How to Invest in Disruptive Technologies January 6, 2021

What this report is about:

- Low interest rates and shifting consumer behaviours have accelerated the adoption of disruptive technologies.

- Disruptive technologies displace established ones and change the way we do things.

- Investing in disruptive companies comes with a high degree of risk. Investors must consider four factors before investing: 1) proof of concept, 2) scalability, 3) valuations and 4) media coverage.

- Investors can gain exposure to the long term growth prospect of disruptive companies via ETFs like ARKK, ARKW, ARKG, ARKQ and ARKF

Winds of Change

The COVID-19 pandemic has brutally shaken up the global macroeconomic environment. It has led to historically low interest rates and extremely dovish monetary policies as central banks scramble to uplift their economies.

Low lending rates provide cheap and easy access to capital. This is vital for high-growth tech companies looking to innovate or expand.

At the same time, pandemic lockdowns have forced whole populations to turn to technology to overcome the physical barriers in many aspects of our lives. This has resulted in paradigm shifts in consumer behaviour.

Hence, the pandemic has effectively laid the foundation for innovative tech companies to prosper and accelerated the demise of certain traditional sectors. This has inevitably pivoted investors’ attention to all manner of disruptive technologies.

It explains this year’s exuberant influx of capital into sector disruptors and the astronomical surge in the share prices of Tesla (NASDAQ: TSLA), Lemonade (NYSE: LMND), Zoom (NASDAQ: ZM), Square (NYSE: SQ) and their likes.

But what exactly is “disruptive technology”?

Disruptive Technology

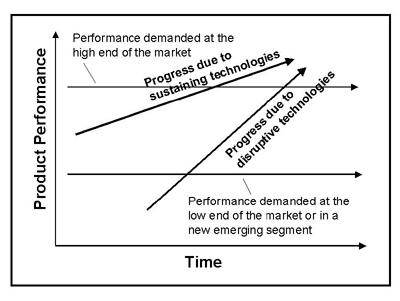

There are two types of technology: sustaining technology and disruptive technology.1

Sustaining technologies are technologies that improve existing product performances.

Disruptive technologies are new or emerging technologies that displace established technologies. They change the way we do things drastically.2

How does this happen? As incumbent businesses focus on improving products and services for their most profitable customer segments, they often neglect the needs of the emerging segments. New entrants target these segments, by tailoring solutions to meet their needs, usually at a lower cost or greater convenience with the use of disruptive technologies.

The disruptors then move upmarket by improving on their performances and delivering the required functionality to mainstream customers. In the process, they grab market share away from the incumbents and shake up the established industries.

Disruptive technologies don’t come by every day but when they do and succeed, they can precipitate the downfall of highly successful companies that are only prepared for sustaining technologies.

Identification of companies with disruptive technologies can be difficult due to the scarcity of information on the emerging segments. Market reception to emerging technologies is also unknown.

This makes investing in disruptive technologies risky as the market may not take to the innovations. On the other hand, companies with successful disruptive technologies can offer multi-fold returns to investors.

Still, how can investors spot companies with potentially ground-breaking disruptive technologies before they overtake traditional sustaining technologies?

Consider these.

Proof of Concept

Proof of concept is evidence that a business model or idea is feasible and profitable.

Tesla’s electric vehicles are examples of a proven concept. To illustrate, Tesla has a growing user base for its range of electric cars. These cars have proven to be roadworthy with their Autopilot feature. Tesla is now building up the self-driving capability of its cars and car owners are expected to be able to subscribe to this feature by 2021.3

Investors must not mistake prototypes for proof of concept. Prototyping is the release of an early sample or model to test a concept or product. A product in its prototyping phase has not yet been launched or sold to the public.

An example is Nikola (NASDAQ: NKLA). At the point of its IPO in June 2020, Nikola had no product, proven technology or mass scalability plan. Only in November 2020 did the company claimed that it had completed the first prototype of its Tre semi-truck. Even then, only images of the prototype were released to the public.

Investing in companies with a proven concept or product minimises the risk of failure and potential investment losses.

Scalability

Scalability refers to a company’s ability to grow without being inhibited by its structure or available resources when it increases production. A scalable company can maintain or improve its profit margins while sales volumes increase.

