Investing 101: How to Start Investing for Young Millennials May 31, 2021

Investing 101 for Millennials (Part I): How to Get Started

At a glance:

- In this first part of our series on millennial investing, we kickstart you on the road to investment, financial planning and wealth accumulation by providing a few pointers.

- Use financial goals as guideposts.

- Track your expenses and financial commitments and figure out how much you can put aside to invest.

- Stay in the loop by reading news and keep up with market trends.

Do you have a friend or acquaintance who cannot stop raving about his or her investments? As you watch your peers reap high returns from meme stocks, are you vexed, thinking, “Where was I? Why didn’t I get in earlier?”

Or perhaps, you are still sitting on the sidelines, unsure where to begin.

Source: https://twitter.com/KatieRagosta/status/1354220142230704133?s=20

Source: https://twitter.com/KatieRagosta/status/1354220142230704133?s=20

Take a step back and breathe. There will be more missed opportunities on your investment journey and trust us, we know how it feels. Everyone has to start somewhere.

Investing 101 is our series of articles for young millennials to get them started on the road to investment, financial planning and wealth accumulation.

Fundamentals are important and nobody should dive into the world of investments headlong, heedless of the pitfalls and risks. We therefore start by posing some preliminary questions and offering a few actionable first steps.

Let’s begin!

Is it ever too early to start thinking about investing?

If you are here, you are probably starting to THINK about investing. If so, you may be wondering, “When is the right time to begin investing?” Mathematically speaking, it is never too early to dip your toes into investing.

Why is that so?

Imagine you have S$100 and you can earn an interest of 10%—or S$10—on this S$100 one year from now. If the interest rate remains 10% in one year and you reinvest the S$10 interest you receive, this S$10 interest will earn another 10% interest the following year.

The cycle repeats itself and accumulates profits for you as you earn interest on interest.

Now, do you see where we are going? The earlier you begin, the more time your capital has to snowball! This phenomenon is known as the compounding effect.

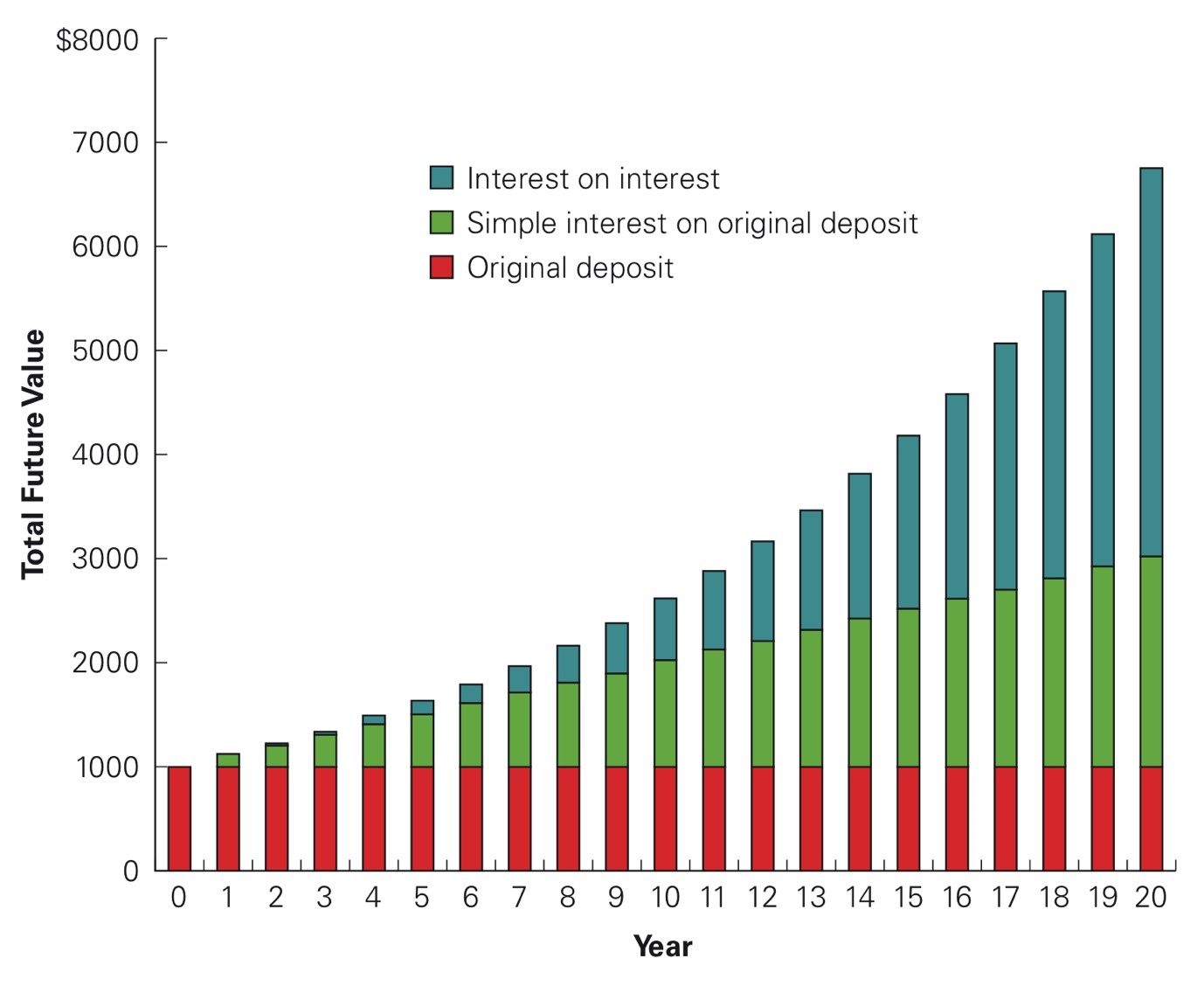

The diagram below illustrates the concept vividly. You start with an initial investment of S$1,000 that earns a 10% compound interest annually. By Year 20, the total future value of your investment has spiralled to S$6,727.50. Of this amount, interest on interest constitutes a hefty 55.41%!

Source: Berk and DeMarzo 2017 (pp. 134)

Source: Berk and DeMarzo 2017 (pp. 134)

5 things to consider before you start investing!

Now that you understand the compounding effect and why it is good to start investing early, what should you consider before you take the plunge?

1. Begin with an end in mind. What are my financial goals?

You may scoff at goal-setting exercises, but goals focus your attention on the end game. Sure, things may change along the way. However, it is important that you lay out short and medium-term goals and revisit your goals periodically. By breaking down your end-goal into achievable steps now, taking the first dip becomes less daunting.

So, start with the end in mind. Then, work backwards and note down achievable intermediate steps to get there.

2. Acknowledge constraints. Do I have any financial commitments? How much can I afford to invest?

Of course, you must be a pragmatic investor even as you aim high. Take some time to track your expenses, liabilities, loans, debts and even your Spotify or Netflix subscriptions. Yes, these recurring items in your bank statement are financial commitments as well!

More meticulous investors may compile everything in an Excel spreadsheet. As for the rest of us who struggle to recall what we ate for lunch yesterday, we may prefer updating our expenses on the go with financial applications such as Wally or Spendee. Give yourself a week or a month to figure out how much money you are willing to set aside for investments.

3. How committed an investor do I want to be?

There are many investment strategies. Each requires a different level of commitment. How willing are you to put in time for continuous research and track not just your holdings but alternative investments as well?

One of the best ways that you can keep up with the latest trends and developments is to sign up for webinars hosted by financial analysts. Check out our webinar schedule and register your interest to start learning how to make your investments work harder for you!

If research and keeping up with market trends aren’t your thing, you will probably appreciate the concept of dollar cost averaging.

What’s that? We will get to the nitty-gritty of this concept in subsequent articles, but you can read ahead if you want to. For now, ponder over the larger question and try not to stress over the exact strategy!

Related: 3 Reasons why Dollar-Cost Averaging is a Smart Investment Strategy

4. Should I save or should I invest?

Besides investing, you could put your money into a savings account that is relatively risk-free. However, is that what you really want to do with your spare cash? You know as well as we do that the interest paid on deposits is trifling. And yet, investing ALL of our savings sounds foolish.

So, how much do we invest and how much do we save?

To answer that question, you have to decide how much liquidity — this refers to cash and bank deposits — you will need to maintain your desired lifestyle. Here’s where Wally, Spendee or whatever you use to track your expenses comes in handy.

Related: Do You ‘Pay Yourself First’?

5. Should I follow my gut?

If there is a written rule for every investment in the market, markets will not be as volatile as they are! A lot of investing comes down to sentiment or how people FEEL about the market. So, yes, you will probably need to depend on your instincts AFTER you have examined all the available information. In other words, take calculated risks after thorough research!

Research is a continuous process even after you have made an investment. We will discuss more about investment research in Part 2 of our series.

Here’s how you can cultivate an investor’s mindset on a day-to-day basis

So far, we have prepared you for the lead-up to your first investment. Now, how can you maintain an investor’s mindset on a day-to-day basis?

1. Stay in the loop

Wars, policies, ministerial statements and these days, even tweets can move markets. Therefore, it is more important than ever for you to be aware of what’s going on and who’s saying what.

To stay in the loop, you may want to:

- Set up Google alerts to receive email updates for certain keywords.

- Download financial news apps such as Bloomberg and CNBC to receive banner notifications on your phone. You will receive push notifications on the latest updates even if selected content is only accessible through paywalls!

- Make it a habit to read or watch the news.

- Join our Global Investment Community on Telegram to receive updates, discuss the latest market trends and more!

2. Be critical of your sources

In time to come, you may notice that opinions on stocks or market trends differ widely. For instance, at least one analyst believes that Tesla is worth US$810 a share, making Tesla a trillion-dollar stock. At the other extreme are analysts who believe that Tesla is only worth US$150 a share. Who’s right? Who do you believe?

Since stock predictions are just predictions and actual prices can swing either way, it is never advisable to make your investment decisions based on one source. Listen to both expert and non-expert opinions, do your research and develop your own opinion before investing.

3. Patience, patience, patience

Your investments will take time to grow. There will be setbacks no matter how hard you try to time your investments. When things do not go according to plan, panic-selling is not the wisest thing to do. We get it, our emotions often get the best of us. To avoid making rash decisions, being self-aware and disciplined are valuable in a volatile trading environment. If 2-year-old Stormi Webster can resist a bowl of candy, so can you stay disciplined!

Source: Tenor https://tenor.com/view/stormi-patience-dance-curly-hair-cute-gif-17389511

Source: Tenor https://tenor.com/view/stormi-patience-dance-curly-hair-cute-gif-17389511

4. Chin up, eyes on the prize

Impatience kicks in when we become short-sighted and lose track of our long-term goals. To avoid making hasty decisions, recall the investment goals that you set earlier.

That said, goals are NOT static. We cannot foresee every contingency and circumstances do change. Review your goals periodically and shift your medium- and short-term goals if necessary. Who knows? Your investments may perform even better. If so, review your plan and reconsider your path forward.

Related: How to Build Wealth – Lessons Learned

Summary

To sum up, self-doubt is normal. If you are fearless in your investments, you probably should not be investing. Risk is part and parcel of investing 101!

To recap, here are your actionable first steps:

- List your financial goals and begin with the end in mind.

- Track your expenses using apps such as Wally or Spendee if necessary. Be aware of your financial commitments and constraints.

- Think about how much time and money you are willing to spend on investing. We will discuss investment strategies in the latter part of our series.

- Stay in the loop by reading the news or subscribing to alerts. Remember to consume opinions and analysis from multiple sources.

- Be patient with your investments and always keep your end goal in mind. Do not be blindsided by short-term setbacks (or gains).

Nobody expects you to go all out from the beginning. Start small, figure out your risk appetite and gradually learn from your experience and that of others. With the right preparation, you can make wise investment decisions.

In our next article, we will share some of the best resources for new and existing investors.

Eager for some hands-on experience now? You may want to start by opening a POEMS account or speak to one of our licensed representatives. Alternatively, you may join our Global Investment Community on Telegram to share your thoughts with us and other like-minded investors!

References

- 3 Reasons why Dollar-Cost Averaging is a Smart Investment Strategy published in Market Journal

- Do You ‘Pay Yourself First’? published in Market Journal

- How to Build Wealth – Lessons Learned published in Market Journal

- What Is a Meme Stock published in The Balance

- Effects of Compounding Interest published in MoneySense

- Corporate Finance 4th Edition by Berk and DeMarzo

- Elon Musk’s tweets are moving markets published in CNBC

- Tesla Could Be Worth a Trillion Dollars published in Barron’s

- A Roth Capital Analyst Says Tesla’s Stock Is Worth $150 published in CNBC

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Ng Ming Qian (Intern) & Joel Lim (ETF Specialist)

Ming Qian is an intern from the Global Markets Desk at Phillip Securities and an Economics Undergraduate at the National University of Singapore. Outside of school, Ming Qian hustles as a freelance writer and blogger who simplifies complex topics for readers. When he is not writing or buried in his books, you can probably find him tending to his aroid plants or bingeing on Grey’s Anatomy.

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!