Episode 3 – Trading entry strategies June 1, 2022

In this episode, we share tips you can use to identify potential entry points for trades. Identifying potential entry points is the first step traders should take to help minimise risks and maximise potential rewards. Before we discuss what to look out for to identify potential entry points to enhance a trading strategy, let us first define what an entry point is.

Determining both an entry point and exit point prior to trading is important. Traders must ensure the distance between the entry and exit points are in line with their risk-reward ratio in order to earn profits in the long run.

An entry point refers to the price at which a trader initiates a position in any financial product (stocks, CFDs, Forex etc.). A trade entry can be initiated with either a buy/long position or sell/short position. A good entry point is often the first step of many, in predetermining a potential successful trade as it minimises the “human” element with regard to trading decisions.

Here are 3 strategies traders can adopt when using technical analysis to determine potential entry points.

1. Using Support and Resistance

Support and resistance are undoubtedly the two most important concepts in technical analysis. These are price levels that act as both a floor and a ceiling, preventing prices from pushing out of these zones.

Support refers to prices on a chart that tend to act as a floor by preventing it from being pushed downward while resistance refers to prices on a chart that tend to act as a ceiling by preventing them from being pushed upward.

Entering a long position using Support Line

Figure 1. Chart of Ascendas Reit with support at 2.76

A support line is a line that connects two or more low points where prices are unable to break further downwards. Long traders may wait for the price to rebound above the support line before entering into a long position.

Example of using support line for entry point from the Ascendas Reit price chart

Figure 1 shows that the Ascendas Reit share price has a support line found at S$2.76. The stock price made contact with that level multiple times, but was unable to break below that level. Instead, it rebounded upwards. Support occurs when a downtrend is expected to pause due to a concentration of demand. Traders who use technical analysis tend to use past historical data to predict future price movements. In late January of 2022, the stock price faltered to S$2.76 but it rebounded upwards shortly after. Traders will then assume that there is huge buying demand at that specific price point. Therefore, long traders may consider the price level of S$2.76 as a potential entry point for Ascendas Reit as the price is unable to break further below the support level.

Entering a Long Position Using Resistance Line

Figure 2. Chart of CapitaLand Integrated Commercial Trust with resistance at 2.18

The opposite of what is mentioned above will explain resistance levels. The resistance line is a line that connects two or more high points where prices are unable to break further upwards.

Long traders may wait for the price to break above the resistance line before entering into a long position. Once the price breaks above the resistance area, the supposed resistance level can turn into support, when we can then assume that the buying power has exceeded the selling power, which may result in more upside in the near future.

Example of using Resistance Line for entry point from CICT price chart

Based on Figure 2, the resistance level for Capitaland Integrated Commercial Trust was at S$2.18 as the stock price reached that level multiple times between June 2021 and August 2021, but was unable to move further upwards. However, in March 2022, the stock price broke above the resistance level of S$2.18 and continued climbing upwards. The price did retrace back to the supposed resistance level of S$2.18 but it was unable to break further downwards. Instead, it climbed upwards shortly after. This shows that the price level of S$2.18 has changed from a resistance level into an intermediate support level.

Long traders may then choose to enter a long position once the stock price breaks above the resistance level as this signifies that the buying power has overcome the selling pressure, which could indicate further upside in the short term.

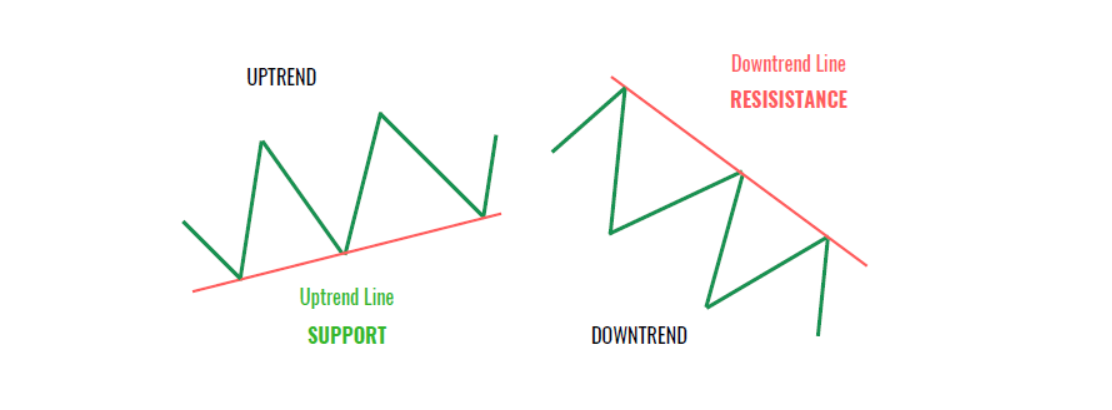

2. Using Trendlines

To draw a trendline, traders will have to draw a straight line connecting a series of high or low points. An up-trend line is drawn by connecting all of the swing lows and a down-trendline is drawn by connecting all of the swing highs. Trendlines act as a support to an uptrend or as a resistance to a downtrend. They are often referred to as “dynamic support & resistance” –meaning they move with the price trend. Therefore, it helps technical analysts determine the current direction in market prices and also helps to determine the potential floor and ceiling levels, as the stock price moves along with the current trend. The more swing points that a trendline touches, the stronger the trendline is, as it becomes more recognisable to more traders.

Downward sloping trendlines suggest that there is an excess amount of supply, indicating that the selling pressure is higher than the buying power, a sign that market participants are more willing to sell an asset as opposed to buying it. Conversely, an uptrend signifies that the demand for a particular financial product is greater than the supply, suggesting that the price is likely to continue heading upward.

Entering a long position during an uptrend

An uptrend or upward sloping trendline refers to a stock price making higher lows over time. It indicates the presence of continuous buying power even as the stock price continues to move upwards.

Figure 3. Chart of Suntec Reit showing an uptrend

Example of using upward sloping trendlines for entry point from the Suntec Reit price chart

As shown in Figure 3, the stock price of Suntec Reit has been on an uptrend since February 2022, having risen from the price area of S$1.50 to a new high of S$1.86 in late April 2022. This indicates that the buying power for Suntec Reit continues to remain strong in recent times as the stock prices continue to reach new highs. Although the stock price retraced downwards along the way, it did not break through the previous support area. Therefore, this indicates that Suntec Reit is currently trading in an uptrend.

Long traders can use trendlines to identify potential stocks that are moving in an uptrend and wait for the stock price to return back to the trendline before entering into a long position. Using the example in Figure 3, long traders may observe that the price of Suntec Reit is trading at a region of S$1.65 during the mid to late February of 2022. By constructing the trendline as shown above, long traders may wait for the stock price to retrace back to around S$1.61 before entering into a long position for Suntec Reit.

Therefore, constructing an upward trendline is important for long traders as it assists in identifying potential entry points that can be used to enter into a long position as prices tend to return to the ‘dynamic support’ which converges with the trendline, before continuing to move upwards.

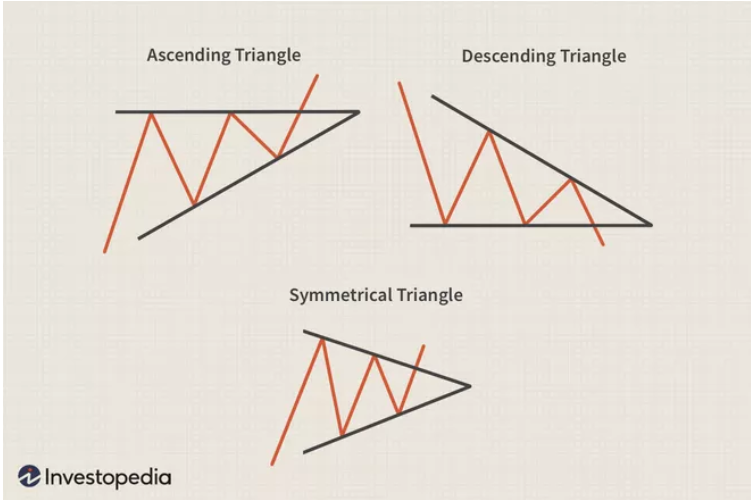

3. Using Triangle Patterns

Triangle patterns are formed when the upper and lower trendlines converge, forming a sharp edge resembling a triangle. The upper trendline is formed by connecting the high points, while the lower trendline is formed by connecting the low points. Traders who make use of the triangle patterns tend to wait for a potential breakout that deviates from the pattern. In this section, we will look into 2 different types of triangle patterns and where the potential entry point are at.

The Ascending Triangle

An ascending triangle is formed by combining an upper trendline that is making equal highs with a lower trendline that is making higher lows. This means that the stock has been consistently testing the resistance level and retraces below the resistance level afterwards. However, buyers in the market are trying to push the price upwards which is evident from the lower trendline where it is rising diagonally, making higher lows. Eventually, the buyers manage to push above the resistance price which triggers more buying action as the uptrend resumes. The initial resistance level will now become a support level once this breakout occurs.

Figure 4. Chart of Singtel showing an ascending triangle

Example of using Ascending Triangle for entry point from Singtel’s price chart

As shown in Figure 4, Singtel’s resistance point is around S$2.59 which has been tested multiple times between October 2021 and February 2022. It was unable to break beyond this point for a period of time until mid-March 2022, when the price broke above the resistance point and hit a high of around $2.68. The price did retrace downwards back towards the initial resistance point in mid-April 2022. However, that level has changed into a support level which cushions the fall of Singtel’s prices. Eventually, it continued its ascend upwards, hitting a high of S$2.81 in May 2022. Therefore, traders could use the ascending triangle pattern to enter into a long position when Singtel was priced at S$2.59.

The Symmetrical Triangle

A symmetrical triangle is composed of a diagonal falling upper trendline and a diagonally rising lower trendline. In this scenario, the price may inevitably breach the upper trendline or the lower trendline forming a breakout of its pattern. Therefore, traders have to wait for the confirmation of the breakout in whichever direction, before entering into a position.

Figure 5. Chart of YZJ Shipbuilding showing a symmetrical triangle

Example of using Symmetrical Triangle for entry point from the YZJ Shipbuilding price chart

An example of a symmetrical triangle can be seen from the YZJ Shipbuilding chart from January 2020 to January 2021 as shown in Figure 5. The stock was making lower highs during this period as shown in the upper trendline, while it was making higher lows as shown in the lower trendline. Eventually, in January 2021, it broke out of the continuation triangle pattern and climbed upwards, hitting a high of around S$1.60. Therefore, traders could enter into a long position if the stock price broke upwards of the symmetrical triangle pattern or enter into a short position if the stock price broke downwards of the symmetrical triangle pattern.

Summary

Traders can use the support/resistance, trendlines as well as the triangle patterns to identify potential long entry points.

For support/resistance, long traders can enter into a position when the stock is at the support point or when the stock price rises and closes above the resistance point.

For trendlines, long traders can look out for stocks that are in an uptrend and enter into a position when the stock retraces back towards the rising trendline, which is also known as the dynamic support.

For triangle patterns, long traders can look out for stocks that are in an ascending triangle pattern and enter into a position when the stock price breaks above the upper bound of the triangle. As for symmetrical triangle, it depends on which bound the stock price breaks. For long traders, look out for the potential breakout of the upper bound.

Should you have any question, feedback or want to find out more on how you can enhance your trading journey, drop us an email at: ActiveTraders@phillip.com.sg

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

- [1]https://www.investopedia.com/trading/support-and-resistance-basics/

- [2]https://www.investopedia.com/articles/technical/02/061802.asp

- [3]https://school.stockcharts.com/doku.php?id=chart_analysis:support_and_resistance#:~:text=Support%20Equals%20Resistance,overcome%20the%20forces%20of%20demand

- [4]https://www.flowbank.com/en/learning-center/what-is-a-trend-line-top-trendline-trading-strategies

- [5]https://www.investopedia.com/terms/t/trendline.asp

- [6]https://www.investopedia.com/terms/t/triangle.asp#:~:text=Ascending%20Triangle%3A%20An%20ascending%20triangle,which%20form%20a%20resistance%20level

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alvin Teo

Alvin Teo graduated from Nanyang Technological University with a Bachelor’s Degree in Economics. Coming from an Economics background, he strongly believes in the importance of understanding macroeconomic policies before making investment decisions. Alvin started investing in Singapore equities at the age of 21 and thus, he has relevant experience in the Singapore market.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap