Investing gets “Smarter” With Phillip SING Income ETF May 12, 2020

In the universe of the Singapore Exchange (“SGX”), there are over 700 individual stocks to choose from. For the average retail investor, picking the right stock is akin to picking out needles in the hay. The difficulty further compounds when retail investors try to produce decent returns consistently over time.

The infographic below summarises some of the key disadvantages for most retail investors:

Importance of Diversification

Inherent to their small capital base, retail investors are less able to diversify their portfolio meaningfully on their own. This gives rise to the popularity of Exchange Traded Funds (“ETFs”), which offer access to diversified portfolios to retail investors.

As the name suggests, an ETF is an investment fund that is listed and traded on the stock exchange. ETFs typically track an index, such as a stock or bond index, and aims to produce returns that reflect the performance of the index or underlying assets.

The benefits of diversification can be simply explained. Consider a retail investor who has in-vested all his capital of $10,000 into a component stock to form Portfolio A. A 10% loss of the component stock will amount to a loss of $1,000 on his portfolio.

Now, consider Portfolio B which is made up of 10 components. A 10% loss on one component would amount to only $100 loss on the portfolio.

| Portfolio | No. of Components | Potential Loss |

| A | 1 | $1,000 |

| B | 10 | $100 |

| C | 20 | $50 |

As illustrated above, meaningful diversification minimises the risk of loss when one particular component stock performs badly. In fact, other investments that do well could potentially make up for the performance of the underperforming component.

A “smarter” way to accumulate SG stocks

The first index which local investors are acquainted with would most likely be the Straits Times Index (“STI”). The STI is a market capitalisation weighted index that tracks the performance of the top 30 companies on SGX.

Phillip SING Income ETF is one ETF that uses the STI as the underlying benchmark. ETFs help retail investors to overcome challenges in an effective and cost-efficient way. Instead of picking out individual stocks, investors actually buy into a basket of top-quality Singapore stocks, thereby unlocking the benefits of diversification.

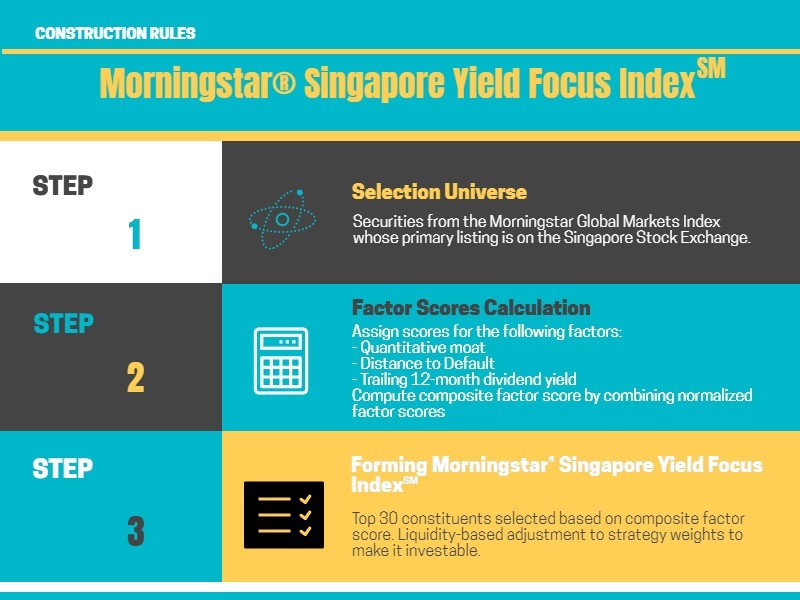

However, unlike traditional market capitalisation based STI ETFs, Phillip SING Income ETF uses smart beta strategies to filter and score components. This is based on the selection criteria of quality, financial health (distance-to-default) and dividend income.

