Analyzing Telecommunication Companies May 2, 2017

With all the on-going news on take-overs, new entrant and upcoming release of results for the telco sector, I thought it will be good to share on a few points to look out for while analyzing telco companies.

Telecoms’ performance are usually judged on the following:

1) Ability to retain and grow their customer base

2) Ability to generate revenue from customer base

3) Ability to contain costs to improve profit margin

1) Ability to retain and grow customer base

Subscriber Growth

Higher subscriber base means higher revenue growth potential. Investors generally look at the growth in subscriber numbers to understand if the company is doing well against its competitors. A strong growth in subscriber numbers usually mean that the company is offering attractive services as compared to its competitors. Flattening growth are usually a tell-tale sign that the company is not doing enough or their subscriber base may have reached saturation point.

Churn Rate

This rate measures the stickiness or stability of the customer base. Usually displayed on the results statements in percentage form, it shows the amount of subscribers who left the service during the period. The higher the churn rate, the more pressure there is on the company to add new subscribers to generate revenue or to improve profit margin.

2) Ability to generate revenue from customer base

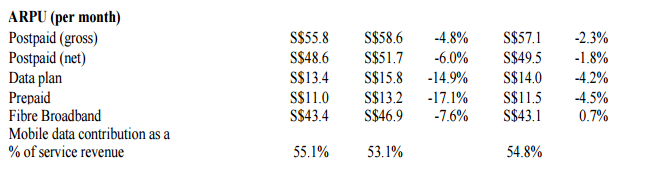

Average Revenue Per User (ARPU)

Measuring the average monthly revenue generated from each subscriber, ARPU is a classic key indicator used in the analysis of a company’s revenue generation and growth at the per unit level, which can help investors to identify which products are high or low revenue-generators.

3) Ability in containing costs to improve profit margin

Earning before interest, tax, depreciation and amortization (EBITDA)

EBITDA allows investors to analyse whether the core operating business is actually generating profit by taking out the effect of capital expenditure (CAPEX), interest payments and depreciations. As telecommunication companies typically have large capital expenditures or depreciations, EBITDA is a convenient metric for comparing the profitability of companies that have different capital investment outlay.

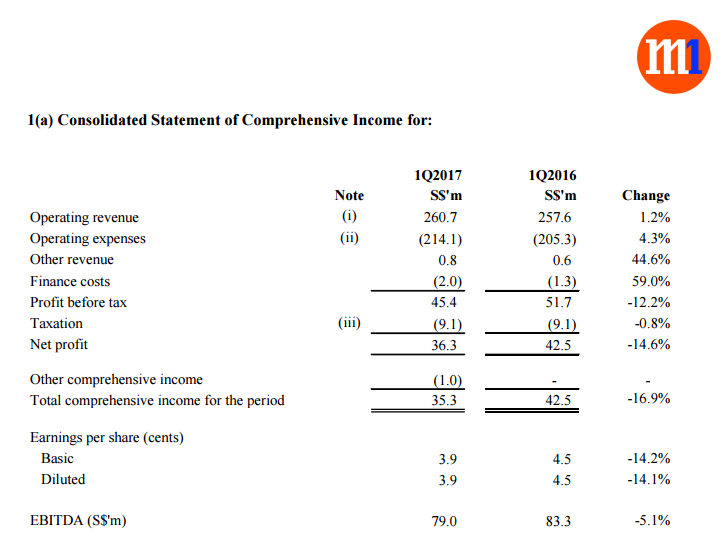

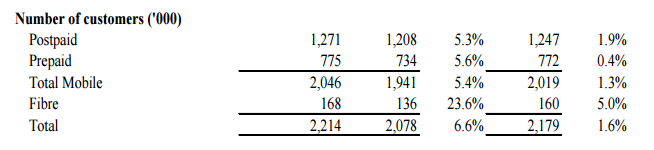

Case Study (Extracted from 1Q17 financial results for M1)

From the 1Q2017 quarterly results from M1 above, we can see that M1 has grown their customer base by 6.6% YoY. On the surface, this seems like a fantastic rate of growth! However, when we take a closer look at the EBITDA (-5.1% QoQ) and ARPU (which reflected a decline in almost all segments), it tells a different story! This means that even though M1 successfully grew their subscriber base, their ability to generate revenue from each user and overall profit margin have actually decreased. This may be attributed to higher operating expenses and costs in attracting new users.

In conclusion, when analysing Telecommunication Company, investors should not solely look at the growth in subscribers. They should combine it together with ARPU and EBITDA to get a more complete picture of the overall health of the company.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chong Kai Xiang (Kai)

POEMS Dealer

Raffles City Dealing Team

Chong Kai Xiang (Kai) is an Equities Dealer in the Raffles City Dealing Team, and currently provides dealing services to over 35,000 trading accounts.

Kai frequently conducts seminars to enrich his clients' trading and financial knowledge. Apart from this, Kai also provides weekly market updates to his clients to keep them informed and up to date on their stock holdings.

Kai holds a Bachelor Degree of Finance from the SIM University – UniSIM and was awarded the CFA Singapore Gold Award and CFP® Certification Achievement Award in 2015.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It