As the pandemic eases, Singapore offers an investment opportunity April 13, 2022

As the world recovers from the COVID-19 pandemic and with Singapore’s easing of COVID-19 restrictions, you probably wonder if it is now a good time to invest in the Singapore stock market.

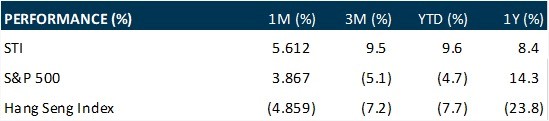

Let us evaluate how the market has been performing Year to Date (YTD). According to Bloomberg data, the Straits Times Index (STI) has risen 9.6% YTD. In contrast, the S&P 500 has declined 3.80% YTD and the Hang Seng Index (HSI) in Hong Kong declined by 7.7% YTD.

Despite the threat of inflation, the ongoing Russia-Ukraine conflict and the higher commodity prices, the STI continues to do well1.

One of the reasons for this is that the bulk of STI’s weight is based on Singapore’s three major banks: DBS Group (SGX: D05), United Overseas Bank (SGX: U11) and OCBC Ltd (SGX: 039), all of which have performed well.

As the three lenders contribute to almost 44% of the index, their performance inevitably has a large effect on the STI’s direction.

According to the report “Phillip 2Q22 Singapore Strategy – A stagflation shelter” published on 4 April 2022 by Paul Chew, head of Phillip Securities Research: “Bank earnings will enjoy a huge lift as we enter an interest-rate cycle. A 100 basis point rise in rates can increase earnings by around 18%. We believe the three domestic banks have excess deposits or float totalling S$160bn that can immediately benefit from the rise in short-term rates2.”

DBS Group and United Overseas Bank Ltd reported impressive fiscal 2021 (FY2021) earnings. DBS reported a record S$6.8 billion in net profit for FY2021 and also increased its quarterly dividend to S$0.36 per share; while UOB reported S$4 billion net profit for FY2021 and also increased its final dividend for the full year compared to the last fiscal year. Similarly, OCBC saw higher FY21 earnings of S$4.86bn with higher net interest income offsetting steep allowances3.

Also, other sectors comprising the index are expected to perform well as Singapore reopens.

Quoting from the same report mentioned above: “The reopening of borders and relaxation of social restrictions will be a further boost for corporate earnings. Primary beneficiaries are transport, telecommunications, retail and hospitality. They make up a combined 20% of the STI. Tourism accounted for 5% of GDP in 2019. So, it becomes a huge economic driver over the next 12-18 months.”

According to data from CBRE’s latest report on the Singapore hotel market, various signs of nascent recovery emerged over the second half of 2021, led by premium segments such as luxury goods and upscale markets.

Tourism in Singapore is expected to pick up further over the course of 2022, benefiting the hotel industry in Singapore as usage of the Vaccinated Travel Lane scheme continues to grow4.

According to Mr Chew, another sector expected to perform well as Singapore reopens, is the construction sector. “Construction, namely building materials, will gain from a return of foreign labour and construction activity.”

Real Estate Investment Trusts (REITs) is also something investors can consider when looking at the STI. There are a total of seven REITs listed in the STI, and these companies hold a combined weight of about 14.6% within the index5.

To further elaborate, REITs hold assets in the hospitality and retail sectors which are expected to benefit as life returns to the pre-COVID norm.

Singapore’s retail sales rose 11.8 per cent year-on-year in January, compared with the increase of 6.7 per cent in December 20216.

The growth was mainly attributed to higher spending prior to Chinese New Year in early February this year, according to data released by the Singapore Department of Statistics (SingStat) on 4 March.

