Celebrating World Health Day – Shining the Spotlight on 2 Healthcare Related Stocks April 6, 2022

World Health Day is celebrated annually with a specific health theme highlighted by the World Health Organization (WHO).

The principle behind this initiative by WHO is to raise awareness about the overall health and well-being of people across the world.

The theme this year is to keep our planet and humans healthy, and foster a society focused on well-being. [1]

So, can investors find stocks in Singapore that contribute to our well-being?

The answer is Yes.

And most of us are probably already using these companies’ services and products. So why not consider investing in them?

Great Eastern (SGX: G07)

Great Eastern provides insurance services in 3 segments: Life insurance, Non-life insurance, and shareholders.

The life insurance segment includes life insurance, long-term health and accident insurance, annuity, and investment-linked policies.

The non-life insurance segment includes short-term property and casualty insurance, and short term medical and personal accident insurance. [2]

The shareholder segment provides fund management services.

If you have any insurance from this company, you are contributing to their business revenue and should look at how they are doing if you want to invest in them.

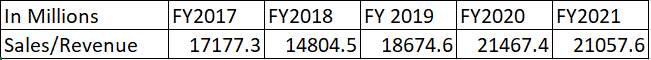

Great Eastern Financial Data

For a start, let’s look at the top line of the company. In other words, the revenue Great Eastern is bringing in.

Source: POEMS 2.0. – Stock Analytics [4]

Source: POEMS 2.0. – Stock Analytics [4]

Great Eastern’s revenue has been increasing over time. This is good news for shareholders as the business earns more revenue each year.

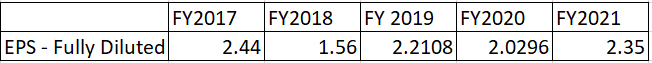

What about the bottom line?

Source: POEMS 2.0. – Stock Analytics

Source: POEMS 2.0. – Stock Analytics

According to data retrieved from POEMS 2.0. Stock analytics, earnings per share have been steady, ranging from $1.50 to about $2.50 per share for the past 5 years.

That is great news, because as an investor you want to be in a business that earns profits consistently.

It is difficult to predict who will make a claim on their insurance, so for Great Eastern’s ability to have a steady EPS speaks volumes.

Source: POEMS 2.0. – Stock Analytics

Source: POEMS 2.0. – Stock Analytics

Source: Great Eastern Annual Report [2]

Source: Great Eastern Annual Report [2]

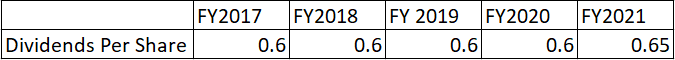

Great Eastern also shares its profits with shareholders through dividends.

And consistent dividends tell us that the management is confident of achieving such earnings in the long run.

The company’s positive free cash flow gives us the assurance that the company is not paying dividends out of debt but out of what it has.

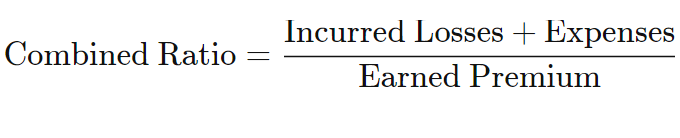

Combined Ratio

Combined ratio is used to assess the profitability of insurance companies and can be used to look at how Great Eastern fares.

Source: Investopedia [3]

Source: Investopedia [3]

A ratio of < 100% is good as it shows that the company is earning more than its expenses.

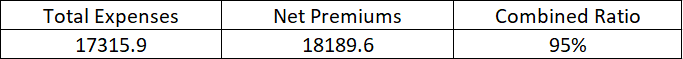

To be conservative, I have included total expenses and the combined ratio is still below 100% which is good.

The Price Is Right…?

If you choose to invest in Great Eastern, you may want to consider the price you enter at.

Ultimately, the price is what you pay and you want a margin of safety. And who would say no to paying 50 cents to buy a dollar bill?

Source: POEMS 2.0.

Source: POEMS 2.0.

Judging from the increasing sales that Great Eastern is enjoying, the price-to-sales ratio is telling us that this stock is currently undervalued. So decide accordingly.

Considerations

Liquidity

The business looks good. However, the share volume seems a bit on the low side with an average traded volume of just over 100,000 a week.

Do note that this share is not for trading but for investors with a long-term perspective.

Source: POEMS Mobile 3

Source: POEMS Mobile 3

Going Forward

Is it a good business? I would say that as a business owner you want your business to be earning consistently.

Is there more room for growth? I believe so, as they are already operating in Singapore, Malaysia and other parts of Asia. And they can grow the business if the company continues to expand.

According to a recent press release, we know that Great Eastern is strengthening its distribution network, core channels of Agency/Financial Adviser Representatives s and selling products through banks using digital tools.

Also, besides digitising its business and strengthening what it already has, Great Eastern continues recruiting financial adviser representatives across the region. [2]

Haw Par (SGX: H02)

Have you heard of Tiger balm? If you are a Singaporean, chances are you know about it, and may even be a user of this product.

Haw Par Corporation Limited is in the business of healthcare products and Tiger balm is one of them.

The company has 4 business segments:

1. Manufacturing, marketing and trading of healthcare products

2. Investments in securities

3. Property rental

4. Provision of leisure-related goods and services

Let’s now look at some numbers to see how Haw Par is doing.

Haw Par Financial Data

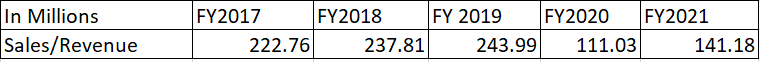

Source: POEMS 2.0. – Stock Analytics

Source: POEMS 2.0. – Stock Analytics

The revenue refers to sales from healthcare and its leisure and property business, and does not include investment in securities.

Haw Par’s revenue was affected by weak consumer spending due to the COVID-19 pandemic and we can tell that from the drop in revenue.

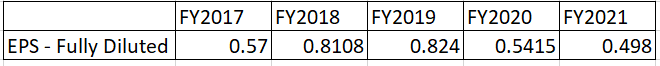

Source: POEMS 2.0. – Stock Analytics

Source: POEMS 2.0. – Stock Analytics

But thanks to its investments in the securities business, earnings per share (diluted) were still comparable to FY2017 despite the drop in revenue.

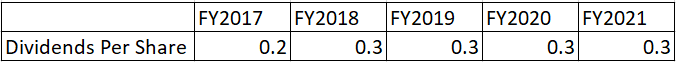

Source: POEMS 2.0. – Stock Analytics

Source: POEMS 2.0. – Stock Analytics

The dividend per share has been steady, giving shareholders a share of the profits, and this tells us that the management is willing to share its profits.

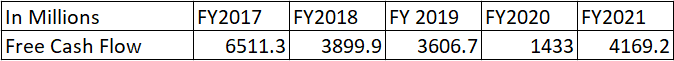

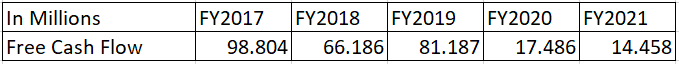

Source: Haw Par Annual Report [5]

Source: Haw Par Annual Report [5]

The cash flow is still positive but falling. However the dividends are not paid out of debt.

The Price Is Right…?

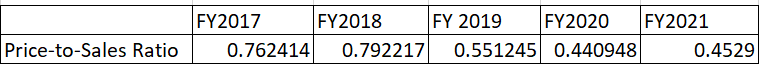

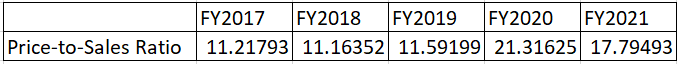

Source: POEMS 2.0.

Source: POEMS 2.0.

On a price-to-sales basis, I would say Haw Par is slightly on the higher side.

A Word On Price-To-Sales Ratio

But do note that we are looking at each company’s historical price-to-sales ratio to gauge if the company is considered over or undervalued.

Great Eastern and Haw Par are 2 stocks in the healthcare sectors, but doing different business. Hence, it is important to understand the context before we conclude that one is cheaper than the other.

Considerations

Free Cash Flow

If its free cash flow is trending down, that could be a cause for concern.

So, can the investment segment continue to do well to make up for its healthcare business? This is hard to say.

Overpriced

Despite the falling revenue, the prices continue to remain high. So, from a long-term investor’s point of view, a good move would be to wait.

Going Forward

With its global network in 100 countries, the company is in a strategic position to expand business operations.

Haw Par’s leisure and property business is still a small contributor to its revenue. So, this could mean it has potential to grow further, especially after the COVID-19 situation improves. But this could probably take some time.

Conclusion

In conclusion, healthcare is definitely a business that is evergreen. Health is wealth and we do not lack buyers who demand some form of treatment and protection.

As investors, however, we want to focus on getting in at a good price in a good business.

As Warren Buffett once said: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Using the price-to-sales ratio is a reasonable way to assess what is considered to be a good price.

But most importantly, manage your risks, buy good businesses, and you will do fine.

How to get started

As the pioneer of Singapore’s online trading, POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares with brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here. T&Cs apply.

We hope that you have found value reading this article! If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1]https://www.who.int/campaigns/world-health-day/2022

- [2]https://www.greateasternlife.com/sg/en/about-us/investor-relations/financial-results.html

- [3]https://www.investopedia.com/terms/c/combinedratio.asp

- [4]https://p2.poems.com.sg/

- [5]https://hawpar.listedcompany.com/financials.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua (Dealing) & Chua Minghan (Assistant Manager, Dealing)

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business and is a member of the largest dealing team in Phillip Securities. He strongly believes in the importance of staying invested in the financial markets and evaluates stocks using fundamentals to make informed investment decisions.

In his free time, he enjoys researching on market events and disruptive investment themes to generate new investment ideas for the short and long term.

Chua Minghan graduated from the National University of Singapore with a Bachelor’s degree in Economics. He is passionate about education and went on to get a post-grad Diploma in teaching. His vision is to educate clients to make informed decisions for their trading and investments.

Minghan enjoys learning fundamental analysis, technical analysis, and strives to use data analysis to improve his trading skills.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It