Creating Your Portfolio of Dividend Yielding Stocks August 21, 2017

“Albert Einstein once said that the power of compounding is the eighth wonder of the world”. While there are numerous methods to compound your wealth, one of the more popular ways to do so is through dividend investing. Dividends are distributions of company earnings to its shareholders and investors receiving those dividends will be able to relocate such funds to other dividend yielding equities, achieving the compounding effect.

In my personal opinion, investors building a dividend portfolio should consider the following 3 factors:

| Stable earnings | When investing in dividend yielding stocks, investors should focus on companies with long term consistent growth in both revenue and net profit. Even with low growth, these companies will be able to pay out dividends from their profit, thus reducing the possibility of declining or no dividends for investors. |

| Consistent Dividend Payout Policy | Each company usually has its specific dividend policy which is highlighted in its annual report. While such policies are subjected to possible changes, investors will still be able to understand how companies are managing their earnings. Companies with consistent dividend policies will give a certain level of assurance to ensure future consistent dividend payment to their shareholders. |

| Diversification | Investors must be prepared for times when one makes a wrong investment due to unforeseen circumstances. Therefore it is always wise not to put all your eggs into one basket. Diversification is best achieved when your portfolio of stocks is diversified across different business models and geographical locations. |

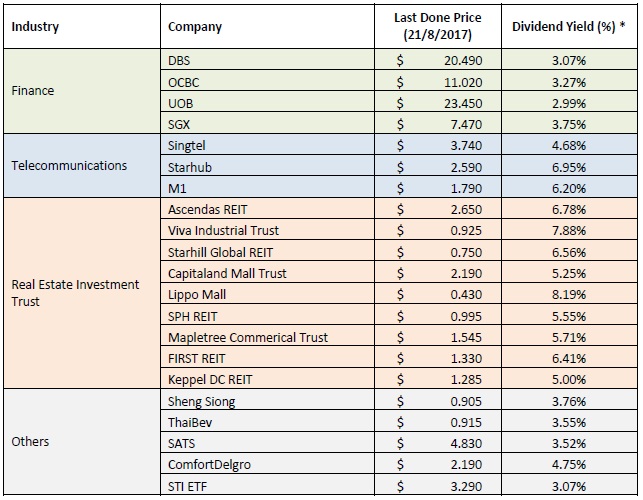

Across Asia, Singapore listed companies are ranked as one of the top in terms of dividend play. Apart from yield, our 1-tier tax system will also help to improve investors’ yield as compared to other countries (e.g. US Dividend Withholding Tax: 30%). Below is a short list of dividend companies or trusts listed on the Singapore Exchange. While the following are not a recommendation to buy or sell, I hope it serves as a good starting point for investors to understand the different industries and historical dividend yields that our local exchange has to offer.

*Dividend Yield are extracted from SGX Stockfacts based on 21 August 2017 closing (www.sgx.com)

*Dividend Yield are extracted from SGX Stockfacts based on 21 August 2017 closing (www.sgx.com)

Conclusion

Summarising the above, I believe it is possible to build a well-diversified portfolio that gives an average dividend yield of 5%. However, investors should take note that historical earnings and dividends are never an indication of the future. Buying a share is equivalent to owning a business; you should always do your due diligence on the businesses you are investing into.

Passive investors looking to accumulate dividend yielding assets over time can consider adopting the dollar-cost-averaging method whereby you allocate a fixed investment amount on a monthly basis. With a disciplined approach, one may be able to build up a portfolio while reducing the risk of purchasing any stock at a single high price.

If you wish to know more information about Share Builders Plan or any other stocks, you can speak to your designated Trading Representatives or a Dealer at a Phillip Investor Centre near you.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Michael Tay

Equity Dealer

Mr. Michael Tay currently provides dealing services to over 17,000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd. Michael is a strong believer of value investing, focusing on companies with strong fundamentals and good dividend policy. Apart from his dealing role, he often provides training seminars on Fundamental Analysis topics to further enrich his clients’ financial knowledge. Michael holds a Bachelor Degree of Finance from the SIM University (UniSIM) and was awarded the CFA Singapore Silver Award in 2012.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It