A Beginner’s Guide to profit from FX Swap Points August 24, 2020

The foreign exchange market, commonly referred to as forex or FX market is open 24 hours a day and 5 days a week. It is the world’s largest market in terms of daily transaction volume. In layman terms, forex trading is the exchange of one currency for another at current quoted/market price.

Forex CFD (FX CFD) is a form of Contract For Differences (CFD) trading that allows you to participate in the exchange rate movements of the underlying forex pair. The main objective of FX CFD is to take advantage of the currency pair’s appreciation/depreciation by exchanging one currency for another.

We have recently released our latest FX CFD trading tool, the FX Swap Heat Map which displays the swap points on the trade date for both the buy and sell direction. This tool is crucial for FX traders as interest may be gained or lost when a FX CFD position is held overnight.

Before we explain more about swap points, make sure you check out our article on “What is FX CFD & Why You Should Trade Them” where we cover the fundamentals of forex trading.

Understanding Swap Points

Forex is always traded in pairs, thus when trading a forex pair, essentially you are borrowing one currency from a broker, and then selling it away to buy another currency before depositing it with the broker.

The borrowing and depositing of currency with financial institutions incur an interest rate on both currencies, similar to the scenario where you borrow (pay interest) or deposit money (receive interest) with a bank.

Hence, you will receive interest for the currency you buy and pay interest for the currency you sell on a daily basis. Such interest rate difference is known as “Swap Points”. Swap points are automatically calculated and debited or credited from your trading account on the next trading day.

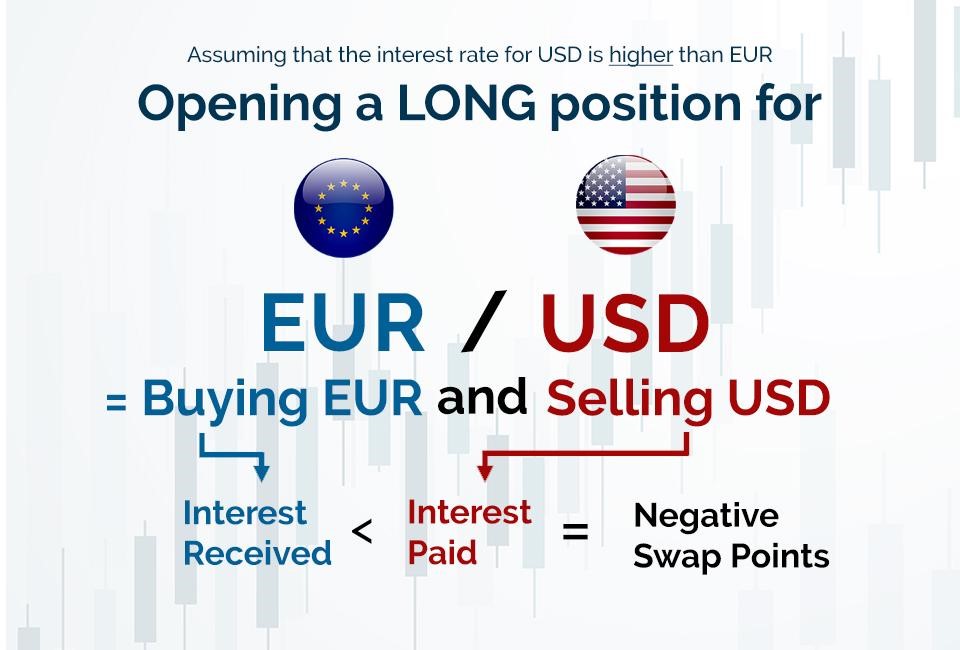

The examples below are valid on the assumption that the interest rate for USD is higher than EUR and remains unchanged.

Holding a long position overnight

Mike decides to enter EUR/USD long position on 17 Aug 2020 and holds it overnight. When you long EUR/USD, you are buying EUR (interest received) to sell USD (interest paid). Since the interest rate for USD is higher than EUR, the swap point is negative, and will be debited in the form of an interest adjustment from Mike’s trading account on the next trading day.

Holding a short position overnight

Mike decides to enter EUR/USD short position on 17 Aug 2020 and holds it overnight. When you short EUR/USD, you are selling EUR (interest paid) to buy USD (interest received). Since the interest rate for USD is higher than EUR, Mike will gain an overall net positive swap points, which will be credited in the form of an interest adjustment into his trading account on the next trading day.

Generating returns with Swap Points

Carry trade refers to earning positive net interest from financial assets. So, how do you identify suitable FX pairs for carry trade and benefit from positive swap points?

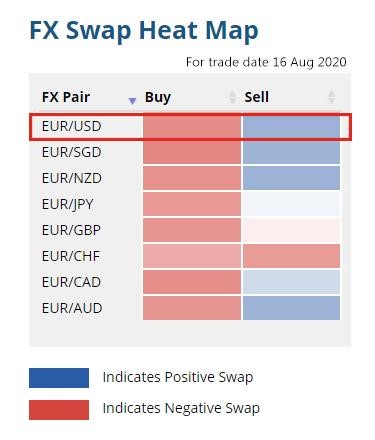

One way would be to refer to the respective currencies’ interest rates set by their central banks. Alternatively, you can use our FX Swap Heat Map that allows you to monitor interest rates by various central banks in a concise table. This approach is effortless as you can make comparisons at one glance.

