ESG Investing February 7, 2022

What is ESG investing?

ESG investing is a type of impact investing which integrates 3 key factors into an investment decision.

The factors are the environment, social and governance.

Environment – Investors look at the company’s environmental behavior, such as resource management and its impact on the surrounding environment.

Social – Investors look at the company’s social responsibility, such as how different stakeholders of the company are treated, and the diversity within the company.

Governance – Investors focus on the structure of the corporate management and shareholder structure.

This investment style is different from the traditional financial analysis where decisions are made mainly on profitability.

ESG investing refers to socially responsible investing, which reflects the investor’s position on environmental and societal issues along with corporate governance of the company. To attract ESG conscious investors, companies need to move towards doing businesses in a way that aligns long-term corporate strategies taking social and environment issues into account.

Historically, the main emphasis when it came to ESG investing was on the environmental factor due to the increasingly adverse repercussions and changes brought about by climate change. However, due to a number of major recent social and corporate governance issues that have cropped up, the social and governance factors under ESG are becoming increasingly important.

Socially, this is a result of increasing discrimination issues (e.g. George Floyd’s death in the US in 2020 and gender diversity) coupled with COVID-19 pandemic where the public and rights groups are scrutinizing how employees are treated during the crisis. Companies’ reputations and legitimacy are threatened when its business practices are unethical or even illegal, and could face a backlash in the form of a boycott of their products.

On the governance side, the focus is a result of numerous frauds surfacing in companies, like Luckin Coffee (LKNCY.US) and Wirecard (WDI.GR). Misplaced investor trust usually results in a plunge of the company’s value, and could even lead to winding up of the business.

Now, these 3 factors are closely inter-linked as they impact the direction of the companies and their performance.

As part of our efforts to promote sustainable investing, socially responsible investing and impact investing, we have curated an ESG Conference: Bridging Today, Building Tomorrow. Come join us on 26 February 2022 (Saturday) at 2pm to learn more from our esteemed speakers! Sign up here: https://bit.ly/3HZq0oX

Popularity of ESG investing

The practice of ESG investing began in the 1960s, and in its earliest form it was used to exclude stocks/industries which had business activities with certain undesirable traits such as tobacco companies1. Fast forward to the 2020s, ESG investing is gaining momentum and popularity among asset managers and investors who are incorporating ESG criteria into their investing strategies. Increasingly, companies around the world are evaluated through an ESG lens as an additional performance measure. Now, there is an ESG score for companies and they are ranked according to their ESG ratings.

A well-executed ESG strategy can reveal both corporate risks and competitive advantages which may not be taken into account when investment decisions are made solely based on traditional financial analysis. Further, ESG investing shows if companies are aligned to their long-term corporate goals. If this is the case, this will increase shareholder value.

Earlier, the environment was the key factor that drove ESG investing because of harmful environmental-related issues. Many initiatives were taken to counteract effects such as the Conference of the Parties (COP). These forums usually end with a specific goal to tame climate change.

As such, companies across the globe are expected to have climate-aligned business plans due to government environment policies which impact business decisions.

Outperformance of ESG fundamentals

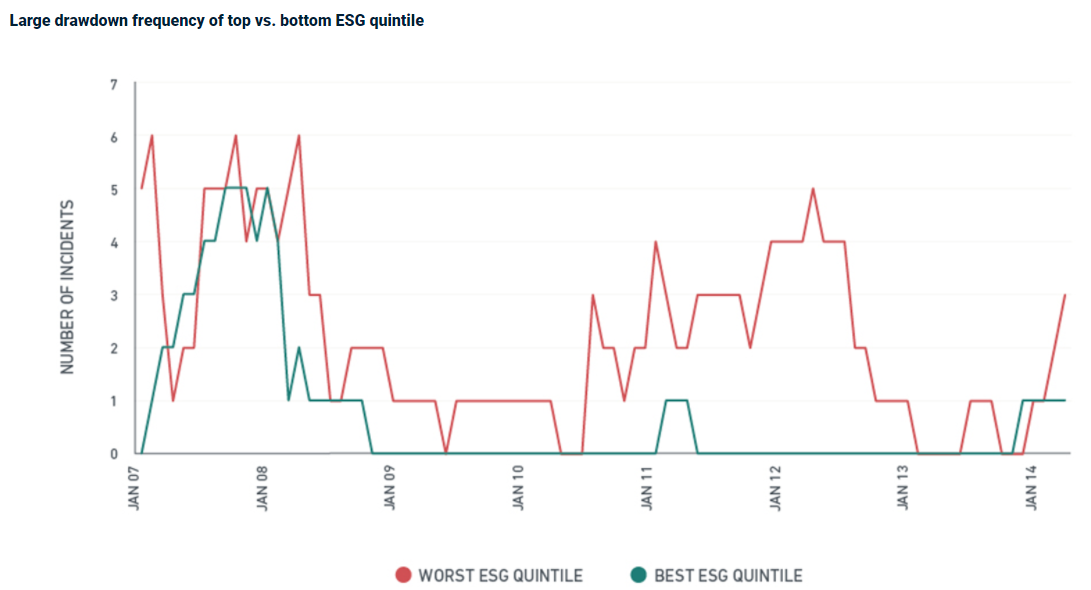

Fig 1. Lower frequency of major drawdowns of top vs. bottom ESG quintile

Fig 1. Lower frequency of major drawdowns of top vs. bottom ESG quintile

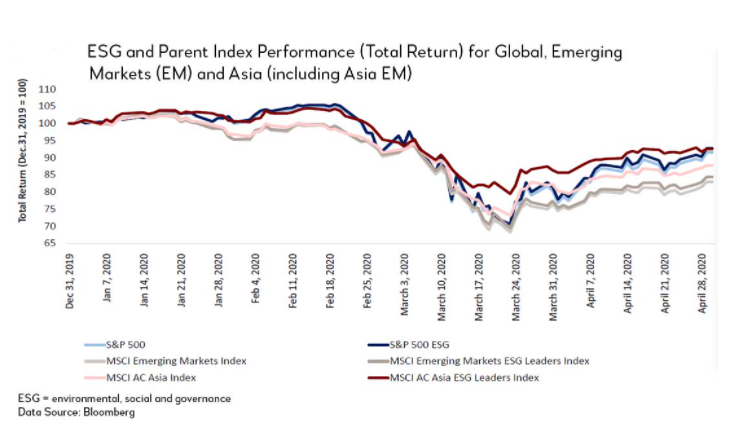

Fig 2. Outperformance of ESG-focused indexes vs. Parent index

Fig 2. Outperformance of ESG-focused indexes vs. Parent index

Very often, companies that are rated above average in terms of ESG metrics are relatively stable companies with good corporate governance.

These are the characteristics of quality companies which can weather exogenous shocks better than peers that are rated lower in terms of ESG metrics. Further, with a higher rating ESG, companies are less likely to succumb to idiosyncratic risks that may affect a company’s specific performance, or simply come in the form of lower moral hazard for its shareholders.

These companies usually outperform in the long run and experience lower volatility. When compared in terms of major drawdowns due to idiosyncratic risks, high ESG-rated companies experience lower frequency of idiosyncratic risk incidents such as major drawdowns relative to low ESG rated companies (refer to Fig 1)2. This is especially true in times of extreme market uncertainty where there is a flight to quality, which tends to hold up better during market sell off. The best example would be during the COVID-19 pandemic when bankrupt companies that had liquidity issues succumbed to an insolvent shut down.

ESG focused-indexes outperformed their respective parent index at the onset of the initial Covid-19 outbreak (refer to Fig 2)3. Thus, these metrics not only serve as a benchmark for socially responsible investing but also as a risk management tool.

Logically, ESG investing will outperform in the long-run due to the costs of not conforming to ESG factors. According to a Morningstar report, on average, the best performing ESG ETFs had a 10-year return of 18% as compared with the broader market ETFs (SPY and DIA) which had a return of 13.23% and 12.47% respectively over 10 years. A company that manages ESG issues by addressing them effectively reveals its quality and ability to compete successfully by properly managing risk, anticipating regulatory action and accessing new markets.

Environmentally, the cost can come as a real cost due to climate change whether directly or indirectly and increased regulation cost which may result in red tape. Socially, the cost can come in the form of backlash from the public or a boycott of company which adversely affects the company’s value. On the governance side, it can come in the form of moral hazard/frauds or existence of extreme bottlenecks in the company.

Adherence to strict corporate governance will boost investors’ confidence which will drive up the value of the company. Sound corporate governance and risk management systems are critical to a company’s performance. Thus, ESG investing makes sense not just socially but economically as well.

Growth of ESG investing

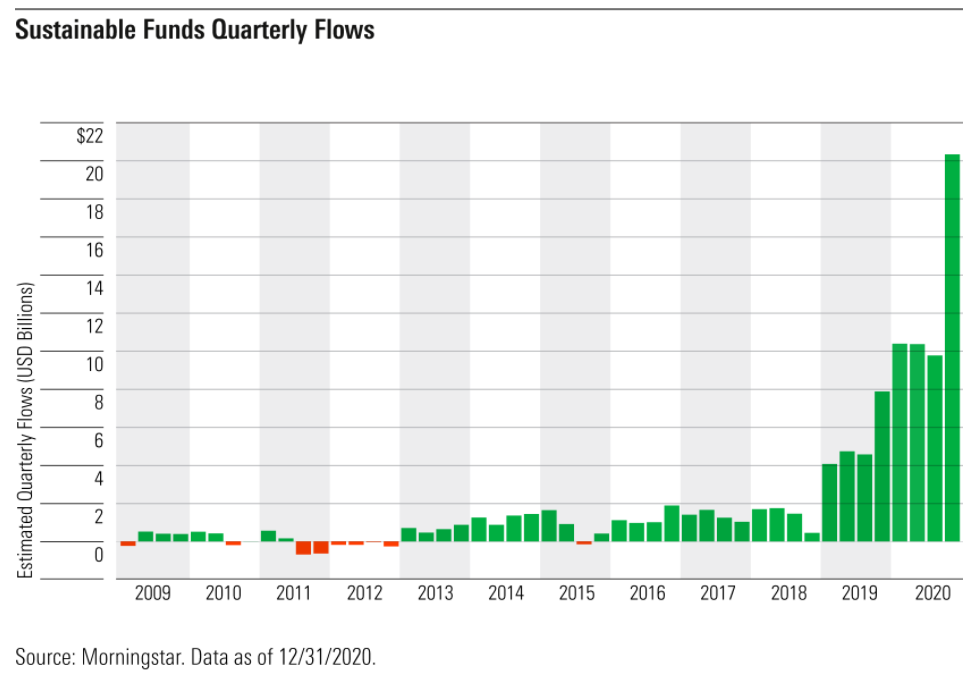

Fig 3. Increased net inflow of funds to ESG

Fig 3. Increased net inflow of funds to ESG

Globally, companies are integrating socially- and environmentally-conscious options into their business models as the importance on corporate responsibility grows. Now, companies are often scrutinized by the general public against the ESG benchmark which can affect the value of the company. This is fundamentally driven by the increasing importance placed upon socially responsible investing.

As Larry Fink, chairman and CEO of BlackRock, an American multinational investment management corporation, says: “This trend brings about an ongoing fundamental reshaping of finance as ESG issues become a defining factor in a company’s long-term prospects4.” Therefore, adherence to ESG reduces costs while boosting investors’ confidence in companies due to strict corporate governance. Thus, ESG investing drives the long-term value of companies.

Increasingly more funds are being poured into ESG investments.

According to a research by Morningstar, estimated net flows into ESG ETFs totaled $20.6 billion for 2019 which is nearly 4 times the previous annual net flow of 2018(refer to Fig 3)5. This trend of increasing inflow of funds into ESG investments will only get larger.

Separately, companies (e.g. Bank of America-BAC.US and Cisco-CSCO.US) also want to be recognized for their impact and effort on ESG issues and are setting aside funds to tackle them. This will also serve to drive the growth of ESG investment.

Another fundamental driving force for ESG investing are asset managers and the increasing interest in this area from the investing public.

The increasing interest may be due to the changing demographics of the investing community.

Firstly, the investing community is now increasingly made up of Gen X and Millennials, this has spurred growth in sustainable investing6. Individuals belonging to the Millennial and Gen X groups are more aware of the impact of their investments, and are using the ESG criterion to choose which portfolios to look at which reflect social good. Secondly, high net worth investors who are in control of bulk of the investment assets are pouring money into ESG assets to boost their philanthropic efforts. And lastly, the major driving force are asset managers who are leading the trend towards ESG investing.

With growing influence of ESG investing, fund managers are centralizing their investment strategy around ESG. They are putting together funds/ETFs which aim to help serve the goal of ESG integration into investment decisions. An example of this is one of the world’s largest asset managers BlackRock, which is using sustainable investing as a new standard for its funds.

BlackRock is to double the ESG focused ETFs in excess of 150 funds over the next few years7. In Singapore, DBS says ESG investments could yield good returns because a “tsunami of money” is rushing into sustainable investments8. All this will shift the trend towards ESG investing due to the availability of options and the structural shift in the investing habit.

ESG ETFs

As for ETFs, this investment vehicle provides transparency and allows for a diversified selection of holdings centered on the ESG criteria to be done in a cheaper and easier manner.

The framework for ESG and benchmark for the performance metrics differ, there are numerous themes for ESG ETFs. The composition of these ETFs satisfy a particular ESG framework and they are indexed against a particular benchmark. The holdings in these ETFs are from different industries or markets and are transparent to investors. They comprise companies globally, regionally or could be concentrated within a country. Constituents of ESG ETFs or companies that are highly rated on an ESG scale are either concentrated or based in developed countries. This is because developing countries are usually more reliant on raw materials that are harmful to the environment (i.e. coal) for economic development.

Further, the risk of corruption or corporate surveillance are higher in these countries due to the lack of strong governance and infrastructure. As a result, the ESG ratings suffers as these countries are more focused on catching up on the economic front.

Investors can put in money according to their beliefs via ESG themes and can also tilt their exposure according to the holdings of the ETF itself.

For example, an investor can select an ‘Energy Efficiency’ theme style ETF or take exposure to the tech industry by selecting an ESG ETF whose holdings are tech heavy. Based on the ETFs, investment in these instruments allow for diversification in an easy and cheap way while following a specific ESG criterion.

ESG related exposure

Exposure to ESG investment can be attained through ESG-focused theme ETFs such as the ones below.

| Ticker | AUM | Average Vol(3mths) | Expense Ratio | Dividend Yield | 3 Year return |

| ESGU.US | USD 25.49B | 1.12M | 0.15% | 1.06% | 124.3% |

| SUSA.US | USD4.33B | 287K | 0.25% | 1.09% | 93.2% |

| ESGV.US | USD6.35B | 317K | 0.09% | 1.09% | 88.9% |

Investors can also get ESG exposure through investment in companies with high ESG scores as the ones below. These companies are scored accordingly to ESG metrics ranging from environmental commitment to corporate governance.

| Ticker | ESG score9 | Market Cap | Industry | 3 Year return |

| MSFT.US | 76.30 | 2,300B | Infrastructure software | 190.6% |

| CAN.US | 75.95 | 225B | IT Services | 134.9% |

| CRM.US | 72.92 | 230B | Application software | 53.7% |

If you would like to learn more, don’t forget to join us at our ESG Conference! You can sign up for the conference here: https://bit.ly/3HZq0oX

Related controversy

Some issues related to ESG investing includes differing ESG frameworks, moral hazards in companies and debatable outperformance relative to the broader market index.

As the definitions of ESG frameworks differ, there are many variations of ESG standards. Thus, when choosing an ESG ETF, there is no one-size-fit-all ESG framework as the chosen ESG might not fulfil the investor’s definition of ESG.

Secondly, moral hazards exist as a company may report ESG adherence measures and practice the reverse without the public knowing (e.g. Volkswagen emission tests scandal). Thus, ESG investing might actually be counterproductive to the intended result. Lastly, the outperformance of ESG ETFs relative to the broader market index is debatable.

Most of these ESG ETFs are tilted to the tech industry which has outperformed the broader market in recent years. Thus, the outperformance of ESG ETFs could be attributed to the tech industry performance rather than the adherence to ESG metrics.

Reference:

- [1] https://www.msci.com/esg-101-what-is-esg/evolution-of-esg-investing

- [2] https://www.msci.com/esg-101-what-is-esg/esg-and-performance

- [3] https://www.aiib.org/en/news-events/media-center/blog/2020/ESG-Safe-Haven-in-Times-of-Crises.html

- [4] https://www.blackrock.com/corporate/investor-relations/2020-blackrock-client-letter

- [5] https://www.morningstar.com/articles/1019195/a-broken-record-flows-for-us-sustainable-funds-again-reach-new-heights

- [6] https://www.cnbc.com/2021/05/21/millennials-spurred-growth-in-esg-investing-now-all-ages-are-on-board.html

- [7] https://www.cnbc.com/2020/01/14/blackrock-is-overhauling-its-strategy-to-focus-on-climate-change.html

- [8] https://www.cnbc.com/2021/06/17/dbs-piyush-gupta-a-tsunami-of-money-is-going-to-sustainable-assets.html

- [9] https://www.investors.com/news/esg-companies-list-best-esg-stocks-environmental-social-governance-values

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng

Senior Dealer

Yong Heng joined Phillip Securities in June 2020 as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a bachelor’s degree in Economics & Finance. He also completed his CFA studies 2019.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It