A Good Time for Gold: 4 Reasons to Buy the Precious Metal February 12, 2019

2019 started off with massive uncertainty.

While volatile market conditions make it more challenging for investors to plan their moves, the flipside is opportunities to gain are created if the right moves are made.

Consider the current political and investing landscape. On the economic front, there is considerable unease surrounding trade tensions between the US and China. Moreover, the Chinese economy grew at its slowest rate since 1990.1

In the west, a prolonged US government shutdown and a deeply-divided political landscape influenced by an unpredictable US president have only made the outlook more uncertain; with signs pointing to a potential slowdown in the US economy.2

Across the Atlantic Ocean in the UK, Britain’s departure from the European Union hangs in the balance, as Brexit threatens to roil much of Europe without a clear vision of how the process will play out.

In Asia, Chinese president Xi Jinping’s signal that military force on Taiwan cannot be ruled out to guard the “One China” policy has sent jitters across the region and serves as a reminder that the current world order cannot be taken for granted.3

Geopolitical tensions aside, central banks are looking to increase interest rates.4 With all these at play, it comes as no surprise that stock markets internationally have taken a hit.

Indeed, bourses have come back down to earth. Bloomberg’s data revealed that in 2018, the S&P 500 Index fell 6.6% while the MSCI Asia ex Japan Index dropped 16.45%. Meanwhile, the Singapore Straits Times Index dipped 9.3%, the Hong Kong HSI fell 13.93% and the Shanghai Composite Index collapsed 24.77%.

Amidst the gloom and doom, one asset class has held up relatively well.

And that is gold.

History of Gold’s Performance

Gold has entrenched its position in the global economy. It is unlikely that the precious metal will ever become worthless, nor will it wither away due to inflation like fiat currency. Gold carries no risk of default like a bond, nor can it go bankrupt, like a company.

When stocks fall, gold tends to hold its ground and often times will rally as investors flee the markets. As an asset for portfolio insurance, it has considerable value. Here are some past instances where gold rallied when markets crashed:

1. Gold prices tripled during the 1973 Arab oil embargo that caused the US stock market to crash and the American economy to go into recession.

2. Prices of Gold quadrupled in the late 1970s as inflation soared to double-digit figures, leading to then US Federal Reserve Chairman Paul Volker raising prime lending rates to a historic high of 20%.

3. During the dot-com boom, gold fell out of favour, but came roaring back after the tech bubble burst, which led the US economy into a recession.

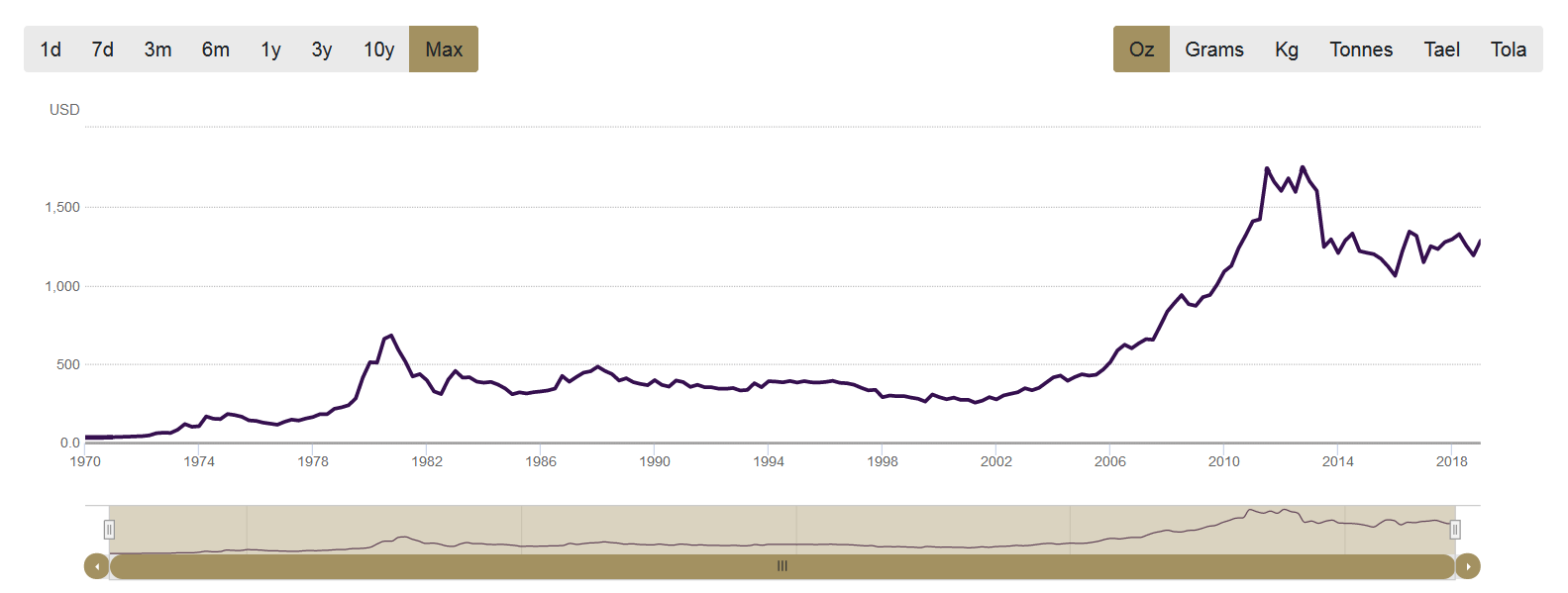

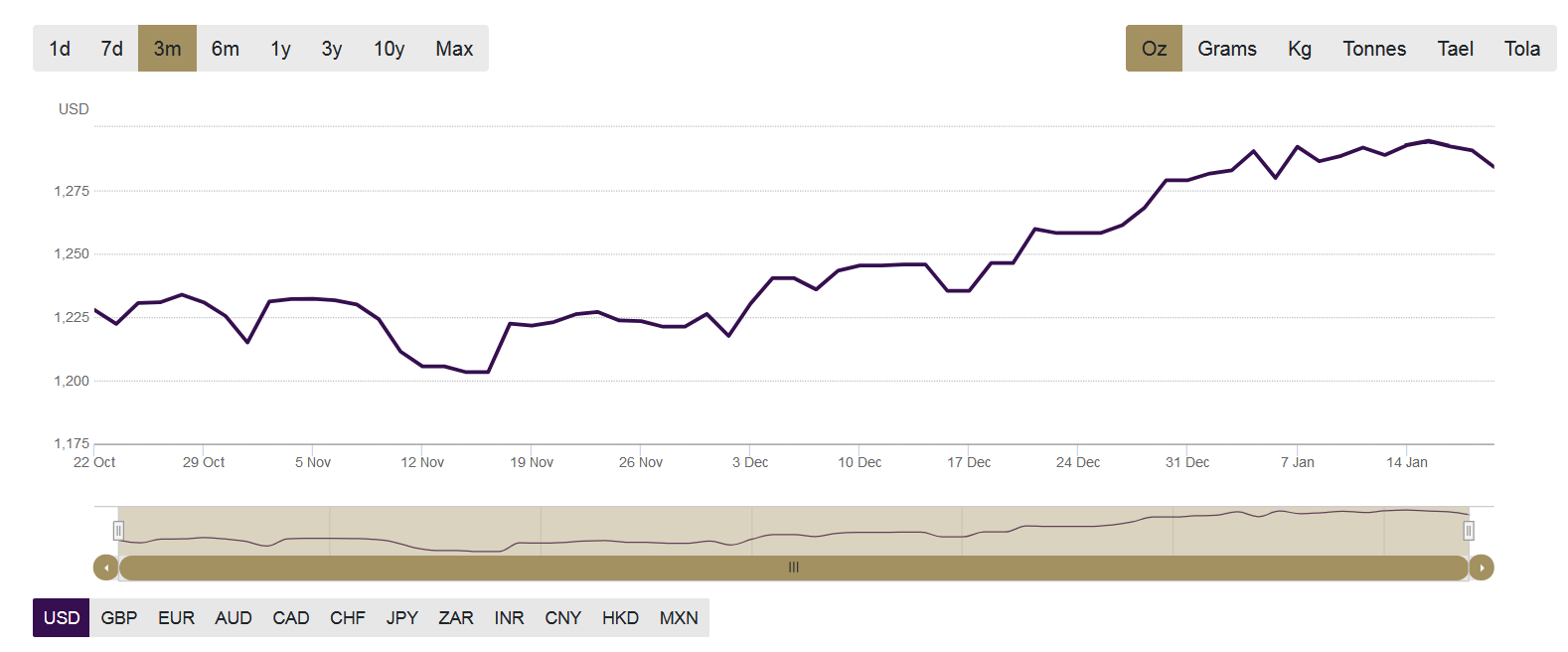

4. Gold rallied 5.3% from March 2001 through November 2001. During the global economic crisis, the S&P 500 fell 56% from peak to trough between October 2007 and March 2009. Gold, on the other hand, gained an astounding 25% during the same period. Similarly, when global markets fell in late-2018, investors once again turned to gold. Its price rallied 5% as stock markets took a hit, as seen below:

Chart 1: Gold Prices

(Source : https://www.gold.org/goldhub/data/gold-prices)

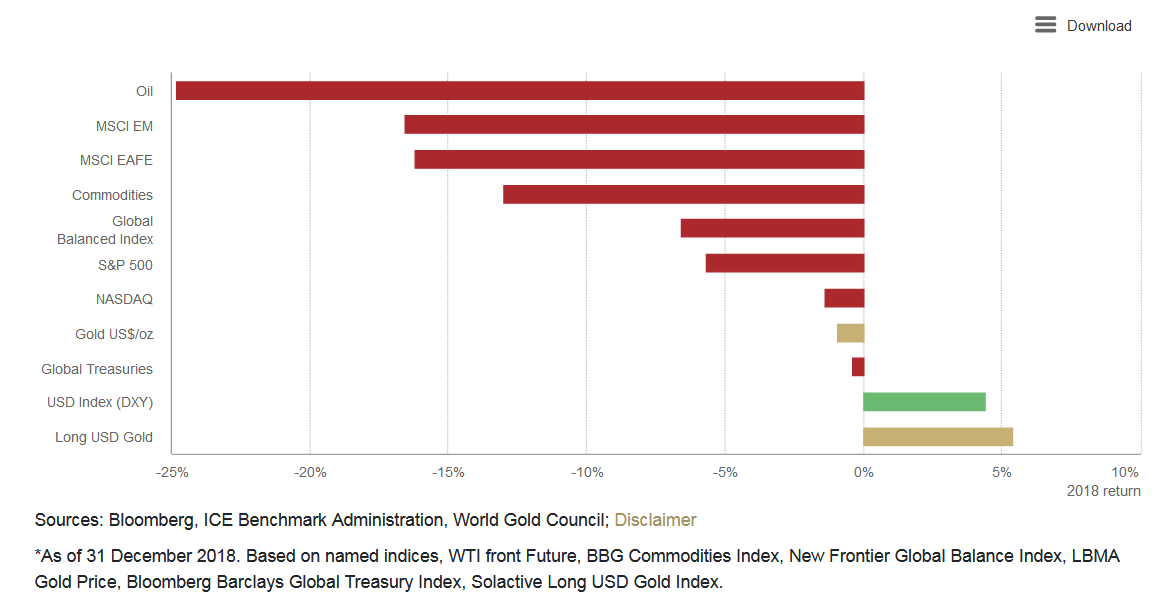

According to the World Gold Council, gold outperformed most global assets in 2018 as shown in Chart 2.5

Chart 2: Key Global Asset Performance

(Source : https://www.gold.org/goldhub/data/gold-prices)

Gold prices look set to rise further in 2019, and we can give you at least four reasons as to why you should consider buying gold.

Reason 1: China is Buying Gold

When it comes to major players on the global stage, it pays to pay attention to what China is doing. Think of it as that “800-pound gorilla in the room”. China, the world’s second-largest economy, was already the world’s largest buyer of gold at 1,089 tonnes in 2017. It was also on-track to increase purchases by at least another 5% in 2018.6 But why does China buy so much gold?

Firstly, the Chinese have always had a long-standing love affair with the precious metal, which they view as auspicious for important events like weddings, birthdays and New Year celebrations.

Secondly, the Chinese government has been buying up increasing amounts of gold to diversify, and reduce dependence on the US dollar. China’s official central bank holdings of gold grew from 1,054 tonnes at the start of 2015 to 1,843 tonnes by the second quarter of 2018.7

That’s the second-largest increase in official central bank gold reserves during this period (Russia was first), and the 789-tonne increase alone is more than the entire gold reserve of Japan’s central bank.8

Reason 2: Other Central Banks are Buying Gold

China is not the only country buying gold in recent years. Other central banks that are buying gold have accelerated their purchases sharply as well. According to the World Gold Council, 16 different central banks have increased their gold reserves since the start of 2017.9 In a quarterly report on demand trends, the World Gold Council said that central banks collectively made net purchases of 148.4 tonnes in the third quarter of 2018, up 22% on-year – the highest level of net purchases since 2015.10

Central banks buying gold include those of Poland and Hungary, the first European Union countries to buy gold since the start of the century. In the case of Hungary, the central bank not only bought its first gold in 32 years , but also increased total holdings by 10-fold.11

Bloomberg reported that central banks now collectively hold more than 33,000 tonnes of the metal; translating to one-fifth of all the gold ever mined – with purchases expected to continue.12

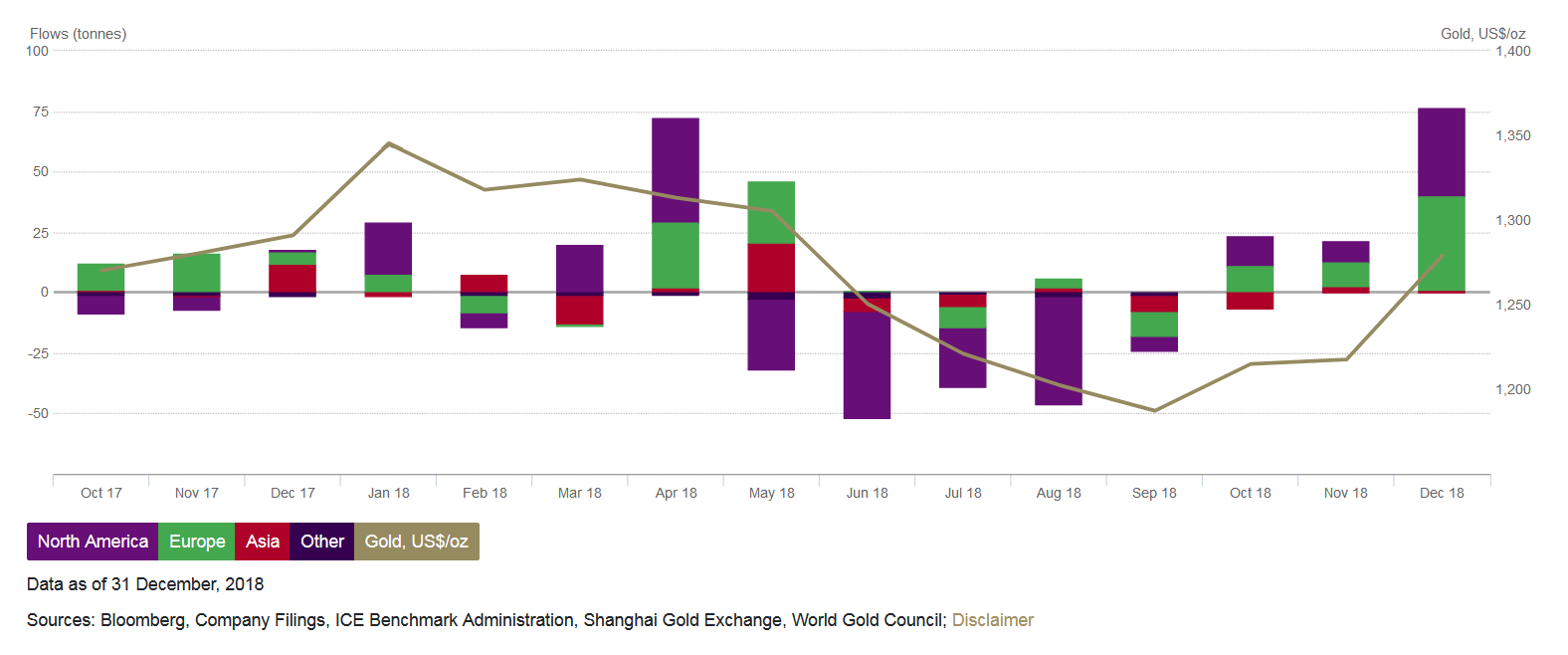

Reason 3: Gold ETF Holdings are Rising

The creation of the first US-listed Exchange Traded Fund (ETF) in 2014 backed by physical gold – the SPDR Gold Trust (Exchange: New York; ticker: GLD), completely changed the way gold was bought. It allowed ordinary retail investors to own and trade gold just like a listed stock for a minimal fee. Since then, its popularity has exploded with the introduction of various other ETFs, including leverage and inverse ETFs.

During the peak of gold prices in September 2011, gold-backed ETFs controlled nearly 2,400 tonnes of physical gold. That was larger than most countries’ central bank gold reserves. At the end of December 2018, the total gold held by gold-backed ETFs amounted to 2,440 tonnes. That was a net increase of 75 tonnes from the previous month, and the third straight month of increased gold holdings.13 Worth noting is that these increases happened in tandem with a downturn in global stock markets.

With bourses still seeing volatility, more and more investors will likely turn to gold-backed ETFs.

Chart 3: Gold-backed ETF Holdings and Flows

(Source : https://www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows)

Reason 4: Gold as Insurance

As mentioned earlier, gold has withstood the test of time and has maintained its inherent value. It is durable, relatively easy to transport, looks the same almost everywhere, is easy to weigh and quantify. It is really the ideal store of value.

Gold prices tend to rise when stocks take a hit. Throughout history, when negative events occur – like a stock market crash, soaring inflation, imploding governments or other black swan occurrences arise – people flock to gold, which makes it a viable insurance option to have in any portfolio.

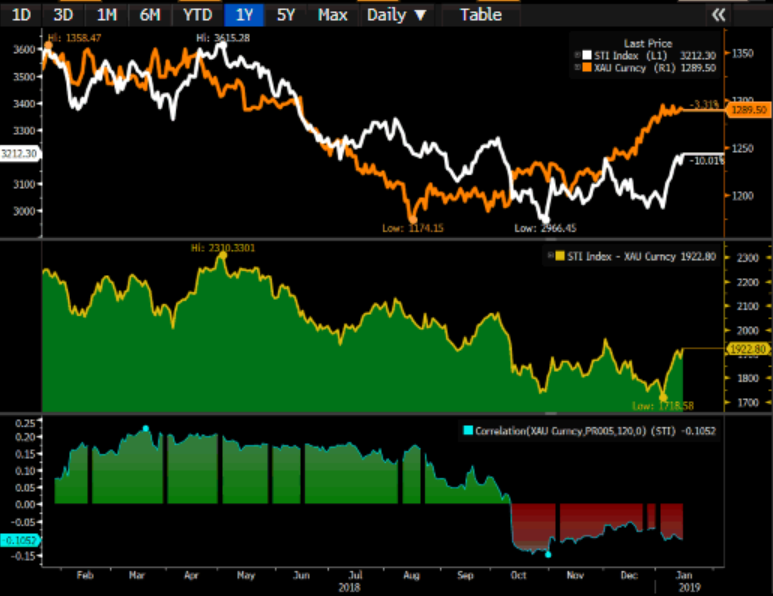

And as demand for the precious metal goes up, so do gold prices. Gold has already been marching high for months. A three-month streak in ETF gold-buying is an indication that investors are starting to pay more attention to gold as seen in Charts 4, 5 and 6.

Chart 4: Gold / STI Correlation

(Source : Bloomberg (Gold / STI correlation -0.1052)

Chart 5: Gold / S&P Correlation

(Source : Bloomberg (Gold / STI correlation -0.164)

Chart 6: Gold Prices

(Source : https://www.gold.org/goldhub/data/gold-prices)

The International Monetary Fund Global Financial Stability report released on 10 October 2018 highlighted an increase in the level of risk among multiple stock metrics, with gold once again acting as a key flight-to-safety asset in the market when stocks in the US, Europe and Asia lost 4%, 3% and 4% respectively over 3 days following the report’s release.14

With so much uncertainty facing investors in the coming months, it is a good time to add some gold to your portfolio through an ETF like the SPDR Gold Trust (GLD.US) which is available for trading on POEMS under the AMEX exchange.

For sophisticated traders looking for leveraged exposure to gold via a gold futures ETF, there is a 3X Long Gold ETC (3AUL.UK) tradeable on the UK exchange under the ticker.

An exchange-traded commodity (ETC) gives traders and investors exposure to commodities (called the underlying) in the form of shares. Traded like a stock (i.e. bought and sold on a stock exchange), ETCs track the price movement of commodities — such as oil, gold and silver — and then fluctuate in value based on those commodities.15

The ETC (3AUL.UK) is designed to enable investors to gain a three times ‘leveraged’ exposure to a total return investment in Gold Futures Contracts. However, do note that leveraged ETFs are not suitable for novice investors as losses will be magnified as well. Furthermore, leveraged ETFs are not meant to be held long term as the daily rebalancing will cause the value of the investment to erode over time. Read more about leveraged and inverse ETFs

There are a variety of Gold ETFs which can be traded on the US and UK markets:

(Source : Bloomberg 3AUL.UK description

(Source : Bloomberg UGL description

Table of Gold ETFs

| TICKER | TOTAL ASSETS | AVERAGE VOLUME | EXPENSE RATIO | INCEPTION DATE | NAV 17 Jan 2019 | LEVERAGE | PHYSICAL COMMODITY |

| GLD (US) | USD 33.1B | 7.6 MIL | 0.4% | 18 NOV 2004 | USD121.99 | NO | YES |

| IAU (US) | USD 11.97B | 13.15 MIL | 0.25% | 28 JAN 2005 | USD 12.36 | NO | YES |

| SGOL (US) | USD 858M | 56.1 K | 0.17% | 9 SEP 2009 | USD 124.47 | NO | YES |

| UGL (US) | USD 86.8M | 44.7 K | 0.95% | 3 DEC 2008 | USD 37.75 | 2X | NO |

| 3AUL (UK) | EUR 7.24M | 1,735 units | 0.98% | 2 NOV 2015 | USD 46.54 | 3X | NO |

(Source : Bloomberg )

William Shakespeare may have written in “The Merchant of Venice” that ‘all that glitters is not gold’, but take that expression with a pinch of salt!

Gold does have its value in uncertain times, and should certainly be an asset you can consider adding to your investment portfolio to give it more shine!

Information is accurate as of 16 Jan 2019.

Reference:

- [1] https://www.bbc.com/news/business-46941932

- [2] https://www.reuters.com/article/us-china-taiwan/chinas-xi-threatens-taiwan-with-force-but-also-seeks-peaceful-reunification-idUSKCN1OW04K

- [3] https://think.ing.com/articles/our-2019-guide-to-global-central-banks/

- [4] https://www.gold.org/goldhub/research/outlook-2019

- [5] https://www.gold.org/news-and-events/press-releases/gold-demand-steady-q3-central-banks-and-consumer-purchases-offset

- [6] https://www.bloomberg.com/news/articles/2018-07-26/china-s-gold-mystery-has-nation-really-stopped-boosting-hoard

- [7] http://global.chinadaily.com.cn/a/201802/07/WS5a7a3cbfa3106e7dcc13b2d2.html

- [8] https://www.gold.org/goldhub/data/monthly-central-bank-statistics

- [9] https://www.bloomberg.com/news/articles/2018-10-29/why-central-bank-buying-has-the-gold-market-guessing-quicktake

- [10] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2018

- [11] https://www.gold.org/goldhub/data/monthly-central-bank-statistics

- [12] https://www.kitco.com/news/2018-11-02/What-Central-Banks-Bought-Gold-In-2018.html

- [13] https://www.gold.org/goldhub/data/global-gold-backed-etf-holdings-and-flows

- [14] https://www.gold.org/goldhub/research/imf-report-highlights-golds-relevance

- [15] https://www.investopedia.com/terms/e/exchangetraded-commodity-etc.asp

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Roger Chan

Senior Dealer

Roger holds a Business Degree in Electronic Commerce from Monash University. He is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He is currently part of the Global Markets Night Trading Team assisting clients with the US and European markets. Before being on the night desk, he was a bond executive at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge. Outside work, he trains and is an active competitor in the martial art of Brazilian Jiu-Jitsu. He finishes on the podium frequently and is also the 2015 Pan Asian BJJFP champion.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?