy warrants the consideration to wrap up the tapering sooner8.

The adoption of a more hawkish tone as compared to the earlier accommodative stance by the Fed may spook the market further.

Supply chain disruption

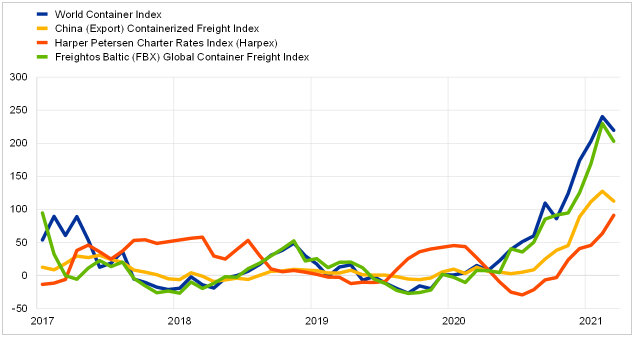

Fig 3. Global freight cost rising

Fig 3. Global freight cost rising

Even though the global economy had started to re-emerge from the COVID-19 pandemic, there is some damage which is more severe than others.

For one, the COVID-19 pandemic has severely impacted the global supply chains. Also, though demand has skyrocketed as restrictions are lifted, the supply chains are still struggling to bounce back.

Additionally, the COVID-19 resurgence in China and Vietnam; both of which are strategically important production lines for global companies, are intensifying the supply chain issues.

Historically, retailers are thought to benefit from increased consumer spending that accompanies the year-end festive season. However, the chaos brought about by the supply chain disruption has meant that companies are not producing enough to meet increased demand.

Furthermore, higher freight costs are also adding to companies’ woes. The cost of shipping a container from China to the US west coast was approximately US$1,600 in pre-pandemic times compared with around US$20,000 today, representing a more than 1,000% jump in costs9. Numerous companies such as Nike have cited supply chain disruptions as a key factor affecting their performance in the near term and provided a gloomier economic picture of their companies heading into the festive season, which ironically should be their best time of the year.

There may be evidence of supply chain stress waning with multiple measures serving to counteract this disruption. Some of these measures include US ports operating around the clock to clear backlogs. But with the festive season adding to existing backlogs, the supply issues are just not easing up enough to keep pace with surging demand.

Also, with the upward pressure on production costs, scarcity of production inputs and higher freight costs, companies’ profit margins are being squeezed.

The absence of sufficient goods to meet demand and the inability to pass on 100% of the cost increase to consumers has also translated into decreased earnings.

Perhaps this supply chain disruption can truly only be resolved after the festive season when demand wanes and shipping activities normalize.

COVID-19 spread

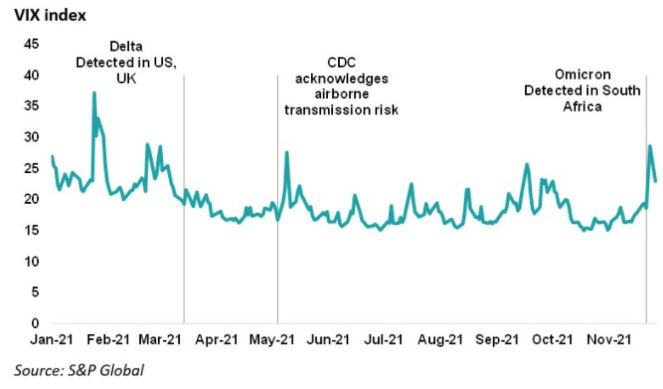

Fig 4. CBOE Volatility Index(VIX) spiking on news of Omicron discovery

Fig 4. CBOE Volatility Index(VIX) spiking on news of Omicron discovery

By far the biggest risk that could threaten the Santa Claus would be the worsening of the COVID-19 pandemic, or the discovery of a variant that severely reduces the efficacy of currently available vaccines.

With the rollout of vaccination programs, the pandemic situation in the US has been coming under control. We see an uptick in economic activities and COVID-19 appearing less in news headlines. However, the global vaccination rates are not uniform, and the percentage of vaccinated people in developed countries far exceed that in developing countries. So far, 54.2% of the global population has been vaccinated, but only 5.8% is from low-income countries.

This means that the risk of the virus mutating, especially in developing countries, remains high.

Also, with the high transmissibility of the Omicron COVID-19 variant, developed and developing countries alike are susceptible to the spread of the disease.

When the Omicron variant was discovered, it pushed the COVID-19 concern back into the limelight. The World Health Organisation (WHO) then classified Omicron as a “variant of concern” as it was believed to be more transmissible, it significantly reduced the effectiveness of the vaccines and could cause more serious disease.

Global markets were spooked by the news, and the Dow Jones index tumbled more than 900 points on Friday, 26th Nov, a day after the Thanksgiving holiday, for the worst day since October 202010.

The news also rattled markets globally with several countries re-imposing travel restrictions to curb the spread of the variant.

Till date, not much is known about the new variant and vaccine makers are working against time to re-engineer vaccines to fight this variant, but it could be months before any is available.

Omicron may manifest itself globally and cause a surge in the infection rates before an effective vaccine is made available. And this may threaten all the economic progress made since the outbreak of the pandemic.

The spread of a more transmissible and deadly variant may cause global economies to scale back or even lock down economies to curb the disease in the absence of an effective vaccine.

We could then experience another selloff in the market if pandemic situation heads in this direction.

US-China relations

Geopolitical tensions between the two superpowers may threaten the market rally. Increasingly, we are seeing tensions between US and China escalate on issues concerning Taiwan, trade practices and treatment of the ethnic minority of Uyghurs among many others.

