Invest in the Future with Thematic ETFs May 15, 2019

It is an unavoidable temptation for us to speculate and to predict the future. To think about the future is to venture into the unknown. To imagine how our lives might be affected by new tools, new methods or new innovations.

Similarly, thematic investing is an investment strategy that involves following certain social, economic, corporate, demographic or other themes that are popular in society. Investors will then identify these powerful macro-level trends and the underlying investments that stand to benefit from the materialization of these trends in the future.

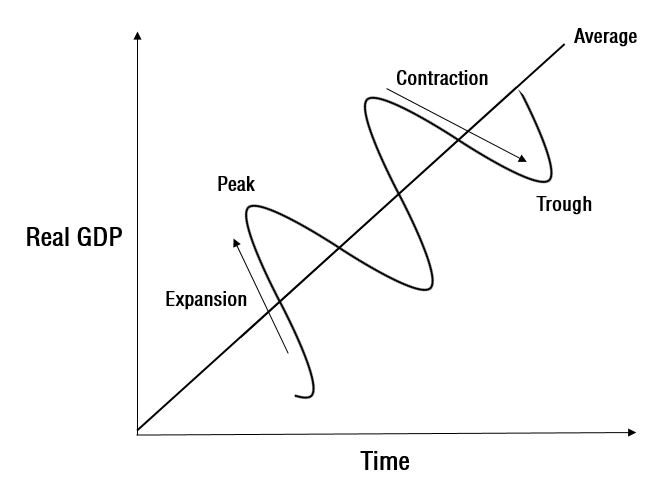

Contrary to popular belief, thematic investing is not a new phenomenon and has been utilised by investors from all over the world. For example, investors may flock towards banking stocks in a rising interest rate regime or swap to defensive stocks during the contraction phase of the business cycle.

However, thematic investing does not revolve entirely around economic policies and rotating between different sectors throughout the business cycles. Unlike business cycles, structural trends in society such as changing demographics, new technologies, evolving consumer behaviour and depleting natural resources represent possible avenues for investors to engage in thematic investing. These one-off structural shifts may change the fundamentals of society and provide growth potential for investors.

Differences between Cyclical Themes and Structural Themes

| Cyclical Thematic Investing | Structural Thematic Investing |

|

|

Figure 1: The Business Cycle

Some areas and sectors of the economy can be affected by both cyclical and structural trends. During periods of economic expansion, technology firms tend to benefit from increases in commercial and industrial spending.1

However, technology firms can also participate in structural trends, such as innovating new products and processes that have a seismic, influential effect on society and the economy.

It is important for investors to identify the main drivers of growth. Is the growth the result of cyclical or structural trends? Structural trends tend to be longer term in nature and can be significantly more impactful over the long term.

Structural Thematic Investing

From the invention of the television to the commercialisation of the Internet, structural shifts in society have influenced our lives and transformed the economy.

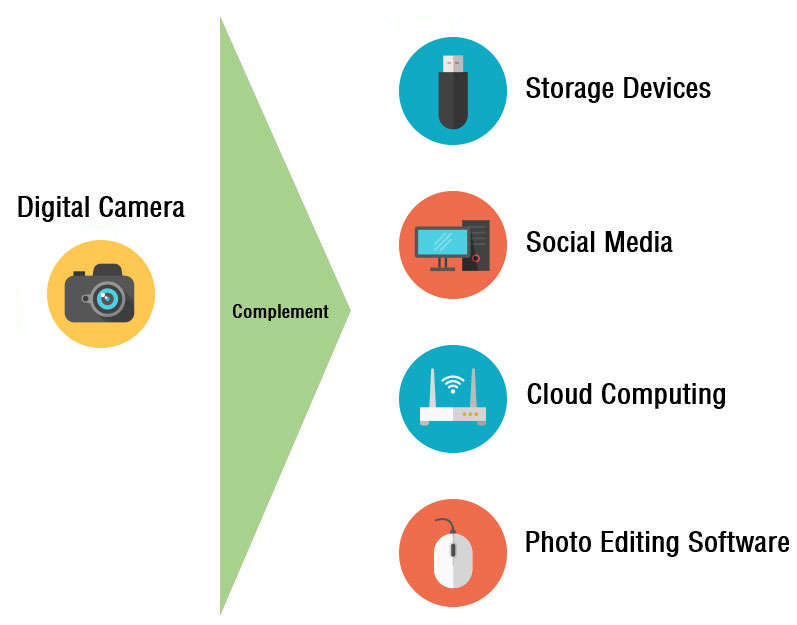

For example, Kodak’s dominance in the photography industry was ended by its failure and unwillingness to adapt to new digital photography technology.2 The innovation of digital photography, coupled with changes in consumer behaviour, spelled the demise for Kodak. The disruptive technology led to the downfall of traditional film photography but also complemented many new technological advancements like digital storage and photo editing software.

Thematic developments are often cross-sectoral and may affect more than one group, area or section of society.

Figure 2: How Digital Cameras Complement other Products & Services

The Technology S-Curve and Rogers Adoption Curve

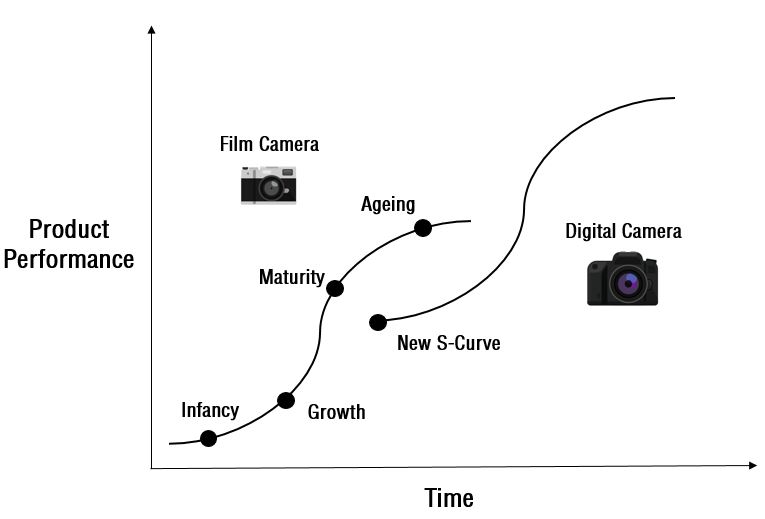

Structural thematic investing revolves around the concept of the Technology S-Curve and Rogers Adoption Curve.

Successful products and innovations follow the “S” curve; from the infancy stage to the end of their life cycles. They may be replaced by new innovations that better serve consumers’ needs. The shape of the “S” curve depends on a variety of factors like product sustainability, technological advancement, competitive environment, societal norms and regulations.

Even then, many innovations may not experience an “S” curve as new products often fail to make it past the infancy stage.

Figure 3: An illustration of the Technology S-Curve

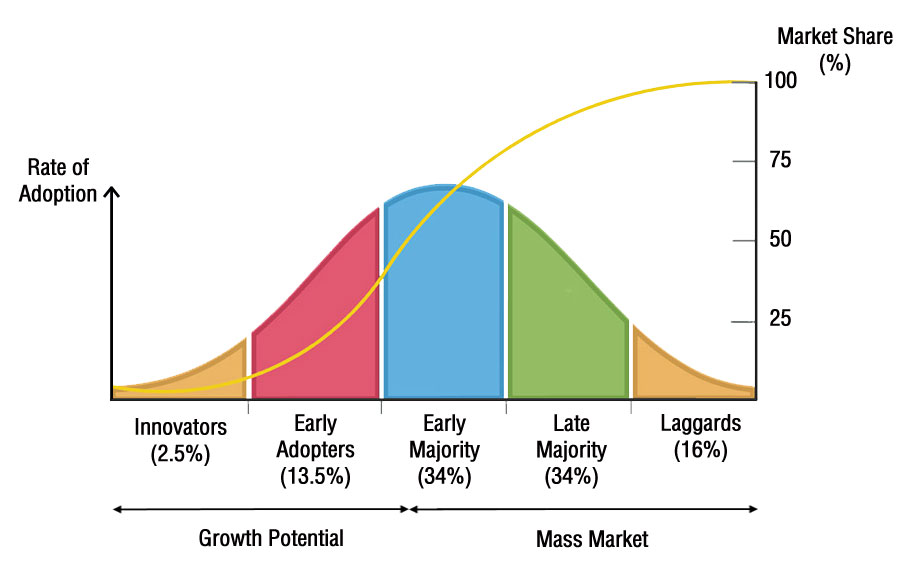

The Rogers Adoption Curve is an illustration of how innovation diffuses across the population. The success of a new product, idea or technology is dependent upon its acceptance amongst the target audience. It is impossible to achieve 100% market share on the launch of a new product and more often than not, disruptive technology has to be accepted by the “Innovators” and “Early Adopters” before it becomes mainstream.

