3 Reasons Why Dollar-Cost Averaging is a Smart Investment Strategy April 8, 2021

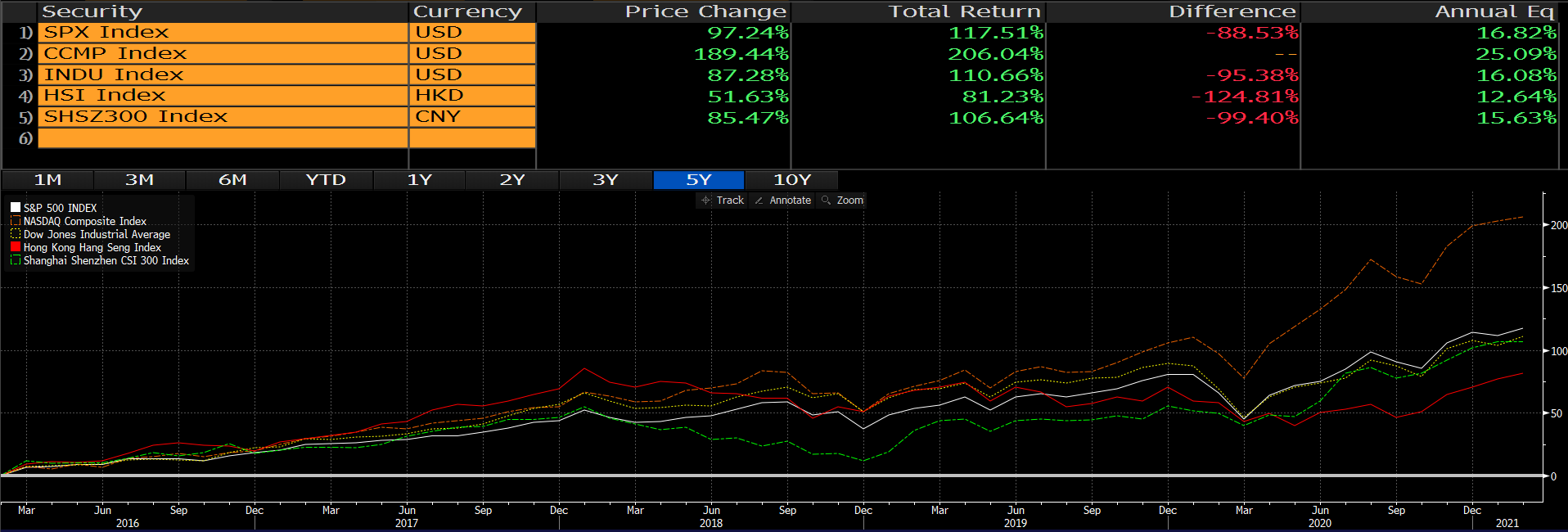

Over the past five years from 2016 to 2020, global indices broke record after record in scaling new highs. One contributing factor was an influx of retail investors with ready access to global markets. As the table below shows, the average price change of the five global indices – S&P 500, NASDAQ, Dow Jones, Hang Seng Index and Shanghai Shenzhen CSI 300 – was a whopping 102.21%!

Along with the indices, share prices of the popular FAANG counters – Facebook, Apple, Amazon, Netflix and Google – smashed all-time highs, averaging a 314.72% rally in prices. At the height of the pandemic in 2020, the market even flipped from bear to bull in an astonishing three months.

Timing the market vs. time in the market

If you are just about to start investing in stocks or regularly investing in stocks, these share prices may daunt you. The most common questions you may ask are, “How many shares can I buy if prices are so high?” and “Should I wait for prices to dip before investing?”.

A common instinct is to try and time the market, in hopes of buying stocks at the lowest prices possible to make the most out of your investments. However, timing the market is incredibly hard, if not impossible, because who can predict markets? Investors may end up timing the market wrongly.

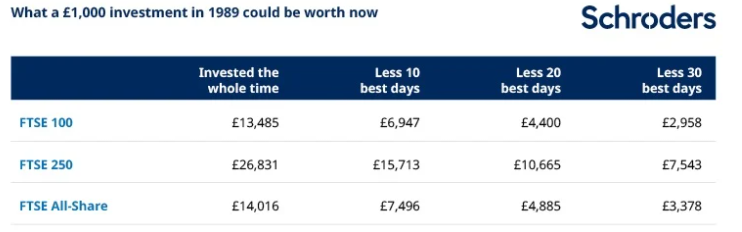

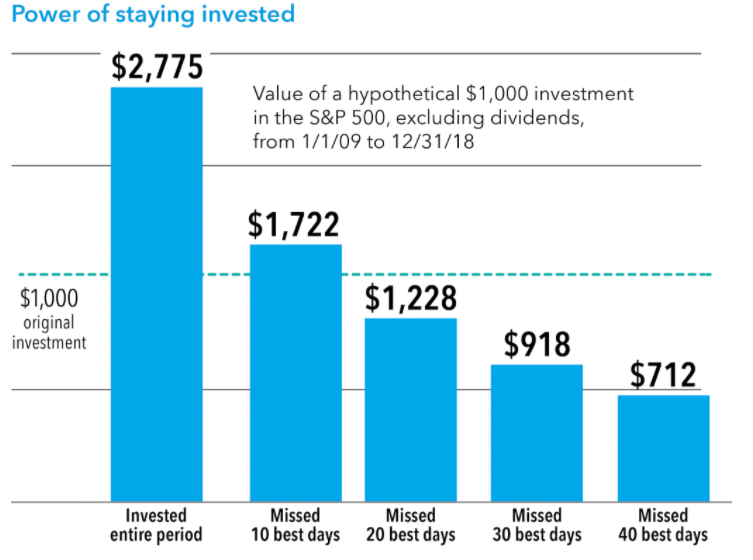

Research, on the other hand, suggests that by staying invested the entire time – as opposed to time spent on “timing” the market – your investments tend to outperform market timing.

Based on the findings of Schroders and CapitalGroup, the returns of staying invested – time in the market – can be much higher than timing the market.

Staying invested in the market means making regular investments or buying and holding for a long period of time. With prices at an all-time high, you might wonder, “Do I want to risk staying invested?”

Yes!

As dollar-cost averaging smoothens out your purchase prices over time, you get to build a position in a stock without having to worry either about dumping all your money in at the high or missing out on market gains.

Dollar-cost averaging: the pros and the cons

Dollar-cost averaging (DCA) is investing in assets such as stocks in small quantities at regular intervals instead of making a one-time lump-sum investment. In DCA investing, you buy more shares when the stock price is low and buy less when its price is high. Over the long haul, as you accumulate more of the stock at lower prices, you lower your average cost per share.

The pros

One of the pros of DCA is that it helps to remove emotions from your investment process, especially during volatile market conditions. Volatile markets can inspire fear, uncertainty and anxiety and trying to determine an entry point can be tricky and costly.

Secondly, by investing a consistent amount over a period of time, DCA helps investors buy more shares at a lower price per share.

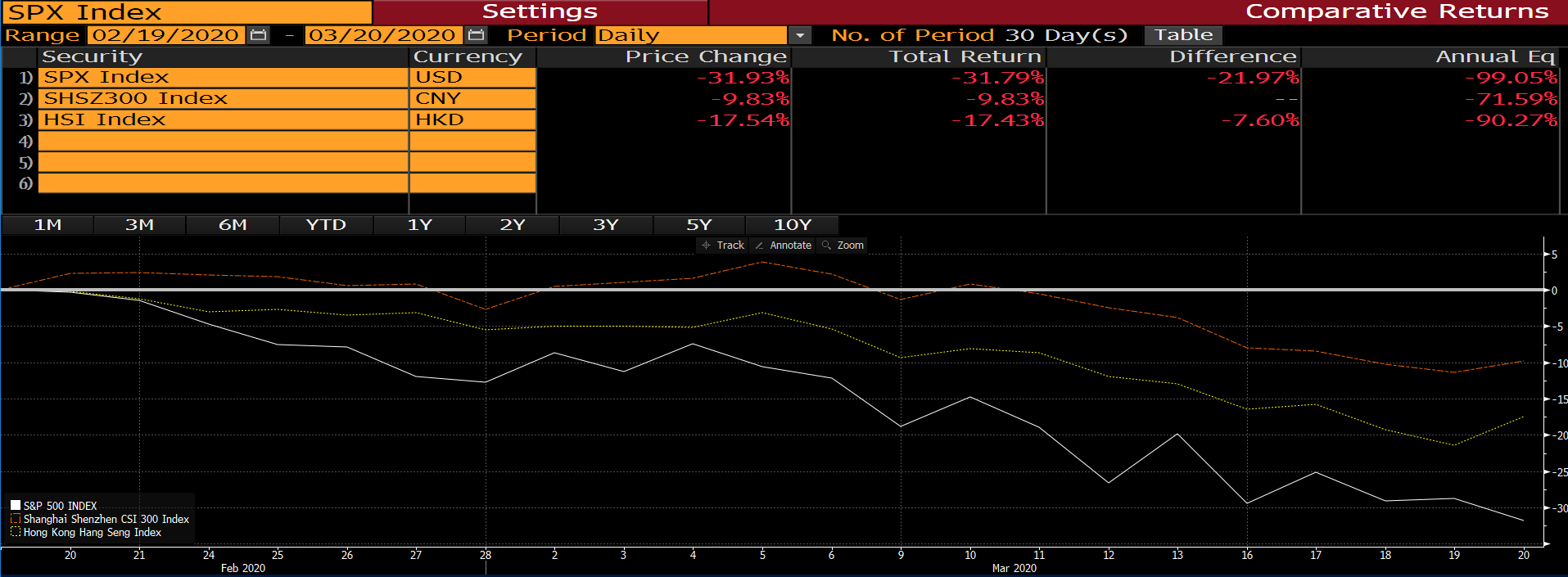

A third benefit is that DCA enables investors with lesser capital to enter the market consistently and benefit from market growth. It also helps investors avoid bad timing such as investing a lump sum just before market-moving events. Think of the 2007/2008 global financial crisis and the 2020 COVID-19 outbreak!

The S&P 500 fell over 30% over a period of one month from February to March 2020 when the pandemic started to spread across the globe.

The cons

One of the cons of DCA is missed opportunity cost in terms of higher capital-appreciation and return potential. As the market trend is generally upwards over time, investing lump sums instead of DCA may yield you higher overall returns.

Take for example the price of Microsoft (MSFT US) over one year. If you had ploughed a lump sum into the stock at its lowest point in March 2020, you could have pocketed a 64.24% return from your investment by the end of 2020. Your 64% return would have been achieved by timing the market during the stock’s dip.

But if you had employed DCA instead, your return would only have been 6.04%, assuming you invested the same amount at the start of every month from March to December 2021.

But don’t end up averaging down on a bad investment!

Dollar-cost averaging is particularly attractive to new investors just starting out. It’s a way for you to build wealth slowly and steadily, even if you start small. But identifying the right investments coupled with due diligence is equally important. Averaging down on an investment with poor or unknown prospects will only mean you are squirrelling your money away consistently into a losing stock.

POEMS’ Recurring Plan and promotions

To help investors achieve their investment goals, POEMS has a Recurring Plan that allows you to invest on a timed and regular basis. Investors can plan regular investments in a highly flexible manner, such as daily, weekly, monthly and so on. The plan currently offers stocks and ETFs from three markets: Singapore, Hong Kong and the US.

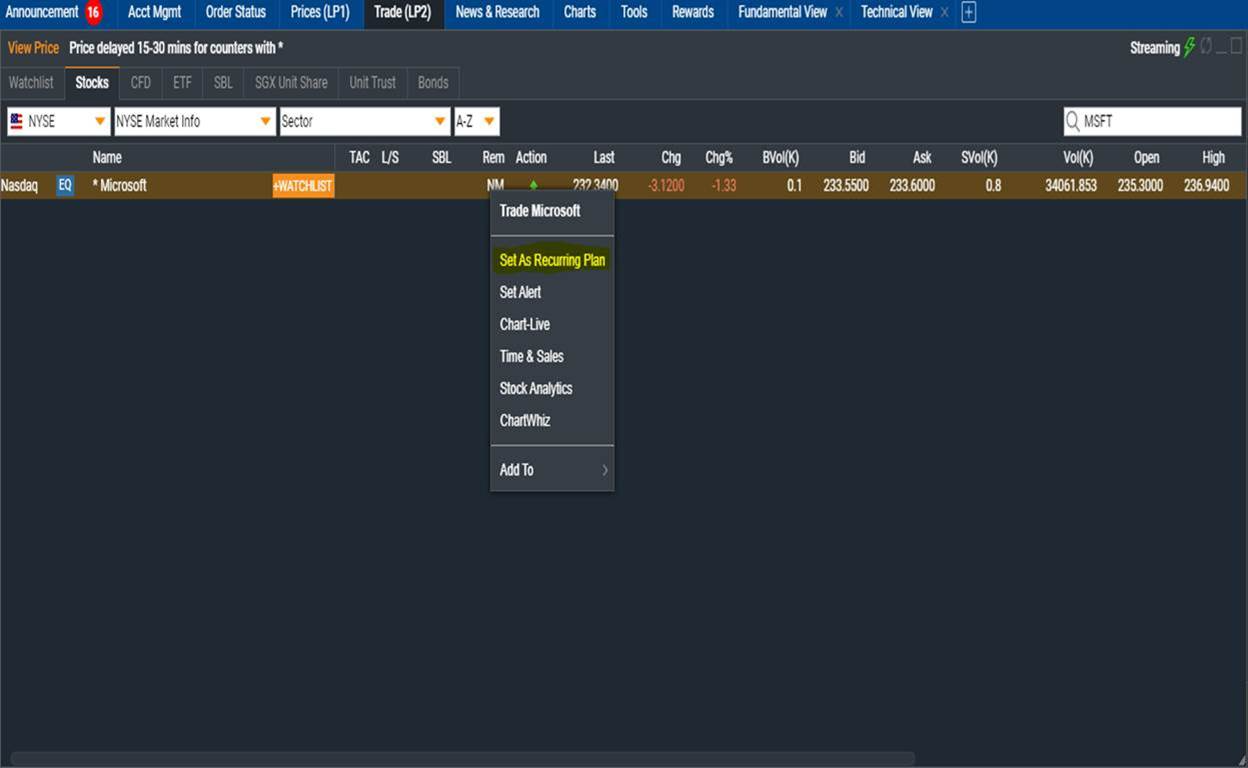

To sign up, select your desired stock such as Microsoft (NYSE) and select “Set As Recurring Plan”.