Ever since President Biden’s predecessor Donald Trump escalated the tensions into an all-out trade war, the relationship between the two countries has yet to turn favourable.

Biden has called for a coalition of US allies to curb the rising “power” of China and has yet to roll back on any of the tariffs slapped on imports from China implemented during the Trump era.

The recent virtual summit between the leaders of the two countries did not produce any breakthrough for better relations. Instead, both leaders reiterated their positions, and agreed on the need to prevent the tensions from escalating into a broader conflict.

The current tensions may not escalate to the levels seen in the Trump era, but any additional measures that threaten to further escalate the sour relationship may negatively impact the sentiment in the market.

Very often trade hurdles are used as hard negotiation tools against one another. And companies with a strong presence in either country tend to lose out the most in such situations as they are directly impacted by the trade hurdles.

As a result of the tensions, we may see lower level of cross-border economic activities between the two countries, which will ultimately hurt the companies’ performance.

Strength in the market?

With the risks described above, the issue is whether the rally can continue.

Heading towards the year end, market was in full bullish mode with better-than-expected market data reported.

October’s retail sales gained 1.7% which is the largest gain since March, and there was a pandemic-low unemployment rate of 4.6%. These were fundamental reasons that boosted the market to record highs.

But the market rally took a pause when a curve ball — the Omicron variant — was thrown at it. The market then retreated on the news to correction territory, and it seems that the strong fundamentals that had boosted the market earlier were forgotten.

The selling pressure may have been made worse by tax loss harvesting11.

Tax harvesting is when investors typically sell losing positions to realise a tax loss advantage to offset their capital gains tax liability, which they may have incurred after a stellar market performance this year.

The market may have been spooked earlier by news of the Omicron variant, but the discovery may actually be bullish for the market if the symptoms are as mild as what early reports suggest.

As the market fundamentals are intact, investors should avoid panic selling and ride out the recent volatility.

Investors can benefit from increased volatility by investing in ETFs whose performance corresponds to the level of volatility in the market. The ETFs below are intended for short-term plays only. Below are some of the VIX ETFs:

Volatility ETFs:

| Ticker | AUM | Average Volume (1 mth) | Expense ratio | Leverage | Inception date |

| UVXY (US) | US$917.1mn | 41.7mn | 0.95% | 1.5x | 3 Oct 2011 |

| VXX (US) | US$1,262.2mn | 37.2mn | 0.89% | 0 | 19 Jan 2018 |

Notwithstanding the volatility, investors are also advised to stay invested and not make huge portfolio reallocation to time the market. Market timing usually results in lower portfolio return over the long term. That said, investors may increase exposure towards retailers as these are expected to outperform during the festive season. Some of the retail ETFs are:

Retail ETFs:

| Ticker | AUM | Average Volume (1 mth) | Expense ratio | Leverage | Inception date |

| XRT (US) | US$713.7mn | 3.6mn | 0.35% | 0 | 19 Jun 2006 |

| RTH (US) | US$268.4mn | 35.2k | 0.35% | 0 | 2 May 2001 |

| RETL (US) | US$143.1mn | 324.7k | 1% | 3x | 14 Jun 2010 |

Note that the RTH.US has a larger percentage of its holdings in online retailers such as AMZN.US, which may be more impacted by supply chain issues due to delivery of products, and that RETL.US is a short-term bullish play on retailers.

Volatility in the market will seemingly persist until there is more information on the Omicron variant. Even though the market has performed badly due to the discovery of Omicron, the 3 US indices are still seeing a stellar performance for the year. Also, the market is being supported by strong fundamental economic data and these may push the market for a year-end rally into the New Year.

Like what you have read? Join our Global Markets Investment Community on Telegram today to share your thoughts with us and other like-minded investors!

Open a POEMS account to start trading or chat with one of our licensed representatives to find out more.

Reference:

- [1] https://www.investopedia.com/terms/s/santaclauseffect.asp

- [2] https://www.nytimes.com/article/omicron-coronavirus-variant.html

- [3] https://www.cnbc.com/2021/11/10/consumer-price-index-october.html

- [4] https://www.cnbc.com/2021/11/24/key-inflation-figure-for-the-fed-up-4point1percent-year-over-year-the-highest-since-january-1991.html

- [5] https://www.forbes.com/sites/arielcohen/2021/11/09/opec-says-to-biden-if-you-want-more-oil-pump-it-yourself/

- [6] https://www.forbes.com/sites/miltonezrati/2021/11/04/inflation-far-from-transitory/?sh=234573ef5361

- [7] https://www.bloomberg.com/news/articles/2021-11-30/powell-ditches-transitory-inflation-tag-paves-way-for-rate-hike

- [8] https://www.nbcnews.com/business/economy/dow-falls-600-points-fed-chair-powell-says-speed-tapering-rcna7081

- [9] https://www.dailysabah.com/business/transportation/pre-pandemic-container-prices-now-a-dream-asbottlenecks-deepen

- [10] https://www.cnbc.com/2021/11/26/stock-futures-open-to-close-market-news.html

- [11] https://www.investopedia.com/terms/t/taxgainlossharvesting.asp

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng

Senior Dealer

Yong Heng joined Phillip Securities in June 2020 as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a bachelor’s degree in Economics & Finance. He also completed his CFA studies last year.

From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

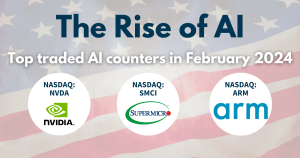

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It  The Rise of AI – Top traded AI counters in February 2024

The Rise of AI – Top traded AI counters in February 2024