Brexit: 4 Investments Worth Looking At April 2, 2019

What is Brexit?

The United Kingdom (UK) has been a key member state of the European Union (EU), being one of its largest economies. But the EU’s foundations were shaken in 2016 when Britain held a referendum which saw 51.9% voters opting for the UK to leave the EU. It was a result that surprised many – that the country had chosen “Brexit”; an amalgamation of the words “Britain” and “Exit” that pointed to the UK’s decision to seek a divorce from the EU.

Brexit as it Stands

23 June 2016

The UK’s Referendum on its membership in the EU was held. 51.9% of the voters voted in favour of leaving the EU. The result came as a shock, as several figures within the UK government expected and wanted Britain to remain within the regional bloc.1

29 March 2017

The UK formally invoked Article 50 of the treaty on EU, beginning the 2-year period for withdrawal negotiations to take place.2

19 March 2018

A 21-month transition plan was agreed upon for the execution of the withdrawal plan from the EU.3

15 January 2019

The UK parliament voted against the plan with a 432 to 202 vote, the heaviest defeat dealt to UK Prime Minister Theresa May.4 This came as a result of the disagreement on the handling of the border between Northern Ireland (which belongs to the UK) and the Republic of Ireland (which belongs to the EU). The controversial Northern Irish backstop plan divided politicians who were unable to come to an agreement. Politicians were not willing to accept a possible situation where Northern Ireland will not be subjected to import and export regulations, in addition to other differences between Northern Ireland and Great Britain which could threaten the union.5

16 January 2019

UK Prime Minister Theresa May narrowly survives a vote of no confidence following the heaviest defeat on the Brexit Plan vote, winning by 325 to 306 votes.6

12 March 2019

UK Prime Minister Theresa May’s Brexit deal withdrawal plans were rejected for a second time in a House of Commons vote. MPs opposed the agreement by a margin of 149 votes, much fewer than the 230-vote defeat handed to her in January.7

13 March 2019

MPs voted against the prospect of the UK leaving the EU without a deal.8

14 March 2019

MPs voted to allow a short delay to the UK’s exit from the EU, a day after they rejected a no-deal Brexit. They also overwhelmingly rejected calls for a second referendum.9

As can be observed, the UK’s divorce from the EU has been fraught with disorder and upheavals. But regardless of what happens to the Brexit process, investment opportunities still present themselves in uncertain situations.

Investment Opportunities Amidst an Uncertain Situation

Amidst all the uncertainties in the UK, there are sectors or industries that investors can look into. Diversification is one key reason why investors should look at the UK market. UK financial institutions, in particular, started to make preparations to meet headwinds brought on by Brexit in 2016 once voters decided to leave the EU.

Here are 3 companies with significant capitalisation and 1 Exchange Traded Fund (ETF) which investors should take note of.

Financial Services – Lloyds Banking Group PLC (Ticker: LLOY.UK)

Lloyds Banking Group PLC has one of the largest retail divisions in the UK by customers and branch network size. Their main operations are in Retail, Commercial Banking, Insurance and Wealth.

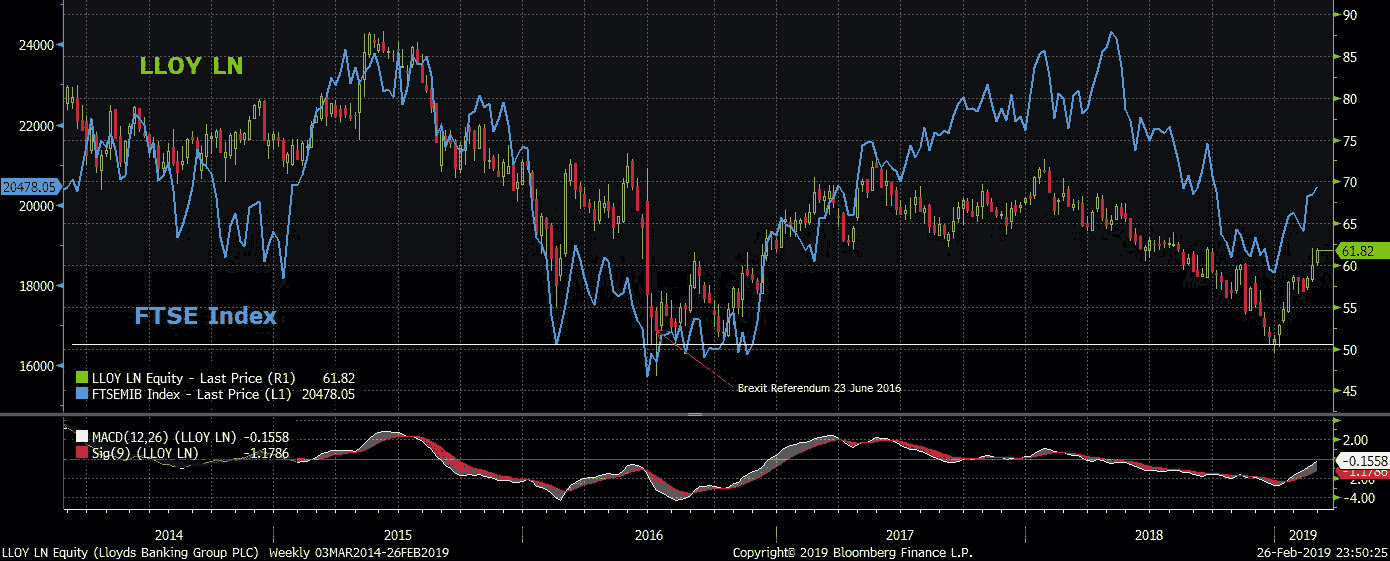

Like the majority of financial services players in the UK, market volatility has caused banking share prices to underperform in 2018. Furthermore, Lloyds Bank, having the largest retail division in the UK, has been seen as a proxy for the UK economy’s health, with its growth being hampered by Brexit as seen below. But not all is negative.

(Source: Bloomberg)

(Source: Bloomberg)

The recent uptick in share prices may be attributable to the return of dividends and share buybacks as Lloyds’ balance sheet strength improves with the overall improvement in market performance.

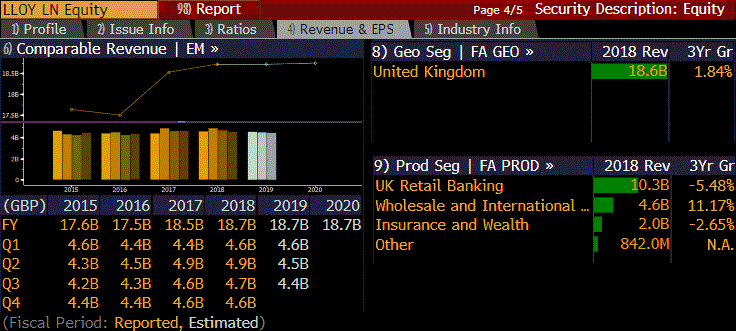

The revenue and Earnings Per Share (EPS) of Lloyds has improved over the past 3 years and the forecast is expected to be stable as well. The dip in retail banking revenue will be offset by the increase in Wholesale and International Banking revenue as the bank looks into diversifying out of its UK-focused business. This should also provide some form of stability to its share performance.

(Source: Bloomberg)

(Source: Bloomberg)

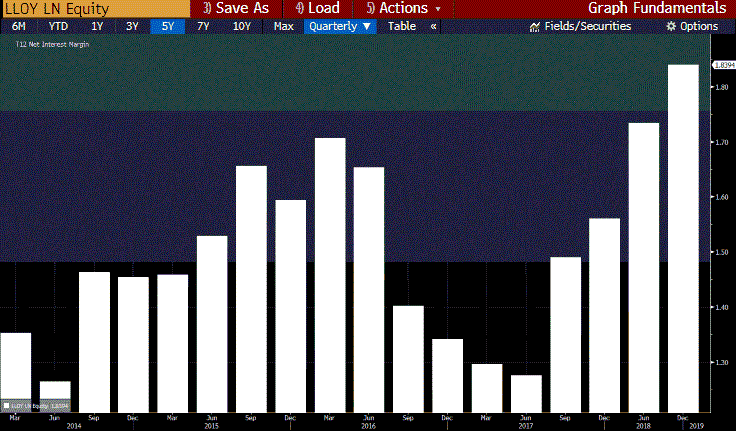

With the current rising interest rate environment, there is also a gradual uptick in Lloyds’ Net Interest Margins over the past four quarters – an indicator of the bank’s profitability. These are positive signs to show that the bank’s business is improving.

(Source: Bloomberg)

(Source: Bloomberg)

In conclusion, the following pointers highlight why Lloyds Bank is worth an investor’s consideration:

- Stable Revenue and EPS

- Increased Net Interest Margins over the four quarters till December 2018

- Resumed dividend payout with a yield of 5.05%

- Largest Retail Bank in UK with a market capitalization of GBP44 Billion

Oil & Gas – BP Holdings (Ticker: BP.UK)

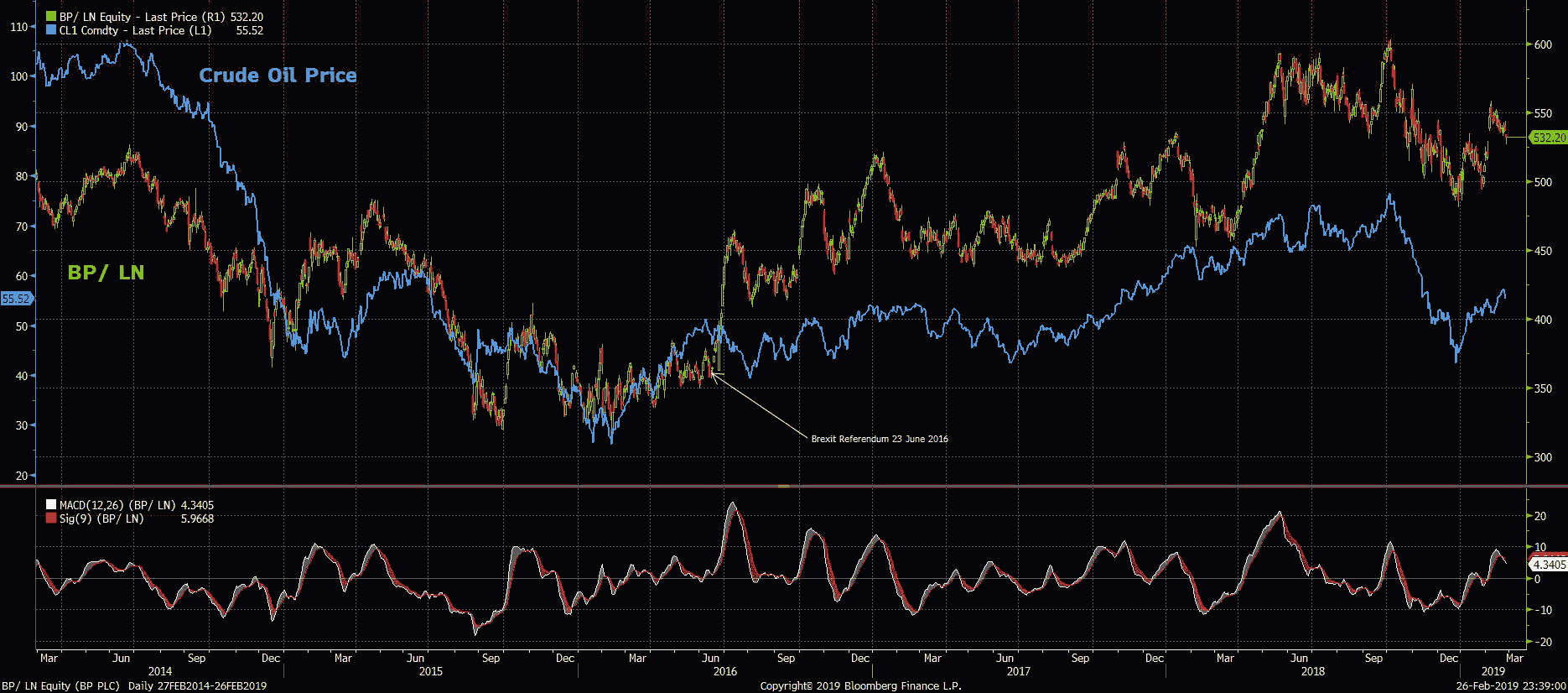

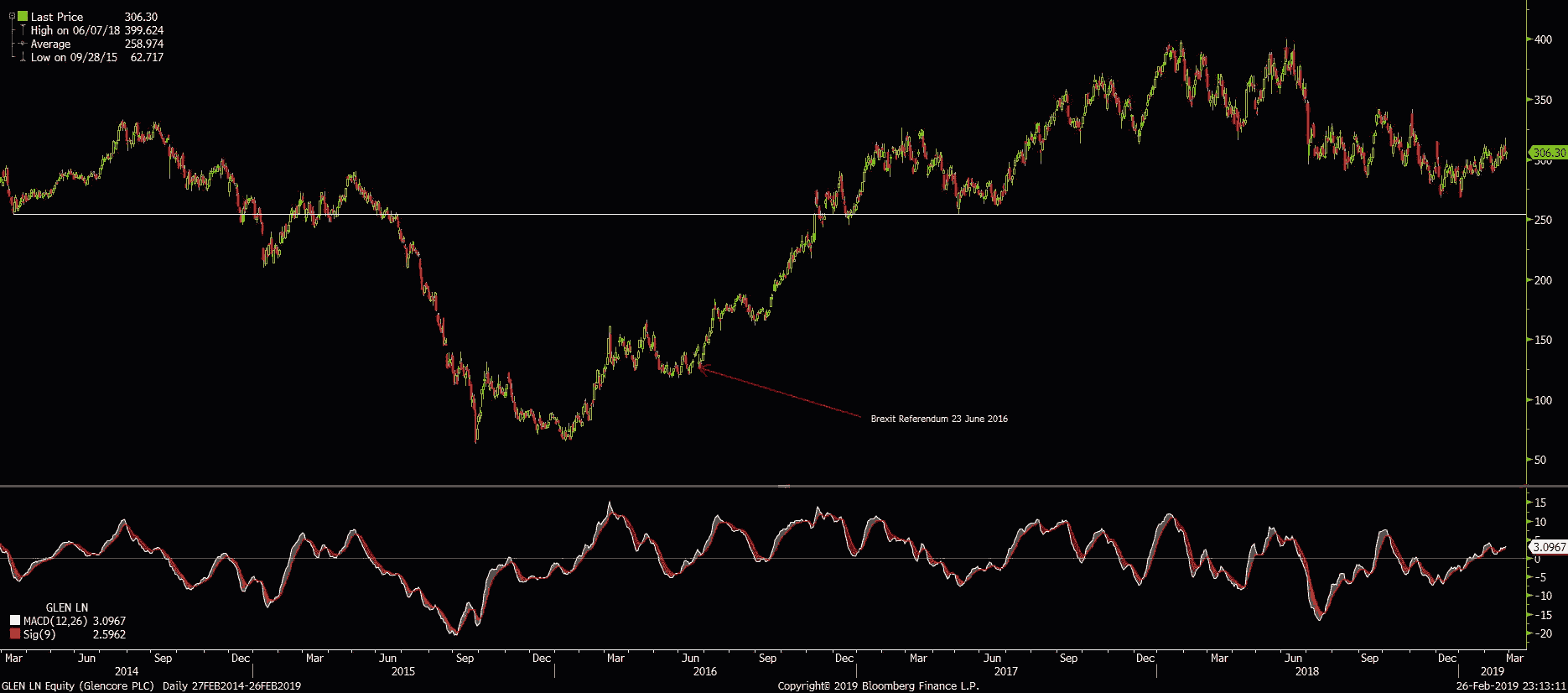

BP Holdings is an Oil and Petrochemicals company with a market capitalisation of GBP108 Billion. It is currently the 3rd largest publicly-traded oil and gas company behind Royal Dutch Shell (RDS) and Exxon Mobil (XOM). BP is incorporated in the UK, but it is also the largest oil and gas producer in the US. Its operations are mainly split