5 Reasons Why You Should Buy US Stocks Today – 2023 Edition November 24, 2022

Summary

Amidst the carnage in the US stock markets so far in 2022, there lies an extraordinary opportunity for investors.

Here are five reasons to start buying US stocks today:

- Inflation U-turn

- Recession Buy Indicator

- 10 Year / 3 Month Treasury Yield Inversion

- Rare 5% Market Reversal

- US Midterm Elections

The Federal Reserve’s aggressive rate hikes and Chairman Jerome Powell’s equally aggressive posturing about future rate hikes have roiled the markets for the most part of the year.

In late October, the S&P index delivered 27.54% in losses while the NASDAQ composite lost 37.77%, effectively pushing them into bear territory. Investors who bought stocks on the dips this year suffered repeated setbacks in the face of the relentless equities rout.

Bloomberg data as of 7 Nov 2022

Bloomberg data as of 7 Nov 2022

According to the American Association of Individual Investors, the percentage of individual investors describing their six-month outlook for stocks as “bearish” stayed at near record highs1.

While several geopolitical factors like the Ukraine War2, the ensuing European energy crisis3 and China posturing on Taiwan4 might have dampened investor sentiment, the biggest dampener was inarguably the Federal Reserve’s resolve to hike interest rates aggressively.

The reason for US central bank’s aggressive interest rate hikes was due to the runaway inflation with consumer prices in the US hovering around a 40-year high5.

At a news conference on 15 December 2021 when which Fed chair Powell contrasted the economic doldrums at the onset of the pandemic in 2020 with the current rising prices, he said: “The economy no longer needs increasing amounts of policy support6.”

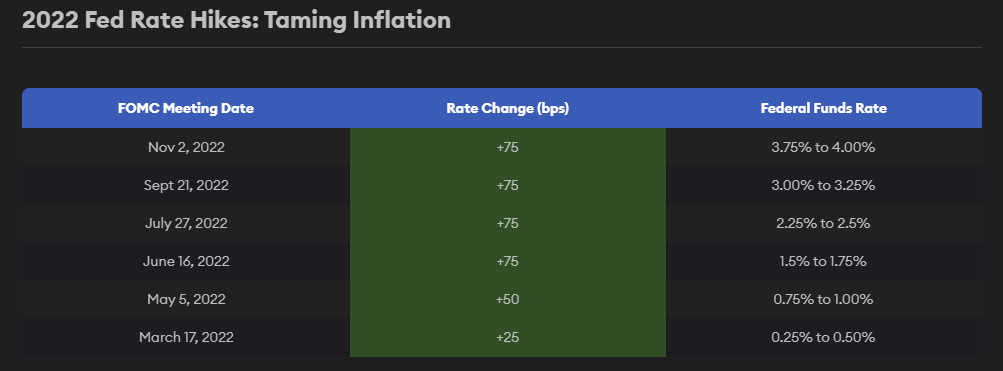

With that said, the US central bank embarked on a series of rate hikes in its quest to bring down inflation7. The latest Federal Open Market Committee (FOMC) meeting on 2 November marks the sixth consecutive rate hike and the fourth straight three-quarter point increase year-to-date, pushing borrowing costs to a new high unseen since 20088.

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

So unlike the previous market turmoil, the current market rout was largely the Federal Reserve’s own doing.

Undaunted by the market rout, Powell pledged in August that the central bank will “use our tools forcefully” to combat inflation that is still running near its highest level in more than 40 years9 and warns of “some pain” ahead as they fight to bring down inflation.

This article will provide an update to the previous one written in 2019 and look at five reasons to invest in the US markets today.

1.Inflation U-turn

While inflation continues to be stubbornly high with core inflation climbing to a 40-year high as reported by various news outlets in October this year10,11 there are clues suggesting that inflation may finally be easing.

The Consumer Price Index (CPI) inflation12 reading, that most economists use for projection is a lagging indicator. It captures and reports inflationary or disinflationary effects months after they enter the economy.

Several inflationary factors have been moderating for months and will very likely show up in the upcoming reports.

Shelter costs make up to about 40% of the CPI and the pandemic sent demand surging. It has by far, been one of the biggest contributors to stubborn inflationary numbers. Recent housing figures seem to indicate a reversal in the demand, which will lead to lower housing prices.

The Case-Shiller Home Price Index (HPI) reported the month-over-month change in August at -0.86%, a further deceleration from the previous months’ -0.44%13. This was the second consecutive month-over-month decline, and the largest decline since February 2010.

Meanwhile, the Federal Housing Finance Agency House Price Index (FHFA HPI) which measures the broad movement of single-family house prices in the US dropped 0.7% month-on-month in August, larger than the 0.6% drop expected by economists14.

Most recently, rent.com reported that average US rent prices dropped in September for the first time in 2022 and prices decreased by the largest amount since late 202015. Rent is traditionally the stickiest component of inflation, and to have it start falling is very bullish for the inflation outlook.

Evidently, housing prices and demand have peaked, and if the Federal Reserve believes that a large contributor (housing) to the CPI is slowing, it will prompt the central bank to back down on additional aggressive rate hikes.

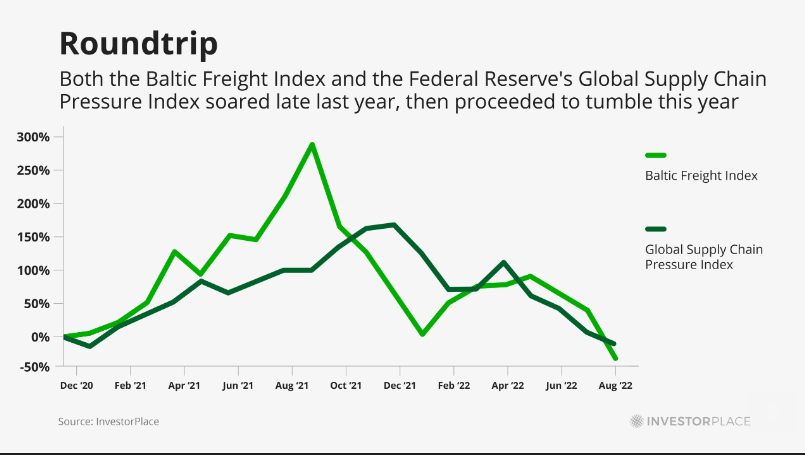

The Baltic Freight Index, which measures shipping rates to transport dry goods, peaked about a year ago and has dropped 70% since then.

The New York Fed’s Global Supply Chain Pressure Index that peaked last December has also tumbled 65% since then.

The prices of energy contracts, agriculture, precious metals, industrial metals, and other commodities, as measured by the Refinitiv/CoreCommodity CRB Index have slipped about 20% in September 2022 after peaking in June.

Bloomberg Data as of 7 Nov 2022

Bloomberg Data as of 7 Nov 2022

The latest November CPI numbers increased 0.4% for the month and 7.7% compared to a year ago, both lower than estimates16. Core CPI – price index excluding volatile food and energy costs increased by 0.3% for the month and 6.3% on an annual basis, lower than expectations. The lower CPI numbers subsequently caused a massive market rally17.

As these deflationary trends continue to work their way through the economy, they will reflect in the upcoming CPI readings as cooler numbers.

With these cooler CPI numbers, we can expect the US central bank to turn dovish and the markets to continue to rally.

2. Recession Buy Indicator

A recent Bloomberg economics model projection forecasted a 100% certainty of a recession by October 202318.

From the report:

While a looming recession is not what investors want to hear, it is not something to fear.

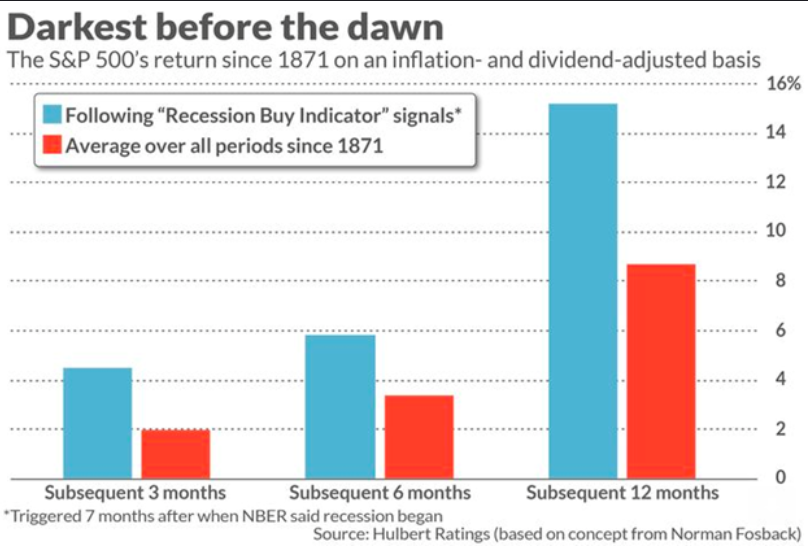

One of the financial world’s best-kept secrets is a largely unknown contrarian indicator also known as the “Recession Buy Indicator”.