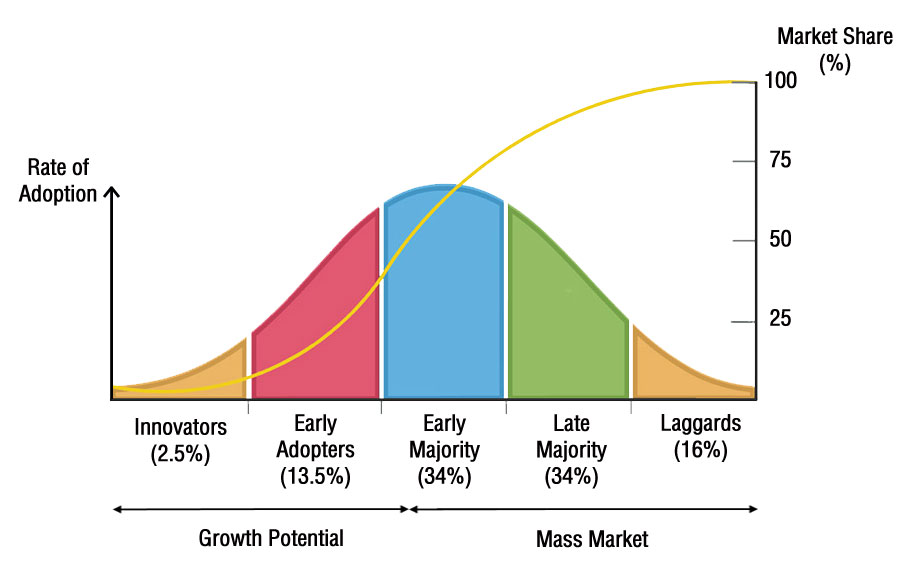

Disruptive technologies are mainly adopted by a niche segment of consumers in their early state. These users are the “innovators” and “early adopters”. Companies with disruptive technologies must be able to diffuse their products or services to the mass market and remain profitable to survive and disrupt the established industries.

High-growth opportunities can be found in certain tech companies that can scale rapidly. Tech companies that produce or deliver digital goods and services can bypass traditional warehouse, labour and inventory management costs. Thus, there is no need to invest heavily in supply-chain facilities to grow quickly.

For example, Lemonade is an insurance company that provides a digital platform for clients to subscribe to its insurance packages. This does away with all the traditional paperwork and agent fees.

In addition, Lemonade uses artificial intelligence (A.I.) to speed up its subscription and claim processing. About 30% of the claims it receives can be paid instantly after verification by Lemonade’s anti-fraud algorithms. Complex claims are handled by its employees.6

The use of big data and A.I. significantly reduces labour and intermediary costs and enables Lemonade to scale up its business digitally.

Valuations

Most new companies with disruptive technologies are still in their infancy phase. They may have a high cash burn rate because of their R&D or marketing expenses. As a result, net income is often negative for the majority of these companies.

Traditional metrics like Price-to-Earnings ratio (P/E), Return on Assets (ROA), and Return on Equity (ROE) are usually not applicable in the valuation process due to the negative earnings.

The most important metric for valuing disruptive companies is usually revenue growth. Having an increasing revenue stream decreases their net cash burn rate and the need for them to raise more capital via debt or new shares issues – both of which are detrimental to existing shareholders.

Other metrics include user growth rates, subscription growth rates, spending growth per user, etc. These metrics can capture their expanding market share and growing acceptance of the new technologies by the mass market.

However, failure to hit analysts’ consensus estimates for these metrics can result in a substantial selloff of their shares.

Media Coverage and Hype

The last, and perhaps, the most controversial factor will be the media coverage and hype surrounding the disruptive companies and sectors. Some readers may not agree with this factor but it is an important catalyst of growth for disruptive companies.

According to Keynesian beauty contest theory, the stock market is like a beauty contest where market participants are rewarded for selecting the most popular stocks, not the stocks they like.

Media publicity of disruptive sectors can drive up the popularity of stocks in trending industries like electric vehicles, digital payment, A.I., etc. It can help attract attention to these companies and induce the mass market to try out their products and services.

But overhyped media coverage can cause overreactions in the market. Stocks can become excessively bought or sold for psychological reasons rather than company fundamentals. The bubble that forms generates superior returns but the crash that may follow can lead to devastating losses for investors.

Exchange-Traded Funds

Investing in disruptive technologies can be a very risky venture. According to the Harvard Business School, the failure rate for new products can be as high as 95%.7

The unsystematic risk (company-specific risk) of investing in individual disruptive companies is very high. This is attributed to the capital-intensive nature of the companies during their growth stage and the high failure rates for their product development or acceptance.

However, such risks can be drastically reduced through diversification among different industries and companies. Instead of trying to pick a winning company, a better strategy is to reduce your concentration risks by spreading out your investments across different companies with disruptive technologies.

ARK Invest is an asset management firm that specialises in managing funds with disruptive technologies themes. Its funds are actively managed and have the flexibility to rebalance their underlying assets in response to ever-changing tech developments.

Investors can utilise ARK Invest’s suite of Exchange Traded Funds (ETFs) to reduce their unsystematic risk exposure across the different thematic sectors. The funds give investors the chance to invest in the growth potential of different industries and reduce their transaction costs of holding onto a large number of stocks.

ARK Invest currently has five ETFs listed on US exchanges: i) ARK Innovation ETF (ARKK), ii) ARK Next Generation Internet ETF (ARKW), iii) ARK Genomic Revolution ETF (ARKG), iv) ARK Autonomous Technology & Robotics ETF (ARKQ), and v) ARK Fintech Innovation ETF (ARKF).

Investors can choose to invest in ARKK for a diversified exposure across the Internet, Genomic, Industrial and Fintech sectors. Alternatively, investors can also choose to invest in one of the four specific themes which they think may have the greatest probability of outperforming the market.

| ETF | ARK Innovation ETF | ARK Next Generation Internet ETF | ARK Genomic Revolution ETF | ARK Autonomous Technology & Robotics ETF | ARK Fintech Innovation ETF |

| Ticker | ARKK | ARKW | ARKG | ARKQ | ARKF |

| Exchange | NYSE Arca | NYSE Arca | Cboe BZX Exchange | Cboe BZX Exchange | NYSE Arca |

| AUM | US$8.9bn | US$2.4bn | US$2.3bn | US$633mn | US$674mn |

| Expense Ratio | 0.75% | 0.76% | 0.50% | 0.75% | 0.75% |

| Number of Holdings | 35-55 | 35-50 | 30-50 | 30-50 | 35-55 |

| Top 3 Holdings |

|

|

|

|

|

Information accurate as of 28 December 2020

Conclusion

To develop, launch and get an innovation adopted require the perfect combination of hard work, research, publicity and luck. Disruptive companies need adequate resources from the capital markets to finance the multiple stages of their product development and launch cycles.

Successful disruptive technologies can reward the respective companies and shareholders in multiple folds.

Despite the potential rewards, the downside risk remains very high. Over 30,000 new products are introduced annually but their success rate is only 5%.7

Several stocks have skyrocketed on the back of high hopes of their participation in the next “big” industries. If their products and services are unsuccessful, the bubble will pop and send these stocks crashing.

By using ETFs as your investment vehicle, you can diversify away from the unsystematic risk of owning individual stocks, yet gain exposure to the long-term growth prospects of companies with the potential to shake up entire industries.

Reference:

- 1 http://web.mit.edu/6.933/www/Fall2000/teradyne/clay.html

- 2 https://medium.com/@coderacademy/what-is-disruptive-technology-how-do-you-know-it-when-you-see-it-ae0ca1eee185

- 3 https://www.engadget.com/tesla-full-self-driving-subscription-early-2021-193919961.html

- 4 https://www.cnet.com/roadshow/news/first-nikola-tre-electric-semi-prototype-built-company-says/

- 5 https://sphweb.bumc.bu.edu/otlt/mph-modules/sb/behavioralchangetheories/behavioralchangetheories4.html

- 6 https://www.businessmodelsinc.com/the-business-model-of-lemonade/

- 7 https://www.inc.com/marc-emmer/95-percent-of-new-products-fail-here-are-6-steps-to-make-sure-yours-dont.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It