Deep Dive Into Electric Vehicles Investing September 24, 2021

What this report is about:

- EV makers face stiffening competition from traditional car makers. Valuations also seem stretched.

- Understand the five main segments of the EV ecosystem to gain exposure to each segment.

- Investors can also take positions on related industries that might benefit from or be hit by EV adoption.

The world is pivoting from petroleum-powered engines to electric vehicles (read our article on “The Future of Electric Vehicles (EVs): 2021 Outlook”). With this shift comes significant investment opportunities.

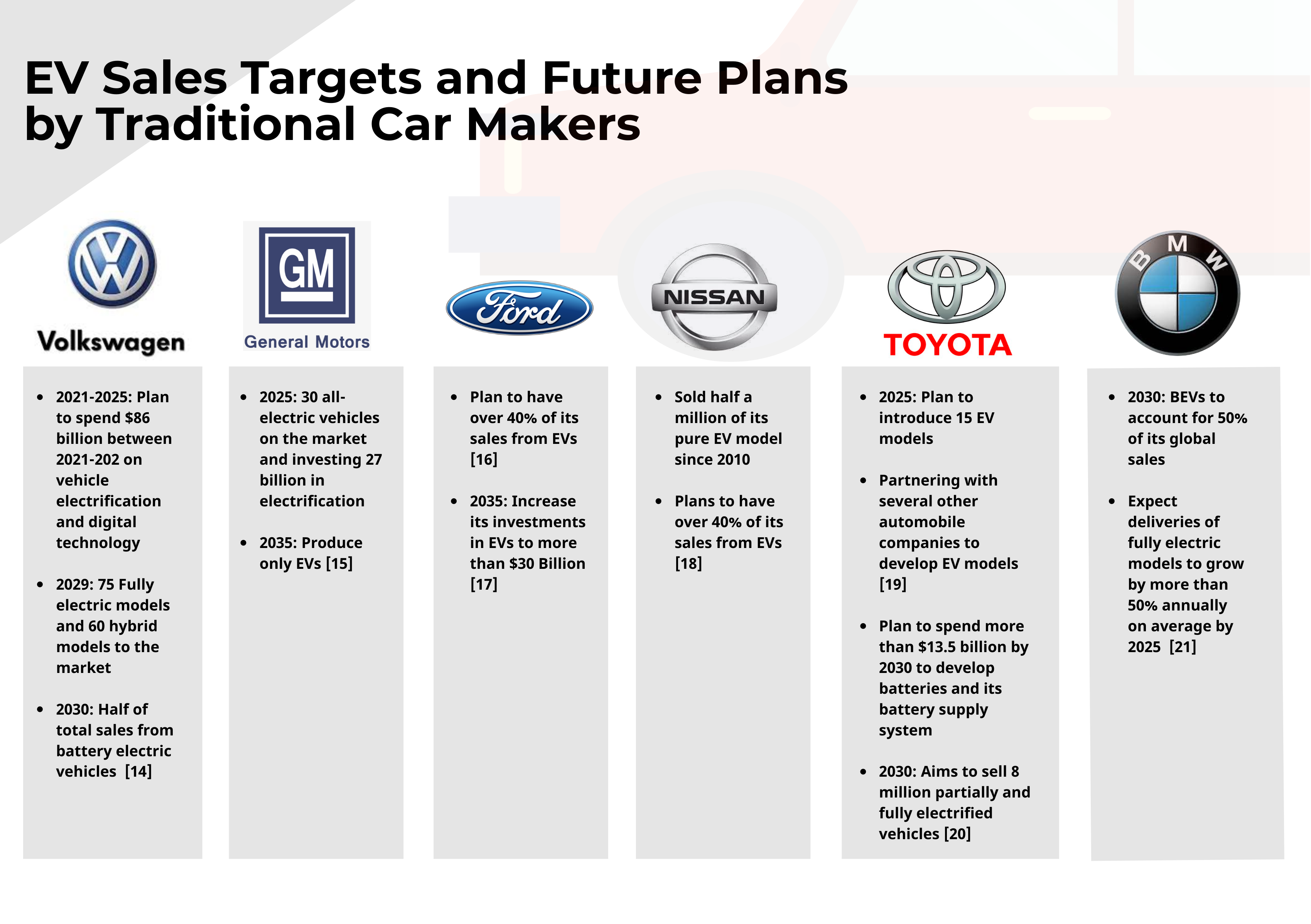

Intuitively, the most obvious way to take advantage of this shift is to invest in EV makers such as Tesla and NIO. However, traditional automakers such as Volkswagen, Ford, Toyota, BMW and Hyundai are also planning big investments and sales targets to catch up in the EV race. With their large manufacturing capacity and incumbent advantages, they may soon overtake the pure EV players.