Economist Norman Fosback developed the Recession Buy Indicator in the 1970s, and it was a theory that the best time to buy stocks in a recession-driven selloff is about seven months into a recession19.

The rationale is that because the stock market is a leading mechanism, stocks drop well before a recession, and they rebound well before an economic recovery.

More than just mere talk, the theory is instead backed by 150 years of data as shown in the research done by Hulbert Ratings.

Since 1870, stocks have produced about 2X returns yearly every time the Recession Buy Indicator is triggered.

No one has a crystal ball, but the quote by Sam Stovall, chief investment strategist at CFRA Research sums it nicely. It describes the interplay between stock prices and a recession:

Prices lead fundamentals—therefore the stock market falling into a decline is traditionally an indication that most investors believe we are headed for a recession. When we do finally fall into a recession, that’s usually a good time to get back into the market20.

3. 10 Year / 3 Month Treasury Yield Spread

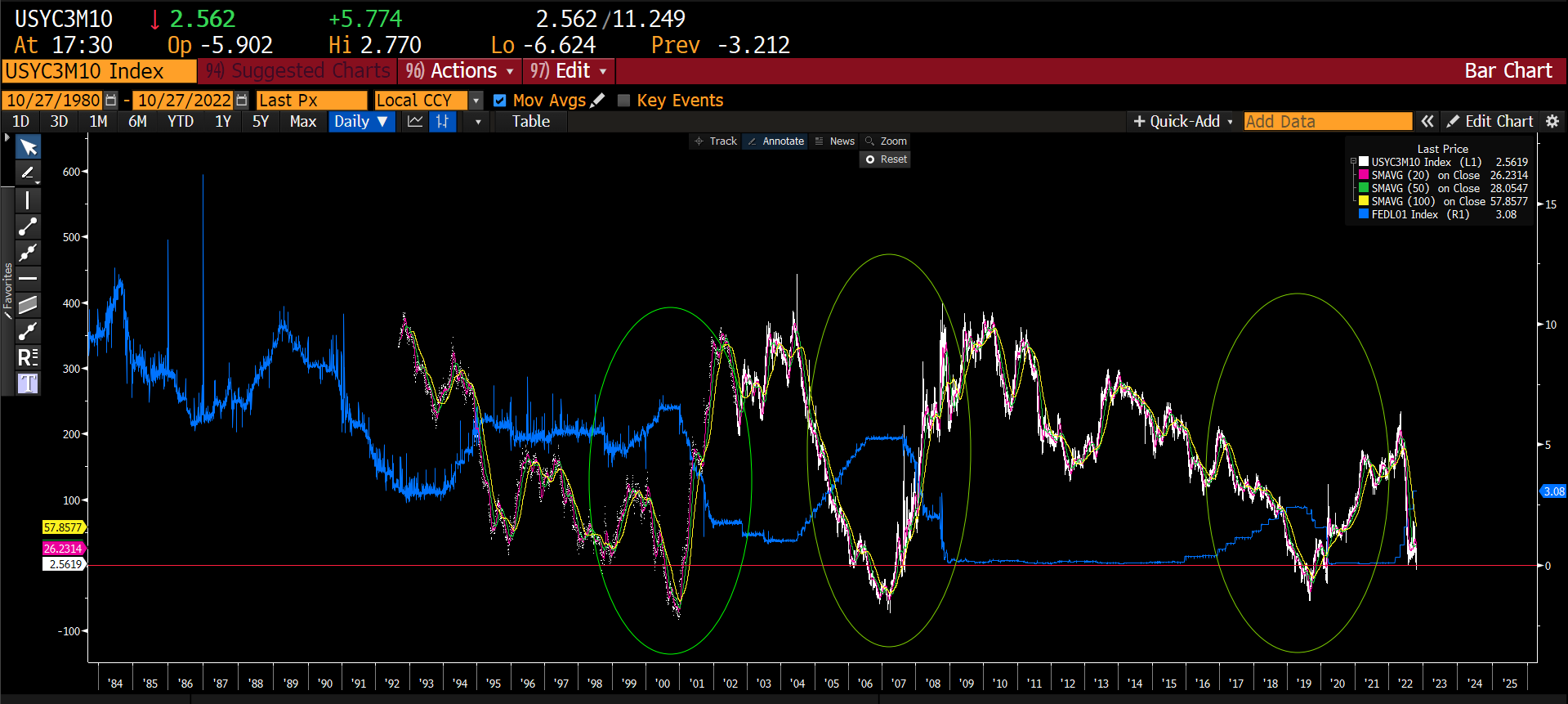

The Federal Reserve’s favourite recession indicator has just gone negative in a sign that it may not be hiking rates for much longer.

A negative yield curve, where the long-term interest rates are less than the short-term interest rates, has been a proven and reliable indicator of a recession in the past.

The 10-year/3-month Treasury yield spread, a favourite recession indicator of the Federal Reserve, turned negative on 26 Oct 2022. Historically, each time the yield turns negative, the US economy tends to be on the brink of a recession.

Incidentally in the chart below, the previous episodes of the 10year/3mth yield going negative (white line going below the red line) was also during the periods where the Federal Reserve either stopped hiking or started cutting interest rates (blue lines).

Additionally certain Federal Reserve officials have started to speak about slowing the pace of rate hikes21 so as not to put the economy into a recession. The recent inversion of the 10-year/3-month yield curve will add more weight to that argument for the central bank to slow or stop interest rate hikes.

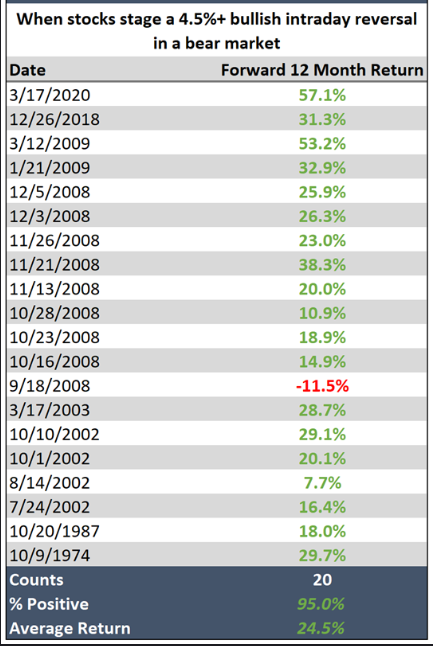

4. Rare 5% Market Reversal

On 13 October 2022, the S&P experienced a 5% intraday swing. Although one day does not make a trend, 13 October was no ordinary day.

As depicted in the chart below, the S&P index opened at down 2% and finished the day at up 3%. That was a 5-percentage point swing in a few hours and indices do not usually perform like that.

In fact, intraday reversals of that size in the midst of a bear market are very rare and tend to mark the end of bear markets.

Researchers at Investorplace22 ran a scan to see how many times the stock markets have had days like this – a 5% bullish intraday swing in a bear market and found that it has only happened 20 times over the past 50 years.

The similarity among these occurrences was that those instances were either at or close to stock market bottoms.

In 19 out of the 20 occurrences (95% of the time), stocks were higher a year later with an average return of about 25%. The only negative occurrence was right after Lehman Brothers went bankrupt in 2008, which many would argue to be an outlier event.

The data does indicate that days like 13 October happen only toward the very end of bear markets.

Data from investorplace23

Data from investorplace23

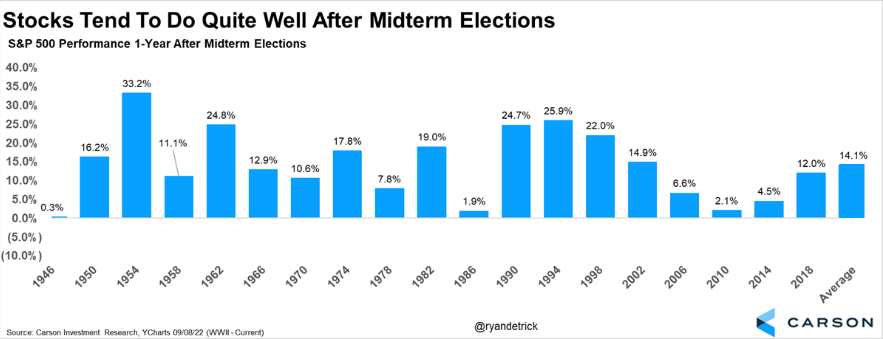

5. US Midterm Elections

This year, the United States held its Midterm Elections.

There have been 20 Midterm Elections since World War II and every time, stocks rallied over the following year as depicted in the chart below.

On average, stocks rally about 14% in the year following a Midterm Election, with zero instances of a negative return.

