FOMC Meeting: What Happens When Interest Rates Rise? August 3, 2021

In Part 2 of our series on inflation and interest rates, we look at June 2021’s FOMC meeting. The US Federal Reserve’s Federal Open Market Committee or FOMC meetings set inflation expectations and interest rates. These have a direct effect on stock markets globally.

During this period of inflation upswing, we share with you how you can position your portfolio to take advantage of a potential increase in interest rates.

At a glance:

- The Fed’s FOMC decisions on interest rates make borrowing either more or less expensive. This has a direct effect on the economy and thus, stock markets.

- June’s FOMC meeting maintained the status quo on interest rates. The Fed, however, tilted towards hawkishness, signally potential rate hikes in 2023 rather than 2024.

- With strong short-term inflationary pressure, markets fear that interest rates may be raised sooner than later to rein in inflation. Monetary easing would also end.

- Rising interest rates serve as tailwinds for financials and value stocks. Over the longer term however, growth stocks are expected to outperform, given structural changes, especially in tech.

What are FOMC meetings?

FOMC meetings are held by the US Federal Reserve eight times a year, or about once every six weeks. At these meetings, Fed officials discuss the trajectory of the US economy and decide on the appropriate monetary policy to adopt. These meetings are one of the most closely watched events by investors due to their impact on interest rates. The Fed uses interest rates as a policy tool to achieve two economic objectives: maximum employment and price stability1.

Due to the size and integration of the US economy with the rest of the world, the FOMC’s decisions reverberate across global financial markets. As such, investors around the globe will try to predict the FOMC’s decisions on monetary policy and adjust their portfolio allocations ahead of changes.

Fig 1. At 4.2%, inflation is at its highest since the 2008 financial crisis

Fig 1. At 4.2%, inflation is at its highest since the 2008 financial crisis

June’s FOMC meeting was one of the most important events this year. It was widely expected to signal any change in the Fed’s policy, after inflation galloped to 4.2% in April 2021, a 13-year high (Fig 1). This was a level not seen since August 20082. The previous surge in inflation in 2008 preceded the 2008 financial crisis. Markets were, therefore, nervous that this bout of inflation could be a prelude to a similar economic meltdown.

The June meeting

At the June meeting, Fed officials concluded that:

- The Fed Funds rate would be unchanged at the target range of 0-0.25%

- The Fed would continue to purchase at least US$120bn of securities per month

- Headline inflation expectations were bumped up to 3.4%, from 2.4%

- Rates could be raised twice in 2023, rather than 20243

The highly-anticipated meeting thus ended with no major policy shocks. The Fed chose to maintain support for the fragile economic recovery from the pandemic. While acknowledging that inflation is rising faster than expected, it still attributed this to transitory factors. These include supply bottlenecks and pent-up demand from the pandemic. Once they subside, the Fed thinks inflation will normalise.

Fig 2. The Fed cited the fall in lumber prices from their record high in May

Fig 2. The Fed cited the fall in lumber prices from their record high in May

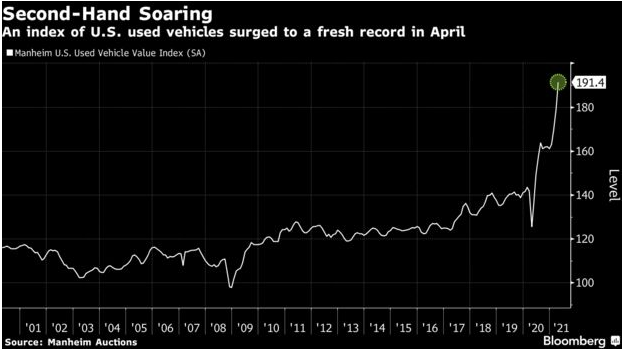

Fig 3. It thinks the record prices of used autos will follow suit soon

Fig 3. It thinks the record prices of used autos will follow suit soon

Fed chairman, Jerome Powell, used falling lumber prices and the surge in used-car prices in the US to make his case about the transient nature of this round of inflation. Lumber prices shot up quickly from 2020 due to supply shortages and bottlenecks. They have fallen more than 43% since touching a record high in May. Used-car prices, that recently accounted for the bulk of the increase in core inflation, similarly surged in an environment of very strong demand and limited supply. As such, they could soon follow lumber’s trajectory4(Figs 2-3).

The central bank thinks that the trend will reverse once supply-chain disruptions ease. It has assured markets that it is monitoring the risk of run-off inflation very closely. Any measures to rein in inflation will be communicated to the market well in advance before actual tapering.

The FOMC, therefore, has largely maintained its accommodative stance. The main change in June was its projected timeline for rate hikes. This has been brought forward to 2023 from 2024, signalling a tilt towards hawkishness5.

Future expectations of the Fed: What happens when interest rates rise?

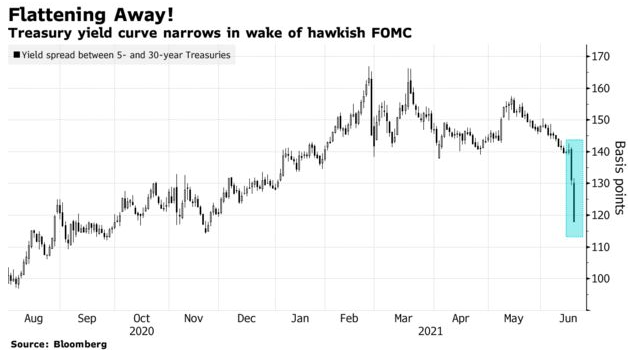

Fig 4. Yield curve flattened after the FOMC leaned towards hawkishness

Fig 4. Yield curve flattened after the FOMC leaned towards hawkishness

The June announcement, nevertheless. sent shock waves across financial markets. The dollar and Treasury yields jumped, especially shorter-duration Treasuries. Stocks retreated.

All three stock indices fell, with the Dow and S&P 500 losing 3.5% and 1.9% respectively in their worst week since October and February respectively6. The increase in the yields of shorter-duration Treasuries narrowed their spreads with longer-dated treasuries, flattening the yield curve (Fig 4).

This is typical in a rising-interest-rate environment. Higher short-term yields reflect expectations of a rate increase to cool an overheating economy. Falling long-term yields reflect a slowing economy due to policy tightening by the Fed.

But while the Fed can directly influence short-term interest rates, long-term rates are determined by the demand and supply of long-dated Treasury yields. These represent market sentiment on the economic outlook.

With limited direction provided at the latest FOMC meeting, markets are looking towards the next meeting in August, during the Fed’s annual Jackson Hole Symposium. That meeting is historically used for significant announcements on interest rates and monetary policies. With current inflation consistently exceeding estimates, the Fed is widely expected to discuss tapering. That said, any paring back of securities purchases is expected to be slow, stretching over many months. With the looming end of quantitative easing, current expectation is at least two rate hikes in 2023.

Another reason for the Fed to tighten monetary policy is better-than-expected non-farm payroll. This has consistently beat estimates. Non-farm payroll in June increased to 850,000. It beat the revised number for May. The market was also expecting only 706,000 new jobs in June7. If the trend continues, the numbers in the coming months could inch closer to the Fed’s goal of maximum employment. The Fed would want to raise rates earlier not because of surging inflation but because of consistently better employment.

Jerome Powell’s term will also end in 2022. This adds another element of uncertainty to policies. US Treasury Secretary, Janet Yellen, is known to openly advocate higher interest rates, on the belief that “We’ve been fighting inflation that’s too low and interest rates that are too low now for a decade8. Pressure could pile on the next Fed regime to raise interest rates to support President Biden’s US$4tn fiscal spending.

Positioning your portfolio: Is inflation good for bank stocks?

In an inflationary environment, how should you position your portfolio to maintain your portfolio returns?

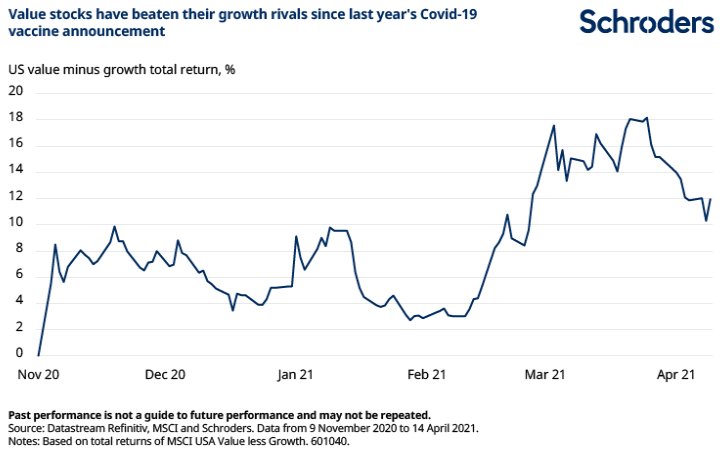

Fig 5. Value has outperformed growth since economic reopening, in reflation trades

Fig 5. Value has outperformed growth since economic reopening, in reflation trades

In the short term, you can increase allocations to value stocks, particularly sectors that will directly benefit from rising interest rates. Financials such as banks are one example.

Financials are traditionally the most sensitive to changes in interest rates. Interest income from loans is a function of interest rates. The higher the rate, the higher the profitability for banks, all things being equal. Rising interest rates also usually indicate strong economic growth. In such times, consumer confidence is higher. Borrowing and investment are likely to increase, translating into loan demand and potentially fewer non-performing loans. For exposure to financials, investors can opt for the Financial Select Sector SPDR Fund (XLY.US) and Vanguard Financials ETF (VFH.US).

Another sector that could potentially benefit is consumer discretionary. In times of economic growth, consumers have more disposable income to splurge on goods and services. These include home improvement, travel, entertainment, leisure, durable goods, automobiles, high-end goods and other big-ticket items. One example is air traffic, which has returned to 75% of pre-pandemic levels in the US9. Part of the reason is pent-up demand and another part, more disposable income. ETFs in the consumer discretionary sector include the Consumer Discretionary Select Sector SPDR Fund (XLY.US) and Vanguard Consumer Discretionary ETF (VCR.US).

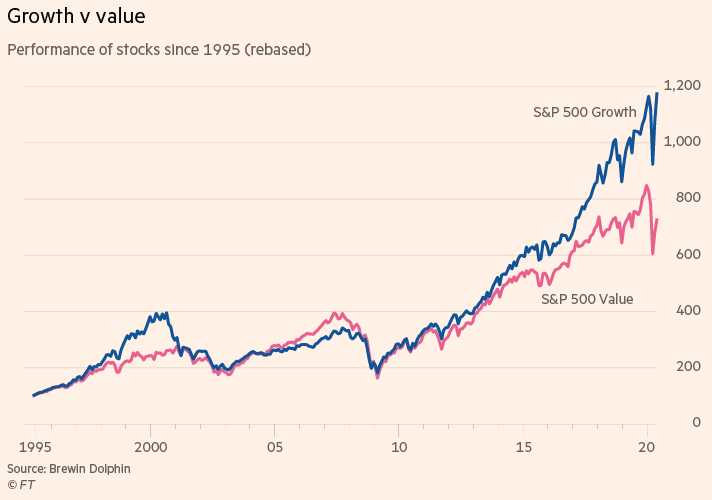

Fig 5. Outperformance of growth vs value over a 25-year period

Fig 5. Outperformance of growth vs value over a 25-year period

While growth stocks could be hurt by higher interest rates, over the longer term, they could still be attractive, when inflation normalises. Growth stocks outperformed their value counterparts in the past decade (Fig 5). The tech sector, in particular, leapfrogged the market during the pandemic. The pandemic forced about numerous structural shifts such as e-commerce, online shopping and virtual meetings. The accompanying technological innovations have made some industries less significant or redundant.

Whether there is inflation or not, transformation is likely to continue in the near future. Countries are in a race to be the leading technology country in the world. This ambition supports further innovations in the tech sector.

Moreover, tech companies generally have pricing power due to stickiness of the products. This can insulate them from inflationary pressures to a certain extent, as they can pass on higher input prices to their customers. While their stock valuations have skyrocketed, their valuation premiums are generally warranted by their competitive advantages.

Investors interested in exposure to tech or growth stocks through ETFs may look at the Invesco NASDAQ Internet ETF (PNQI.US) or iShares Expanded Tech Sector ETF (IGM.US).

Investors may also adopt the Rule of 40 as a rule of thumb for stock selection of future growth leaders. They can tap POEMS’ thematic portfolio of ‘World Leaders with Rule of 40’.

Bottom line: Stocks to buy when interest rates rise

The short-term impact of inflation and higher interest rates may favour rotation to the value sector. However, the risk is that this sector may underperform its growth counterpart once the reflation trade fades and inflation stabilises.

Investors could do better by constructing a barbell portfolio, with a focus on each of the value and growth themes. This helps their portfolios rotate to the value sector in the short term while leveraging current buying opportunities in growth stocks. It is probably unwise to consider unwinding an entire position because of the fear-of-missing-out herd mentality.

Ultimately, investors should focus on investing in companies with fundamental value that will benefit from structural shifts in the economy over the long term.

Enjoy what you’ve read? Stay tuned for the next part of our series!

Reference:

- [1]https://www.federalreserve.gov/monetarypolicy/fomc.htm

- [2]https://www.cnbc.com/2021/06/10/cpi-may-2021.html

- [3]https://www.federalreserve.gov/newsevents/pressreleases/monetary20210616a1.html

- [4]https://www.foxbusiness.com/economy/feds-powell-uses-lumber-prices-to-explain-inflation-path

- [5]https://www.cnbc.com/2021/06/16/the-federal-reserve-now-forecasts-at-least-two-rate-hikes-by-the-end-of-2023.html

- [6]https://www.cnbc.com/2021/06/18/the-fed-will-continue-to-dominate-the-market-in-the-week-ahead-after-sell-off.html

- [7]https://www.cnbc.com/2021/07/02/jobs-report-june-2021.html

- [8]https://www.nbcnews.com/business/economy/road-recovery-may-be-paved-higher-interest-rates-treasury-secretary-n1269890

- [9]https://www.forbes.com/sites/jemimamcevoy/2021/06/01/memorial-day-weekend-travel-returns-to-nearly-75-of-pre-pandemic-levels/?sh=4521c0494c4b

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng (Dealer) & Roger Chan (Manager)

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Roger holds a Business Degree in Electronic Commerce from the Monash University and is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He currently heads the Global Markets Night Trading team assisting clients with the US and European markets.

Prior to the night desk, he was a bond trader at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge.

Outside work, he trains and is an active competitor in the martial art of Brazilian Jiu-Jitsu. He finishes at the podium frequently and is also the 2015 Pan Asian BJJFP champion. His other interests include chess and reading.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!