Iceberg Research strikes again with another Short Report February 27, 2017

Iceberg Research and Muddy Waters are examples of short activists that have been extremely vocal with their reports. Their reports have been a bane to certain companies’ stock price, forcing such companies to be on the defensive and address concerns publicly. Overall, it is to the investors’ advantage because it makes the market more efficient and aware of any asymmetric information. However, Investors ought to think about the motives of such reports, and whether it is out of self-interest or a genuine concern for the company.

One recent example is Noble.

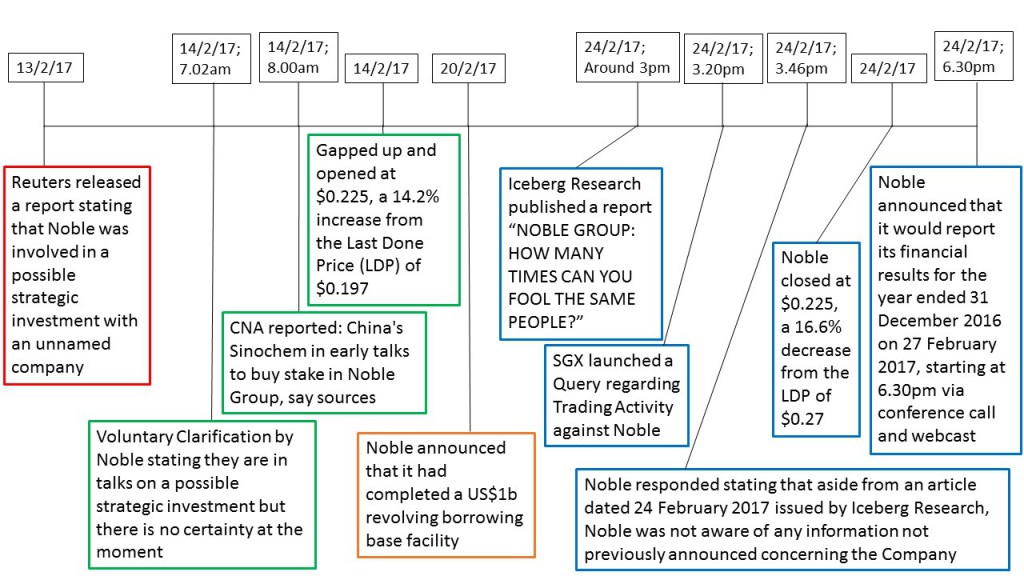

Noble stock price went through a roller coaster ride last week, resulting in increased interest by investors. The share traded with a 40% range between the week low of $0.20 and week high of $0.28. A major contributor to Noble’s volatile price movements could be the various company announcements released over the past week. High volatility and price swings were also observed on the day Iceberg made a comeback report on Noble.

Source: 10 day hourly chart for Noble from POEMS 2.0

Timeline:

Source: Timeline details derived from SGX data

Notable points on the Iceberg Research:

Source: Extracts from Iceberg Research “Noble Group: How many times can you fool the same people?”

Investors may want to take note that Noble still remains a volatile counter. Thus, investors should carry out sufficient due diligence and take caution by understanding the risks involved, before making any investment decision. Personally, I feel that Noble’s debt is a key risk for concern. It had on various occasions raised funds through various means, such as rights issue, selling of certain business units, as well as a borrowing base facility. The risk of excessive borrowings by companies have been in the spotlight many times last year with companies like Swiber, and Tech Oil&Gas going into judicial management.

Either way, such “short” reports brings to light certain concerns that may be valid and useful for market participants. However, the views provided in those reports may also be quite one sided, and investors ought to keep an open mind when reading such reports. In my personal opinion, before placing any orders every investor or trader should ask themselves certain questions. Examples would include, “What am I basing my trade on? On a speculation? On a tweet? Or something more established?” At the end of the day, the decision making process lies in the hands of the investor or trader, and the outcome of the trade would be determined by the decisions made and the market conditions.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject tIceberg Research strikes again with another Short Report o change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Siew Wei En Samuel

Equity Dealer

Mr Siew Wei En Samuel - Equity Dealer, POEMS Dealing (Toa Payoh), Phillip Securities Pte Ltd Mr. Samuel Siew currently provides dealing services to over 10,000 trading accounts and is part of the POEMS Dealing, the core in-house dealing department of Phillip Securities Pte Ltd. Apart from his Dealing role, he also gives training seminars to further enrich his clients’ financial knowledge. Samuel often conducts Market Outlook/ Educational/ Product seminars monthly for clients and Tertiary Institutions in both English and Chinese. He believes in value investing, and focuses on stocks with good company fundamentals, as well as dividend paying stocks. Samuel regularly provides market commentary for Lianhe Zaobao, Capital 95.8FM and 938 Live FM. Samuel holds a Bachelor of Degree of Commerce with a Double Major in Marketing & Finance from Curtin University.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It