Volkswagen, for one, announced earlier this year that it plans to be the top EV maker in the world no later than by 2025. Some analysts predict that it could match Tesla in EV unit sales as early as next year. On top of that, valuations of some of the EV stocks are looking stretched, at excessive premiums to the traditional automakers. All these spell uncertainties as to which automaker would come out on top of the game.

Another way to invest in EVs with less uncertainty is to understand the EV ecosystem or entire supply chain and gain exposure to each segment.

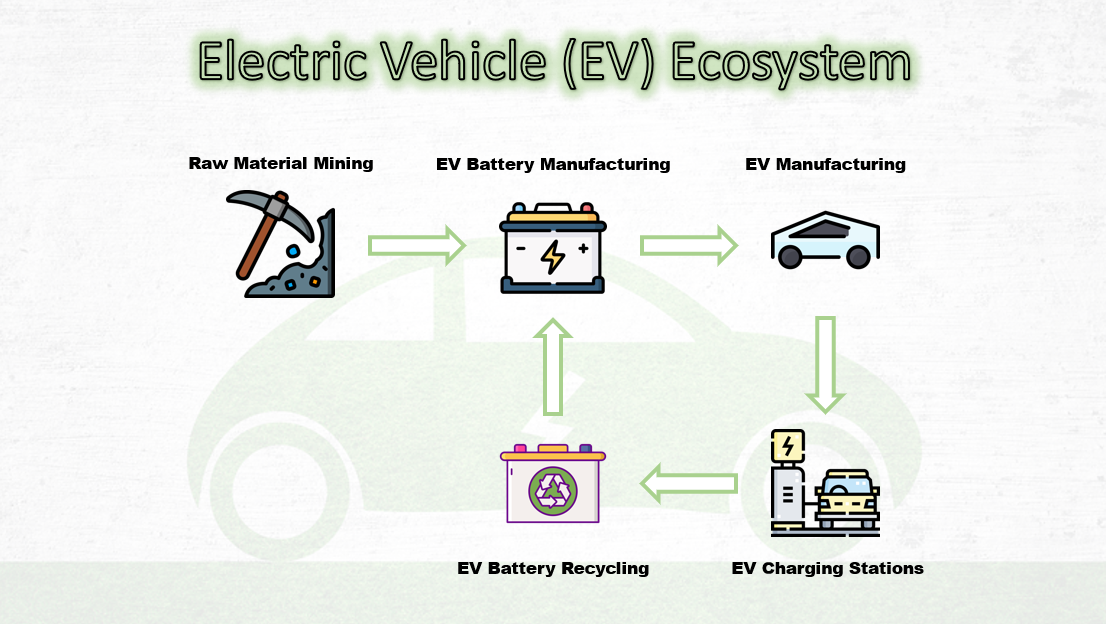

EV Ecosystem

The EV ecosystem consists of five main segments: raw material mining, EV battery manufacturing, EV manufacturing, EV charging stations and EV battery recycling.

Raw material mining

This segment focuses on the mining of the key raw materials that go into making the lithium ion batteries that power EVs. The three most common raw materials are lithium, cobalt and nickel.