Adopters of innovation can refer to domestic consumers, industrial producers, business users, governments, etc.

Figure 4: An Illustration of the S-Curve (Orange Line) and Rogers Adoption Curve (Bell Curve)

How can Investors Utilise the S-Curve and Rogers Adoption Curve?

There may not always be a direct or positive correlation between stock prices and the “S” curve. The difference between the two variables may be attributed to market forces like competition, business uncertainty, the political or economic environment.

Earnings and revenue growth may further lag behind the “S” curve as companies redirect cash flow back into their products or businesses in a bid to dominate market share or to build up their critical mass.

However, the “S” Curve is a useful indicator for investors to evaluate the risk and return profile of their investment. An innovation in its infancy stage provides high potential return but presents a significant risk for investors because of its high possibility of failure. At the other end of the spectrum, an ageing technology that is widely used by consumers provides less upside potential but may represent less risk for investors.

Five Main Characteristics of Innovations

The diffusion of innovations is a complex process. A survey by PricewaterhouseCoopers (PwC) revealed that consumers would be the main disruptive force affecting society and it is very likely that consumers will replace one of their products or services with a better alternative in the next five years. Our choice of new technology will affect the ways in which we shape our future.3

There are five main characteristics that determine the success and adoption of new technology.4

| Characteristics | Description | |

| 1 | Relative Advantage | How improved an innovation is over its competitors, substitutes or predecessors |

| 2 | Compatibility | How compatible is the innovation with the routines of the potential adopters and its complements |

| 3 | Complexity | How difficult it is for adopters to learn or to use the innovation |

| 4 | Ease of Conducting Trials | How accessible is the innovation for potential adopters to try out the innovation |

| 5 | Observability | How visible is the advantage or benefit of using the innovation to potential adopters |

Investors should always assess these five characteristics to determine the likelihood of acceptance of an innovation and the probability of success for their thematic investment strategy.

Thematic Exchange-Traded Funds

With plain vanilla Exchange-Traded Funds (ETFs) saturating the market, ETF issuers are now churning out thematic ETFs in an attempt to attract investors in an increasingly competitive environment.

From strategies that favour quirky segments like pet care, outer space exploration and electronic gaming, to emerging trends like biotechnology and Artificial Intelligence (A.I.), investors are spoilt for choice.

Unlike traditional broad market index and sector-based ETFs, which are market capitalisation weighted, thematic ETFs use alternative rules-based index construction strategies . This method allows the ETFs to select stocks that adhere to their specific thematic investment objective.

As a result, thematic ETFs have democratised thematic investing for retail investors. Instead of ciphering through market reports and data to identify companies with high exposure to structural trends, investors can now use thematic ETFs to gain access to their desired thematic investment strategy.

After learning about the basics of thematic investment strategy, what are some of the possible investment themes that may be of interest to investors?

Robotics and Artificial Intelligence

The worldwide spending on robotics and related services is expected to increase from US$91.5 billion in 2016 to US$188 billion by 2020.5 With the world’s ageing population growing from 559 million in 2015 to 604 million in 2020, companies are progressively looking towards robotics and A.I. to improve productivity and pare down labour costs.

It is widely believed that mass adoption of robots, automation and A.I. could represent a fourth Industrial Revolution – after the advent of the steam engine, mass production and electronics.

| ETF | iShares Robotics and Artificial Intelligence ETF | First Trust NASDAQ Artificial Intelligence and Robotics ETF | ROBO Global Robotics and Automation Index ETF | Global X Robotics and Artificial Intelligence Thematic ETF |

| Ticker | IRBO | ROBT | ROBO | BOTZ |

| Inception Date | 26 June 2018 | 21 February 2018 | 21 October 2013 | 12 September 2016 |

| Exchange | AMEX | NASDAQ | AMEX | NASDAQ |

| AUM (US$) | 36.06 million | 43.78 million | 1.50 billion | 1.74 billion |

| Expense Ratio | 0.47% | 0.65% | 0.95% | 0.68% |

| Number of Holdings | 89 | 96 | 95 | 38 |

| Top 3 Holdings |

|

|

|

|

Cybersecurity

Cybersecurity refers to the process of protecting internet-connected systems like computers, networks, programs, and data from unauthorised access, misdirection of services and/or cyberattacks.

The market for cybersecurity products and services reached US$60 billion in 2016 and the figure is expected to double in 2020.6 With internet connectivity becoming ubiquitous in our lives and business processes, the spending on cybersecurity will continue to accelerate in the near future as companies and individuals look for efficient means to protect their digital assets.

| ETF | First Trust NASDAQ Cybersecurity ETF | ETFMG Prime Cyber Security ETF |

| Ticker | CIBR | HACK |

| Inception Date | 6 July 2015 | 12 November 2014 |

| Exchange | NASDAQ | AMEX |

| AUM (US$) | 881.18 million | 1.67 billion |

| Expense Ratio | 0.60% | 0.60% |

| Number of Holdings | 45 | 52 |

| Top 3 Holdings |

|

|

Marijuana

There has been increasing social and government acceptance of marijuana for both its medicinal properties and recreational uses. The potential therapeutic benefits of marijuana have led to 30 U.S. states and countries, including Germany and Canada, legalising medical marijuana.7

In addition, Canada became the first industrialised country in the world to legalise recreational cannabis in 2018 and we could expect to see the number of U.S. states that legalise recreational marijuana to increase in the near future.8

It is projected that the U.S. marijuana industry will reach US$22 billion by 2022. There are also plans by ETF issuers to launch new ETFs with direct exposure to the underlying U.S. Marijuana market.9

| ETF | ETFMG Alternative Harvest ETF | AdvisorShares Pure Cannabis ETF | Horizons Marijuana Life Sciences Index ETF | Horizons Emerging Marijuana Growers Index ETF |

| Ticker | MJ | YOLO | HMMJ | HMJR |

| Inception Date | 3 December 2015 | 17 April 2019 | 4 April 2017 | 13 February 2018 |

| Exchange | AMEX | AMEX | TSX | TSX |

| AUM | US$1.26 billion | US$43.24 million | CA$920.28 million | CA$12.45 million |

| Expense Ratio | 0.75% | 0.74% | 0.87% | 0.99% |

| Number of Holdings | 36 | 20 | 58 | 52 |

| Top 3 Holdings |

|

|

|

|

Gaming

The gaming industry is disrupting traditional media and entertainment as computing hardware continues to advance and online streaming, social media and mobile gaming rise in popularity.

Technology advancements have made games more complex, interactive and dynamic. Gone are the days when you have to stand in line at an arcade to play your favourite video games. Now you can access your video game across multiple platforms and play with strangers from around the world.

PricewaterhouseCoopers (PwC) classified the gaming industry into four revenue-generating categories; traditional gaming revenue, social/casual games, video game advertising and e-sports.10 The global video game industry is worth as much as US$135 billion, with the U.S. seeing an 18% year-over-year uptick in the sector for revenues in 2018.11

With the average gaming consumer skewed towards the younger demographic, there is potential for companies involved in the gaming industry to build long and loyal brand relationships with their target audience. Investing in these companies may offer investors the chance to participate in what may be a long-term growth story.

| ETF | ETFMG Video Game Tech ETF | VanEck Vectors Video Gaming and eSports ETF |

| Ticker | GAMR | ESPO |

| Inception Date | 9 March 2016 | 16 October 2018 |

| Exchange | AMEX | AMEX |

| AUM (US$) | 99.73 million | 22.9 million |

| Expense Ratio | 0.75% | 0.55% |

| Number of Holdings | 79 | 25 |

| Top 3 Holdings |

|

|

Water

Although two-thirds of our planet Earth is covered by water, only a fraction of it is available for drinking for a global population that exceeds 7 billion. It is estimated that the world’s total population will reach 9.7 billion in 2050 and demographic changes will accelerate the growth in demand for water.12

According to Global Water Intelligence, operating and capital expenditure by utilities and industrial water users are expected to grow from US$770 billion in 2018 to US$914.9 billion by 2023.13

The water industry comprises of businesses and companies involved in products and processes designed to conserve and purify water. Investing in the water industry is a good way for investors looking for long-term growth potential.

If current structural trends were to continue and water companies continue to adopt emerging technologies to cope with the increasing demand for water, consumer experience in the water industry can be fundamentally changed and improved.

| ETF | First Trust Water ETF | Invesco Water Resources ETF | Invesco S&P Global Water Index ETF |

| Ticker | FIW | PHO | CGW |

| Inception Date | 8 May 2007 | 6 December 2012 | 14 May 2007 |

| Exchange | AMEX | NASDAQ | AMEX |

| AUM (US$) | 356.47 million | 948.10 million | 621.70 million |

| Expense Ratio | 0.55% | 0.62% | 0.62% |

| Number of Holdings | 37 | 35 | 50 |

| Top 3 Holdings |

|

|

|

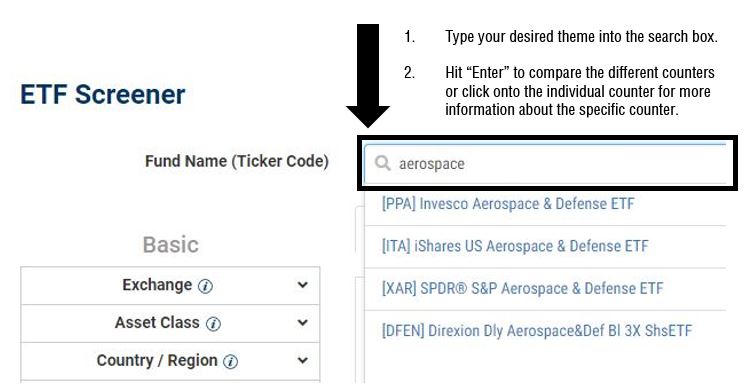

You may search for other thematic ETFs by using our ETF Screener’s search box.

Figure 5: Screenshot of ETF Screener

Conclusion

Thematic investing is a forward-looking investment approach that seeks to beat broad-based market returns by anticipating changes that are happening in the world. A successful thematic investment strategy involves identifying the correct structural trends, finding the companies with high exposure to those themes, and timing market entry early to take full advantage of the growth potential of the themes.

Effective themes seldom emerge in isolation and are often complements to one another. For example, increasing adoption of robotics and A.I. technology could represent a boost in spending in the cybersecurity industry because of increased vulnerabilities to cyberattacks. The most attractive investment opportunities are often found when the different themes congregate and reinforce each other.

So if you want to ride on the wave of the future, ETFs can function as ideal investment vehicles in helping you gain exposure to your desired investment themes. Who knows? You just might be an oracle in the making!

Reference:

- [1] https://www.msci.com/documents/1296102/8328554/GICS2018Consultation.pdf/0f246611-27f7-4126-b7f0-02a9255724d5

- [2] https://www.forbes.com/sites/chunkamui/2012/01/18/how-kodak-failed/#2f605a786f27

- [3] https://www.pwc.com/gx/en/ceo-agenda/pulse/the-disruptors.html#Ready

- [4] https://www.smashingmagazine.com/2015/01/five-characteristics-of-innovations/

- [5] https://www.investopedia.com/news/another-robotics-etf-here/

- [6] http://techgenix.com/cybersecurity-industry-growth/

- [7] https://www.fool.com/investing/2018/09/15/should-you-invest-in-marijuana-stocks.aspx

- [8] https://www.fool.com/investing/2019/03/16/new-jersey-is-on-the-verge-of-making-recreational.aspx

- [9] https://www.bloomberg.com/news/articles/2019-03-21/cannabis-fund-innovator-is-planning-etf-of-u-s-companies-only

- [10] https://investingnews.com/daily/tech-investing/gaming-investing/how-to-invest-in-gaming/

- [11] https://finance.yahoo.com/news/video-gaming-industry-warming-play-170005833.html

- [12] https://www2.deloitte.com/content/dam/Deloitte/pl/Documents/Reports/pl_Water-Tight-2-0-The-top-trends-in-the-global-water-sector.pdf

- [13] https://finance.yahoo.com/news/dive-water-etfs-big-gains-150003463.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Joel Lim

ETF Specialist

Joel graduated from Singapore Institute of Management, University of London with a First Class Honours in Business. He was the recipient of SIM University of London’s Top Student Bronze Award in 2017 and was the worldwide examination topper for the “Financial Management” module in 2016. Joel was also commended by University of London for his excellent performance in the 2014 Examinations.

Joel is involved in ETF education, providing trading ideas and support to traders, dealers and fund managers. Joel also works closely with ETF issuers to educate retail investors about new ETFs during the Initial Offering Period.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?