A Guide to Portfolio Construction with ETFs January 14, 2019

Investors invest for a variety of reasons – from growing their savings to purchase a house, building a pool of funds for their children’s education, or preparing for their retirement needs. However, many investors are unfamiliar with the concept of portfolio construction, preferring instead to purchase individual securities piecemeal. This particular investment approach exposes investors to significant concentration risks, as their returns will depend on the performance of the individual security, or a few concentrated securities.

On the other hand, an investment portfolio is a collective of financial assets such as stocks and shares, bonds, alternative investments and cash holdings.

Portfolio construction is a disciplined, personalised process to meet your investment goals while striking a balance between risk and return. In constructing a portfolio, the individual risk and return characteristics of the underlying securities are evaluated by their contribution to the unique needs, goals and risk tolerance of the investor.

To put it simply, portfolio construction should be about structuring your investments in such a way that stands the best chance of meeting your investment objectives within your appetite for risk.

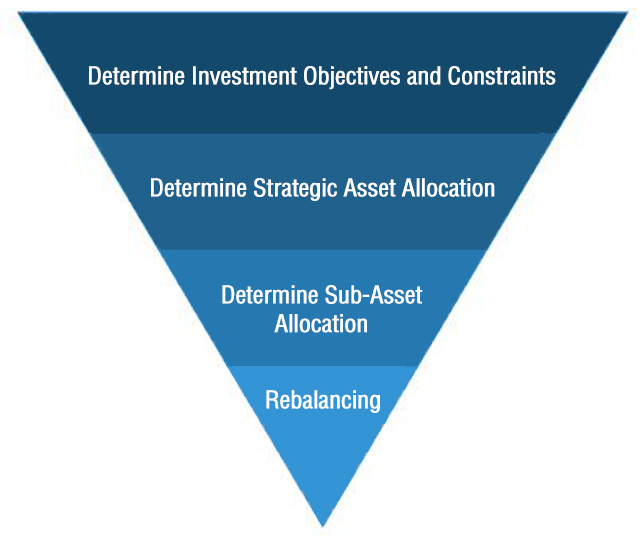

Below is a systematic guide on how to construct your own portfolio.

Stage 1: Determine Investment Objectives and Constraints

Before you start to construct your personalised investment portfolio, you will need to define your investment objectives and constraints.

A retiree investing to gain a passive income stream will have a different set of investment goals, objectives and constraints as compared to a fresh university graduate who is saving up to purchase a new house or car.

Risk

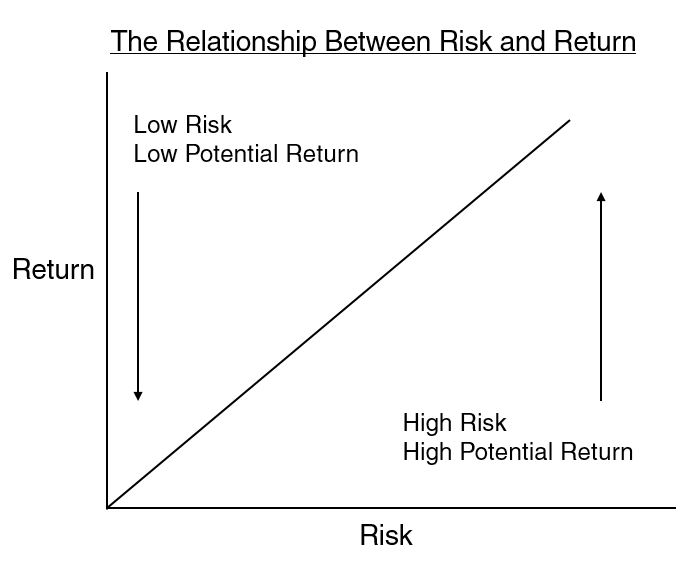

Investment risk is defined as the degree of uncertainty and potential financial loss inherent in an investment decision.

An investor’s ability to bear risk depends on the unique financial circumstances of the individual. An individual with a secure, well-paying job and greater wealth tend to have a greater ability to bear risk. In general, your capacity to bear risk increases when you have other, more stable sources of income available.