Outlook of lithium

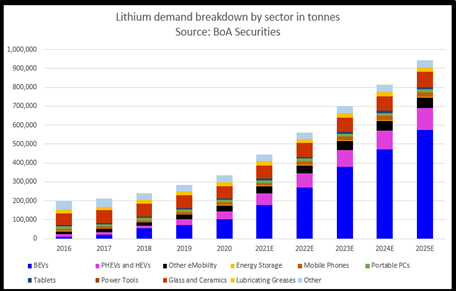

Although cobalt and nickel are also widely used in lithium batteries, investing in lithium miners and processors might provide more direct exposure to the EV industry. The reason for this is, lithium is the biggest raw material in lithium ion batteries. Legacy automakers such as Volkswagen, General Motors, Ford, BMW and Toyota are also investing more in the development of solid-state batteries. These use proportionately more lithium and less of the other two materials than today’s lithium ion batteries.

Bank of America’s analysts are expecting lithium demand for EVs – denoted as “BEVs” and “PHEVs and HEVs” in the graph below – to jump by about five times from 2020 to 2025. [6]

Research by Benchmark Mineral Intelligence, a data provider, also indicates that lithium demand could exceed supply modestly from 2022 onwards.[7] Rising adoption of solid-state batteries could be another booster for lithium’s future demand.

Concerns

There are some concerns when it comes to investing in this segment. For instance, the mining of raw materials for EV batteries has been associated with human rights issues in the Congo where child labour is employed for cobalt extraction and environmental issues in Argentina, Chile and Bolivia, where mining has degraded soil, contaminated water resources and polluted the air.

As the EV market grows, we can expect more legislation to govern the mining of these metals. Investors should therefore choose mining companies that are able to source their raw materials in an ethical and sustainable way.

How to gain exposure

The lithium market is an oligopoly, with four players accounting for more than 90% of the market. [8] They are: Ganfeng Lithium (SZSE: 002460 & HKEX: 1772), Albemarle (NYSE: ALB), Sociedad Química y Minera (NYSE: SQM) and Tianqi Lithium (SZSE: 002466).

A safer and simpler approach to gain exposure is through a diversified basket of battery-focused stocks with exposure to raw material mining.

| Stock | Stock code | Market | Description |

| Global X Lithium & Battery | LIT | AMEX | Invests in the full lithium cycle, |

| Tech ETF | from mining and refining the metal to battery production. | ||

| Amplify Lithium & Battery Tech ETF | BATT | AMEX | Invests in advanced battery materials and technology companies globally. |

EV Battery Manufacturing

Next up are the battery manufacturers which buy or source their own lithium and other metals to build battery packs for EVs. Currently, there are two types of EV battery packs in the market: those that use lithium ion batteries and those that use solid-state batteries.

Lithium ion batteries

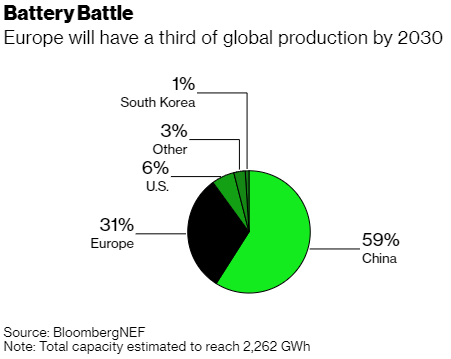

China dominated 77% of the global lithium ion battery market by capacity in 2020. [10].

In Europe, state support of at least EUR6.1bn or US$7.3bn and heavy investment plans are set to accelerate the development of its home-grown battery industry. Bloomberg New Energy Finance estimates that Europe’s share of global battery production could rise to 31% by 2030 from just 7% in 2020. [11].

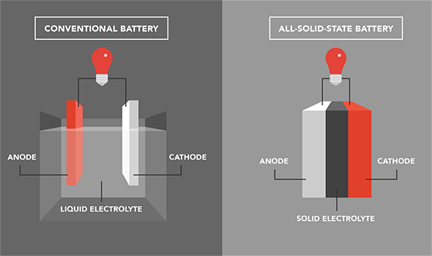

Solid-state batteries

Apart from traditional lithium ion batteries, EV companies are slowly venturing into solid-state batteries. The structure of a solid-state battery is quite similar to that of a traditional lithium ion battery; their main difference is that solid-state batteries use solid electrolytes instead of liquid electrolytes.

Solid-state batteries are considered a safer alternative for EVs, as they have higher energy density which allows for a longer driving range and much shorter charging time.

