A Good time for Gold: 4 reasons to buy gold (Aug 2020 edition) September 2, 2020

We witnessed an unprecedented black swan event at the start of 2020. The COVID-19 pandemic has blindsided many countries and their governments by the speed of its spread and severely disrupted the global economy. Millions of people have since been put out of work while hundreds of thousands of businesses were badly affected.1 International borders have almost completely shut, causing international travel to literally come to a standstill overnight.

The current economic, political and investing landscape

On the economic front in the U.S., unemployment hit 14.7% in April and while it tapered off to 11.1% in June, millions of people are currently still2 unemployed. Meanwhile, economists project that more than 100,000 small businesses in the U.S. have shut down permanently since the pandemic escalated in March3; this will likely exacerbate as the country and many others struggle to return to economic normalcy.

The U.S. Presidential election to be held later this year in November, further amplifies the uncertainty of this environment. For the first time in living memory, it will take place amid an economic crisis, a crushing debt burden and a public health emergency4.

Geopolitically, uneasiness remains around the revival of the US-China trade tensions5. The double whammy of the virus and trade tensions has severely hampered the growth of the Chinese economy as it expanded at its slowest rate in 3 decades6.

In addition, the highly disputed South China Sea continues to be a point of contention between the two global powers7 when the U.S. in a rare move, sent two aircraft carriers to the area in July and further raised the ire of China.

A new Hong Kong national security law9 roils international anger as it hinted at China’s grip on Hong Kong, with some analysts likening the current geopolitical tensions between China and the U.S. as the new Cold War10.

Lofty stock markets prior to the COVID-19 pandemic have since crashed landed when countries on a global scale shut down their economies. They have since come roaring back11 but given that the virus continues to lurk and hinder economic activity, one has to wonder how sustainable this recovery would be, before we see another slide to the downside from inevitable disastrous earnings returns12

Amidst this gloom and doom, there exists an asset class that will serve investors well moving forward.

When the pandemic struck, investors fled for the exits and liquidated everything including stocks, bonds, commodities and cryptocurrencies. But the asset class has since recovered to make new highs and as we will explain in the later part, and poised to perform well in the new economic environment.

The asset class we are referring to is gold.

Gold performance history

Gold is the constant in our global economy. It is highly unlikely to lose value and will never wither away from inflation like a fiat currency. Gold carries no risk of default like a bond, and cannot go bankrupt, like a company. When stocks fall, gold tends to hold its ground and often times rally, as investors flee the markets. It is a great portfolio insurance.

For instance, gold tripled during the 1973 Arab oil embargo that caused the U.S. stock market to crash and the economy went into recession.

It quadrupled in the late 1970s as inflation soared to double-digits, leading to then-Fed Chairman Paul Volker raising prime lending rates to a historic high of 20 percent.

During the dot-com boom, gold fell out of favour but came roaring back after the tech bubble burst and the U.S. economy went into a recession. Gold rallied 5.3 percent from March 2001 through November 2001 since then.

During the global economic crisis of 2008, the S&P 500 fell 56 percent from peak to trough between October 2007 and March 2009 while gold gained 25 percent during the same period.

