ETF 101: A Basic Guide to Exchange-Traded Funds July 10, 2024

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund that trades on stock exchanges, much like individual stocks. ETFs hold a basket of assets such as stocks, commodities, or bonds, and typically operate with an arbitrage mechanism designed to keep their trading prices closely aligned with their net asset value (NAV).

Passive vs Active ETFs

ETFs can be broadly categorised into two types: passive and active.

Passive ETFs, also known as index ETFs, are designed to track a specific index or benchmark, such as the Straits Times Index or the S&P 500.

Active ETFs, on the other hand, are managed by fund managers who make decisions on asset allocation and security selection, with the aim of outperforming a specific benchmark or index.

Here’s the quick side by side comparison

| Passive ETFs | Active ETFs | |

| Management Style | Track a specific index | Actively managed by fund managers |

| Fees | Typically lower | Typically higher |

| Potential Returns | Aims to track the performance of the index | Aims to outperform the benchmark index |

| Benefit | Cost-effective | May outperform the benchmark index |

| Drawback | Does not aim to outperform the index | Higher costs, manager risk |

Advantages of ETFs

ETFs offer several advantages over other investment vehicles, including:

- Diversification: ETFs provide instant diversification by holding a basket of assets, reducing the risk associated with investing in individual securities.

- Cost-effectiveness: ETFs generally have lower expense ratios compared to actively managed unit trusts, making them a more cost-effective investment option.

- Liquidity: ETFs can be bought and sold throughout the trading day on stock exchanges, providing investors with greater liquidity compared to unit trust.

- Transparency: The holdings of most ETFs are disclosed daily, providing investors with visibility into their investments.

Disadvantages of ETFs

While ETFs offer numerous benefits, they also have some potential drawbacks:

- Tracking error: There may be a difference between the performance of an ETF and its underlying index, known as tracking error. This can be caused by factors such as fund expenses, trading costs, and rebalancing activities.

- Trading costs: Although ETFs are generally more cost-effective than unit trusts, investors may still incur trading commissions and bid-ask spreads when buying or selling ETF shares.

- Potential liquidity issues: Niche or thinly traded ETFs may have lower trading volumes, leading to wider bid-ask spreads and potentially higher trading costs.

How to Choose an ETF

When selecting an ETF, investors should consider the following factors:

- Expense ratios: The ongoing costs of an ETF, expressed as a percentage of the fund’s assets. Lower expense ratios can lead to better long-term returns.

- Tracking error: For index ETFs, it’s essential to evaluate how closely the ETF tracks its underlying index. Lower tracking error is generally preferable.

- Trading volume: Higher trading volume typically indicates better liquidity, which can result in tighter bid-ask spreads and lower trading costs.

- Fund assets: Larger ETFs tend to have better liquidity, lower tracking error, and potentially lower expense ratios due to economies of scale.

- Index construction: Understand the methodology behind the index the ETF tracks to ensure alignment with your investment goals and risk tolerance.

- Fund manager track record: Evaluate the experience, expertise, and historical performance of the management team. A strong track record can indicate better ETF management and potentially more consistent performance. (Eg: CSOP, LionGlobal, PhillipCapital, and more)

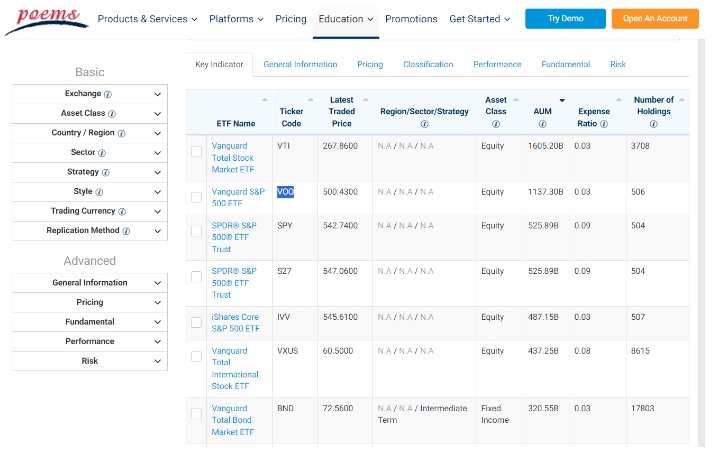

Getting Started with ETFs on POEMS

To begin, navigate POEMS ETF Screener

Here, you can compare various criteria by clicking through different tabs such as:

- Key indicator

- General information

- Pricing

- Classification

- Performance

- Fundamental

- Risk

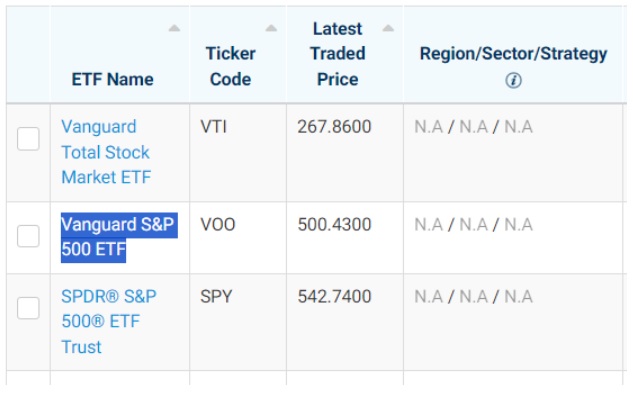

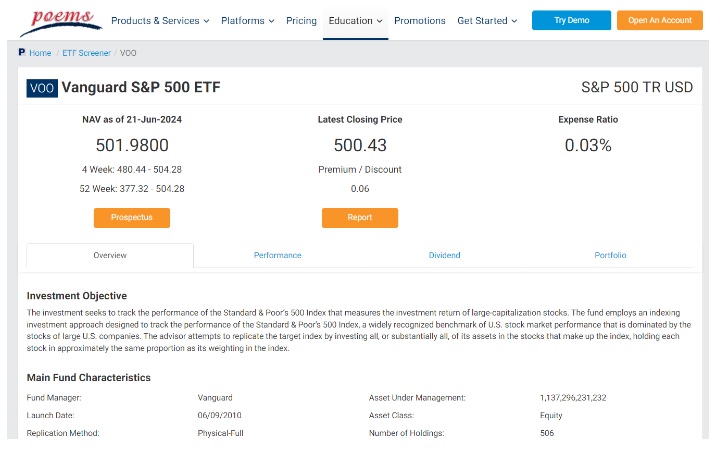

For a practical example, if you’re looking to explore a fund that tracks the S&P 500, simply tap on the ETF name “VOO”.

This allows you to toggle around and view details like portfolio constituents, dividends, performance, and more.

Usage of ETFs

Investors utilise ETFs for various purposes:

- Portfolio building via core & satellite ETFs

- Dollar cost averaging investing

- Tactical investing into specific investments themes such as Mag7 (MAGS), Nasdaq Covered Call (QYLD), Uranium (URA), etc.

- Hedging via leveraged and inverse ETFs

Dollar-Cost Averaging (DCA)

One of the most prudent and time-tested strategies is Dollar-Cost Averaging.

This involves investing a fixed amount regularly to mitigate the effects of market volatility.

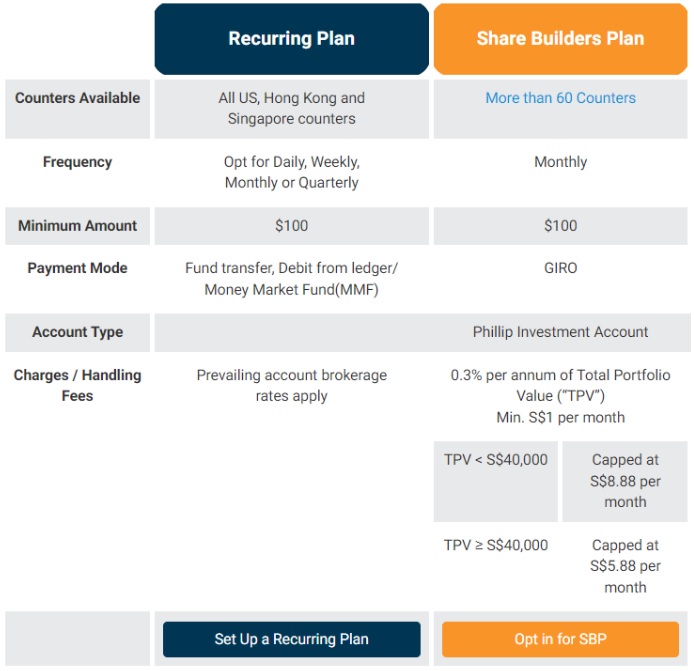

On POEMS, you can do so via 2 ways; Share Builders Plan (and/or) Recurring Plan.

Depending on your individual needs and circumstances, you can choose the option that best suits you.

What to invest on a regular basis?

Consider these themes for your next investment:

- Asset types: Equity, Fixed Income, REITs, Commodity, etc.

- Geographical: Singapore, US, Hongkong, China, Asia, Emerging Market, etc.

- Sector: Technology, healthcare, consumer discretionary, energy, etc.

Conclusion

As we conclude this introduction to ETFs, it is evident that these versatile investment vehicles offer a wealth of opportunities for investors with diverse purposes and interests.

ETFs provide access to a wide range of themes, from broad-based equity indexes like the STI and S&P 500 to thematic investments focused on specific regions or sectors, and even alternative asset classes such as gold, natural gas, bitcoins and more.

As you progress in your ETF journey, consider exploring various ETF themes, understand how to construct a diversified portfolio, and learn about the distinctions between active and passive ETFs. With their cost-effectiveness, transparency, and flexibility, ETFs have become indispensable tools for both novice and seasoned investors alike. Stay tuned for our upcoming intermediate and advanced ETF articles, where we’ll dive deeper into these fascinating aspects of ETF investing.

Your next steps: save these useful tools under your investment arsenal.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

MuMing Yong

ETF Specialist

Phillip Securities Pte Ltd

Mu Ming traded and invested for more than 8 years in various instruments including ETFs, Equities, Unit Trusts, Options, DLC, CFD, and ILP from the US, SG and HK market. He's a believer of personal finance, macroeconomics, and, technical analysis - so much so that he found himself analysing his social media engagement using trend lines and patterns.

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection

Gold ETFs for Singapore Retail Investors: Diversification and Inflation Protection  ETF Market Review: February Outlook Signals Strong Performance

ETF Market Review: February Outlook Signals Strong Performance  ETF Market Analysis: Oil & Hang Seng Set for January Gains

ETF Market Analysis: Oil & Hang Seng Set for January Gains  Buffer ETFs — What Are They and How Do They Work?

Buffer ETFs — What Are They and How Do They Work?