You then choose your preferred frequency. This can be Daily, Weekly, Monthly or Quarterly, depending on your needs. The plan also allows you to set Start and End dates for your investments.

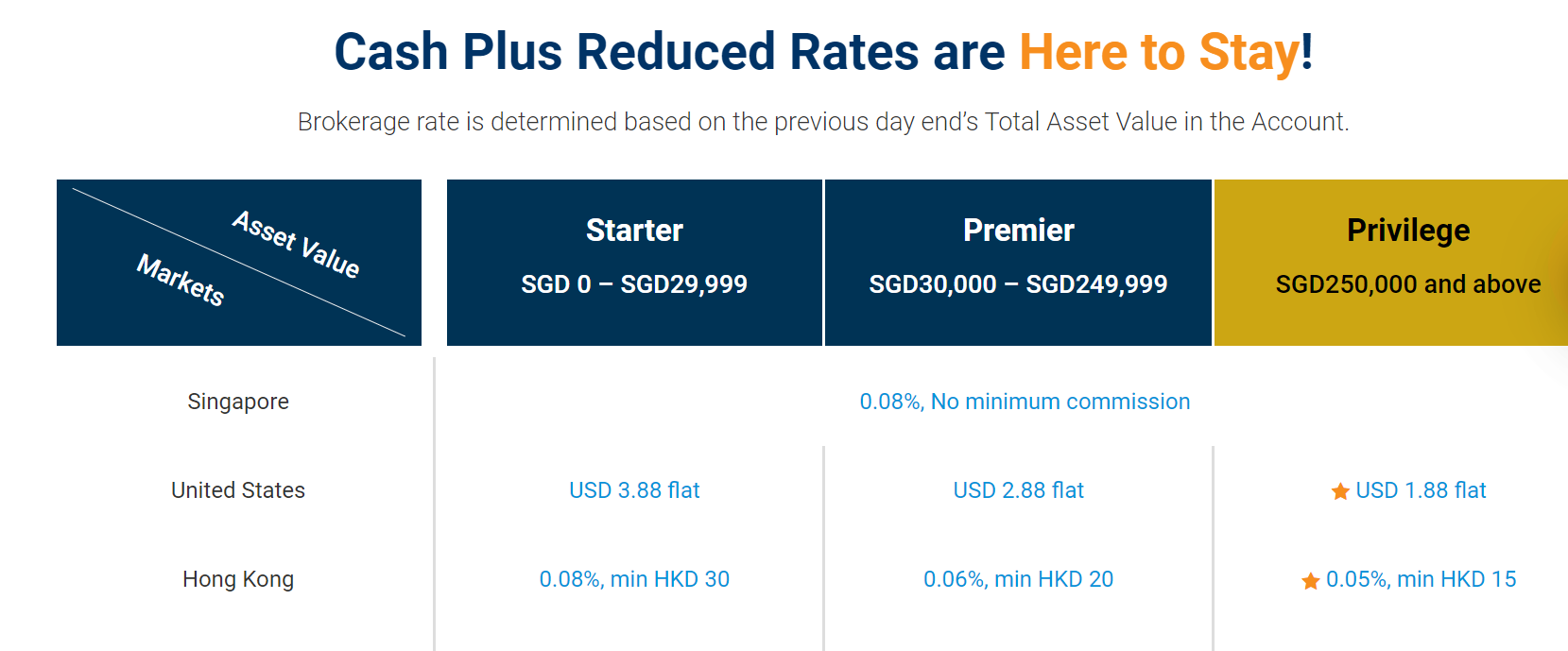

Investors can take advantage of no minimum commission for Cash Plus Account on top of setting up their Recurring Plans. This account can minimise your costs by paying commission based on size of your investment and maximise the value of your investments.

You can stay invested in the market using a DCA strategy through POEMS’ Recurring Plan.

Sources:

1. https://www.investopedia.com/investing/dollar-cost-averaging-pays/

2. https://www.capitalgroup.com/individual/planning/investing-fundamentals/time-not-timing-is-what-matters.html

3. https://www.schroders.com/en/hk/retail-investors/education/investment-basics/

1. https://www.poems.com.sg/rsp/#recurringplan

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Clement Chua

Equities Dealer

Clement is a dealer for the Global Markets Team focusing on the day markets. He graduated from Monash University with a Bachelor of Business, majoring in Banking and Finance.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!