An investor’s willingness to bear risk is based on his or her attitudes and beliefs about investments. It points to the amount of risk that an investor is comfortable with or the degree of uncertainty that an investor is able to handle.

An Investor should always assess the capacity to bear risk even though he or she may have a high-risk tolerance or willingness to bear risk.

Returns

An investor’s return objective has to be compatible with the risk level of the investment portfolio. The goal of achieving high returns with a low risk portfolio, while ideal, is unlikely to materialise. Investors should be compensated with higher potential returns for additional risks that they are willing to undertake.

Liquidity Needs

Liquidity needs refer to how much readily-accessible cash you need to cover your daily expenses, upcoming purchases, loan repayments or emergency spending. A fresh graduate who is in the midst of paying off his student loan and an elderly citizen who is required to make monthly payments for his or her medical expenses are examples of individuals with high liquidity needs.

Understanding your liquidity needs will help you determine the right investment strategy and financial instruments to take on for your portfolio. A fixed deposit with a minimum locked-in period may not be suitable for investors with high liquidity needs.

Time Horizon

The longer an investor’s time horizon, the more risk and less liquidity the investor can accept in the portfolio. Historically, the financial markets have always recovered from short-term volatility and investors with long time horizons have the ability to ride out any market downturn.

Conversely, for investors with shorter time horizons, it makes sense to invest more conservatively, which could help investors avoid a situation whereby they may be forced to liquidate their investments when the market is down and suffer losses in the process.

Tax Situation

Investors should take into consideration the tax treatment of various types of investment products and the tax treaties between different countries. For example, Singaporean investors buying into US financial products are susceptible to 30% withholding taxes on all dividends affecting shares, bonds, treasuries or REITs, etc.1 A US REIT with an expected yield of 5% per annum, will provide a yield of around 3.5% after accounting for the dividend withholding tax.

Investors should always consult their qualified financial or tax advisors if they have any queries on their tax status and the statutory tax laws that may affect their investment returns.

Legal and Regulatory Requirements

In addition to financial market regulations and statutory laws that apply to the public, more specific legal and regulatory constraints may apply to particular investors.

In Singapore’s context, investors who wish to trade certain structured products are required to clear their Customer Account Review and/or Customer Knowledge Assessment with their respective brokers.

Accredited Investors, in addition, may be exposed to financial products that are not being marketed to the public.2

Stage 2: Determine Strategic Asset Allocation

After determining your investment objectives and constraints, you can now proceed to the next phase of allocating your money between the major types of asset classes. Strategic asset allocation is based on the Modern Portfolio Theory by Harry Markowitz, which emphasizes diversification to reduce risk and improves portfolio returns.3

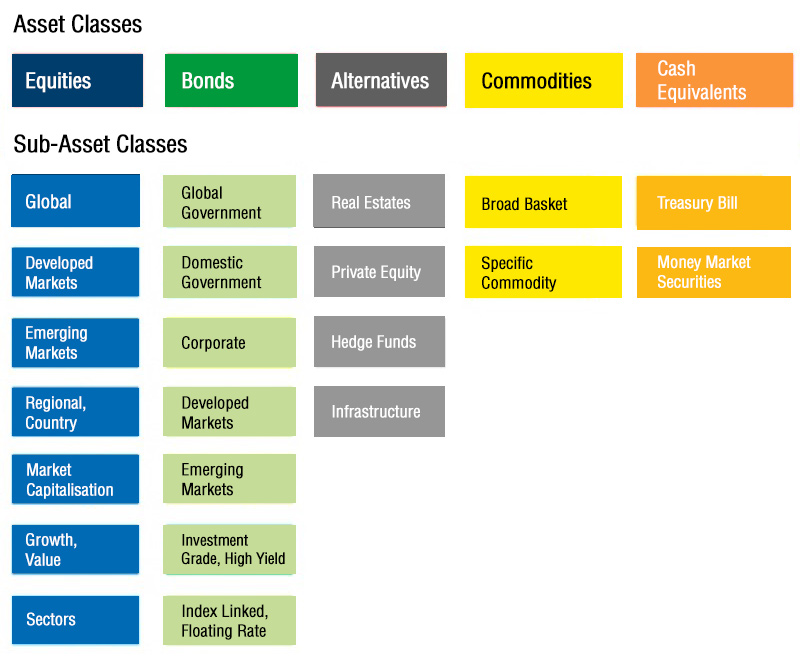

The Major Asset Classes

Investments are divided into different asset classes such as equities, bonds, alternative investments, and cash and cash equivalents. These asset classes have unique characteristics and provide the basic building blocks of an investment portfolio.

By having funds spread out across multiple asset classes, a downturn in one asset will be partially offset by the gains in others, which can provide a level of portfolio stability.

| Asset Class | Key Characteristics |

| Equities |

|

| Bonds |

|

| Alternative Investments |

|

| Cash and Cash Equivalents |

|

Exchange-Traded Funds

Exchange-Traded Funds (ETFs) are pooled investment vehicles that allow investors to gain exposure to these different asset classes. The intraday trading flexibility of ETFs on stock exchanges lowers the barrier of entry for investors to gain access to bonds and alternative investments.

Moreover, ETFs hold a basket of securities, which provides the benefit of diversification to help smooth out market fluctuations and reduce the volatility of the portfolio performance.

Imagine a basket filled with rocks. The basket is the ETF and each rock is a single stock, bond, commodity or cash holding. A portfolio may contain numerous ETFs (baskets) and the sum of all the financial assets (rocks) under the ETFs equals the total number of holdings inside the portfolio.

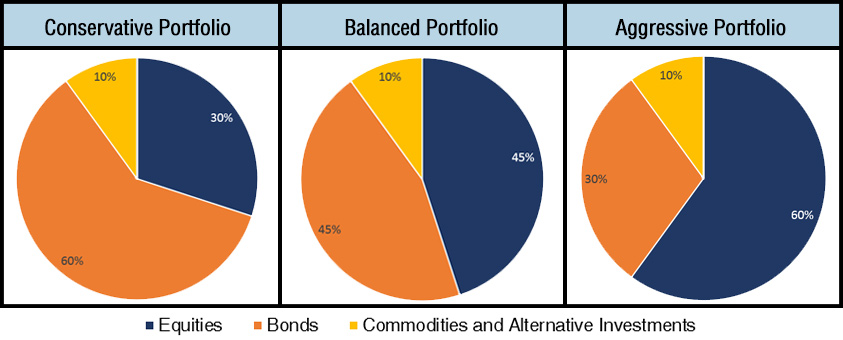

Target Allocation

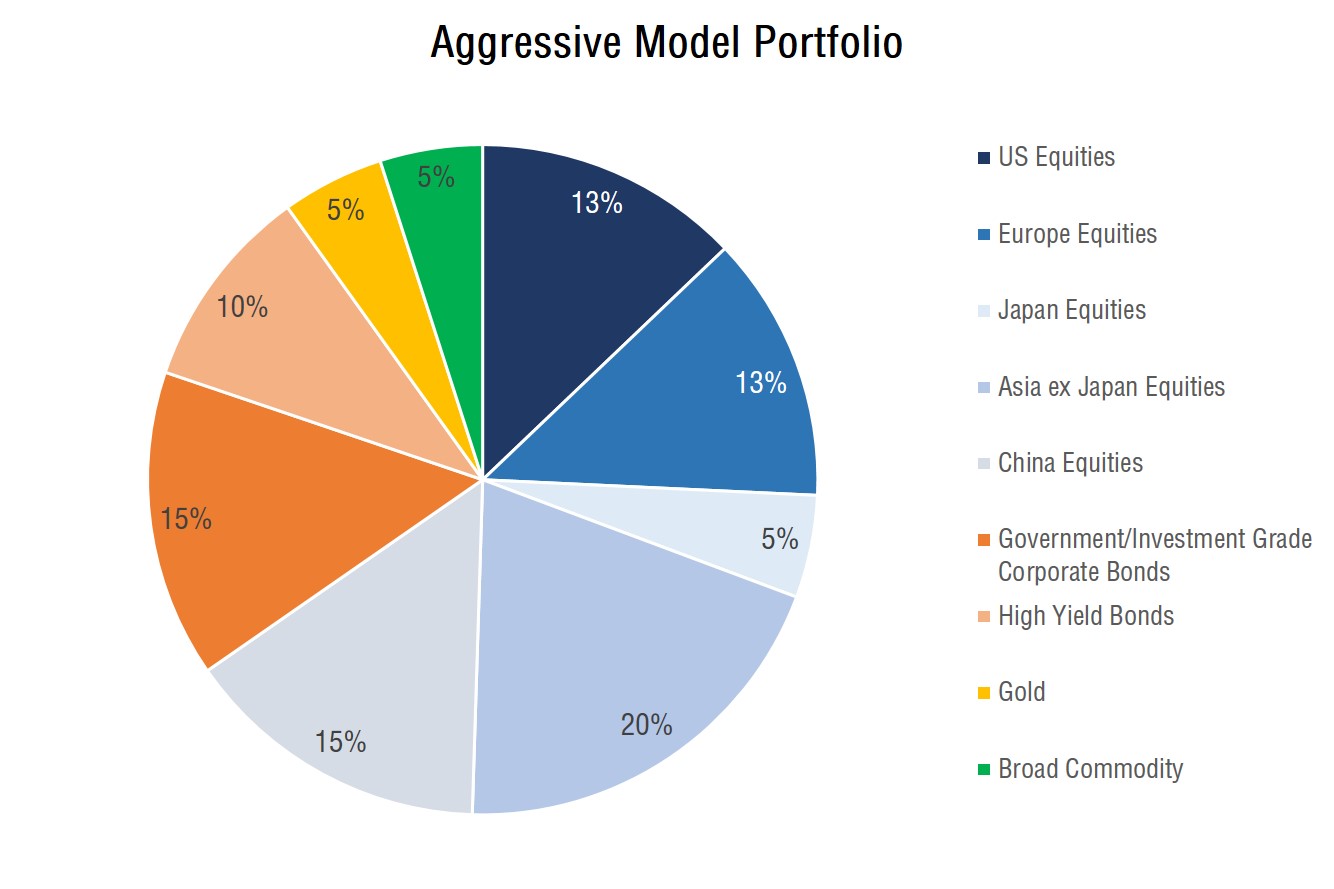

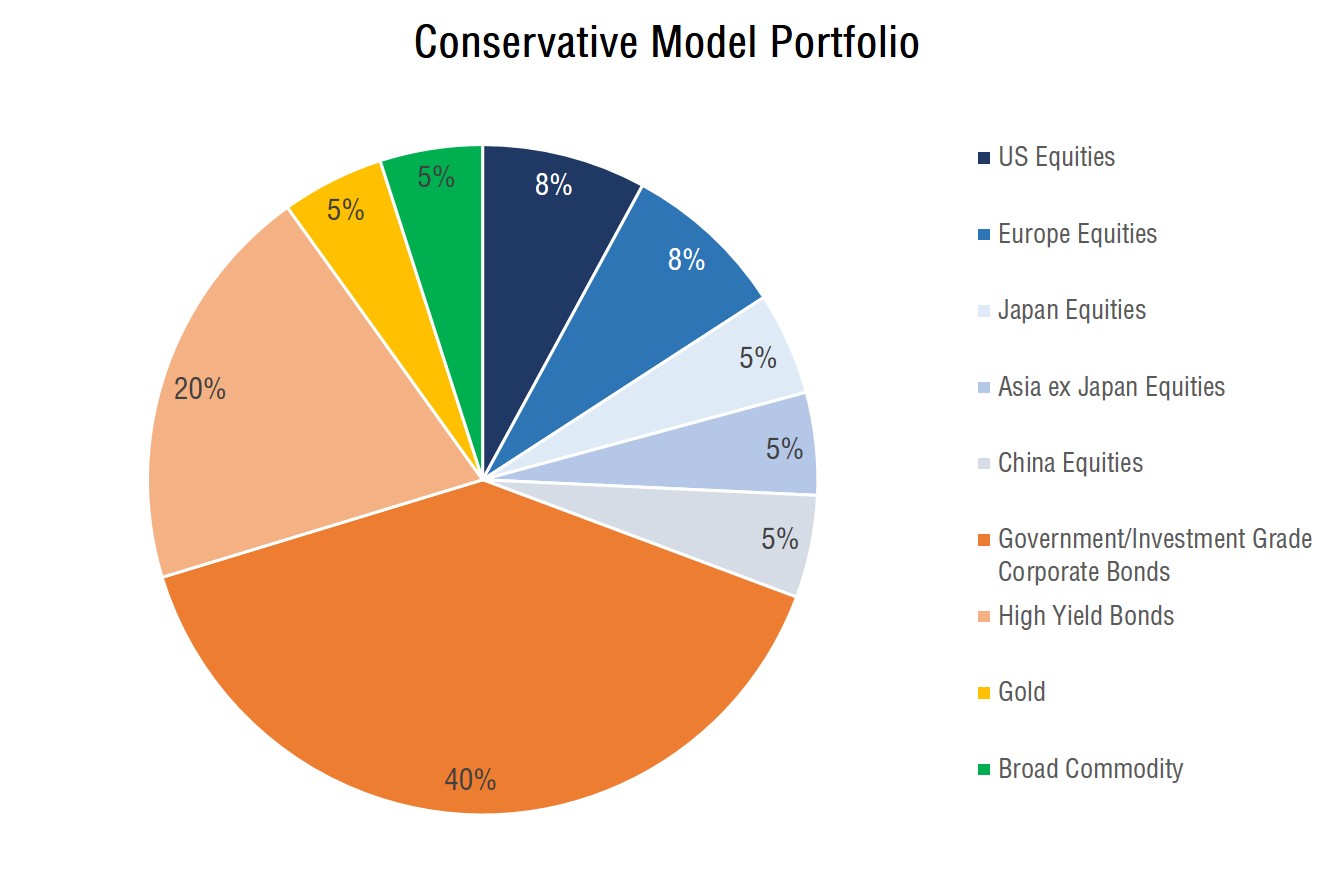

In a portfolio with strategic asset allocation, the target allocations would differ with individuals based on the investor’s risk tolerance, time horizon, liquidity needs and investment objectives.

To illustrate, investors with conservative risk profiles will allocate a greater percentage of their investment portfolio into a safer asset class like bonds and investors with aggressive risk profiles will allocate a greater percentage of their portfolio into equities.

Stage 3: Determine Sub-Asset Allocation

A sub-asset class is a sub-segment of a broad asset class. They are generally defined by certain characteristics that make them unique within their broad universe of asset classes.