between fuels, petrochemicals and oil and gas exploration and refinery. BP has a huge global presence of 18,000 BP-branded retail sites in more than 70 countries. As we can see below, the industry is largely influenced by the movement of crude oil prices as opposed to Brexit news. In fact, BP’s share price has actually been on an uptrend for the past 2 years after the Brexit referendum. This suggests that Brexit has had minimal impact on share performance. As the company has major operations globally, country risk is reduced when investing in BP.

(Source: Bloomberg)

(Source: Bloomberg)

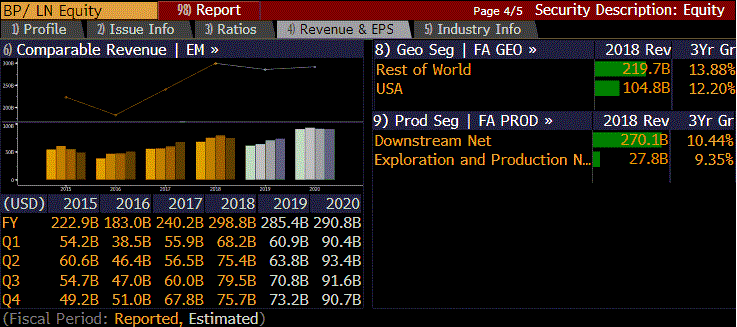

As seen below, BP’s revenue has been rising over the past 3 years, and is expected to stabilise in the subsequent years. Profit has also grown over 2018, allowing BP to maintain dividend payouts.

(Source: Bloomberg)

(Source: Bloomberg)

The company was previously affected by the Gulf of Mexico Oil Spill disaster which has resulted in it burning substantial cash over the past few years. This is due to outstanding claims by affected stakeholders which have steadily grown since the company settled for a landmark $19 billion settlement of Federal and State claims in 2015. As of end-2017, BP has paid out claims in excess of $60 billion.10 This is expected to fall gradually from 2019. BP is also expected to raise cash with further asset sales in the next two years. These measures will effectively help them cut their debt levels and hopefully bring back dividend growth.11

In conclusion, the following pointers highlight why BP Holdings is worth an investor’s consideration:

- Healthy and stable dividend yield of 5.9%

- 3rd largest publicly-traded oil and gas company

- Heavily diversified across 70 countries which makes BP less vulnerable to country-specific events like Brexit

- Stable oil prices outlook should bring further stability to share prices

Commodities and Mining Conglomerate – Glencore PLC (Ticker: GLEN.UK)

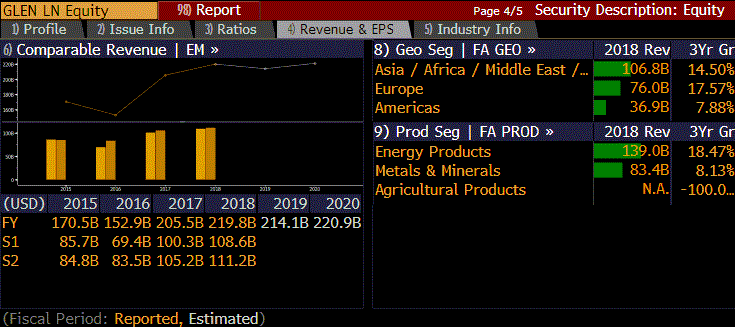

Glencore PLC is a diversified natural resource company that specialises in metals, minerals and energy products, among other commodities. The company is a major producer of more than 90 commodities and has a large number of mining locations. It has a huge global presence with more than 90 offices in 50 countries. Its long term strategy is to move beyond trading in commodities to actively acquire major mining and commodity producers. These are long term investments made by the company as it seeks to expand globally.

(Source: Bloomberg)

(Source: Bloomberg)

The majority of Glencore’s business revenue comes from other parts of the world as seen below, helping to reduce the risk and impact of Brexit. The increment of revenue is also a result of aggressive mergers and acquisitions as it seeks to shift from being a commodities trader to being a long term investor in other major commodities producers.

(Source: Bloomberg)

(Source: Bloomberg)

Generally, mining companies command relatively low Price-to-Earnings (P/E) multiples. Glencore’s forward P/E multiple is currently at 10.62, which is relatively low for a company in its sector. Glencore’s P/E, together with its dividend yield of 4.88%, provides a good value proposition for the company as an investment opportunity.

(Source: Bloomberg)

(Source: Bloomberg)

Another bright spot for Glencore would be its sector’s performance. The commodities sector runs in a cyclical nature. Commodities prices came off the peak in the beginning of 2018, which resulted in share prices retracing – further enhancing Glencore’s position as a value investment proposition.12

In conclusion, the following pointers highlight why Glencore PLC is worth an investor’s consideration:

- Global commodities conglomerate with a market cap of GBP42 Billion

- Good Dividend Yield resumed after the company’s crisis over money laundering in 2016

- Majority of revenue derived from markets outside of the UK which makes it less vulnerable to events like Brexit

Here’s a roundup of the three equities discussed above:

