Introduction to Shenzhen Stock Exchange (Series 1) December 5, 2016

Phillip Securities, Global Market department is pleased to present our emails series on the Shenzhen Stock Exchange. Since the Shenzhen-Hong Kong Stock Connect has been approved by the China government, this email series can help arm you with relevant market information, so that you will be prepared to invest in this market when it is officially launched.

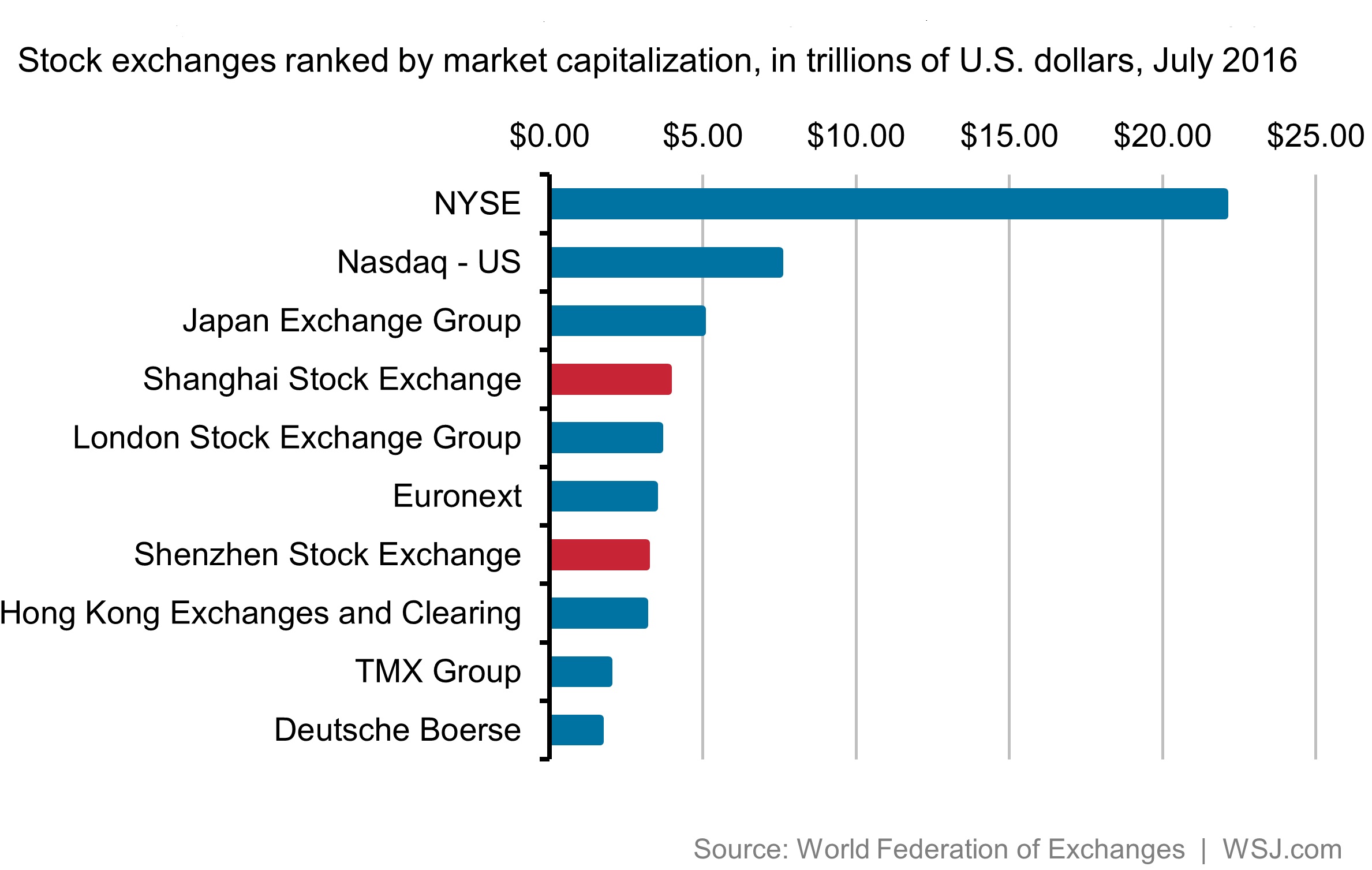

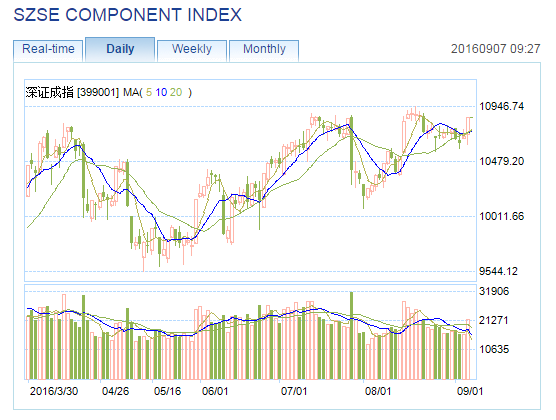

The Shenzhen Stock Exchange (SZSE; Chinese: 深圳证券交易所) was established on 1st December, 1990 and based in the Futian district of Shenzhen, Guangdong. It operates from 9:00 AM to 3:00 PM on weekdays and there is no trading on holidays. With a market capitalization of its listed companies around US$3.16 trillion in 2016, it is the 7th largest stock exchange in the world, and 3rd largest in Asia. Besides, the Shenzhen Stock Exchange is the largest in China by trading volume, with average daily turnover of about $50 billion in 2016.

Source: Shenzhen Stock Exchange

In May 2004, the Shenzhen Stock Exchange started the SME Board (中小企业板) and launched the ChiNext (创业板) board, a NASDAQ-type exchange for high-growth and high-tech start-ups, on October 23, 2009. Because the government is seeking to create a more efficient capital market system that would steer investment capital to small and midsize private enterprises, this would help to reshape the economy through technology and innovation, rather than just relying on low-priced exports.

Source: Shenzhen Stock Exchange

Source: Shenzhen Stock Exchange

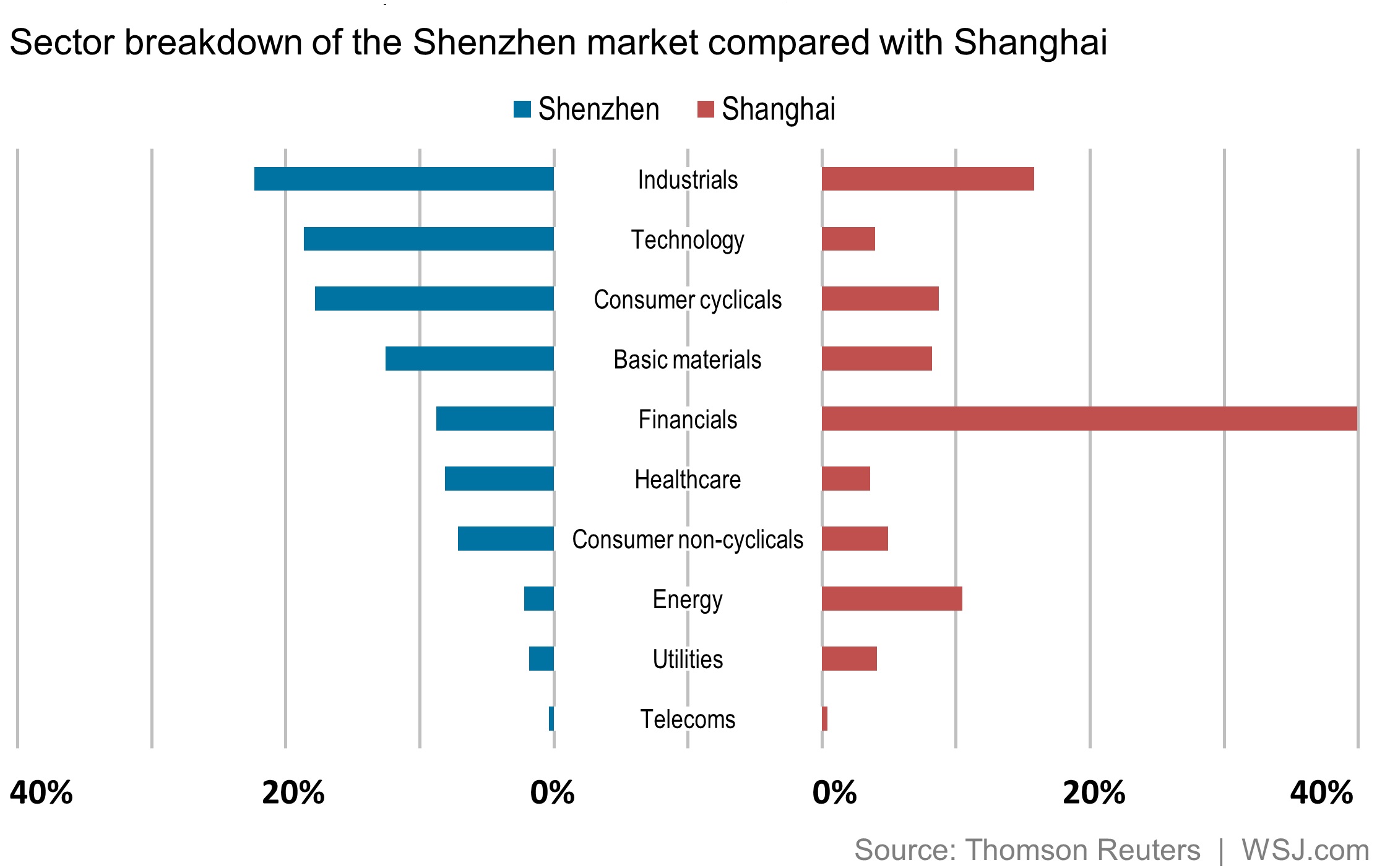

Chinese biggest state-owned enterprises, such as banks and energy firms are the major components of the Shanghai stock market, while Shenzhen market is composed of companies from the private sectors.

As of Jun 2016, 1777 companies are listed in Shenzhen Stock Exchange. And the Shenzhen market provides more opportunities in liquid small-cap stocks, high-growth sectors and non-state-owned enterprises. While Shenzhen stocks as a whole have shown significantly stronger earnings growth compared with their Shanghai counterparts in recent years, they have also commanded much higher valuations due to local investors’ preferences for growth and small caps.

Nearly a fifth of Shenzhen’s stocks are tech companies, a much bigger proportion than that in Shanghai, where tech stocks make up just 4% of the market.

Shenzhen-Hong Kong Stock Connect was approved on 16 August 2016. What the stock connect provides most is greater access for overseas investors to Chinese private enterprises and innovative companies, which comprise over 70% of the Shenzhen market (such as healthcare, materials, consumer and IT companies), leading to more balanced China exposure. The launch of the Shenzhen-Hong Kong link marks a concrete step toward making Chinese capital markets more law-based, market-oriented and globalized.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Shengyu Xu

Senior Dealer

Global Markets Department

Xu Shengyu graduated from the National University of Singapore with a master degree in Chemistry and joined Phillip Securities since 2011. He is currently a Senior Dealer in the Global Markets department. Shengyu is proficient in stock trading using both technical and fundamental analysis and frequently conducts educational seminars such as Market Outlooks, “Why Invest Globally” and trading platform introductions to enable his clients to make informed decisions in their investment. Shengyu specialises in China and Hong Kong markets.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It