How to gain exposure

Some of the biggest battery companies by market share are LG Chem (KRX: 051910), CATL (SZSE: 300750) and Panasonic (TSE: 6752). These three control 69% of the EV battery market.

Pure solid-state battery makers include QuantumScape (NYSE: QS), an emerging mid-cap company developing these batteries for EV application.

A safer and simpler way to gain exposure, again, is through a diversified basket of battery-focused stocks with exposure to EV battery manufacturing.

| Stock | Stock code | Market | Description |

| Global X Lithium & Battery | LIT | AMEX | Invests in the full lithium cycle, from mining and refining the metal to battery production. |

| Amplify Lithium & Battery Tech ETF | BATT | AMEX | Invests in advanced battery materials and technology companies globally. |

EV Manufacturing

Investing in pure EV makers is probably the most obvious way to ride the EV trend (read our article on “The Future of Electric Vehicles (EVs): 2021 Outlook”).

Rising competition from traditional car makers

However, be mindful that traditional car makers are no longer in denial mode when it comes to EVs. They are planning huge investments and sales targets to penetrate the EV space. This means rising competition for EV makers.

While pure EV makers could continue to hog investors’ attention, the traditional automakers’ impressive manufacturing capacity may soon allow them to produce EVs on a much larger scale than the newbies.

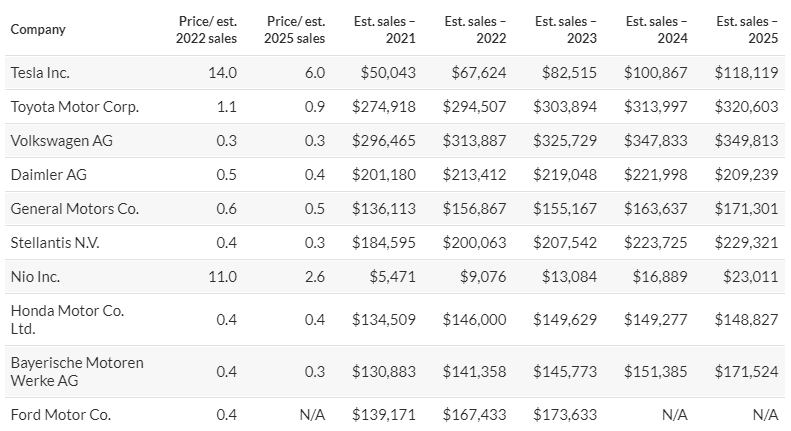

Valuations

Valuations of some of the pure EV makers are looking stretched. Investors are pricing them as if they are going to be the next winners. Based on price to projected sales for 2022, Tesla and Nio are valued at 14x and 11x respectively while most traditional automakers are valued at less than 1x.[22]

Part of their valuation premium comes from investors’ enthusiasm for innovation and ESG. Another part comes from these companies’ focus on market share and growth rather than profits in their growth stage. Recall that Amazon traded at high P/S for decades as it expanded into new lines of business, often at the expense of its bottom line.

How to gain exposure

For pure EV makers, the big players are Tesla (NASDAQ: TSLA), NIO (NYSE: NIO) and XPeng (NYSE: XPEV & HKEx: 9868).

A more conservative approach is to invest in established traditional automakers with lower valuations such as Ford (NYSE: F), General Motors (NYSE: GM) and Volkswagen Group (FWB: VOW & VOW3).

EV Charging Stations.

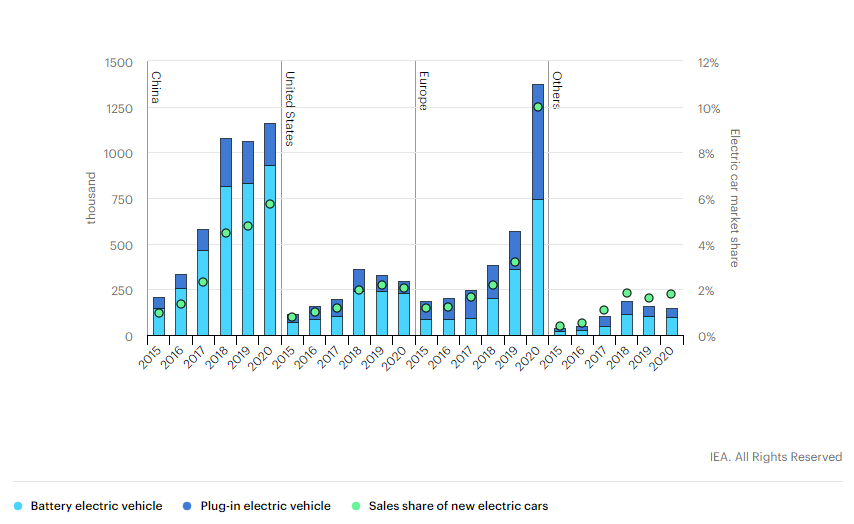

The rise of EVs on the roads naturally necessitates battery-charging stations. According to the International Energy Agency, China, Europe and the US are the three biggest markets for EVs globally. [24]

McKinsey estimates that about 40mn chargers will be required across China, Europe and the US by 2030 [25]. This compares with 1.3mn public charging points in these three regions in 2020, [26] implying considerable growth opportunities for the EV charging industry.

Government policies

Governments around the world have been supportive of EVs. Plans are afoot to roll out interconnected charging infrastructure networks.

In the US, a recently-passed infrastructure bill includes a US$7.5bn budget for EV charging networks, which is a step towards President Biden’s goal of constructing 500,000 EV charging stations in the country over the next decade. [30]

In Europe, the EU’s Alternative Fuel Infrastructure Directive is the main guideline for the rollout of publicly accessible EV charging stations. EU members are required to set deployment targets for publicly accessible EV chargers for the decade to 2030, with an indicative ratio of one charger per 10 electric cars. The EU Green Deal has set a target of 1mn publicly accessible chargers by 2025 and mapped out plans to achieve this. [30]

China announced a US$1.4tn digital infrastructure public spending programme at its 2020 National People’s Congress that included funding for EV charging stations. This has trickled down to the local level, with more than 10 cities announcing targets to install about 1.2mn chargers by 2025. [30]

Drivers for the EV charging industry

Apart from government support, the successful rollout of charging infrastructure will also depend on the EV industry’s ability to provide rapid recharging to consumers, better interoperability between public chargers and the varying EV models, sufficient density of public chargers in key locations such as metropolitan areas and improving power grid systems to cope with the rising demand for electricity. All these factors are critical in preventing bottlenecks in the EV ecosystem and limiting the growth of EV adoption.

How to gain exposure

A few prominent companies are focused on building and operating EV charging stations. They are ChargePoint (NYSE: CHPT), Blink Charging (NASDAQ: BLNK) and EVgo (NASDAQ: EVGO).

EV Battery Recycling

One of the least appreciated segments of the EV ecosystem is the recycling and reusing of EV batteries. Before diving into this segment, be aware of two issues surrounding EV battery manufacturing today.

1. Is the shift towards EVs as green as many of us think?

- ○ Lithium battery production is energy-intensive and one of the biggest sources of carbon emissions from EVs today. Research suggests that making EVs produces much more emissions than petrol cars.

- ○ In Argentina, Chile and Bolivia, where more than half of the world’s lithium supply is, lithium mining has crowded out the agricultural sector. It has increased soil degradation, water contamination and air pollution.

2. Miners hesitant to scale up production

- ○ Lithium, cobalt and nickel aren’t really scarce but uncertainties over the future demand of EVs makes it hard for miners to decide how much to scale up their mining operations. A few years ago, lithium miners had expanded too fast when they anticipated explosive growth in EV battery demand. When the boom didn’t happen and lithium prices collapsed, many were burnt.

To ensure sustainable growth, EV battery recycling can play a vital role in closing the loop of the EV ecosystem.

