4 Reasons to Invest in Stocks Listed on Hong Kong Stock Exchange May 29, 2017

Gloomy industries outlooks from the oil and gas, property and banking, coupled with lukewarm political ties with China are undermining growth prospects for Singapore’s economy. Investors may consider investing into regional markets as a form of diversification and to tap into China’s one belt one road initiative. Investing in stocks listed on the Hong Kong Stock Exchange (HKEx) is an option as it has more than 1700 listed companies with a market capitalization of HKD28 trillion. Aside from being Asia’s 3rd largest bourse by market capitalization, here are more reasons to consider stocks listed on HKEx.

1. Tax competitiveness

Both Singapore and Hong Kong are generally tax-friendly with corporate tax rates of 17% and 16.5% respectively while US companies are subject to a corporate tax rate of 39.6%. Hong Kong does not impose withholding tax on dividends. Investors will receive the full amount declared by a company. On the other hand, the United States levies a 30% withholding tax on dividends paid to foreign investors.

All else being equal, a company’s return on equity and operating cash flow will be eroded with increasing corporate tax rate. Net dividend yield will also be reduced by withholding tax. Therefore, it makes sense for investors who are focusing on building a dividend income stream to invest their funds in tax-friendly stock exchanges like HKEx.

2. Access to sectors-which are not-available on SGX

Always dream of owning a stake in the Electronic Road Pricing (ERP) system? Yes, you can via HKEx! HKEx offers a diverse list of listed companies. Investors can have access to domestic TV broadcasting companies, toll roads companies and airport operations. So how is this beneficial to investors? High-risk investors can diversify their stock holdings through investing into these traditional businesses while investors with lower risk appetite will also have more stock selections.

3. Valuation

Hang Seng Index (HSI) is the main benchmark of the overall market performance in Hong Kong. Dividend yield as of April 17 stands at 3.44% with a price to earnings (P/E) ratio of 14.22. The HSI certainly does not look cheap. However, certain counters within the REITs and property sectors may be worth a closer look. Some of these counters have good dividend records and are priced below their book value.

Let’s take a look at Hang Seng properties sub-index. It is trading at a dividend yield of 3.5% and P/E ratio of 8.9 as of end Mar 17. Some of the constituents in the Hang Seng properties sub-index include Sun Hung Kai Properties, Cheung Kong Properties, Sino Land and Wharf Holdings.

Hang Seng SCHK High Dividend Low Volatility Index (HSHYLV), an index that tracks the performance of the top 50 Hong Kong-listed stocks with high dividend yield and low volatility, is trading at a dividend yield of 4.35% and P/E ratio of 10.04 as of end Apr 17. Valuations of these indices are inexpensive relative to both the Straits Times and Dow Jones Industrial indices. Value Investors should be able to find well managed and growth companies listed under these indices at good entry prices.

4. A gateway to Tap onto China growth

Hong Kong, being a financial hub with a strong legal framework, is the gateway for Chinese companies looking to expand internationally. Hong Kong’s economy will certainly benefit from China’s growth. One area that is benefiting is Hong Kong’s exports to China, which made up 53% of Hong Kong’s total exports and a year-on-year increase of 12.6% in export volume between Jan to Mar 17.

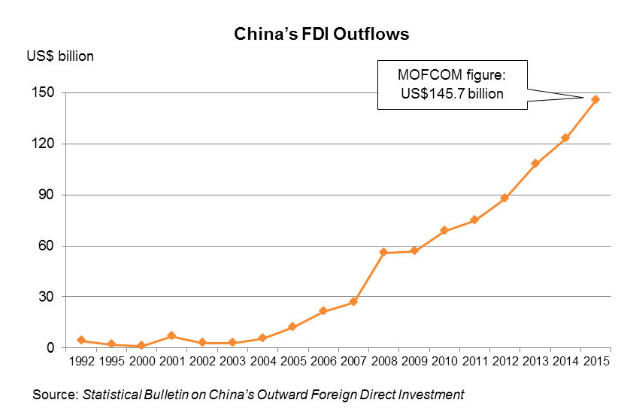

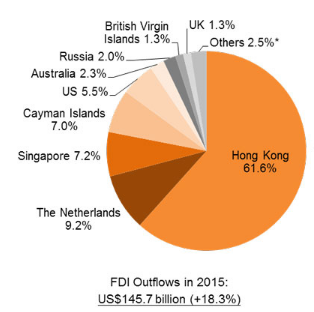

China’s foreign direct investment (FDI) outflow has grown exponentially over the past decade (refer to Chart 1). In 2015, China’s FDI outflow to Hong Kong accounted for an eye-popping 61.6% of the total outflow and a year- on- year increase of 18.3% in value (refer to Chart 2). Investors who want to participate in China’s growth story could consider investing through stocks listed on HKEx.

Chart 1

Chart 2

China’s Outward FDI Destinations 2015

Investors can access HKEx via POEMS 2.0. Alternatively, investors can also invest into Lyxor HSI US$ ETF (Stock quote: A9B). This ETF is listed on SGX with the objective of tracking the HSI. SGX also offers HSI warrants for speculative trading. Do note that Investors are exposing themselves to forex risk when investing in overseas market or foreign currency denominated counters.

To understand more about these products, please speak to your designated Trading Representatives or Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chiang Jin Liang

POEMS Dealer

Jin Liang is currently providing dealing services to over 8000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd.

Jin Liang believes in applying both fundamental and technical analysis in equities investing. He likes companies that can grow their earnings, stay relevant in an ever-changing landscape and focus on investor relations. Jin Liang frequently conducts educational seminars with the objective of imparting financial knowledge to the general public.

Jin Liang holds a Bachelor Degree in Electrical Engineering from Nanyang Technological University (NTU) and passed Level II of the Chartered financial Analyst (CFA) exam.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It