Country ETF Series – Indonesia December 6, 2016

Local investors constantly seek investment products that are liquid and versatile in order to manage their risks better and for diversification of their portfolios. One such product that meets these requirements would be the Exchange Traded Funds (ETFs). There are many variants of ETFs, allowing investors to invest and have exposure in sectors, industries, countries, or even movements in markets that regular investment products would not be able to provide. Therefore, we will be publishing a series of Country ETF articles over time that we believe investors will be interested in.

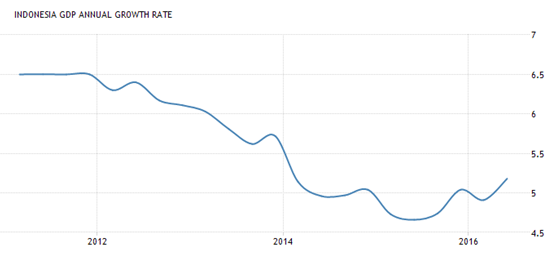

This article will be covering Indonesian ETFs, which invest in stocks of companies in major sectors, located in Indonesia. Indonesia is fast becoming a country to invest in due to increasing political stability and economic growth potential, driven by pro – business and pro – growth government policies. One such policy would be Indonesia’s newly introduced Tax Amnesty programme, which the Indonesian government aims to get tax residents to declare and repatriate funds back to Indonesia. Growth for Indonesia have been declining since 2012 due to global adverse economic events, but have steadily stayed above 4.5 percent.

Source: TradingEconomics

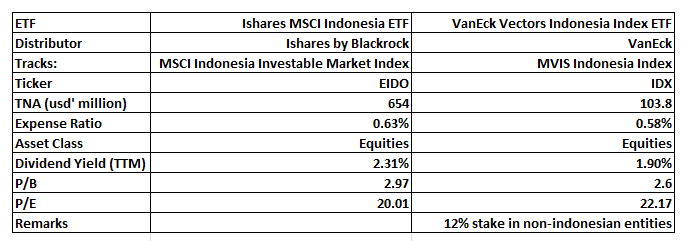

The two larger ETFs that track the Indonesia index are the Ishares MSCI Indonesia ETF (EIDO) and VanEck Vectors Indonesia Index ETF (IDX). We will be using these ETFs for illustration purposes in this article. Index tracking Indonesian ETFs such as EIDO and IDX are managed by well known service providers such as Ishares and VanEck, and generally have total net assets of more than USD 100 million. Most ETFs that track the broad market Indonesia Index pay dividends, and have expense ratios of approximately 0.6 percent. Some ETFs such as IDX will include companies that are not domiciled in Indonesia, but have more than 50 percent of their revenues derived from the country in question.

Source: Factsheets

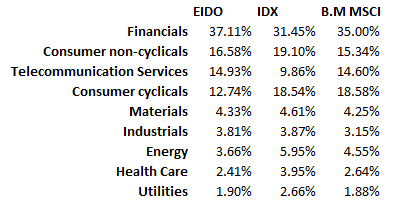

The percentage composition for sectors are similar amongst these ETFs, with minor variations, depending on the aggressiveness of the fund manager. The heaviest weighting for Indonesian ETFs will in most cases be focused on financials, followed by the consumer, and telecommunications sectors. Financials make up the biggest component of such ETFs because indices usually depict banking and financial services stocks to be heavy weights and serve as a key cornerstone for any country’s economy.

Source: Factsheets

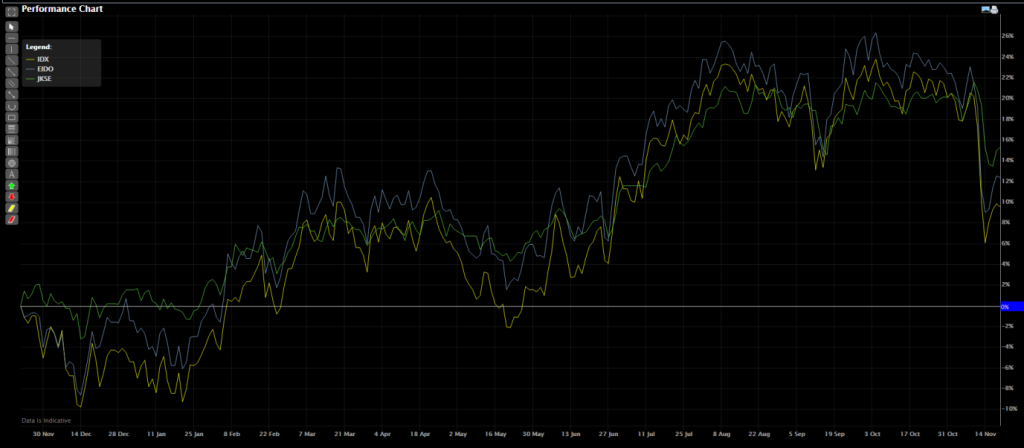

The generic characteristics of country ETFs are usually similar as they take on a single country view, have close to a hundred percent composition in stocks, and do not perfectly track the underlying index, due to varying degrees of tracking error.

Source: POEMS 2.0 Chart-Live

Investors who wish to invest in such ETFs will have to take note of the foreign currency risks involved. This is because many of such ETFs are traded in USD. Therefore investors will be affected in the event that there are currency fluctuations.

It is also important to note that before Donald Trump became President – elect, Indonesia’s exports could have benefitted from its active participation in the Trans Pacific Partnership (TPP). This has changed, however, as Donald Trump had on many occasions mentioned that he will likely not continue to support the TPP once he officially assumes office. Without the support of the United States of America (USA), the TPP will unlikely to be able to succeed.

Although emerging markets have not been as popular as they once were before, we have to acknowledge that these markets do provide for potentially higher returns compared to that of developed markets. Being one of the few larger emerging markets, Indonesia will likely be able to open up new opportunities to investors . The key concern used to be Indonesia’s risk of political uncertainty. With the incumbent president Joko Widodo at its helm, we will possibly continue to see a conscious commitment to the improvement in policy making and administration. With this, we should reasonably expect to see him serve out his entire presidential term up till the year 2019.

If you wish to know more information about Indonesia ETFs, you can talk to a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Kervin Ong Zhi Yong

POEMS Dealer

Jurong West Dealing Team

Kervin Ong currently provides dealing services to a portfolio of trading accounts and is part of the POEMS Dealing Team. Apart from his Dealing role, he also gives training seminars to further enrich his clients’ financial knowledge under his care. An external auditor by profession before joining Phillip Securities, his background in due diligence and statutory audits for listed companies equips him with in-depth analytical skills; a skill hugely advantageous for value investors who seek to invest in companies with favorable valuations or shrewd management. Kervin holds a Bachelor of Science in Applied Accounting (Hons) from the Oxford Brookes University, along with memberships under the Association of Chartered Certified Accountants (ACCA) and Institute of Singapore Chartered Accountants (ISCA).

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?