Table 1: Summary of Lloyds Bank, BP Holdings and Glencore

| Ticker | Company Name | Market Cap (GBP Bil) | Last Done Price (GPX) | Analyst Recommendations | Consensus Target Px (GPX) | P/E | P/B | Div Yield | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Buy | Hold | Sell | ||||||||

| LLOY.UK | Lloyds Banking Group PLC | 45 | 63.27 | 17 | 7 | 4 | 71.16 | 9 | 1 | 5.05% |

| BP/.UK | BP Holdings | 108 | 533 | 20 | 7 | 2 | 618.70 | 15 | 1.4 | 5.90% |

| GLEN.UK | Glencore PLC | 42.5 | 305.50 | 22 | 8 | 0 | 362.79 | 17 | 1.2 | 4.88% |

(Source: Bloomberg)

London FTSE ETF: IShares Core FTSE 100 ETF (Ticker: ISF.UK)

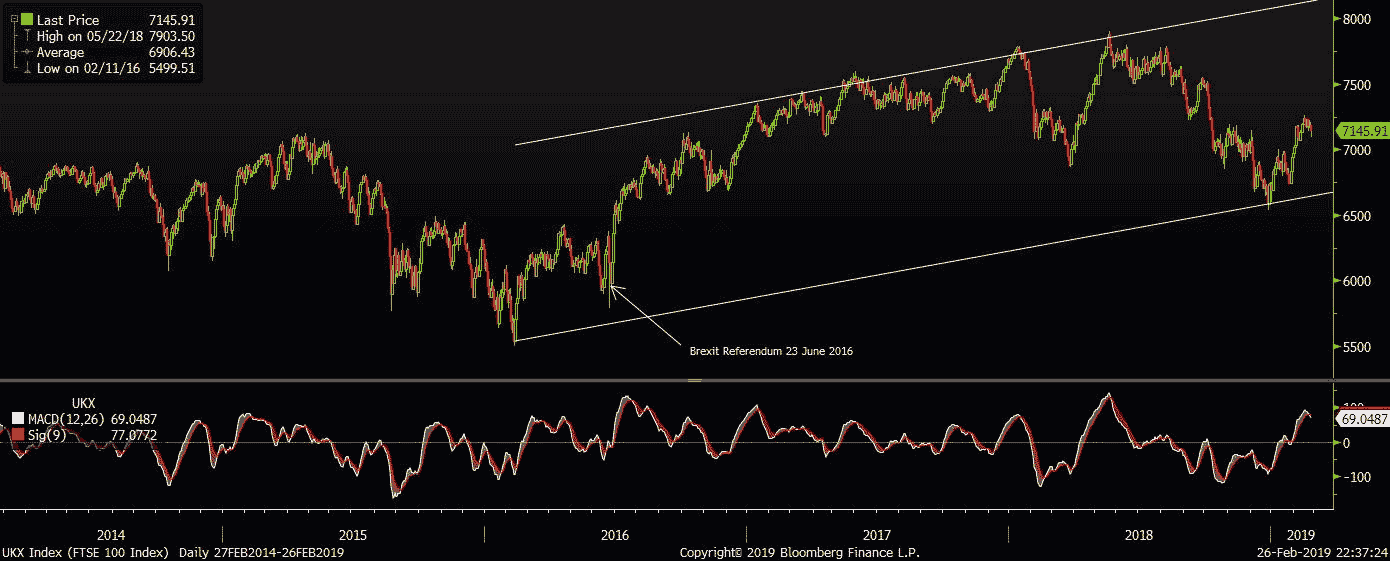

For investors who are unsure on which company to invest in the UK, the iShares Core FTSE 100 ETF might be the way to go. This ETF, which is listed in the London Stock Exchange, aims to track the performance of the FTSE 100 Index. The below shows the FTSE 100 Index’s performance over the past 5 years. Even after the Brexit referendum, the performance of the FTSE index did not falter, with the Bull Run leading the performance during the same period.

(Source: Bloomberg)

(Source: Bloomberg)

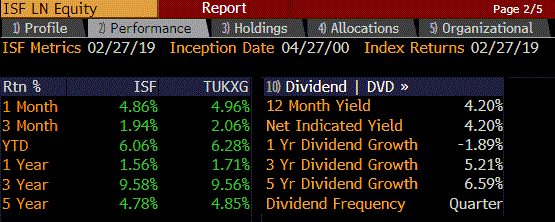

The ETF has also yielded positive returns over the past 5 years, providing a stable dividend yield of 4.2%.

(Source: Bloomberg)

(Source: Bloomberg)

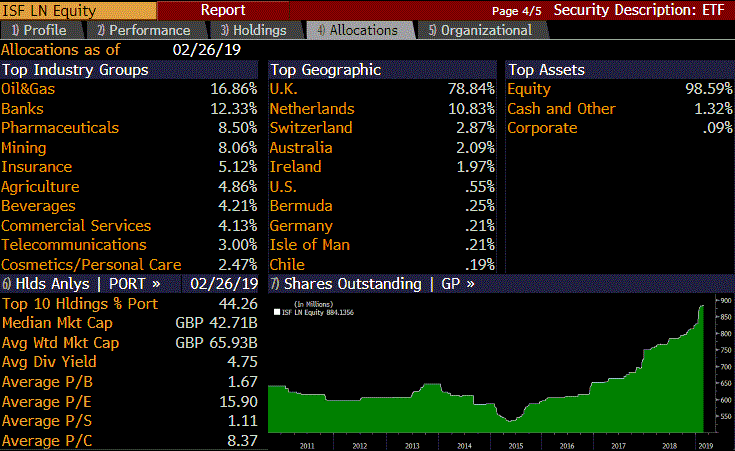

Here is some information about the ETF’s portfolio allocation and top fund holdings:

(Source: Bloomberg)

(Source: Bloomberg)

Table 2: Top Fund Holdings

| Top Fund Holdings | ||

|---|---|---|

| Ticker | Company Name | Fund Weightage (%) |

| HSBA.UK | HSBC Holdings PLC | 6.818% |

| RDSA.UK | Royal Dutch Shell PLC | 5.910% |

| BP/.UK | BP PLC | 5.741% |

| RDSB.UK | Royal Dutch Shell PLC | 4.913% |

| AZN.UK | AstraZeneca PLC | 4.377% |

| GSK.UK | GlaxoSmithKline PLC | 4.021% |

| DGE.UK | Diageo PLC | 3.907% |

| BATS.UK | British American Tobacco | 3.507% |

| RIO.UK | Rio Tinto PLC | 2.747% |

| LLOY.UK | Lloyds Banking Group PLC | 2.455% |

(Source: Bloomberg)

In conclusion, the following pointers highlight why the iShares Core FTSE 100 ETF is worth an investor’s consideration:

- Diversified ETF that significantly reduces company-specific risks

- Healthy and stable dividend yield with positive fund performance over the past 5 years

In short, despite the risks of Brexit, the UK market still presents opportunities for investors, who should study it carefully to see if there is scope to beef up an investment portfolio!

Information is accurate as of 14 Mar 2019.

Reference:

- [1] https://en.wikipedia.org/wiki/2016_United_Kingdom_European_Union_membership_referendum

- [2] https://en.wikipedia.org/wiki/United_Kingdom_invocation_of_Article_50_of_the_Treaty_on_European_Union

- [3] https://city.wsj.com/articles/946cdd71-2220-4092-b68b-87648becd175

- [4] https://www.theguardian.com/politics/2019/jan/15/theresa-may-loses-brexit-deal-vote-by-majority-of-230

- [5] https://www.bbc.com/news/uk-northern-ireland-politics-44615404

- [6] https://www.nytimes.com/2019/01/16/world/europe/brexit-theresa-may-no-confidence-vote.html

- [7] https://www.bbc.com/news/av/uk-politics-47547213/brexit-vote-round-two-how-may-lost-again

- [8] https://www.bbc.com/news/uk-46318565

- [9] https://www.news.com.au/finance/work/leaders/brexit-vote-mps-expected-to-delay-leaving-eu-as-donald-trump-slams-theresa-may/news-story/d6fd7ee9842087b9c6a00ff94ca897e9

- [10] https://www.reuters.com/article/us-bp-deepwaterhorizon-idUSKBN1F50NL

- [11] https://www.fool.co.uk/investing/2019/02/25/why-id-buy-the-bp-share-price-today-and-avoid-this-ftse-250-falling-knife/

- [12] https://www.fool.co.uk/investing/2018/09/07/is-the-glencore-share-price-tempting-you-heres-what-you-need-to-know/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Ming Jun Chuang

Dealer

Ming Jun graduated from RMIT with a Bachelor’s Degree in Business Management. He joined Phillip Securities in 2016 as an Equity Dealer and is currently with the Global Markets Night Trading Team, specialising in the UK and Europe markets, as well as supporting the US and Canada markets.

He has provided regular market commentaries across various media channels such as Morning Express Channel 8, 95.8FM Live Radio, and 联合早报.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It