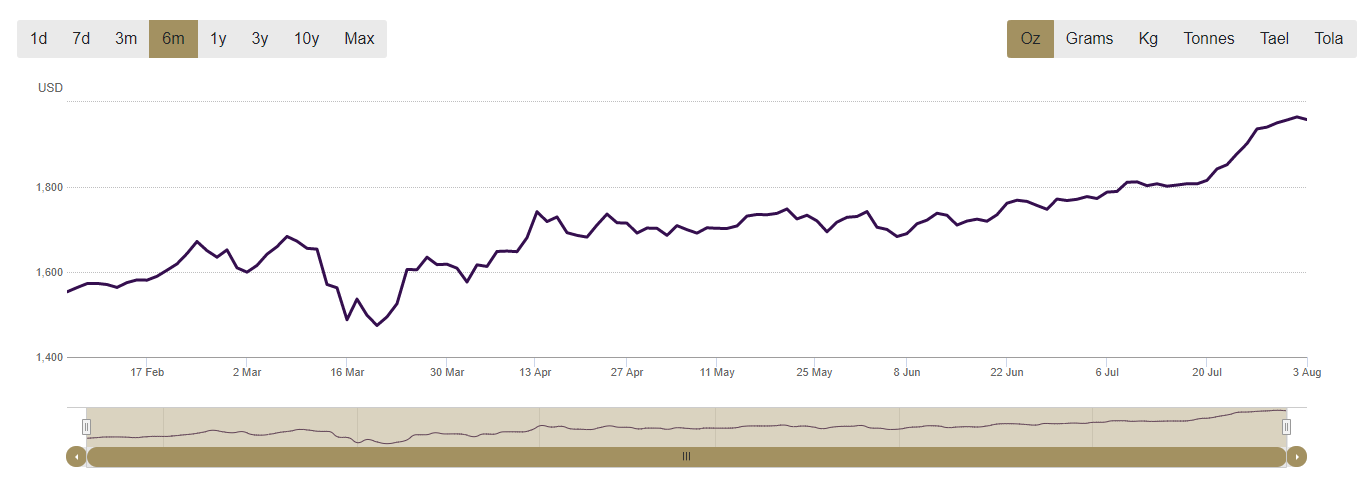

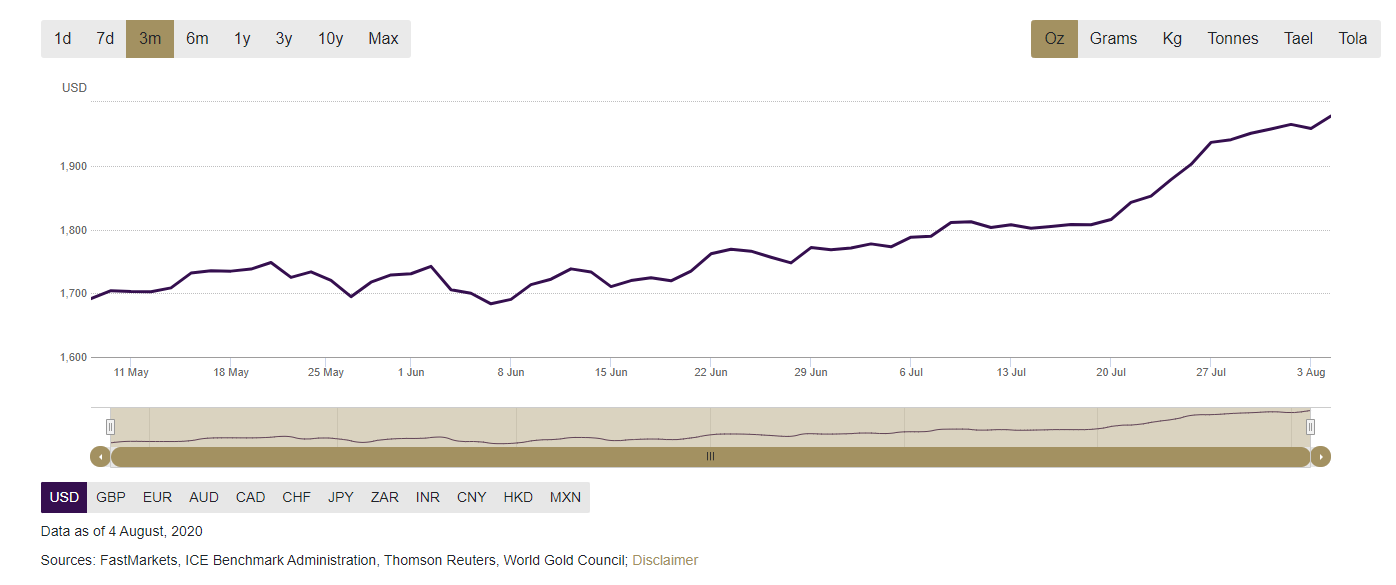

In more recent times, gold prices continue to show resilience as it recovers and hits an all-time high in USD terms since the Mid-March sell off.

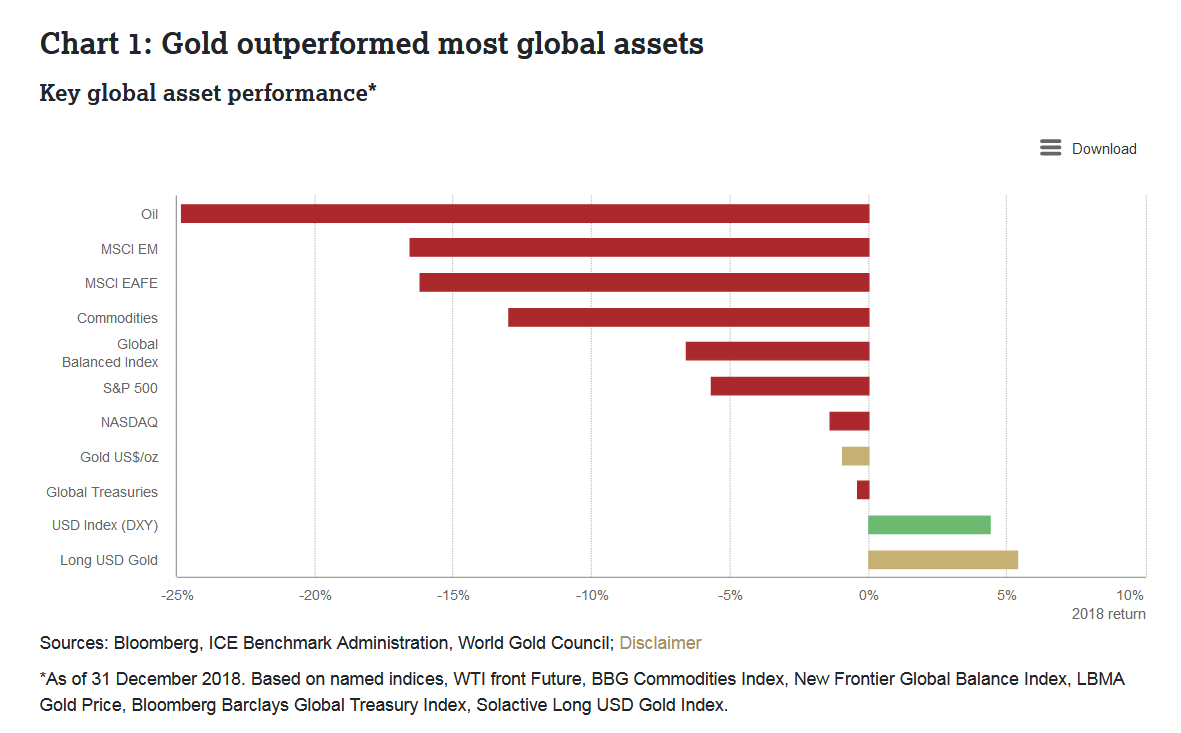

In fact, even before the COVID-19 pandemic happened this year, according to the World Gold Council’s outlook for 2019, gold outperformed most global assets as shown in the chart below for the year 2018 . In other words, gold was already performing well prior to the emergence of COVID-19 and its global economic effects merely super-boosted its performance.

Gold prices look likely to rise even more toward foreseeable future and here, we give you the 4 reasons to buy Gold today.

Reason 1: Bernanke Asset Bubble 2.0

Ben Bernanke was the Federal Reserve chairman during the 2008 financial crisis and in the midst of the crisis, he did the only thing he could to stop another Great Depression from happening on his watch.

In a crisis, money dries up. When companies cannot borrow enough money to fund short term operations such as paying employees, it can cause the economy to go into a serious and prolonged slump.

So Bernanke cut interest rates to zero for the first time in U.S. history and went to the U.S. congress to orchestrate a $700 billion stimulus with much of it going into bailing out banks15.

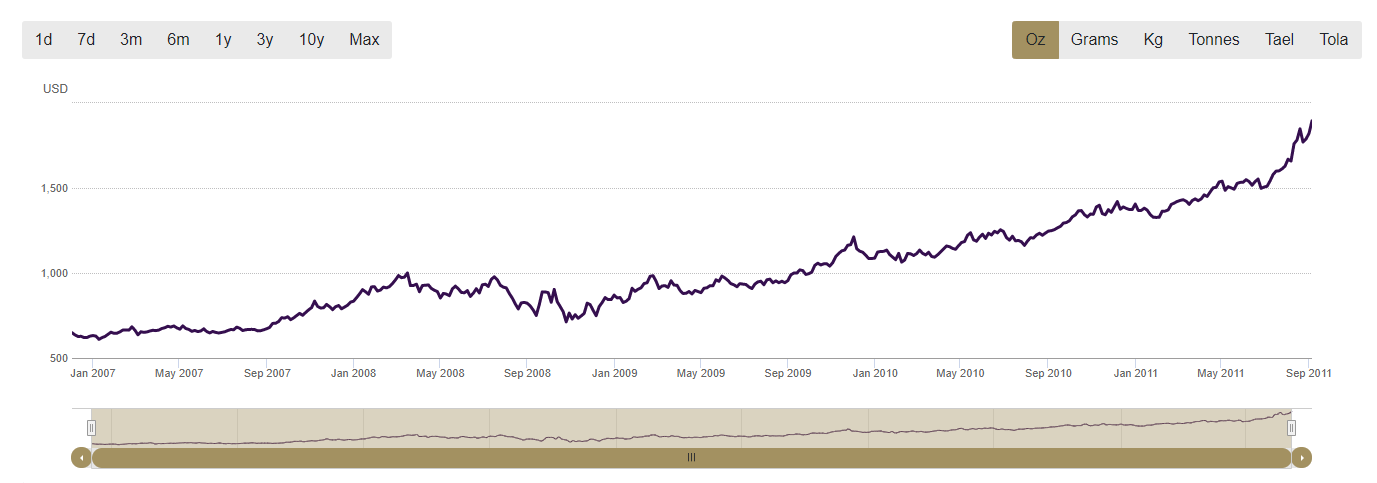

He then kicked off years of quantitative easing which pushed trillions worth of liquidity into the financial system. These actions fuelled the fires of recovery which sent the S&P 500 Index up by more than 500% during the 10-year period. Gold prices went from $712.5/oz. in 2008 to $1895/oz. in 2011 as shown in the chart below.

The Federal Reserve has a new face, Jerome Powell who took over as Federal Reserve chairman in 2018 and when the COVID-19 pandemic struck, he jumped into action immediately.

In two quick moves, he cut interest rates from 1.5% to 0%16.

The Federal Reserve not only dropped the rate it would charge banks to borrow money, it cut reserve ratios too, allowing banks to lend more without holding more in reserve. That would mean more liquidity in the financial system.

Powell further engaged in massive lending facilities to pump trillions of liquidity into the system. They included:

- A way for the Federal Reserve to buy commercial paper (short-term debt) and municipal bonds

- A lending option to keep money market accounts running

- An unlimited amount of quantitative easing

- A $2.3 trillion lending program to banks and businesses

In total, Powell’s stimulus plan could inject more than $6 trillion in new liquidity into the financial system17. It took Bernanke seven years to rack up half that amount and Powell’s measures were dramatically beyond what the Federal Reserve had ever put into motion.

Money was now cheaper than ever and the Federal Reserve was pumping more cash into the system quicker and in much larger doses than before. And like what we had all witnessed during the Bernanke’s time as the Federal Reserve chairman, that was a recipe for a massive asset boom that saw gold prices soar again like it did in 2008.

Reason 2: Central banks are buying gold

According to the 2020 Central Bank Gold Reserves (CBGR) survey, 20% of central banks intend to increase their gold reserves over the next 12 months, compared to just 8% of respondents in the 2019 survey18.

Central banks look set to go on a gold buying binge this year in the wake of the COVID-19 pandemic with one leading reason – the fear of another financial crisis.

Gold buying by the world’s’ central banks is now at a 50-year high, with sovereign gold buyers having added a net 650 tonnes of physical gold to their strategic monetary reserves. Central banks purchase gold for a number of reasons and the main reason is that gold provides protection in times of acute market crisis and stress.

With the entire financial and monetary system currently undergoing monumental dislocations across all asset classes, the gold accumulation and holding strategies of these central banks look more crucial now than ever.

The buying activities of these central banks will likewise, inevitably, be a major tailwind for gold prices moving forward.

Reason 3: Gold ETF holdings are rising

The creation of the first U.S.-listed exchange-traded fund (ETF) backed by physical gold and the SPDR Gold Trust (Exchange: New York; ticker: GLD) back in 2004 completely changed the way gold was bought.

It allowed ordinary retail investors to own and trade gold for a minimal fee just like a listed stock. Since then, its popularity has exploded with the introduction of various ETFs, including ETFs that allow leverage and inverse ETFs.

During the peak of gold prices in September 2011, gold-backed ETFs controlled nearly 2,400 tonnes of physical gold and that was larger than most countries’ central bank gold reserves.

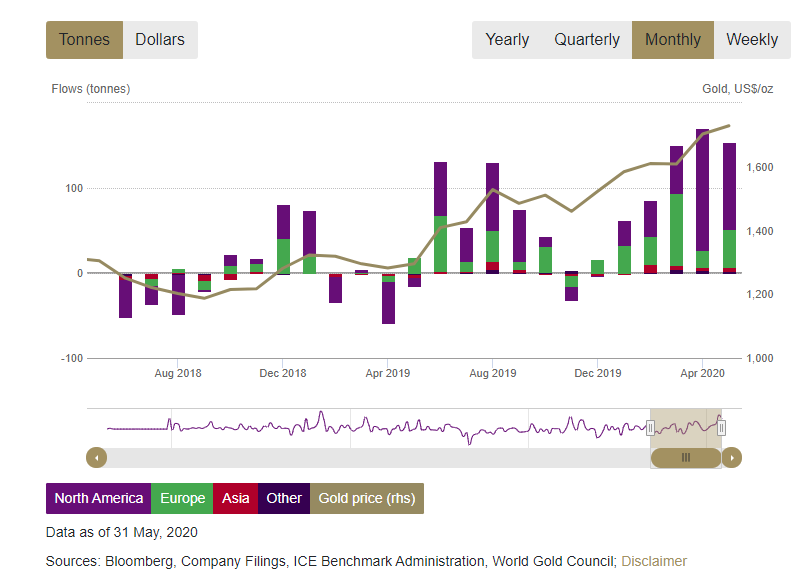

According to a recent World Gold Council report, since the start of the pandemic, global gold-backed exchange-traded funds marked their largest annual inflow of the precious metal on record in dollar terms, just five months into the calendar year.

Over the past 12 months, assets in global gold-backed ETFs have nearly doubled. (+90%)

The data further revealed that year to date as of May, gold-backed ETFs saw inflows of $33.7 billion, or 623 metric tons, with the inflow in dollar terms topping the highest level of annual inflows of $24 billion seen in 2016. Gold ETF assets have experienced the largest calendar-year asset growth in only five months.

For the month of May, the ETFs added 154 metric tons, valued at $8.5 billion. That was up 4.3% from a month earlier, boosting global gold ETF holdings to a new all-time high of 3,510 metric tons19.

And as stock markets see volatility and the economies continue to struggle, more investors are likely to turn to gold-backed ETFs which will further fuel prices.

Reason 4: Gold as insurance

As mentioned earlier, gold has withstood the test of time and maintained its inherent value. It is durable, portable, compact and looks exactly the same everywhere; almost the perfect store of value.

Gold prices also tend to go up as stocks go down due to its negative correlation. Throughout history, when bad things happen – like a stock market crash, soaring inflation, imploding governments and other black swan events – people flock to gold, which makes it the perfect insurance to have in any portfolio.

As demand goes up, so does gold price. Gold prices have already exploded to reach new highs in the wake of the COVID-19 pandemic. And the streak in ETF gold-buying is an indication that investors are starting to pay attention to gold.

Moving forward

The COVID-19 pandemic has brought about uncertainty on both the economic and social fronts. While some countries continue to struggle to contain the initial outbreaks, there are others which initially succeeded but were later hit by a second or third wave outbreak. This underscores the extreme difficulty and complexity in eradicating the virus20.

The Federal Reserve, in response, pledged to keep interest rates low until full employment which will likely result in a low rate environment for years21. The unprecedented monetary stimulus co-ordinated by several countries, coupled with the increased central banks and gold ETFs buying will be a major tailwind that may push gold prices higher.

Future stock earnings expectations have fallen as well, while race-related civil unrest in the U.S. leading up to the U.S November election, further complicating the already uncertain nature of things.

With so much uncertainties in the coming months for investors, it is definitely a good time to add some gold to your portfolio through an ETF like the SPDR Gold Trust (GLD.US) which is available for trading on POEMS under the AMEX exchange.

For sophisticated traders looking for a leveraged exposure to gold via a gold futures ETF, there is a 2X Long Gold ETF tradeable under the ticker UGL.

However, do note that leveraged ETFs are not suitable for beginners and retail investors as the loss will be magnified as well. Furthermore, leveraged ETFs are not meant to be held long term as the daily rebalancing will cause the value of the investment to erode over time. Read here to know more about leveraged and inverse ETFs.

