5 Things to look out for when investing in REITs April 3, 2017

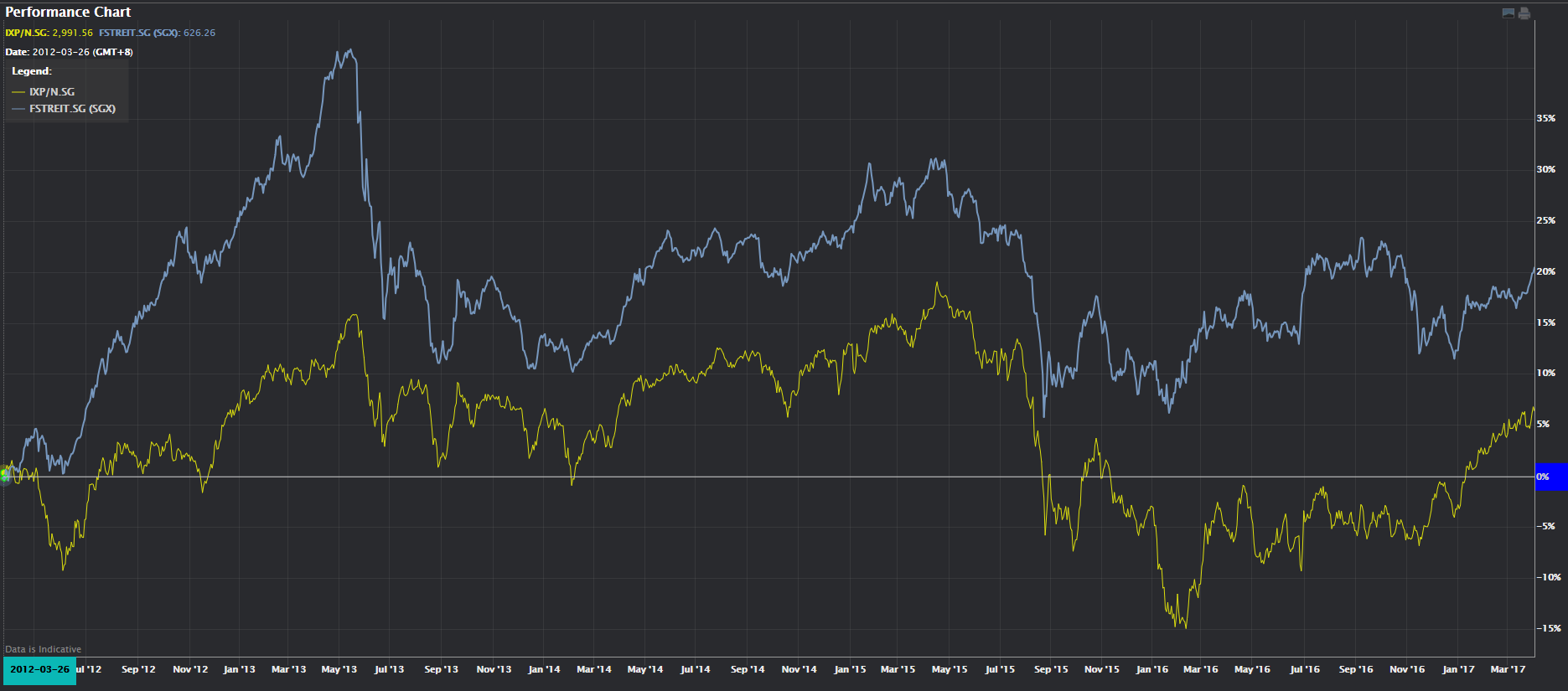

With equity indices trading higher, uncertainties on US policy such as possible tax tariff and increased tension on the Korean Peninsula, passive income assets such as Real Estate Investment Trust (REIT) have once again garnered strong interest. Comparing to last week’s closing, FTSE ST REIT Index has gain 1.32% while STI only managed to inch up 1.02%. Looking back at the past 5 years, the FTSE ST REIT Index has outperformed the STI index by 13.9%.

Source: POEMS 2.0

The recent debut of NikkoAM-StraitsTrading Asia ex Japan REIT ETF on 29 March with an opening price of $1.02 and subsequently finishing the week at $1.014, higher than its IPO price of $1.00 still shows a strong demand for this asset class till this day.

With the Federal Reserve projected to hike interest rates 2 or maybe 3 times this year, should an investor still consider investment in REITs? In my personal opinion, I believe that interest rate risks are already priced-in and the key is to cherry pick REITs with strong fundamentals.

So what are some fundamental matrix we should look at? Below is a list of my personal investment criteria that I will analyse before investing in any REIT.

| Occupancy Rate and Tenant Base | Occupancy Rate is the ratio of rented space as compared to available space. A comparison with past numbers would reflect how strong the REIT manager is in securing tenant. Do read these numbers together with the tenant mix to ensure that the REIT is not overly-exposed to few big tenants. A high and improving occupancy rate together with good tenant mix is always desired. |

| Weighted Average Lease Expiry (WALE) | This defines the average lease term remaining to expire across the entire tenant portfolio and it is usually calculated as the Net Lettable Area (NLA) or Gross Rent (GR). Sometimes, a single big tenant occupying a large space for a long period may skew the WALE higher. Higher WALE

Shorter WALE

|

| Gearing Ratio | Gearing ratio refers to the business’ level of debt compared to its equity capital. REITs in Singapore can have a leverage ratio of not more than 45%, so this will show us the health of the company and whether they would be required to raise equity to improve their balance sheet. Higher Gearing Ratio

Lower Gearing Ratio

|

| Debt Management | In an increasing interest rate environment, it is important to look out for the hedging strategy adopted by the business. This will give investors a clearer picture of the business going forward should there be any changes in interest rates. One ratio that I like to monitor is their interest coverage ratio (EBIT/Interest Expenses). This is to ensure that revenue generated is sufficient to cover their interest expenses. Increase in interest rate will generally have negative impact on REIT prices

|

| Price-to-Book (P/B) Value | Investors who aren’t well-versed in valuation model such as dividend discount model, you can consider adopting relative valuation method such as P/B value. When compared with relative peers (same industry), it can tell a simply story on whether the current price is overpriced or undervalued. |

Fundamental analysis is only a piece of the investing puzzle. Investors should not lose sight of the macro business outlook. For example, with possible slowing down of Singapore’s tourism, will the traffic of shopping malls in neighbourhood be more affected than those in prime district? I would say that the likelihood will be much lesser.

Last but not least, it is never wise to put all your eggs in one basket. If an investor is not able to diversify his/her portfolio due to lack of capital or prefers a more passive approach, ETF such as Phillip SGX – APAC Dividend Leaders REIT ETF or NikkoAM-StraitsTrading Asia ex Japan REIT ETF might be a better consideration in the long run.

If you wish to know more information about ETFs or any other stocks, you can speak to your designated Trading Representatives or a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tay Tiong Yuan

Equity Dealer

Mr. Michael Tay currently provides dealing services to over 17,000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd. Michael is a strong believer of value investing, focusing on companies with strong fundamentals and good dividend policy. Apart from his dealing role, he often provides training seminars on Fundamental Analysis topics to further enrich his clients’ financial knowledge. Michael holds a Bachelor Degree of Finance from the SIM University (UniSIM) and was awarded the CFA Singapore Silver Award in 2012.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It