By referring to our FX Swap Heat Map, you can look out for FX pairs with historical buy swap or sell swap highlighted in blue and earn interest when you hold the FX pair.

Our FX Swap Heat Map table example above indicates that EUR/USD has negative Swap Points in Buy direction (indicated in red) and positive Swap Points in Sell direction (indicated in blue).

Holding a long position overnight

Here, Mike decides to enter into a long position for EUR/USD on 17 Aug 2020 and closes off the position on 18 Aug 2020.

The table below shows the calculations on daily swap points incurred on Mike’s CFD account when holding long position for EUR/USD:

| Trade Date | Action | FX Qty at hand | Swap Points per FX Qty | Daily Total Swap Points incurred (USD) |

| 17/8/2020 | Open and hold EUR/USD long position overnight | 20,000 | -0.000036 | -0.72 |

| 18/6/2020 | Close EUR/USD long position | 0 | -0.000036 | 0 |

| Total cash debited from Mike’s CFD account (USD) | 0.72 | |||

The swap points per FX Qty on 17 Aug 2020 trade date was -0.000036 which is a negative value, hence the Buy column in the Heat Map example above was red colour.

Since Mike held EUR/USD long position overnight on 17 Aug 2020, the negative swap points of USD 0.72 was automatically debited from his CFD account on the next trading day.

Holding a short position overnight

If Mike was holding a short position for EUR/USD instead, the table below would be like this:

| Trade Date | Action | FX QTY at hand | Swap Points per FX Qty | Daily Total Swap Points incurred (USD) |

| 17/8/2020 | Open and hold EUR/USD short position overnight | 20,000 | 0.000012 | 0.24 |

| 18/8/2020 | Close EUR/USD short position | 0 | 0.000011 | 0 |

| Total cash credited into Mike’s CFD account (USD) | 0.24 | |||

The swap points per FX Qty on 17 Aug 2020 trade date was 0.000012 which is a positive value, hence the Sell column in the Heat Map example above was blue colour.

Because of the positive swap points, USD 0.24 was automatically credited into his CFD account on the next trading day.

Carry trade strategy works well during periods of low volatility. As long as the exchange rate fluctuation for the currency pairs is small, or none at all, traders stand to profit from swap points. Note that examples shown are for illustrative purposes and the interest rates of the respective currencies are accurate as of publication date.

* For more information on the FX CFD trading hours, kindly refer to our FX CFD Product page.

Important points to note

1) Just like most trading & and investing strategies, carry trade requires risk management because it possesses a certain degree of risk. The examples above focus solely on the calculation of swap points and did not take the following risk into consideration.

Exchange Rate risk and Interest Rate risk:

Exchange Rate risk: Exchange rates change according to the laws of supply & demand for the currency and it can fluctuate at any moment. If the currency bought is weakened against the currency sold, long position traders would see the trade moves against them while continuing to receive the daily interest. To mitigate this risk, frequent monitoring on exchange rate movement is important.

Interest Rate risk: Interest rates are dynamic and subjected to changes at any time. If the bought currency interest rate is reduced and the borrowed currency interest rate is increased, this will reduce the swap points and hence the profitability of the carry trade. Regular monitoring on swap points is crucial for risk mitigation, especially when the respective countries’ economic condition is changed.

2) Swap points on the Heat Map are subjected to changes on a daily basis.

Because of the interest rate risk, fluctuations of the respective Forex pairs’ interest rates may change the swap points of that particular Forex pair from positive to negative, and vice versa. This will be denoted by the colours changes in the FX Swap Heat Map.

3) Higher values on interest adjustment may be expected if the value date of the underlying Forex pair crosses over a weekend or holiday.

4) Past History may not be indicative of future results.

5) Although CFDs can magnify your gains through leverage, losses are also magnified and you could lose more than the original investment committed when the exchange rate for the underlying Forex pair moves against your position.

The key is always to use leverage responsibly and to have a trading exit strategy in place.

Conclusion

Trading FX involves borrowing and selling one currency in exchange for another currency and such trading involves interest rate for both borrowing one currency and holding another currency. The differences between these interest rates are known as “swap points”. Traders can make use of our FX Swap Heat Map to identify opportunities with better swap points in carrying out carry trade strategies to maximize interest earning.

We have also launched 7 new Pairs for FX CFD!

- USD/CNH

- EUR/NZD

- NZD/CAD

- NZD/CHF

- NZD/JPY

- NZD/SGD

- NZD/USD

Gain access to a wide variety of currency pairs and trade across 36 FX pairs in total. Enjoy up to 20 times leverage, tight spreads and zero commission when you trade FX CFD with us!

For more information on our FX CFD, kindly refer to our FX CFD page. Be sure to check out our other articles and the free webinars courses that we offer. If you have any questions on trading or investing, feel free to drop us an email at cfd@phillip.com.sg and we will be glad to assist you through your investment journey.

Till next time, folks!

Explore our FX Swap Heat Map now!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tan Kean Soon

Dealer

Kean Soon graduated from National University of Singapore with Bachelor’s Degree in Materials Engineering. He is a passionate CFD dealer who believes that equity markets can help grow one’s wealth with the right mindset, risk management & discipline. In his free time, he enjoys learning and experimenting with long-term investment and short-term trading ideas as well as following the latest market news to get in touch with market reality.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading  Demystifying Forex Trading – Technical Analysis

Demystifying Forex Trading – Technical Analysis