There is also a table at the end that shows the different Gold ETFs which can be traded on the U.S. and UK markets.

| Ticker | TOTAL ASSETS | AVERAGE VOLUME | EXPENSE RATIO | INCEPTION DATE | NAV 17 JAN 2019 | LEVERAGE | PHYSICAL COMMODITY |

| GLD (US) | USD 79.95B | 11.5M | 0.4% | 18 NOV 2004 | USD185.81 | NO | YES |

| IAU (US) | USD 31.36B | 23.5M | 0.25% | 28 JAN 2005 | USD 18.88 | NO | YES |

| SGOL (US) | USD 2.66B | 1.35M | 0.17% | 9 SEP 2009 | USD 19.02 | NO | YES |

| UGL (US) | USD 300.3M | 148K | 0.95% | 3 DEC 2008 | USD 79.04 | 2X | NO |

Source: Bloomberg

Editor’s Note: This original article was published in February 2019.

Reference:

- 1https://www.cnbc.com/2020/03/20/the-upcoming-job-losses-will-be-unlike-anything-the-us-has-ever-seen.html

- 2https://tradingeconomics.com/united-states/unemployment-rate#:~:text=Unemployment%20Rate%20in%20the%20United,percent%20in%20May%20of%201953.

- 3https://www.washingtonpost.com/business/2020/05/12/small-business-used-define-americas-economy-pandemic-could-end-that-forever/

- 4https://www.straitstimes.com/world/united-states/covid-19-injects-uncertainty-into-us-presidential-election-in-nov

- 5https://www.bloomberg.com/news/articles/2020-05-01/treasuries-rise-after-trump-revives-u-s-china-trade-war-fears

- 6https://www.ft.com/content/73f06b8a-a696-11e9-984c-fac8325aaa04

- 7https://www.cnbc.com/2020/07/14/china-says-the-us-is-aggravating-tensions-in-the-south-china-sea.html

- 8https://www.nytimes.com/2020/07/04/us/politics/south-china-sea-aircraft-carrier.html#:~:text=Deploying%20two%20at%20once%20is%20recognized%20as%20a%20significant%20show%20of%20force.&text=WASHINGTON%20%E2%80%94%20Two%20American%20aircraft%20carriers,China’s%20military%20conducts%20exercises%20nearby

- 9https://www.cnbc.com/2020/07/01/hong-kong-sanction-threat-is-the-logic-of-bandits-chinese-official.html

- 10https://www.nytimes.com/2020/07/14/world/asia/cold-war-china-us.html

- 11https://www.cnbc.com/2020/03/01/awaiting-us-stock-futures-open-at-6-pm-after-wall-streets-worst-week-since-2008.html

- 12https://www.nytimes.com/2020/06/08/business/recession-stock-market-coronavirus.html

- 13http://www.perthmintbullion.com/sg/Blog/Blog/20-08-04/Silver_surges_as_gold_hits_all-time_high_in_USD.aspx#:~:text=Gold%20prices%20rose%2011%25%20in,USD%201%2C950%20per%20troy%20ounce.&text=Silver%20was%20an%20even%20better,USD%2024%20per%20troy%20ounce.&text=Gold%20ETF%20holdings%20increased%20again,record%20run%20seen%20in%202020.

- 14https://www.gold.org/goldhub/research/outlook-2019

- 15https://www.forbes.com/sites/steveschaefer/2011/12/06/bernanke-there-was-no-secret-bank-bailout-and-it-was-only-1-5-trillion/#4018814a1cfa

- 16https://www.cnbc.com/2020/03/15/powell-says-fed-is-willing-to-be-patient-before-raising-rates-again-amid-coronavirus-slowdown.html#:~:text=The%20Federal%20Reserve%20slashed%20interest,patient%20before%20raising%20rates%20again.

- 17https://www.forbes.com/sites/sarahhansen/2020/04/09/the-fed-will-pump-another-23-trillion-into-the-economy/#47c9e4452f28

- 18https://www.centralbankgold.org/2020-survey

- 19https://www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows

- 20https://www.nytimes.com/2020/07/20/world/asia/hong-kong-coronavirus.html

- 21https://www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows/2020/may

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Roger Chan

Roger holds a Business Degree in Electronic Commerce from the Monash University and is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He currently heads the Global Markets Night Trading team assisting clients with the US and European markets. Prior to the night desk, he was a bond trader at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge. Outside work, he trains and is an active competitor in the martial art of Brazilian Jiu-Jitsu. He finishes at the podium frequently and is also the 2015 Pan Asian BJJFP champion. His other interests include chess and reading.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It