Why is that?

One possible reason could be “certainty” once the Midterm Elections are over.

Markets hate uncertainty and there is usually massive uncertainty leading up to a Midterm Election. Uncertainty from policy changes that might favor some industries or segments over others for example.

Another possible reason is that the US Midterm Elections can often lead to political gridlock or a divided government where multiple political parties share power. Gridlock is often viewed as positive for the markets. It likely means fewer laws pass successfully, and those laws that are passed are often less controversial, leading to predictability and fewer surprises.

In any case, a paper published by the researchers at the New Zealand’s University of Canterbury in 201824 has found that historically, returns from October of a Midterm Election year to June of the following year have seen above average returns for markets.

To sum everything up, there is massive opportunity in the US stock market amidst the current turmoil.

Several stocks have retraced from their 52-week highs to a much lower valuation and clients who are interested in researching more can check out our monthly market journal on the Popular US Stocks traded for that month

Those who are interested in joining a community that is themed around US stocks can consider joining the POEMS Mobile 3 US stocks community.

Investors who may want to invest but are concerned about market volatility may wish to consider a Recurring Plan where dollar cost averaging is used.

Those who are interested in more research reports on US stocks can visit our StocksBnB site for more information.

Reference:

- [1] https://www.aaii.com/latest/article/21781-aaii-sentiment-survey-pessimism-stays-above-60

- [2] “https://www.nytimes.com/article/ukraine-russia-war-timeline.html”

- [3] “https://www.washingtonpost.com/world/2022/10/05/europe-blackouts-energy-crisis-ukraine-russia/”

- [4] “https://www.washingtonpost.com/world/2022/10/12/china-taiwan-war-xi-jinping/”

- [5] “https://www.ft.com/content/b91996b3-79b2-4f41-acc9-651a0952008f”

- [6] “https://www.wsj.com/articles/powell-confirmation-hearing-could-shed-more-light-on-plans-to-contain-inflation-11641897004”

- [7] “https://www.cnbc.com/2022/09/21/fed-rate-hike-september-2022-.html”

- [8] “https://www.forbes.com/advisor/investing/fed-funds-rate-history/”

- [9] “https://www.cnbc.com/2022/08/26/powell-warns-of-some-pain-ahead-as-fed-fights-to-lower-inflation.html”

- [10] “https://www.nytimes.com/live/2022/09/13/business/inflation-cpi-report”

- [11] “https://www.bloomberg.com/news/articles/2022-10-13/core-us-inflation-rises-to-40-year-high-securing-big-fed-hike#xj4y7vzkg”

- [12] “https://www.bls.gov/cpi/questions-and-answers.htm#:~:text=%E2%96%B8,of%20consumer%20goods%20and%20services.”

- [13] “https://edition.cnn.com/2022/10/25/homes/case-shiller-home-prices-august/index.html”

- [14] “https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-HPI-Down-0pt7-Percent-in-August-Up-11pt9-Percent-from-Last-Year.aspx”

- [15] “https://www.cnbc.com/2022/10/21/us-cities-where-rent-prices-dropped-most-in-september.html”

- [16] “https://www.cnbc.com/2022/11/10/consumer-prices-rose-0point4percent-in-october-less-than-expected-as-inflation-eases.html”

- [17] “https://www.cnbc.com/2022/11/09/stock-market-futures-open-to-close-news.html”

- [18] “https://www.bloomberg.com/news/articles/2022-10-17/forecast-for-us-recession-within-year-hits-100-in-blow-to-biden”

- [19] “https://www.marketwatch.com/story/if-its-a-recession-buy-this-little-known-market-indicator-is-telling-you-to-scoop-up-stocks-on-the-cheap-11657271368”

- [20] “https://www.forbes.com/sites/sergeiklebnikov/2022/06/02/heres-how-the-stock-market-performs-during-economic-recessions/”

- [21] “https://www.reuters.com/markets/us/st-louis-fed-says-will-think-differently-about-involvement-private-events-2022-10-20/”

- [22] “https://investorplace.com/2022/10/a-generational-turning-point-in-stocks/”

- [23] “https://investorplace.com/hypergrowthinvesting/2022/10/this-1-chart-proves-the-bear-market-is-basically-over/”

- [24] “https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3253726”

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Roger Chan

Roger holds a Business Degree in Electronic Commerce from the Monash University and is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He currently heads the Global Markets Night Trading team assisting clients with the US and European markets.

Prior to the night desk, he was a bond trader at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It