The top 30 constituents are then selected to form the portfolio and weightage is tilted towards higher scoring constituents. In this way, investors can view this strategy as a mean to position the portfolio towards stronger dividend income quality. We explain the index methodology as follows:

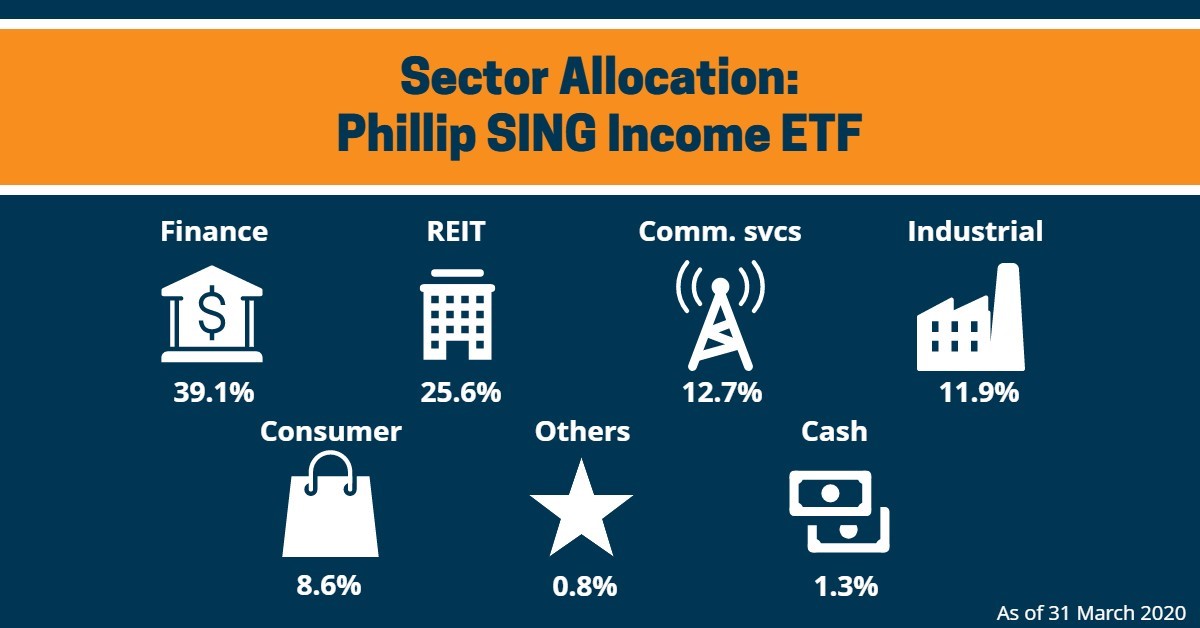

Check out the sector allocation of Phillip SING Income ETF in the infographic below:

Effectively, prospective investors are buying into familiar local companies such as DBS, Singapore Exchange, Singtel etc.

Wait, that’s not all! We have another smarter option for you!

You may invest in Phillip SING Income ETF via our Share Builders Plan (“SBP”). It is a regular fixed dollar amount investment plan, which enables you to buy shares on a consistent and incremental basis so as to build up a portfolio of securities for yourself eventually. Therefore, you do not need a huge amount of funds to invest in the stock market since SBP presents an opportunity for you to invest at smaller quantities.

By leveraging the Dollar Cost Averaging methodology, you invest in a fixed amount of funds consistently every month over a period of time, and the dollar cost averaging benefits you regardless of price fluctuations. You purchase more units when the price is lower and fewer units when the price is higher.

Grow your portfolio gradually and cultivate the habit of disciplined savings. You may begin investing from as low as $100 on a monthly basis.

Sign up now and receive 3 months handling fee rebates*.

That’s not all, we have something for your little ones too! Sign up for a Junior Share Builders Plan and receive 12 months handling fee rebates*.

HOW TO GET STARTED?

For existing POEMS clients, please click here to sign up!

For existing SBP Clients, please follow the following steps to add Phillip SING Income ETF into your investment instruction:

Log on to POEMS > Acct Mgmt> Regular Savings Plan(RSP) > Share Builders Plan > Invest-ment Instruction > Amend > Submit Password

Think BIG. Start small.

For more information on Share Builders plan, please email rsp@phillip.com.sg.

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for gen-eral information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific in-vestment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily in-dicative of the future or likely performance of the Products. There can be no assurance that investment objec-tives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, pas-sively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and re-demption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such crea-tion or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliat-ed companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.

About the author

Phillip Capital Management (PCM)

Phillip Capital Management(PCM) is an independent fund management company, and the Asset Management arm of PhillipCapital Group. We manage funds for both individual investors as well as institutions, and help our clients achieve their financial goals. Visit our PCM website to find out more.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?