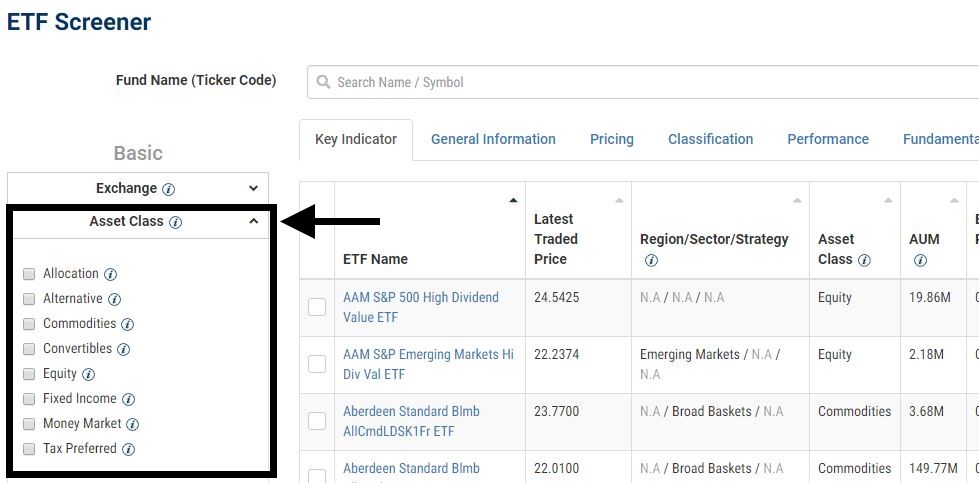

ETFs provide investors with convenient access to these sub-asset classes. There are over 5,000 ETFs listed on exchanges worldwide, each with exposure to different asset classes, geographic regions, countries, investment themes, strategies etc.4

Sub-asset allocation is as important as strategic asset allocation. It helps to ensure that investors do not take on too much risk by concentrating on a particular sub-asset class.

Tip for Investors: You may use the ETF Screener to find out which ETFs track a particular asset class and/or sub-asset class.

Investors can adjust the proportions of sub-asset classes to enhance their portfolio’s growth potential or reduce the volatility of their portfolio return. This is also an important aspect for investors to identify securities for factor investing.

Factor investing is a strategy that chooses securities that are associated with higher returns or lower risks.5 Firm size, value and momentum are some of the factors that are used by investors to identify securities to help drive investment performance, or as part of their portfolio strategy.6 Investors can gain access to factor investing using ETFs with exposure to specific sub-asset classes.

To summarise, investors with aggressive risk profiles can allocate a higher proportion of their portfolio into more volatile sub-asset classes like emerging markets equities while investors with conservative risk profiles can allocate a higher proportion of their portfolio into sub-asset classes with lower volatility.

Stage 4: Rebalancing

Rebalancing

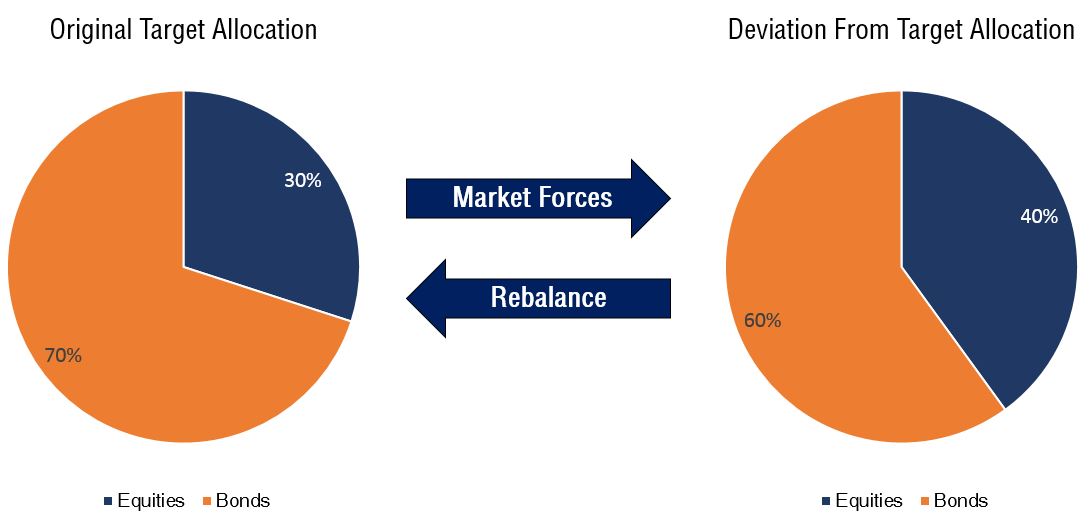

The portfolio target allocation may deviate from its original desired level of allocation because of market forces and differences in asset performances. For example, a conservative investor may choose to allocate no more than 30% of his portfolio into equities. However, after a rise in stock market performance and a fall in bond value, the resulting weighting allocated to equities may exceed 30%.

Rebalancing is a strategy by which investors realign their portfolio back to its original target allocation. This helps to ensure that the portfolio risk remains consistent with the intended financial goals.

Rebalancing often involves selling off the better performing assets and using the proceeds to purchase underperforming assets. Alternatively, investors can inject fresh funds into underperforming assets in their portfolio. Through this process, investors can restore their portfolio back to its desired level of allocation.

In conclusion, rebalancing gives investors the opportunity to sell high and buy low. It is a disciplined way of making sure that funds are poured into underperforming assets. In this way, investors will be buying assets when they are cheap (undervalued) and selling them when they are expensive (overvalued).

When and How Frequent Should You Rebalance?

- Fixed Interval Schedule

Investors can rebalance their portfolios monthly, quarterly, semi-annually or annually. However, the more frequent an investor rebalances his portfolio, the higher the transaction fees incurred.

While there is no strict schedule for an investor to adhere to, it is recommended that investors review and rebalance their allocations at least once per year to keep transaction costs low.

- Threshold Level

Investors can choose to rebalance a portfolio at any time a given asset class exceeds the desired allocation by a certain percentage level. For example, if an asset class position within a portfolio deviates from the desired allocation by more than 5%, funds should be channelled into or away from the asset class.

- Fixed Interval Schedule and Threshold Level

Investors can have a combination of the two methods, whereby they rebalance their portfolios at a regular fixed interval, but also have the discretion to adjust the holdings if the asset classes were to deviate from the desired allocation by more than a certain percentage level.

Adjustment to Target Allocation

An investor’s risk profile, investment needs and strategy will change over time. If this happens, the original target allocation of the portfolio can be re-adjusted to accommodate the changes. Monitoring any changes in investment needs and adjusting the portfolio allocation to realign with the investment needs is an important part of the rebalancing process.

To demonstrate, as an investor approaches the investment goals or horizon, he or she should shift a higher proportion of the investment portfolio into lower risk asset classes like bonds and cash equivalents. This will help protect the savings from taking a major hit right before investors need them the most. Often, the portfolio is at its most conservative once investors prepare to liquidate it to meet their investment objectives.

Investors can try using retirement planning tools like Vanguard’s Retirement Nest Egg Calculator to forecast how their asset allocation will affect their savings balance over time and re-adjust their portfolio accordingly.

Conclusion

The phrase “don’t put all your eggs in one basket” is another way of summing up the rationale behind asset allocation strategies used in portfolio construction. Simply put, if you invest all your resources into one asset, you face the possibility of losing everything.

Asset allocation strategies are useful in matching your portfolio risk to your investment objective. Devising an asset allocation strategy may help you in managing your risks to enable you to invest more confidently, and with a greater probability of reaching your investment goals.

ETFs are convenient tools for investors to utilise to construct their portfolios. The availability of a wide variety of ETFs with exposure to different sub-asset classes allows investors to assemble their own unique portfolio to meet their investment needs.

ETFs also provide investors with access to asset classes like bonds and alternative investments, which are generally inaccessible to the majority of retail investors.

The intraday tradability of ETFs on exchanges provides investors with the flexibility to rebalance their portfolios or to liquidate their holdings.

So if you want to construct a portfolio with durable qualities, ETFs can function as a key driver, among other elements, in helping you achieve your desired investment objectives!

Reference:

- [1] http://taxsummaries.pwc.com/ID/United-States-Corporate-Withholding-taxes

- [2] https://dollarsandsense.sg/mean-accredited-investor-singapore/

- [3] https://www.investopedia.com/walkthrough/fund-guide/introduction/1/modern-portfolio-theory-mpt.aspx

- [4] https://etfgi.com/news/press-releases/2018/07/etfgi-reports-etfs-and-etps-listed-globally-gathered-net-inflows-us869

- [5] https://www.investopedia.com/terms/f/factor-investing.asp

- [6] https://www.vanguard.com.hk/portal/articles/research/investing/four-key-applications.htm?cmpgn=ET1118HKPAAPBedm3EN

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?