Aerospace and Defence Industry – Soaring Above the Horizon May 27, 2020

Summary

- Donald Trump’s presidential victory in 2016 has led to a pro-military administration and resulted in the exponential growth of Aerospace and Defence (A&D) stocks over the past five years.

- However, the COVID-19 pandemic has thrown the growth trajectory of the A&D industry off course.

- Most A&D companies have established economic moat to aid in the recovery of their businesses.

- A&D companies may also have exposure to new technologies that will provide growth opportunities.

- Investors can gain exposure to the A&D industry via ITA, XAR and PPA.

Introduction

Donald Trump’s presidential victory in 2016 has provided a boost to the Aerospace and Defence (A&D) industry. His emphasis on protectionism amidst a global climate filled with geopolitical tensions has driven defence spending for the United States military through the roof.

Just last December, Trump approved a colossal US$738 billion defence bill for the 2020 fiscal year, a US$21 billion increase over what was enacted in 2019.1 US accounts for about 38% of global defence expenditure and it is the main catalyst for influencing defence spending worldwide.2

The consecutive increases in annual global defence expenditure have propelled stock prices for companies in the related industries to soar in recent years. Defence stocks like Raytheon (NYSE: RTX), Lockheed Martin (NYSE:LMT) and Northrop Grumman (NYSE: NOC) grew by at least 82.28% over the past five years.3

The A&D industry is forecasted to grow at a compound annual growth rate (CAGR) of 3.5% from 2019 to 2025, to reach an estimated value of US$1.6 trillion.4

However, the COVID-19 pandemic has thrown the growth trajectory of the A&D industry off course.

COVID-19’s Impact on the Aerospace and Defence Industry

Air travel is one of the hardest-hit industries by COVID-19 pandemic. When several countries started implementing lockdown measures and closing their borders, demand for air travel plummeted significantly. The global crackdown on international travel has prompted many airlines to seek deferrals or cancellations of new aircrafts orders.5

Traditionally, pure-play defence stocks have their own cycle and do not follow the rhythms of the broad business cycle. Defence spending will rise during times of conflicts and fall when a war is over or public perceptions of risk fade off.

While the defence sector may not be as adversely affected as the aerospace industry, it is not exactly immune to the detrimental impacts brought forth by the pandemic. Governments around the world are scrambling to provide fiscal stimulus in a bid to support their countries’ economies and their defence budgets may be reduced in order to channel funds into other essential areas.

Even though both sectors are negatively affected by the pandemic, the A&D industry will always exist because the world simply cannot function without them. To illustrate, speculations about Kim Jong-un’s health status has evoked the importance of the A&D industry to citizens around the world. Furthermore, the virus outbreak may exacerbate the ongoing US-China trade war and heighten the geopolitical tensions between the two nations.

The Economic Moat of the Aerospace and Defence Industry

Conceptualised by Warren Buffett, an economic moat refers to the sustainable competitive advantages a company has over its competitors which allows it to protect its market share and profitability. It is a usually an advantage or combination of advantages that is difficult to replicate by competitors. By establishing its sustainable competitive advantages, a company can create a wide defensive economic moat to deter competition within its industries and protect its long-term profit.

Five Sources of Sustainable Competitive Advantages6

| Competitive Advantages | Description |

| Intangible Assets | Intangible assets like brand names that allow companies to charge a premium or patents and regulatory licences that prevent competitors to vie for market share |

| Switching Costs | The time, money and energy that a customer would incur to change from one product/provider/producer to another. |

| Network Effect | The phenomenon whereby the value of a product or service increases when more people use it. |

| Cost Advantage | Companies with cost advantage can undercut the price of its competitors to gain market share or earn excess profit by charging the same price point as its competitors. |

| Efficient Scale | New competitors may not be motivated to enter a niche market limited in size and demand. The initial capital outlay may not justify the market returns. |

Most companies in the A&D industry are characterised by their sustainable competitive advantages. For instance, Boeing (NYSE: BA) and Airbus (Euronext Paris: AIR) have a combined market share of 91% in the global commercial aircraft market.7 It may not be economical for new firms to enter the market in an attempt to wrest market share away from these two companies.

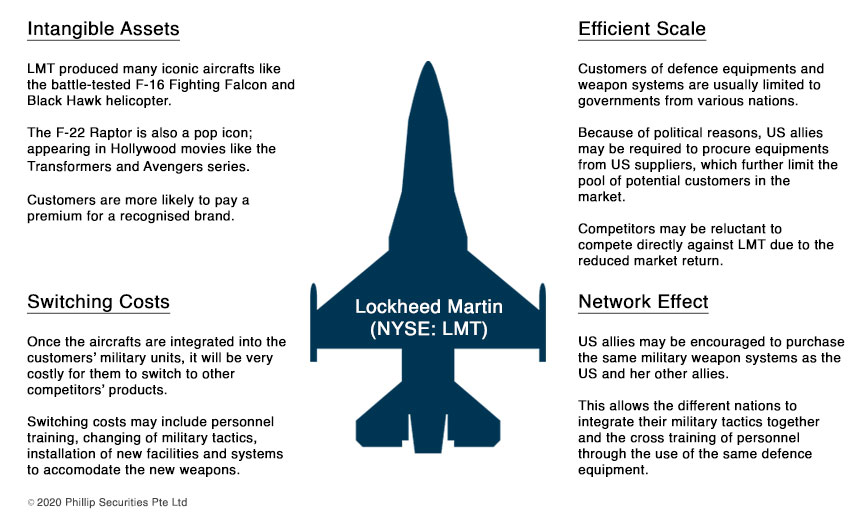

The economic moat established by the giants in the A&D industry allow them to fend off competition and maintain their performance edge. Below is a detailed example of the sustainable competitive advantages of Lockheed Martin (NYSE: LMT).

Figure 1: Sustainable Competitive Advantages of Lockheed Martin (NYSE: LMT)

The Future of Aerospace and Defence Industry

The A&D industry is known for its research and development (R&D) efforts. Some of the greatest advances in human history were born from military research – digital photography, radar, jet engine, microwave oven, internet etc.

These innovations help lay out the foundation for structural change in our society and represent potential growth opportunities for other businesses to tap into.

Some of the innovations from the A&D industry that may revolutionise the future include the following:

Drones

The world’s first remote controlled planes were developed during the First World War. Since then, different types of Unmanned Aircraft Systems (UAS), although largely inhibited by technologies, were used during wars in the past.8

However, with advancement in aerodynamic and transmission technologies, it is now possible for personnel to control their UAS across borders to carry out surveillance or seek-and-destroy mission.

Besides military operations, the commercial and domestic applications for drone technology are limitless. From aerial videography, infrastructure inspection, human transportation to parcel delivery, UAS has the potential to transform our everyday lives. AeroVironment (NASDAQ: AVAV), a traditional supplier of drones to the US military, has a suite of products for use in both battlefield and emergency-response situations.

Amazon (NASDAQ: AMZN) is also exploring the use of drones in its Prime Air delivery system in the near future.

Cybersecurity

It is hypothesised that the next world war will not be fought on the physical front but on the internet. Cyberwar has been described as the use of cyberspace to achieve military objectives by members of the governments or organisations funded by governments.9

Examples such as oil pipeline explosions, shutdown of power grids, nuclear reactor meltdowns, sabotage of weapon systems and other events could cause substantial damage and significant fatalities. Hence, the consequences of cyberwarfare can be devastating.

Several governments that are exposed to cyber threats are increasing their spending on cybersecurity measures and are interested in procuring cyber protection and services equipment.

As A&D companies continue to invest in R&D efforts to develop new products, they are also looking to protect their supply and value chain from cyberattacks. The ability to fend off cyberattacks is becoming an important attribute for many A&D companies and their products.

Raytheon (NYSE: RTX), a US-based defence contractor, has invested more than US$3.5 billion in cybersecurity initiatives over the past decade. The company expects to further increase investments in cybersecurity-related R&D and acquisitions, as combating cyber threats is becoming a priority for its customers.

Space Technologies

The first artificial satellite, Sputnik, was launched by the Soviet Union in 1957. To date, more than two thousand commercial space companies have entered the scene, greatly accelerating the world’s commercial space capacities and satellite industry. Revenue from global space companies reached US$277 billion in 2018 alone.11

Space technologies help benefit human civilisation by providing accurate weather forecasts and climate monitoring capabilities for agricultural development or aversion of natural disasters. In addition to its superior surveillance potential, space-based communication technologies have considerably enhance our ability to communicate internationally and improve our Positioning, Navigation and Timing (PNT) services.

For example, Airbus Defence and Space, a division under Airbus (Euronext Paris: AIR), has designed and built several high profile satellites like the Mars Express and GAIA for space exploration campaigns. On top of space exploration satellites, the company is also involved in supplying Earth observation satellites, telecommunication satellites, navigation satellites, spacecraft equipment and on-orbit services such as maintenance, logistics and cleaning.12

With the arrival of spacecraft launch service companies, like United Launch Alliance – a joint venture between Boeing (NYSE:BA) and Lockheed Martin (NYSE: LMT), the cost to launch Low-Earth Orbit Satellites has been steadily decreasing. The lower cost is one of the reasons behind the recent surge in space-related activities and there is potential for price of launch services to be even lower in the future.

The reliance and importance of satellite infrastructures have increased the potential threats of anti-satellite (ASAT) weapons to tear a nation’s fabric. As a result, US and other countries are increasing investments to improve the resiliency of their military space capabilities and capacities.13

Exchange Traded Funds

The highly cyclical commercial aerospace industry has been badly affected by the COVID-19 pandemic and demand for new commercial airplanes is likely to nosedive in the near future. Nonetheless, the two biggest market players in the commercial aerospace industry, Boeing and Airbus, have diversified revenue sources via their defence and space divisions.

Niche A&D stocks with exposure to drone, cybersecurity and space technologies may provide growth prospects to investors with long investment horizon.

A&D themed Exchange Traded Funds (ETFs) provide investors with convenient exposure to a range of A&D companies. During this volatile market, the ETFs help reduce concentration risk by spreading the dollar investment across the underlying stocks held by the ETFs.

| ETF | iShares US Aerospace and Defence ETF | SPDR S&P Aerospace and Defence ETF | Invesco Aerospace and Defence ETF |

| Ticker | ITA | XAR | PPA |

| Exchange | Cboe BZX | NYSE | NYSE |

| AUM | USD 2.91 billion | USD 1.28 billion | USD 692.5 million |

| Expense Ratio | 0.42% | 0.35% | 0.59% |

| Number of Holdings | 35 | 34 | 48 |

| Top 3 Holdings | – Lockheed Martin Corp(NYSE: LMT)– Raytheon Technologies Corp(NYSE: RTX)– Boeing (NYSE: BA) | – Mercury Systems Inc (NASDAQ: MRCY)– Axon Enterprise Inc (NASDAQ: AAXN)– Lockheed Martin Corp (NYSE: LMT) | – Raytheon Technologies Corp(NYSE: RTX)– Lockheed Martin Corp (NYSE: LMT)– Honeywell International Inc (NYSE: HON) |

All ETF information is accurate as of 12 May 2020

Conclusion

The COVID-19 pandemic will inevitably cause the forward earnings of companies in the commercial aerospace industry to drop as the demand for new airplanes and spare parts plunge. The occurrence of this event has caused some companies within the A&D industry to trade at valuation below their long term averages. This may provide an entry opportunity for investors who are on the lookout for value stocks.

The economic moat established by the A&D titans will aid in the recovery of their stock prices when the global economy returns to normalcy. Moreover, the diversification of their revenue sources may help soften the adverse impact caused by the pandemic.

Finally, the lifeblood of the A&D industry is the R&D endeavours committed by the companies in a bid to discover the next big thing. These R&D efforts may help create the next structural shift in society and bestow new growth opportunities for various industries all over the world.

Reference:

- [1] https://www.cnbc.com/2019/12/21/trump-signs-738-billion-defense-bill.html

- [2] https://www.sipri.org/sites/default/files/2020-04/fs_2020_04_milex_0_0.pdf

- [3] https://www.fool.com/investing/2020/03/04/why-shares-of-defense-stocks-were-down-in-february.aspx

- [4] https://www.prnewswire.com/news-releases/global-1600-bn-aerospace–defence-market-outlook-to-2025-boom-in-commercial-aircrafts-surge-in-global-airline-traffic-rise-in-military-expenditure-300930703.html

- [5] https://www.ft.com/content/35da9db0-6d11-11ea-9bca-bf503995cd6f

- [6] https://marketrealist.com/2017/10/efficient-scale-offers-narrow-moat/

- [7] https://www.forbes.com/sites/greatspeculations/2020/01/06/how-airbus-has-grown-over-the-years-to-dethrone-boeing-as-the-largest-commercial-aircraft-maker/#243367c43a59

- [8] https://www.thebureauinvestigates.com/explainers/history-of-drone-warfare

- [9] https://theweek.com/articles/441194/why-world-war-iii-fought-internet

- [10] https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consumer-business/us-cb-what-makes-high-performing-a-and-d-companies-tick.pdf

- [11] https://www.aerospacedefensereview.com/news/space-technology-is-transforming-human-life-here-is-how-nwid-76.html

- [12] https://www.airbus.com/space.html

- [13] https://www2.deloitte.com/global/en/pages/manufacturing/articles/global-a-and-d-outlook.html

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.