Secondary market for EV batteries

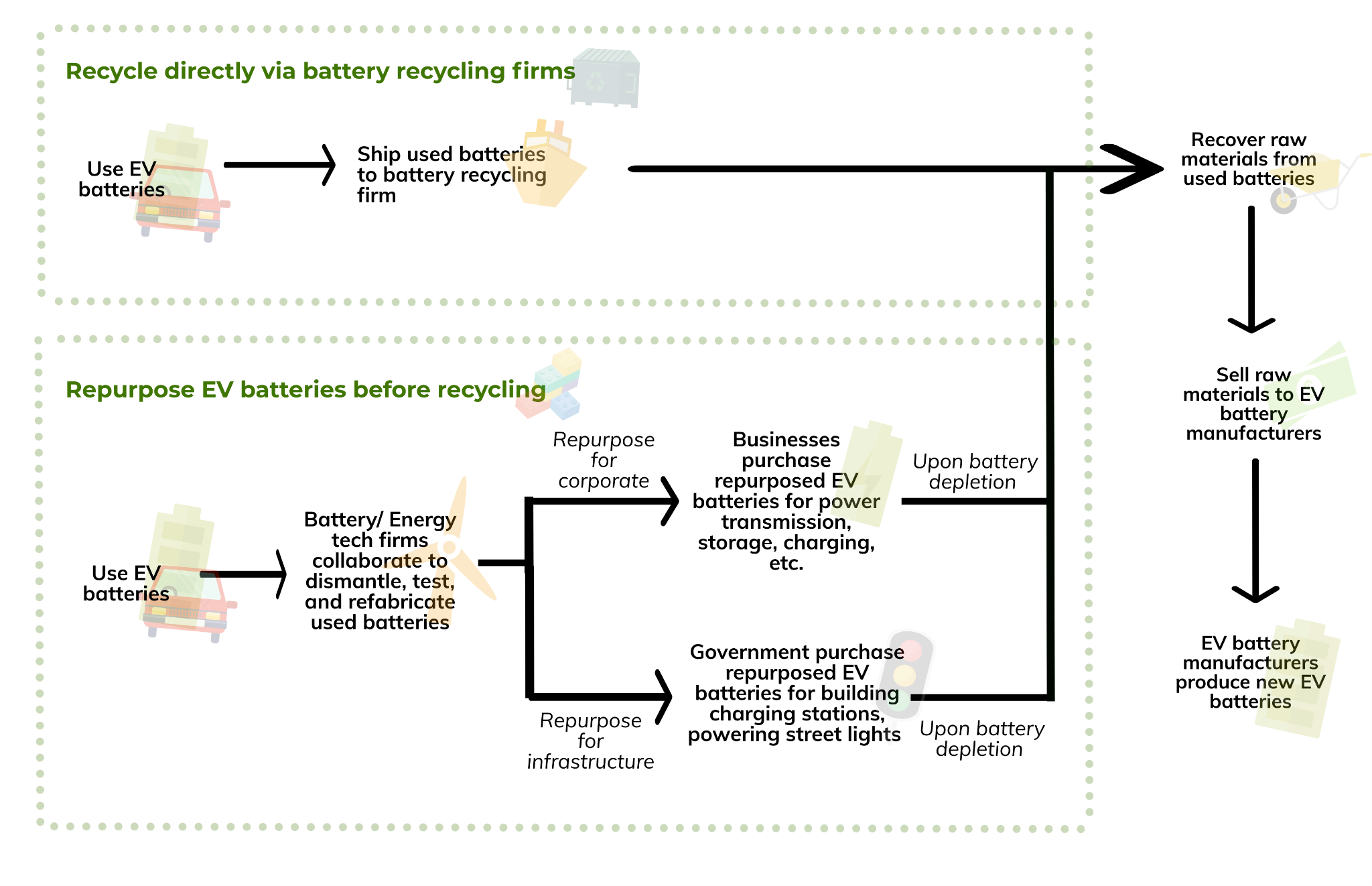

A number of options exist for EV batteries when they come to the end of their life cycle. These include recycling or repurposing for other uses.

The range of options in the diagram is not exhaustive. As EV batteries become more powerful and the number of batteries approaching their end-of-life increases, we could start to see an expansion of their secondary uses.

Government policies

Just like the other parts of the ecosystem, government policies play a role in the growth of the EV battery recycling market. Some measures already adopted by various countries are:

China required automobile manufacturers to establish battery-recycling channels and recycling service outlets in 2018. [27, 30]

Several states in the US, including California, Texas and Wisconsin, have battery disposal and recycling laws on the books. Others, including New York, Florida, New Jersey and Minnesota, have enacted laws requiring extended producer responsibility. This shifts the cost of waste management and recycling back to the battery producers. [27, 30]

The EU’s Battery Directive has been revised to take EV batteries into account. The directive now provides targets for battery collection and the recovery of materials that constitute lithium batteries. It also provides for battery-handling at the end of the batteries’ “second life”. [27, 30]

All in all, this presents opportunities in the secondary lithium battery recycling market, which is estimated to reach US$24bn by 2030 [26].

How to gain exposure

Pure battery-recycling firms include Li-cycle (NYSE: LICY), a start-up focusing on lithium ion battery recycling.

Among general battery-recycling firms, investors can consider Umicore (Euronext Brussels: UMI) and Gem Co. Ltd (SZSE: 002340).

A company which is under the radar is Redwood Materials. Yet to be listed, this is a Nevada-based start-up founded by Tesla’s former CTO. It focuses on recycling and processing scrap from battery cell production and consumer electronics. The recycled material is supplied back to the battery makers and auto companies together with the raw materials, with the aim to creating a feedback loop that will ultimately cut the cost of batteries and offset the need for mining.

Related Industries

Apart from investing in the EV ecosystem, there are two industries that may either benefit from rising EV adoption or suffer from it.

Industries that stand to benefit from EV adoption

More EVs on the road mean a rise in electricity usage, though BNEF only expects EVs to increase global electricity demand by 5.2% by 2040. [31] On top of selling electricity, utility companies can also profit by building infrastructure to hook charging stations to the power grid.

One simple way to gain exposure is to invest in ETFs with a focus on utilities. Some popular US utility ETFs are the Utilities Select Sector SPDR Fund (XLU), Vanguard Utilities ETF (VPU) and iShares U.S. Utilities ETF (IDU).

Industries that could lose from rising EV adoption

The oil industry stands to lose as EV adoption increases and the world shifts from petroleum-powered engines to EVs. EVs are already displacing 1mn barrels of oil demand per day at current run rates. BNEF estimates that they will displace 17.6mn barrels of oil demand per day by 2040, about 20% of today’s consumption volume. [31]

If you are bearish on the oil industry, you can short oil stocks, ETFs or even oil itself.

To wrap up

The shift towards EVs is probably one of the biggest trends in current times. Instead of attempting to find the next Amazon or Google among the few overhyped EV manufacturers, investors may consider safer alternatives such as investing in a basket of shares across the EV ecosystem. By doing so, you are not concentrating your investment risks in a particular stock or sector but spreading them across sectors or industries. You are likely to benefit regardless of which automaker comes out on top.

How to get started

Looking for ways to trade EV shares and ETFs? You can now trade with POEMS!

1) Trade EV shares and ETFs from US$1.88 flat

As the pioneer of Singapore’s online trading, POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Explore an array of US shares at brokerage fees as low as US$1.88 flat* when you open a Cash Plus Account with us today. Find out more here. T&Cs apply.

2) Trade EV CFDs like Tesla, Nio and XPeng, with or without leverage

Investors and traders with a bigger risk appetite may consider using Contracts for Differences (CFDs) to invest in the EV sector. CFDs are versatile tools for investors, particularly those who take an active approach to investing. CFDs can be used for hedging, short-selling and even leveraged trading. They only require minimum investments upfront, which are known as the margin requirement.

CFDs are also ideal tools for people with less capital but who wish to capitalise on the growth potential of certain industries. Or they may simply want to take advantage of the latest market movements regardless of direction.

CFDs, however, may not be suitable for investors whose investment objective is to preserve capital and/or whose risk tolerance is low.

To understand more, read our article on “Understanding Contracts for Differences”.

We sincerely hope that you found value reading this article! If you do not have a POEMS account, you may visit this link or scan the QR code below to open one with us today!

Open a POEMS account within minutes and trade instantly!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1] https://www.entrepreneur.com/article/367316

- [2] https://www.usitc.gov/publications/332/journals/the_supply_chain_for_electric_vehicle_batteries.pdf

- [3] https://seekingalpha.com/article/4111150-where-money-is-in-electric-vehicle-supply-chain-part-i

- [4] https://www.linklaters.com/en/insights/thought-leadership/electric-vehicle-batteries/powering-the-future/sourcing-raw-materials

- [5] https://www.quantumscape.com/blog/solid-state-battery-landscape/

- [6] https://www.reuters.com/business/energy/shortages-flagged-ev-materials-lithium-cobalt-2021-07-01/

- [7] https://wcsecure.weblink.com.au/pdf/CXO/02283662.pdf

- [8] https://www.mordorintelligence.com/industry-reports/lithium-market

- [9] https://www.linklaters.com/en/insights/thought-leadership/electric-vehicle-batteries/powering-the-future/battery-manufacturing

- [10] https://about.bnef.com/blog/china-dominates-the-lithium-ion-battery-supply-chain-but-europe-is-on-the-rise/

- [11] https://www.bloomberg.com/news/articles/2021-04-04/the-next-electric-car-battery-champion-could-be-european

- [12] https://chargedevs.com/newswire/samsung-researchers-describe-all-solid-state-battery/

- [13] https://www.barrons.com/articles/traditional-auto-makers-are-getting-into-evs-here-are-their-plans-to-battle-tesla-51606734002

- [14] https://www.cnbc.com/2021/07/13/volkswagen-wants-half-of-its-vehicle-sales-to-be-electric-by-2030.html

- [15] https://www.cnbc.com/2021/06/13/gm-ford-are-all-in-on-evs-heres-how-dealers-feel-about-it-.html

- [16] https://www.cnbc.com/2021/05/26/ford-ups-ev-investments-targets-40percent-electric-car-sales-by-2030-under-latest-turnaround-plan.html

- [17] https://media.ford.com/content/fordmedia/fna/us/en/news/2021/05/19/the-ford-electric-vehicle-strategy–what-you-need-to-know.html

- [18] https://www.autoweek.com/news/green-cars/a37269279/nissan-to-boost-ev-output/

- [19] https://asia.nikkei.com/Business/Automobiles/Toyota-steps-up-electric-vehicle-push-with-plans-for-15-new-models

- [20] https://www.forbes.com/sites/greggardner/2021/09/07/toyota-expects-to-spend-135-billion-by-2030-on-battery-production/?sh=6e696a447785

- [21] https://europe.autonews.com/automakers/bmw-raises-target-ev-sales-plans-new-electric-focused-platform

- [22] https://www.marketwatch.com/story/nio-releases-earnings-wednesday-heres-how-to-value-its-stock-compared-to-tesla-ford-and-other-rivals-11628716814

- [23] https://www.linklaters.com/en/insights/thought-leadership/electric-vehicle-batteries/powering-the-future/recharging-of-electric-vehicles

- [24] https://www.iea.org/reports/global-ev-outlook-2021/trends-and-developments-in-electric-vehicle-markets

- [25] https://www.mckinsey.com/~/media/McKinsey/Industries/Automotive%20and%20Assembly/Our%20Insights/Charging%20ahead%20Electric-vehicle%20infrastructure%20demand/Charging-ahead-electric-vehicle-infrastructure-demand-final.pdf

- [26] https://about.bnef.com/blog/ev-charging-data-shows-widely-divergent-global-path/

- [27] https://www.linklaters.com/en/insights/thought-leadership/electric-vehicle-batteries/powering-the-future/recycling-and-reuse-of-electric-vehicle-batteries

- [28] https://www.greenbiz.com/article/electric-revolution-needs-sustainable-battery-materials

- [29] https://www.automotiveworld.com/articles/risky-business-the-hidden-costs-of-ev-battery-raw-materials/

- [30] https://www.iea.org/reports/global-ev-outlook-2021/policies-to-promote-electric-vehicle-deployment

- [21] https://about.bnef.com/electric-vehicle-outlook-2020/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jeremy Chua

Dealer

Jeremy graduated from Nanyang Technological University with a Bachelor’s Degree in Business, specializing in Banking & Finance. Coming from a finance education background as well as being a former banker, he strongly believes in the importance of staying invested in the financial markets and reading consistently to make informed investment decisions.

In his free time, he enjoys reading finance related books as well as generating new investment ideas.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile