Episode 6 – Signs of a True and False Range Breakout August 31, 2022

Introduction

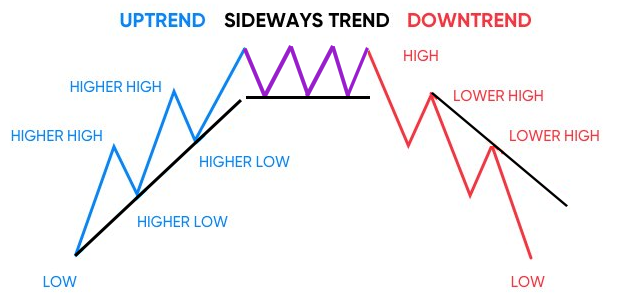

When analysing market trends and movements, we find that two-thirds of the time, trades fluctuate in a price range without any significant up or down trend. This is also known as a Sideways trend. This leaves us with the remaining one-third of the time, where the market is trending in a pronounced direction. Hence, it is essential for traders to know how a price range is formed, what constitutes a true breakout or what prolongs a Sideways trend, so that they can recognise the change in phases.

When and how does a range occur?

Before exploring how to differentiate between a true and a false range breakout, let us first understand when and how a range or Sideways trend occurs.

A Sideways trend is a horizontal price movement that occurs when the forces of demand and supply are relatively equal. This usually takes place during a period of consolidation before the price continues a prior trend or reverses into a new trend (a breakout).

There are 2 possible reasons for a market to trade in a range:

1. When there are no trigger events

The lack of trigger events such as quarterly / annual result announcements, new product launches, geographical expansions news, collaborations, etc. can result in sideways movement.

2. The market is in anticipation of a big announcement

Till the announcement is made, both buyers and sellers are hesitant to take action, and hence the stock falls into a range. The range under such circumstances can last until the announcement (event) is made.

When analysing trends, trading volumes speaks volumes. When a stock is trading in a range, its trading volume usually remains flat because it is equally balanced between bulls and bears. The stock shoots up (or down) sharply in one direction when a breakout (or breakdown) is expected to occur.

Thus, during a Sideways trend, traders would rather focus more on the nature of the Sideways trend rather than make trades. This is necessary in order to determine which position you should take, and will help to determine the moment the Sideways trend transitions into the impulse phase. The transition to the impulse phase of the trend is realised when there is a breakout of the side line border, which can be both true and false. Good traders must be able to differentiate these breakouts.

The Logic of False Range Breakouts

To identify a false breakout, you need to analyse the most common formations of false breakouts. False breakouts are meant to lure new traders into wrong positions during trading and to test the residual strength of the opposing-trend movement. The 2 main distinguishing features of false breakouts are:

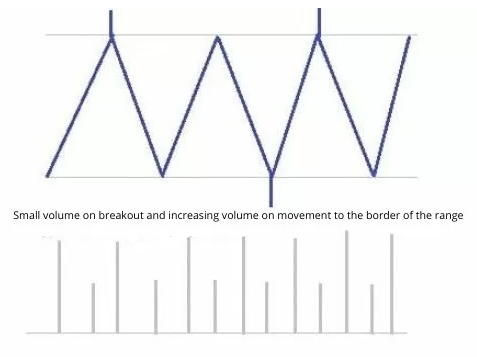

1. The minimum volume at the time of the breakout of the range, and the volume of trades can greatly increase before that.

2. A large concentration of orders and trades towards a return to the trading range.

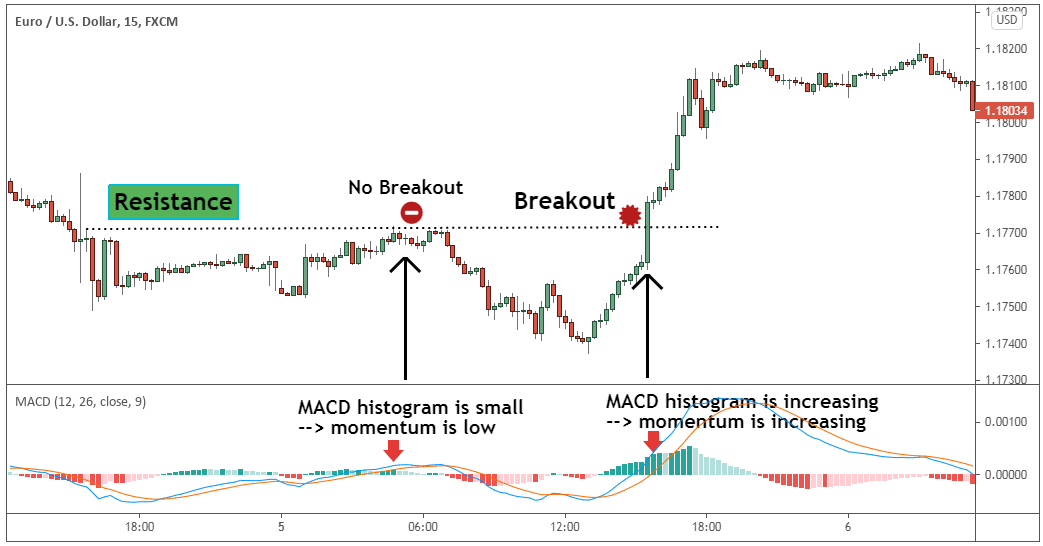

Apart from referring to the volume indicator, we can refer to the Moving Average Convergence Divergence (MACD) indicator as well. MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. A false breakout could be supported by a small MACD histogram indicating that momentum is low.

In addition, the price often takes an engaging run-up right before a false breakout. This will result in an increase in trading volume when the price is reaching the lateral border. This lures trading participants into a pretence that the infusion of money from professionals has begun. Hence, traders should be aware of this ‘false’ signal.

A good analogy is what happens in hurdling. In order to jump over an obstacle, a runner must jump before it, not after. Likewise, when trading volume increases before reaching the border, the liquidity that is present is actually absorbed into the Sideways trend. Therefore, upon recognising that the opposing trend is still strong, the pros use this trading strategy they continue to collect liquidity, but not without allowing others to fuel a false breakout of the range in order to stretch traders along the stops.

Another sign of a false breakout is a fall in volume when prices are near the border of the range (support and resistance lines), especially if there is a large number of candles with long wicks up to that moment. This is a result of the pros luring trading participants into the position.

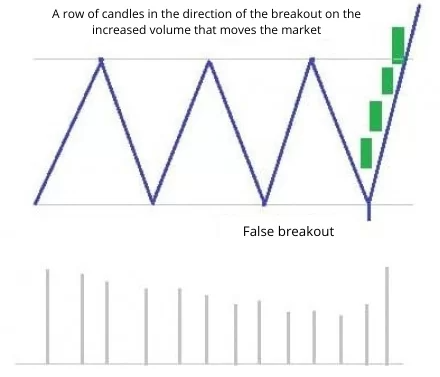

In summary, a false breakout happens when a ‘not so trigger friendly event’ occurs, with impatient retail market participants reacting to it. Usually, the volumes are low on false range breakouts indicating that there is no smart money involved in the move. After a false breakout, the stock usually falls back within the range.

The Logic of True Breakouts

A true breakout of the range should combine these 3 signs:

1. Completion of liquidity accumulation in the sideways body

2. Increased volume towards the breakout

3. After the breakout, the momentum (the rate of at which price changes) is high – indicated by the MACD

It is good to remind ourselves that a true breakout is usually not the first breakdown of a Sideways trend. This is because the passengers will first disembark and trim stop orders, after which a clear impulse in the direction of the trend will be launched.

Before a true breakout, the quantity of orders and movements by the opposing trend are already minimal and hence any large trades in the direction of a true breakout will be able to move the market in the appropriate direction. This indicates an unobstructed path towards the breakout.

From a technical analysis aspect, before a true breakout, a series of candles will usually appear in the direction of the breakdown, closing at their extremes or having small wicks. This indicates that the strength of the opponents of the breakout movement is weakening, hence signalling that the movement will continue rather than reverse. In addition, the breakout itself is often carried out by a long candlestick, which closes at its extremum.

Thus, a true breakout occurs when the liquidity of the range levels have been reduced to minimum and there has been at least one false breakout that has trimmed the stops. At the same time, a true breakout will be supported by an increased volume, which moves the market towards the breakout.

It is important for traders to not be tempted and learn to ignore false breakouts. Traders should trade true exits outside the price flat. Observing the nature of the price range breakouts and understanding what constitutes the formation of a true breakout could lead to profitable trades.

At PhillipCapital, our online trading platform POEMS houses educational contents such as Market Journals, Podcasts and Webinars with the objective of giving insights to help you make smart investment decisions. Feel free to register and attend the webinars that POEMS has to offer. We also welcome you to approach our Financial Advisory Representatives / Relationship Managers in Phillip Investor Centre who can guide you along your investment journey. Contact ActiveTraders@phillip.com.sg should you have any enquiries or feedback.

Reference:

- [1] https://www.investopedia.com/terms/s/sidewaystrend.asp#:~:text=A%20sideways%20trend%20is%20the,as%20a%20%22horizontal%20trend.%22

- [2] https://zerodha.com/varsity/chapter/dow-theory-part-2/

- [3] https://tradingstrategyguides.com/signs-of-a-true-and-false-range-breakout/

- [4] https://www.babypips.com/forexpedia/sideways-trend

- [5] https://www.investopedia.com/terms/m/macd.asp

- [6] https://tradingstrategyguides.com/best-breakout-trading-strategy/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tan Yan Yi

Yan Yi graduated from Nanyang Technological University with a Bachelor's Degree in Banking and Finance. As an Equity Specialist, she strongly believes that all investors should make informed investment decisions. Thus, she is passionate in educating and guiding clients along their investment journey. Yan Yi also diligently equips herself with market analysis skills and stays updated with economic events.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap