Regular Savings Plan

Regular Savings Plan (RSP) is an investment plan that offers a consistent and disciplined means of investment for stocks and unit trusts. Our plans cater to all kinds of investors, from new investors looking to invest smaller amounts to investors looking to invest abroad.

At PhillipCapital, we offer regular fixed-dollar amount investment plan which enables you to buy shares or unit trusts. By investing a fixed amount of funds consistently at an interval of your choice, you will eventually buy more units when prices are low and less units when prices are high. This investment method is known as dollar-cost averaging, and it is especially useful in hedging against market volatility where it lessens the risk of investing a large amount in a single investment.

Plan With Us

| Recurring Plan | Share Builders Plan | Unit Trust Regular Savings Plan |

|||

|---|---|---|---|---|---|

| Counters Available | All US, Hong Kong and Singapore counters |

More than 50 Counters | More than 500 funds | ||

| Frequency | Opt for Daily, Weekly, Monthly or Quarterly |

Monthly | Monthly or Quarterly | ||

| Minimum Amount | $100 | $100 | $100 | ||

| Payment Mode | Fund transfer, Debit from ledger/ Money Market Fund(MMF) | GIRO | GIRO | ||

| Account Type | Phillip Investment Account | ||||

| Charges / Handling Fees | Prevailing account brokerage rates apply |

0.3% per annum of Total Portfolio Value (“TPV”) Min. S$1 per month |

0% Sales Charge | ||

| TPV < S$40,000 | Capped at S$8.88 per month | ||||

| TPV ≥ S$40,000 | Capped at S$5.88 per month | ||||

| Set Up a Recurring Plan | Opt in for SBP | ||||

Why regular savings plan?

Good for Beginners

New to investing? If you are conservative and would like to start small,we have plans that could be ideal for you, starting from as low as $100.

For investors looking to invest abroad or would like the choose your own investment interval, you may consider our Recurring Plan.

Setting Goals in Life

The most important thing about setting goals in life is having one. Whether you are planning for retirement, saving for your children’s education or aiming to achieve other financial objectives, Regular Savings Plan (“RSP”) could potentially help you reach your goals with peace of mind. RSP is an investment plan that offers a consistent and disciplined means of investment for stocks and unit trusts.

“Time in the Market”, rather than “Timing the Market”

It is difficult to time the market where the prices fluctuate all the time. However, by adapting the approach of dollar-cost averaging, it turns market fluctuations to your benefit. Instead of investing a lump sum of your money, you are gradually building your portfolio over a period of time with a fixed amount of funds at an interval of your choice.

If you are still waiting to time the market why not just start with one that may average out the market’s peaks and troughs? Let the impact of time work at your advantage

Dollar Cost Averaging

By investing a fixed amount of funds consistently every month over a period of time, dollar cost averaging benefits you regardless of price fluctuation. You purchase more units when the price is lower and fewer units when the price is higher.

*Investment inclusive of handling fees

Recurring Plan can be accessed through the POEMS platform, no opt in required.

Available Counters for Share Builders Plan

Phillip Share Builders Plan

Think BIG. Start small…

Share Builders Plan (“SBP”) is a regular fixed dollar amount investment plan, which enables you to buy shares on a consistent and incremental basis so as to build up a portfolio of securities for yourself eventually. Therefore, you do not need a huge amount of funds to invest in stock market since Share Builders Plan presents an opportunity for you to invest in stock market to buy small quantity at a reduced cost.

Share Builders Plan

What is Share Builders Plan (SBP)?

Share Builders Plan is a regular fixed-dollar amount investment plan which enables you to buy shares on a consistent and incremental basis so as to build up a portfolio of securities for yourselves eventually. Therefore, you do not need a huge amount of funds to invest at a time.

What is dollar-cost-averaging method of investment?

By investing a fixed amount of funds consistently every month over a period of time, dollar cost averaging benefits you regardless of price fluctuation. You purchase more units when the price is lower and fewer units when the price is higher. This investment method is known as dollar-cost averaging. And it is especially useful in hedging against market volatility. With such a disciplined and consistent method, you will eventually build up a portfolio of stocks in average cost.

Can I apply for SBP through POEMS online?

Yes, you can apply for SBP online through POEMS with the following steps:

Login to POEMS > Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan (SBP) > Investment Instructions & Apply.

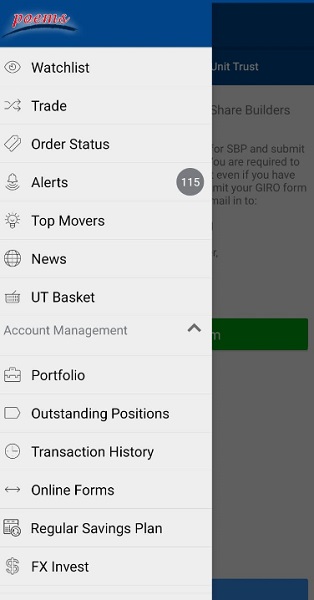

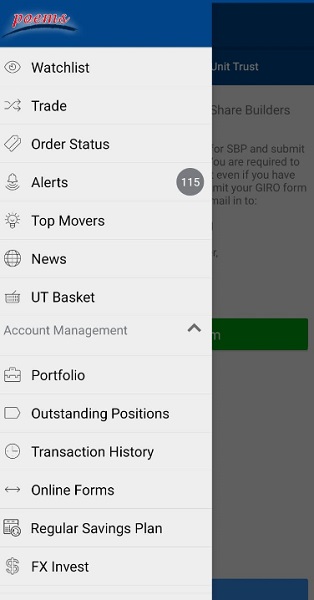

Alternatively, you can apply via POEMS Mobile 2.0 by following the steps below:

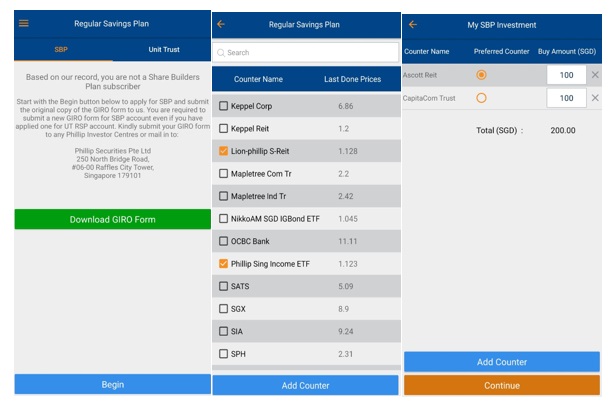

Firstly, log in to POEMS Mobile 2.0 and go to “Regular Savings Plan”. Next, choose SBP.

Tap on the “Begin Button” to start > Select one or more counters from the list displayed>Tap on Add Counter> Select your preferred counter> Tap on [Continue] to submit

Who is eligible to apply for SBP?

Anyone above the age of 18 years old can apply for SBP.

Individuals below the age of 18 years old must open a joint SBP with their parent / legal guardian only.

Does SBP allow joint application?

Yes, SBP allows joint application. Either one of the specimen signatures of both applicants is authorized and empowered to act in accordance to the terms and conditions binding SBP. For joint application with a child below 18 years old, a copy of the birth certificate must be submitted during application.

How do I participate in SBP?

You may complete an SBP Application Form together with an Interbank GIRO Application Form. If you do not have a trading account with Phillip Securities Pte Ltd (PSPL), you will need to open one. The purpose of the trading account is to facilitate your share liquidation from SBP in the future.

Alternatively, you can apply online by the following steps:

Login to POEMS > Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan.

Can I e-Sign the GIRO Form or submit a softcopy instead?

Do take note that due to Monetary Authority of Singapore (MAS) regulations, original GIRO forms with pen signature is required. Electronic/printed signatures are NOT allowed and will be rejected immediately.

Interbank GIRO Application Form can be found here and you may submit the GIRO Form to any of our Phillip Investor Centres located conveniently around the heartlands of Singapore or mail it to us at:

Attention: SBP Team

Phillip Securities Pte Ltd

250 North Bridge Road

#06-00 Raffles City Tower

Singapore 179101

What do I need to bring along when applying for SBP?

You will need to bring along your NRIC or Passport & Work Permit / Employment Pass (for foreigners) and a valid bank account number that you want to use for the Inter-bank GIRO deduction. If you are opening a joint account with your child below 18 years old, please bring along the birth certificate of the child.

What is the minimum amount that I have to invest?

The minimum amount of investment is S$100 a month per counter.

Can I choose the shares that I want to invest in?

Yes, you can choose to invest in any of the 56 selected Singapore listed shares.

What are the counters available?

Click here for full counter list.

How do I indicate the share counters that I want to invest in?

You will have to fill in your investment instructions on the SBP Application Form. On the investment instructions, you have to indicate the share counter(s), the investment amount for each counter and select a preferred counter if you have more than one counter in your investment selection.

What is preferred counter?

The preferred counter is the counter that the handling fees will be deducted from. Moreover, if there are any excess funds in the SBP account resulting from the previous month’s left over or corporate actions (such as dividends, cash offers, bonus rights issue, etc.) they will be rolled over for the following month’s investment and reinvested into your preferred counter.

How would I know how many shares I have?

Every month, there will be a statement sent to your email address based on POEMS record, if you have opted in for e-statement. Please take note that a monthly administrative fee of $2.14 (inclusive of GST) will be levied for each physical statement that we send to you, if you do not opt in for e-statement. The statement will state the total shareholdings, current cash ledger balance and investment execution of the month. Alternatively, you can view your shareholdings via POEMS.

Please login in to your POEMS > Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan (SBP) > Portfolio.

Can I amend the investment instruction?

Yes, you can amend your investment instructions via POEMS or by completing the SBP Investment Amendment Form and and submitting a softcopy to us. Amendments can be made to the selection of counters and the investment amount. However, amendment for the month will be effected only if the instructions are completed and submitted to us 6 business days before the transaction date, which is on the 18th of every month or the next business day if 18th of the month is on a non-market day. Otherwise, the amendment will be effective from the next investment month.

Can I temporarily suspend the SBP?

Yes, you can suspend your SBP by completing the SBP Suspension Form. However, if the SBP is suspended for more than 3 months without any shareholdings. Phillip Securities Pte Ltd reserves the right in its sole and absolute discretion to terminate your SBP.

How can I re-activate my SBP after it is suspended?

You can re-activate your SBP account via POEMS or by completing the SBP Re-activation form.

What will happen if my SBP is suspended?

When your SBP is suspended, no further GIRO deduction will be effected from your bank account until you reactivate your SBP. During the suspension period, your shareholdings and cash balance remains in your SBP portfolio.

All corporate actions for your shareholdings are still eligible. There is no maintenance fee during the suspension period except for the physical statement charge of S$2.14 per month, if you decided not opt-in for e-statement.

If I want to terminate my account, what will happen to my SBP shareholdings?

Before proceeding for termination, you can request Phillip Securities Pte Ltd to transfer your SBP shareholdings to your CDP GSA. Transfer fees apply at $21.60 (inclusive of GST) per counter chargeable by CDP and Phillip Securities Pte Ltd. Alternatively, you can liquidate your shares through POEMS online or your Trading Representative. The sale proceeds will be credited to your trading account.

How do I pay for my investment?

Interbank GIRO is used for fixed monthly transfer of funds from your bank account into Share Builders Plan for investment. You have to ensure that sufficient funds are available at least 6 business days before the Transaction Date (18th of every month or the next business day if 18th of the month lies on a non-market day).

Who are the participating banks for this Inter-bank GIRO facility?

All banks with Interbank GIRO Facility in Singapore.

How long does it take for my Interbank GIRO Account to be linked with my SBP?

It takes about 3 weeks to link up your GIRO. However, the processing times may vary with each bank.

What if I do not have enough funds in my bank account?

If you do not have enough funds in your bank account, your monthly investment will not be executed and there will be insufficient funds charge of S$5.00 (subject to GST) to be deducted from your SBP ledger next month. If you have insufficient funds for 3 continuous months, your SBP will be suspended. If you wish to continue, you will have to re-activate your SBP Account and ensure that you have sufficient funds in your bank account for monthly investment deduction.

Can I change my Interbank GIRO Account for my SBP?

Yes. You can change the Interbank GIRO account for your SBP by submitting a new Interbank GIRO Application Form to us.

However, please take note of the processing time for your new GIRO Bank Account to link up your SBP as it could lead to lapse of investment during this transition period. Hence, please ensure there are sufficient funds in your existing account in the meantime.

When and how are the buying executed?

The aggregate monthly investments of all clients for any particular selected SBP counter will be done on the 18th of every month (“Transaction Date”) on a non-discriminatory and non-preferential basis. If the 18th of the month falls on a non-market day, buying of the counter will be done on the next available market day.

How are the shares allocated to me?

You will be credited with the nearest rounded-down whole number of the designated share counter that can be purchased with your fixed monthly investment less the handling fee.

How is the SBP handling fee deducted?

You will have to indicate the preferred counter from which the handling fee will be deducted. The actual buy amount for the counter will be the buy amount you stated on the amendment of Investment Instruction minus the handling fees. You may amend your preferred counter via POEMS or by completing the investment instruction form.

For example, if you indicate that your investment amount for SIA is S$300 and if our handling fee is S$6.42 (inclusive of GST), the actual investment amount for SIA will be S$293.58.

Will the execution of my investment instruction be based on the whole amount of fund I have indicated?

Since we cannot credit shares on a fractional basis, we will only buy shares to the nearest whole number that is available with your monthly investment minus the handling fees. The un-invested amount of fund will be rolled over to be aggregated with next month’s investment amount.

How are the excess funds in my SBP Account being handled?

If there are excess funds left in your SBP, these funds will be added to your current month’s investment amount for purchasing your preferred counter. The excess funds may arise from but are not limited to un-invested balances brought forward from previous month as well as corporate actions such as dividends, cash offers and bonus rights issue.

For example, if you indicate that your investment amount for SIA is S$300. if the un-invested amount last month was S$8.70, then the investment amount for SIA this month will be S$302.28, which is the sum of S$300 plus the un-invested amount of S$8.70 less handling fee of S$6.42 (inclusive of GST).

Can I put the excess funds from the SBP into the Money Market Fund (MMF)?

No. The excess funds from the SBP cannot put into the Money Market Fund (MMF).

How do I sell my shares?

You can sell your shares via POEMS online or from your Trading Representative. However, please check for the correct counter and quantity in your SBP Portfolio before selling your shares. It is also important for you to notify your Trading Representative that you are selling from your SBP shareholdings if you execute the trade/sale through POEMS online.

How can I get the proceeds from selling the shares?

Proceeds from the sale of shares will be credited to your shares trading account that is tagged to your SBP.

Can I transfer my SBP shareholdings to my own CDP GSA?

Yes, you can transfer the shares from your SBP shareholdings to your CDP GSA with a transfer fee of S$21.60 (inclusive of GST) per counter per transaction chargeable by CDP and Phillip Securities Pte Ltd. Shares transfer from Junior SBP to CDP GSA of the main account holder is NOT allowed.

What are the charges involved?

*Month Handling Fees (NEW!)

| 0.3% per annum of Total Portfolio Value (“TPV”) Min. S$1 per month |

|

|---|---|

| TPV < S$40,000 | Capped at S$8.88 per month |

| TPV ≥ S$40,000 | Capped at S$5.88 per month |

As we understand many companies have raised fees on their products and services over the years amidst rising costs and high interest rates, we have decided on a new fee structure designed to reduce your SBP fees, providing relief to inflationary burdens

To view your TPV using:

POEMS Website:

Login > Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan (SBP) > Portfolio > Total Market Value

POEMS Mobile 3 App:

Login > Trade > RSP > Share Builders Plan > Holdings > Total Market Value

*Other Fees and Charges

min S$1 capped at $50 |

|

(Except Rights Issue) |

|

* All fees are subjected to GST

**Dividend charges will be equivalent to dividend amount, if the amount is less than S$1.

***Rights will be sold off as “nil-paid”. Brokerage for this liquidation will be waived by PSPL but subject to handling fee of S$5.35 (inclusive of GST) instead of S$10.70 (inclusive of GST)

How will my handling fees be calculated?

Your handling fee will be deducted on a monthly basis. Every month before the transaction date, your Total Portfolio Value (“TPV”) will be calculated.

Here is an illustration of how your fees will be calculated:

| TPV | 0.3% p.a. × TPV ÷ 12 months | Fees Charged |

| S$1,000 | S$0.25 | S$1.00 |

| S$10,000 | S$2.50 | S$2.50 |

| S$38,000 | S$9.50 | S$8.88 |

| S$40,000 | S$10.00 | S$5.88 |

For example, if your TPV is S$1,000 and you have indicated $300 as your investment amount for SIA, a handling fee of S$1 (exclusive of GST) will be deducted. The actual investment amount for SIA will be S$299 for that month.

To view your TPV using:

Login > Acct Mgmt > Regular Savings Plan (RSP) > Share Builders Plan (SBP) > Portfolio > Total Market Value

POEMS Mobile 3 App:

Login > Trade > RSP > Share Builders Plan > Holdings > Total Market Value

*To note that if your SBP is suspended, you will not be charged handling fees*

Will I be entitled to the dividend payment?

Yes, you will be entitled to dividends that declared by the respective company that you hold the shares. The cash dividends will be reinvested to your preferred counter by default. The cash dividends can also be paid out to you on request before reinvested into your preferred counter.

We will not impose additional fees if the cash dividend amounts is less than S$1, or the cash dividend amount is less than or equal to the dividend charges.

What about bonus issue and capital distribution?

For bonus issue, it will be allocated to you based on the issue ratio and the number of shares you hold. As for capital distribution, it will be calculated and credited into your ledger balance.

Will I receive entitlements to a rights issue?

Yes, you will be credited with the rights entitlement based on your shareholdings.

Am I able to subscribe for the rights issues allocated to me?

SBP is a low cost saving product that presents an opportunity for client to invest in stock market to buy odd lots securities at a reduced cost. Therefore, to meet our objective to keep the product affordable for everyone, PSPL will arrange for the Rights Shares (the “Rights”) to be sold as “nil-paid” rights on the SGX-ST during the trading period. The net proceeds allocated after the deduction of a minimal handling fee of SGD5.35, if any, will be credited into your SBP to form part of the excess funds and will be reinvested into your preferred counter. If you would like to withdraw any excess funds from your SBP, you may do so by informing your respective trading representative at least 3 business days prior to the monthly “Transaction” date.

Am I able to opt for Scrip Dividends under Scrip Dividends Scheme (SDS)?

PSPL will arrange for SDS to be automatically elected as Cash Dividends. The net proceeds allocated after the deduction of minimal Dividends Charge of 1%, (minimum SG$1.07 capped at SG$53.50 – inclusive of GST) if any, will be credited into your SBP to form part of the excess funds and will be reinvested into your preferred counter. If you would like to withdraw any excess funds from your SBP, you may do so by informing your respective trading representative at least 3 business days prior to the monthly “transaction” date.

What if the share counter that I am buying is suspended / halted on the execution day?

If the share counter is suspended / halted on the execution day, the funds for investment will be rolled over to be invested in the preferred counter the following month.

Who can I contact for more detailed information with regards to SBP?

You can contact your respective Financial Adviser/Trading Representative for assistance or Talk to Phillip at

6531 1555/talktophillip@phillip.com.sg or email to rsp@phillip.com.sg

Unit Trust Regular Saving Plan

Unit Trust RSP is an investment plan that offers a consistent and disciplined means of investing into a particular fund.

It adopts the concept of dollar cost averaging whereby more units are bought when prices are low and lesser units when prices are high. As a result, in times of fluctuating markets, the average cost for all the units can be lower than the average price during the same period.

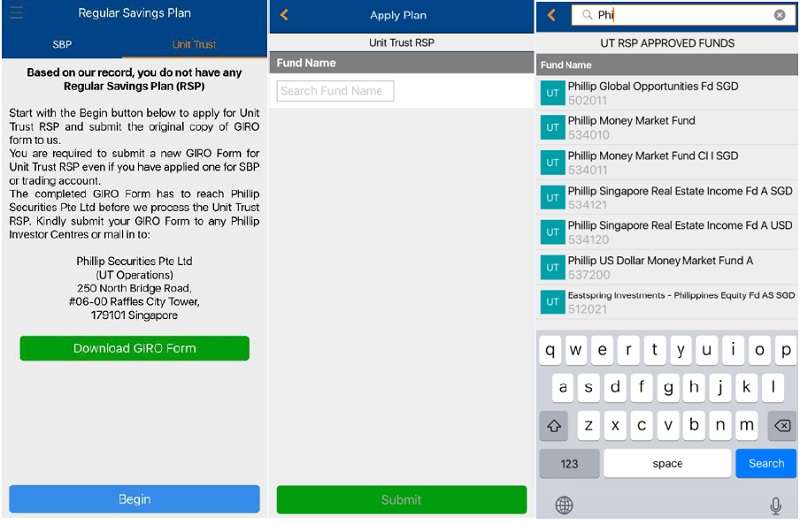

Simply start a new UTRSP plan via Acct Mgmt > Regular Savings Plan (RSP) > Unit Trust RSP > Apply Plan. Setting up of GIRO linkage is not required unless your bank information has changed. Alternatively, you can apply via POEMS Mobile 2.0 by following the steps below:

Firstly, log in to POEMS Mobile 2.0 and navigate to Regular Savings Plan (RSP). Next, select Unit Trust.

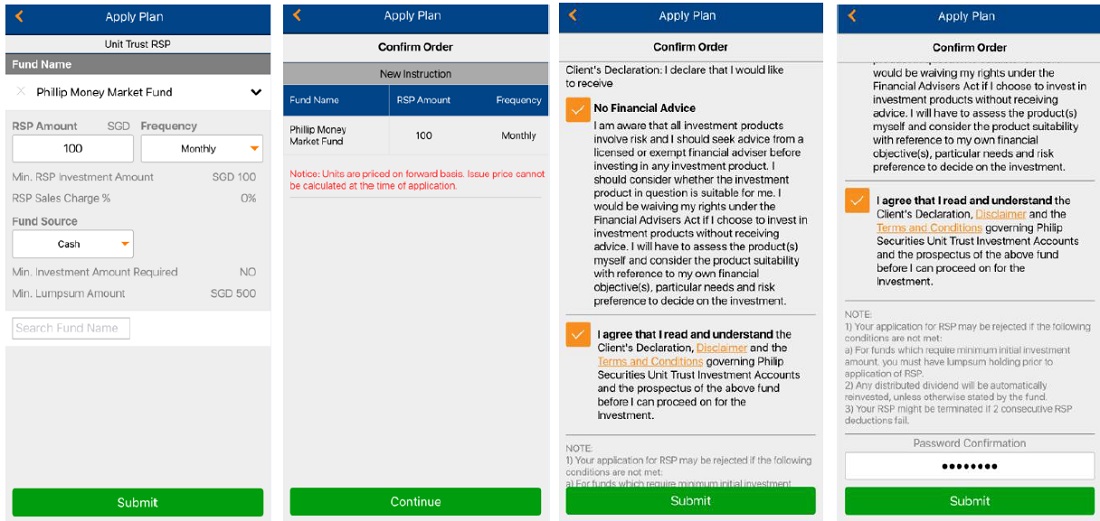

Tap on the Begin Button to start > Type the RSP fund in the Search Fund Name column and select the fund from the list

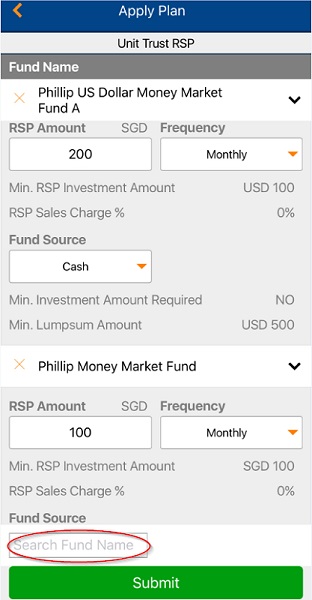

Input the RSP amount in SGD, frequency and fund source > Submit > Continue > Submit > Submit

To subscribe more funds for RSP, select [Search Fund Name] and complete them with the steps above

Please go to UTRSP > Search Unit Trust Regular Saving Plan > Look under each fund’s fund information.

You can apply online via POEMS or visit any of our Phillip Investor Centres.

For online applications via POEMS, kindly follow these steps:

Login to POEMS > Acct Mgmt > Regular Savings Plan (RSP) > Unit Trust RSP > Investment Instruction > Apply Plan

For new Unit Trust RSP application, the plan will commence only when the GIRO Linkage Application has been received by Phillip Securities Pte Ltd (PSPL), and approved by the respective banks. For non-cash RSP, there must be CPFOA/SA/SRS details tagged to your account.

Note: Applications received will take up to 30 business days to come into effect.

You can download and complete the GIRO form via the link below and mail to us using the business reply envelope below. Alternatively, you can submit to any of our Phillip Investor Centres for assistance.

You will be notified by the bank first when your GIRO is approved. A letter will then be sent to your mailing address after we have received the status of your GIRO linkage from the bank.

Additionally, you can login to POEMS to check your status via Acct Mgmt > Regular Savings Plan (RSP) > Unit Trust RSP > Investment Instruction.

You may prefund to kick start your Unit Trust RSP while pending the GIRO Linkage approval via the prepayment option.

You can seek assistance from your servicing representative or visit any of our Phillip Investor Centres for the arrangement.

Unit Trust RSP subscription will be on the 7th (T-day) calendar day of the month, if the 7th falls on a weekend or public holiday, it will be on the next business day.

Deduction details as follow:

- For Cash investment, money will be deducted from your bank account on T-3 day, depending on bank processing timeline

- For CPF/SRS investment, money will be deducted from your CPF account/SRS agent bank on T-1 day.

Please ensure that you have sufficient funds in your account before the deduction date (T-3) to prevent failed deductions.

A failed GIRO deduction fee may be imposed to your account by your bank. You may reach out to your bank should you require further clarification.

If there is an insufficient amount in your bank/CPF account, GIRO deduction would be unsuccessful and there will be no Unit Trust RSP investment for that month.

For Unit Trust RSP via cash, there will be no penalty. However, your Unit Trust RSP will be terminated after 3 consecutive months of unsuccessful deductions.

For Unit Trust RSP via CPF, a penalty charge may be imposed by the CPF bank. Your Unit Trust RSP will be terminated after 3 consecutive months of unsuccessful deductions.

Please ensure that you have sufficient funds in your account before the deduction date (T-3) to prevent failed deduction.

A failed GIRO deduction fee may be imposed to your account by your bank. Please reach out to your bank should you require further clarification.

If your holdings are at or above the minimum holding amount or minimum units required by the Fund Manager, your holdings will remain unchanged. You may retain them as a long-term investment.

If your holdings are below the minimum holding amount or minimum units required by the Fund Manager, you will be requested to redeem your holdings. If you wish to retain your holdings in this case, you may purchase more units to fulfil the minimum holding amount or minimum units and continue your investment.

Amendment of investment instruction(s) such as change of funds (including increasing or reducing the fund to invest), investment amount, fund source or frequency can be done via POEMS or physical form. No charges will be imposed for any changes made.

a. Amendment(s) via POEMS:

Login to POEMS > Acct Mgmt > Regular Savings Plan (RSP) > Unit Trust RSP > Investment Instruction > Amend

Please note that amendment(s) made via POEMS will not be reflected immediately. The updated investment instruction will be reflected after it has been processed. Instructions received via POEMS will take up to 30 business days to come into effect.

b. Amendment(s) via Physical Form

Kindly seek assistance from your Financial Adviser Representative or visit any of our Phillip Investor Centres to complete the form submission.

Form submissions received will take up to 30 business days to come into effect.

Note:

Some funds will require a minimum initial investment. For such funds, you must have lumpsum holdings prior to the application or amendment of the Unit Trust RSP. Otherwise, your application or amendment for the Unit Trust RSP may be rejected.

You may terminate your Unit Trust RSP as follows:

a. Partial Termination (Amendment)

Partial termination of Unit Trust RSP is termed as Amendment. For amendment, you may submit online via POEMS 2.0/Mobile or physical form.

b. Full termination

If you would like to have a full termination of all the Unit Trust RSPs, you are required to submit the physical termination form with the assistance from the respective Financial Adviser Representative or visit any of our Phillip Investor Centres.

All RSP amendments/terminations will take up to 30 business days to come into effect.

Your Unit Trust RSP will not be terminated when full redemption is made on the particular fund(s).

You will have to submit the amendment/termination via POEMS 2.0, Mobile or physical form after redemption as specified in the question above (How can I terminate my Unit Trust RSP?).

All submission of RSP amendments/terminations will take up to 30 business days to come into effect.

If the fund is temporarily suspended or closed for subscriptions, your subsequent Unit Trust RSP will be stopped until the fund is open for subscription.

If the fund has been suspended or closed to subscriptions indefinitely, your Unit Trust RSP will be terminated. Your existing holdings will remain unchanged unless the fund is to be closed.

Recurring Plan

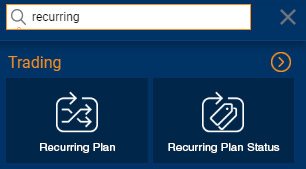

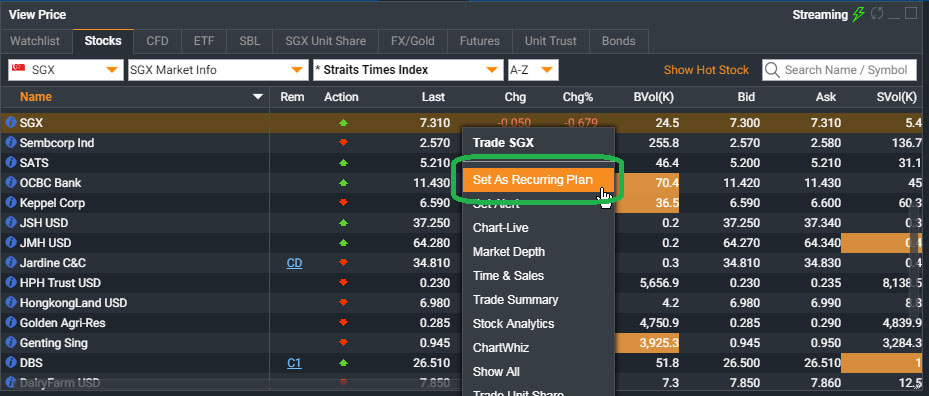

Open the Recurring Plan widget. There are 2 ways you can create a Recurring Plan.

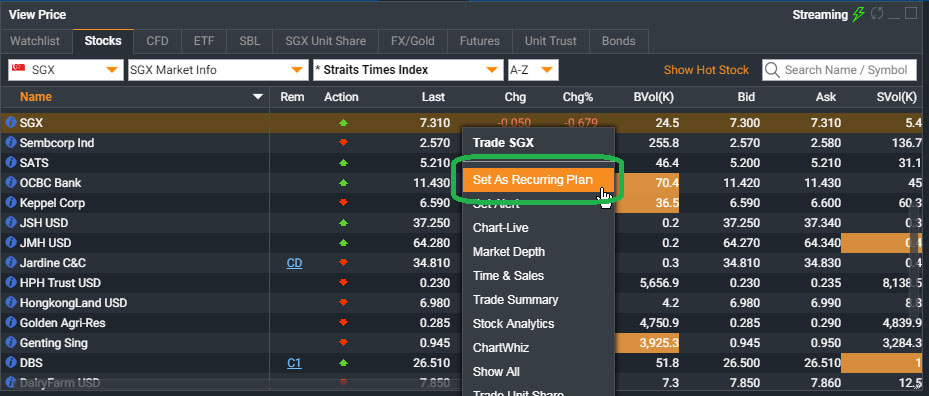

Search for your desired counter that you wish to set a Recurring Plan for. Right click on the selected counter and select “Set as Recurring Plan”

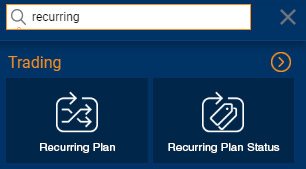

Create a new widget and search for “recurring”. Select the “Recurring Plan” and search for the counter using the search bar.

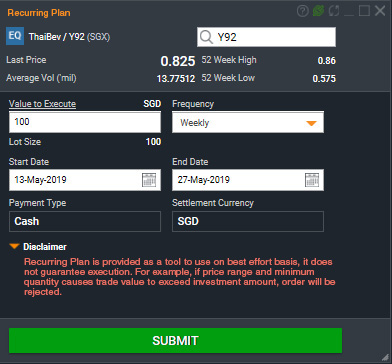

Step 2:

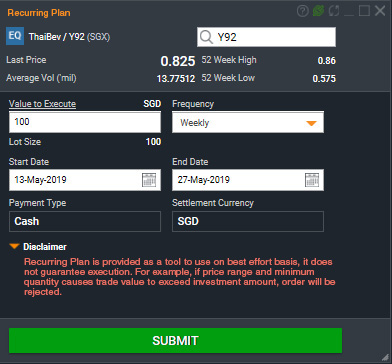

Key in the value, frequency, start date and end date of the Recurring Plan that you wish to place. Key in your password and submit.

Step 3:

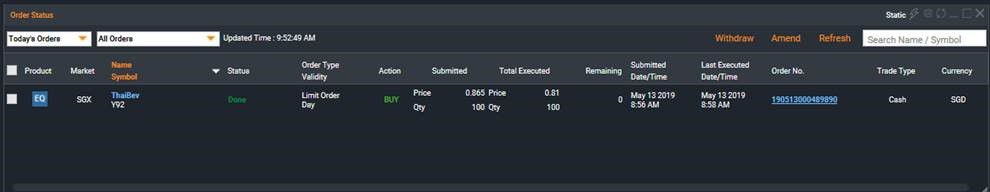

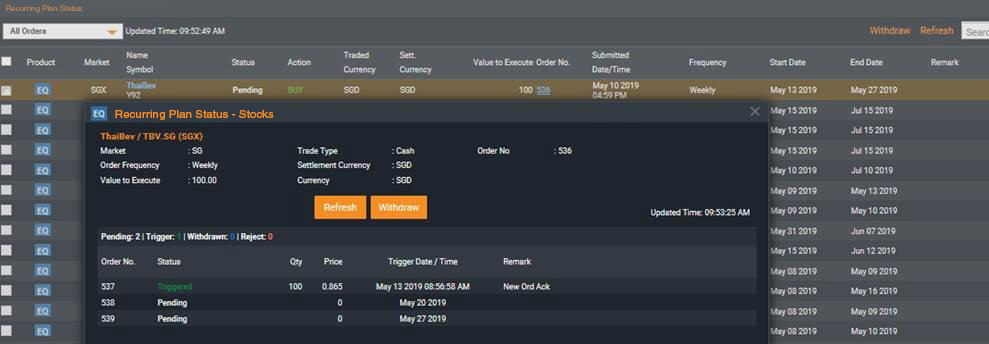

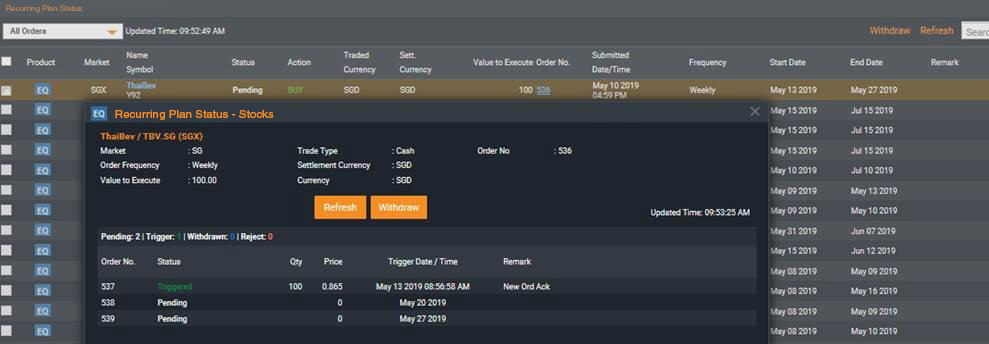

Check the order status under the “Recurring Plan Status” widget to ensure that the details are correct.

Step 4:

Click on the Parent Order number to view details of the Child Order status. The Child Order status will indicate “Triggered” if the order has been successfully sent to the market on the actual trigger date.

Step 5:

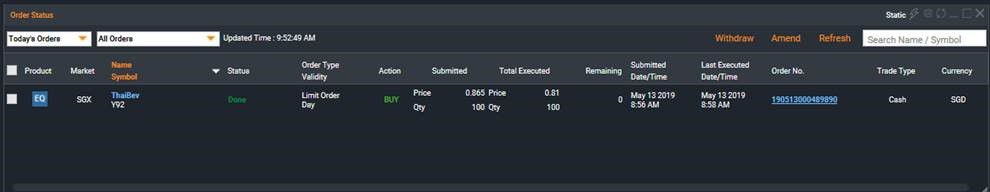

Open the Order Status widget to view the quantity and actual price executed for the Child Order. The contract will be created the next day, and you will be able to view it under the Account Management Widget.

| Benefits | Risks |

|---|---|

| Use of Dollar Cost Averaging (DCA) | Cannot control the buy price |

| Manage market risks | Commission may be a consideration if your investment amount is small |

| Disciplined way of regular investing | |

| Accumulate position before announcements |

| Recurring Plan | Share Builders Plan | Unit Trust Regular Savings Plan |

||

|---|---|---|---|---|

| Counters Available | All US, Hong Kong and Singapore counters |

50 Singapore Counters | More than 500 funds | |

| Frequency | Opt for Daily, Weekly, Monthly or Quarterly |

Monthly | Monthly or Quarterly | |

| Minimum Amount | $100 | $100 | $100 | |

| Payment Mode | Fund transfer, Debit from ledger/ Money Market Fund(MMF) | GIRO | GIRO | |

| Account Type | Phillip Investment Account | |||

| Charges / Handling Fees | Prevailing account brokerage rates apply |

0.3% per annum of Total Portfolio Value ("TPV") Min. S$1 per Month |

0% Sales Charge | |

| TPV < S$40,000 | Capped at S$8.88 per month | |||

| TPV ≥ S$40,000 | Capped at S$5.88 per month | |||

- Blue-Chips Stocks for capital appreciation and dividend income

- REITs and Retail Bonds for dividend income

- ETFs tracking broad base index, commodities etc

- The minimum value has to be higher than $100 in the respective currencies (ie SGD, HKD or USD) and;

- The value of the minimum executable quantity of the counter, which can be derived by multiplying the counter lot size by the last traded price

| Frequency | Maximum Duration (From start to end) |

| Daily | Not more than 3 months |

| Weekly | Not more than 1 year |

| Monthly | No limit |

| Quarterly | No limit |

Invested Amount: $1000

Investment Interval: Every 1st Trading Day of the Month

Brokerage per Investment: $10

Invested Amount:

Investment Interval:

Brokerage per Investment:

$1000

Every 1st Trading Day of the Month

$10

| Date | Price | Quantity | Total Amount Invested | Total Amount Invested Including Brokerage | Total Quantity To Date | Total Amount Invested to Date | Average Price/ Stock to Date | Current Gains |

|---|---|---|---|---|---|---|---|---|

| 1-Oct-18 | 0.68 | 1400 | $952.00 | $962.00 | 1400 | $962.00 | $0.68 | - |

| 1-Nov-18 | 0.625 | 1600 | $1,000.00 | $1,010.00 | 3000 | $1,972.00 | $0.65 | (77.00) |

| 3-Dec-18 | 0.64 | 1500 | $960.00 | $970.00 | 4500 | $2,942.00 | $0.65 | (32.00) |

| 2-Jan-19 | 0.61 | 1600 | $976.00 | $986.00 | 6100 | $3,928.00 | $0.64 | (167.00) |

| 1-Feb-19 | 0.735 | 1300 | $955.50 | $965.50 | 7400 | $4,893.50 | $0.65 | 595.50 |

| 1-Mar-19 | 0.815 | 1200 | $978.00 | $988.00 | 8600 | $5,881.50 | $0.68 | 1,187.50 |

ThaiBev on ChartLive from 1st Oct 2018 to 22nd Mar 2019

Past performance figures as well as any projection or forecast used in this publication are not necessarily indicative of future or likely performance of any securities.

Past performance figures as well as any projection or forecast used in this publication are not necessarily indicative of future or likely performance of any securities.- Minimum value to execute should be 100

- The minimum value to execute should be at least $100 (in the respective currency).

- Minimum executable quantity has exceeded requested value

- The value to execute must be higher than the minimum tradable value (ie. lot size x traded price).

- Order rejected due to price abnormality, contact dealer

- The order was rejected due to a wide Bid/Ask spread of 10% and more than 30 ticks.

Junior Share Builders Plan

Every child is a precious gift to us and we want the best for them. Open a Junior Share Builders Plan jointly with your child to give them a head start in life. You can start up with as low as S$100 a month with any counters that are available in Share Builders Plan.

Important Notice: To apply for Junior Share Builders Plan, main parent applicant should have an existing POEMS account.

You may also visit any of our Phillip Investor Centres and bring along your required documents to start up now:

- NRIC

- Singaporean & Singapore PR or

- Employment/ S-Pass and Passport (Foreigner) of Parent/Legal Guardian

- Birth Certificate or proof of guardianship of the child

- A bank account number that you want to use for the Inter-bank GIRO deduction

Unit Trust Regular Savings Plan

Think BIG. Start small…

Unit Trust Regular Savings Plan aims to turn market fluctuations to your benefit by managing risk with Dollar Cost Averaging. In this scheme, you enjoy the potential returns, reasonable risk and cost effectiveness of Unit Trust with a risk management tool.

There are wide ranges of Unit Trust funds in Phillip which offer Regular Savings Plan facility.

At Phillip, we provide a range of UTRSP-approved funds for your selection. You may use the filters below to find a suitable for your investment needs:

Recurring Plan

Think BIG. Start small…

Recurring Plan gives you more control over your investments. It works similarly to the other plans, whereby it aims to manage market risk through the use of Dollar Cost Averaging. You gradually build your portfolio over a period of time with a fixed amount of regular investment that is determined by you, purchasing more units when the price is low and fewer units when price is high. The main difference is that while you only get to choose from the 44 stocks available in the Share Builder’s Plan, you get to choose from the entire pool of Stocks and ETFs in the US, Hong Kong and Singapore market for the Recurring Plan! Beyond the increased pool, you also get to choose your own interval – daily, weekly, monthly or quarterly – giving you greater flexibility.

Open the Recurring Plan widget. There are 2 ways you can create a Recurring Plan.

Search for your desired counter that you wish to set a Recurring Plan for. Right click on the selected counter and select “Set as Recurring Plan”

Create a new widget and search for “recurring”. Select the “Recurring Plan” and search for the counter using the search bar.

Step 2:

Key in the value, frequency, start date and end date of the Recurring Plan that you wish to place. Key in your password and submit.

Step 3:

Check the order status under the “Recurring Plan Status” widget to ensure that the details are correct.

Step 4:

Click on the Parent Order number to view details of the Child Order status. The Child Order status will indicate “Triggered” if the order has been successfully sent to the market on the actual trigger date.

Step 5:

Open the Order Status widget to view the quantity and actual price executed for the Child Order. The contract will be created the next day, and you will be able to view it under the Account Management Widget.