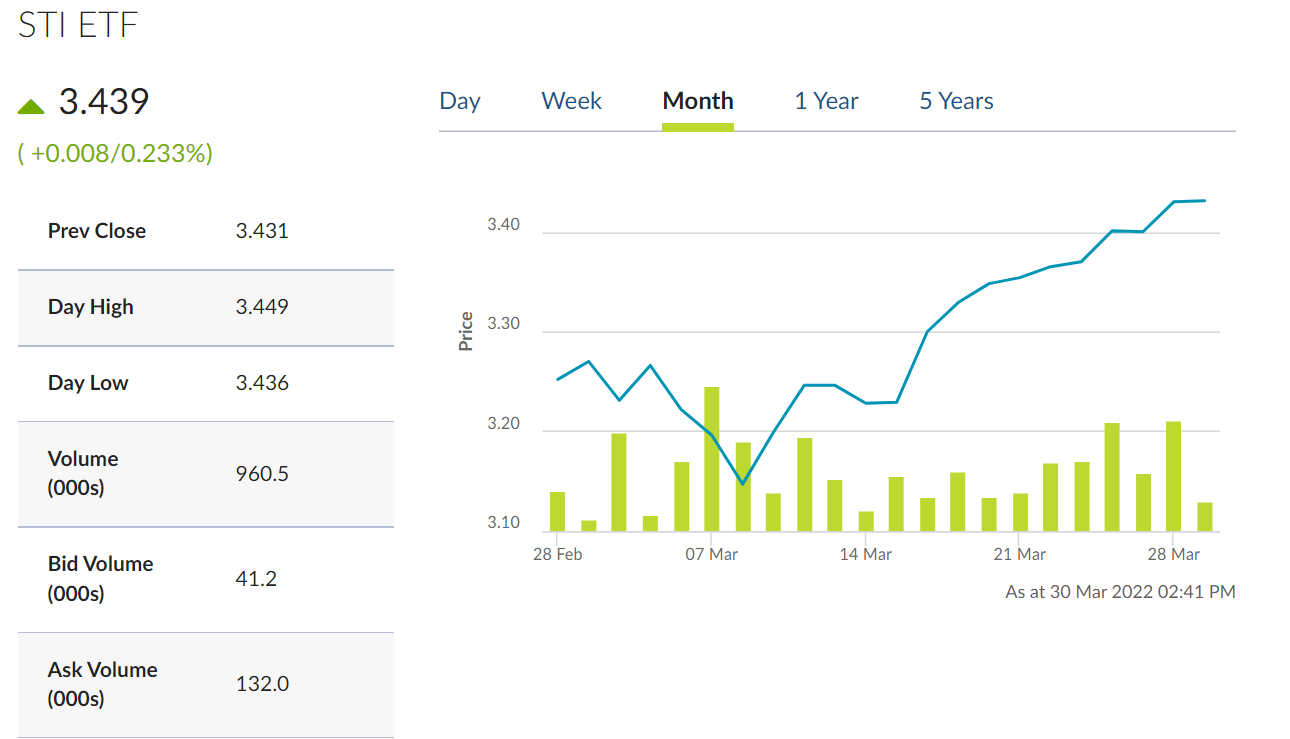

As for the performance of the STI YTD (see table above), one can see that it started rising after a brief decline. The decline, from 3 to 8 March 2022, was mainly due to the Russia-Ukraine conflict where Russia announced that corporate deals with companies and individuals from “unfriendly countries” including Singapore, required approval from a government commission. This resulted in the STI falling 0.4% to 3174.40. The index then started to rise again from 9 March 20227.

To gain exposure from the STI’s good performance, investors can consider looking into Exchange-Traded Funds like SPDR STI ETF (SGX: ES3) (See table below) and Nikko AM STI ETF (SGX: G3B).

In the SPDR STI ETF’s case, the ETF tracks Singapore’s 30 biggest companies and the economy’s top-performing sectors such as banking, real estate, and industrial goods8.

The SPDR STI ETF is SGX’s most famous ETF, and considered to be one of the core investments any Singaporean should have since it is a tracker of the country’s economy. Those who have been buying the ETF from its inception would have benefitted from Singapore’s rapid economic growth over the past decades.

Some ETFs also pay out dividends at regular intervals, prompting some investors to use them as a source of passive income9.

Latest promotion

To encourage investors to start investing in bite-sized amounts while making use of the benefits of DCA, the minimum commission of all SGX-listed ETFs has been removed.

For example, if your current minimum commission rate on SGX market is $10 or 0.1%, whichever is higher, from 3 Feb 2022 till 30 Jun 2022, this minimum amount will be removed and the commission will only be at 0.1%. This will allow investors to spread their purchases over a longer period without incurring additional costs.

If you have further enquiries, please contact your trading representative or make an appointment to visit the nearest Phillip Investor Centres.

Alternatively, you can email us at etf@phillip.com.sg or visit our ETF page.

Have a look at some ETFs! Visit: https://www.poems.com.sg/etf-screener/

The PhillipCapital’s Share Builders Plan is another avenue where investors can buy ETFs on a monthly basis. To find out more, visit: https://www.poems.com.sg/faq/general/information-sheets/share-builders-plan-sbp/

Reference:

- [1]https://thesmartinvestor.com.sg/singapores-straits-times-index-what-to-expect-for-2022-and-beyond/

- [2]https://www.stocksbnb.com/reports/phillip-2q22-singapore-strategy-a-stagflation-shelter/

- [3]https://www.stocksbnb.com/reports/singapore-banking-monthly-interest-rates-up-in-february/

- [4]https://www.businesstimes.com.sg/real-estate/singapore-hotel-market-poised-for-steady-rebound-as-border-restrictions-ease-cbre

- [5]https://www.sgx.com/indices/products/sti

- [6]https://www.channelnewsasia.com/business/singapore-retail-sales-singstat-january-2022-2538696

- [7]https://www.straitstimes.com/business/companies-markets/singapore-shares-fall-at-tuesdays-open-extending-global-losses-sti-down-04

- [8]https://blog.moneysmart.sg/invest/spdr-sti-etf-straits-times-index-20-anniversary/

- [9]https://www.singsaver.com.sg/blog/best-etf-singapore

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It