Investor Portfolio: Exchange Traded Funds September 9, 2016

Do finance professionals beat the market?

Many believe that professional hedge fund managers always get higher returns. Year after year, studies show that neither professional investors nor individuals could outperform broad market indices consistently over long periods of time. Nevertheless, a questions I would ask is, “Does it matter?”

Isn’t the purpose of investing the hope that the seeds sown today can reap a harvest in future? Your future, and more importantly, the future of those who matter to you most.

Exchange Traded Funds (ETFs) is a marketable security that tracks a specific underlying asset and is often used as a proxy of the “market”. Buying the SPDR S&P 500 ETF for example is equivalent to buying 500 stocks worth of exposure at a cheap cost, extremely useful for the passive investor who does not know how to pick stocks. There is a wide array of regions, sectors, commodities, bonds and other asset classes. Advantages and disadvantages of ETFs are listed below:

| Advantages | Disadvantages |

|---|---|

| – Trades like a stock– Marginable or short selling– Updated prices through the day– Liquidity | Lacks focus – E.g. Dividend may not be as high as owning a high yield stock |

| Transparency | Tracking error |

| Diversification | Bid-Ask spread can be large |

| Low costs & expense ratios (In comparison to actively managed funds) | ETF’s traded price not reflective of NAV per unit |

Geography

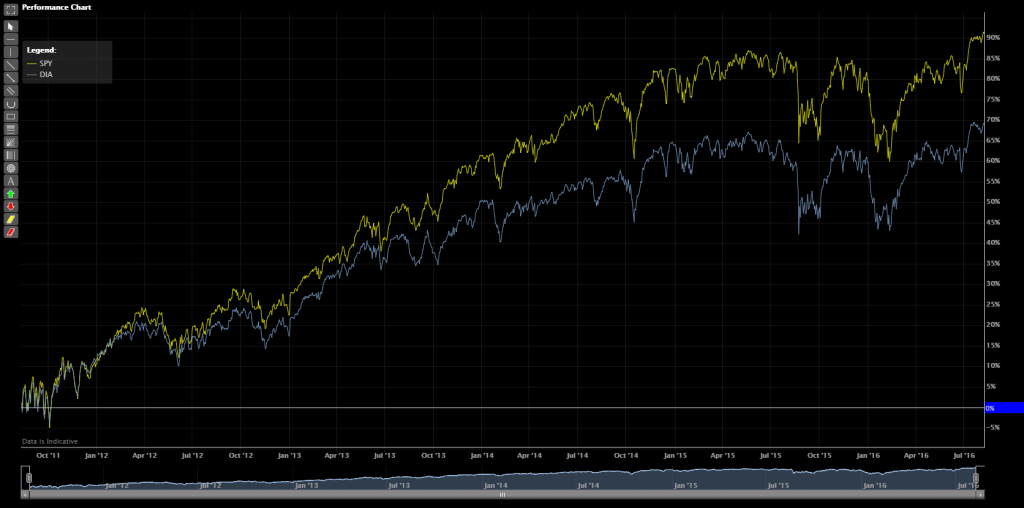

Index ETFs hold an important role in every portfolio and that is diversification, which is usually misunderstood or under-appreciated. The importance of introducing variety reduces risk and ensures that your financial goals are not derailed by the unexpected. It becomes more important as you grow older in age and your investment portfolio shifts from riskier returns to capital preservation.If you can’t beat the market, why not ride it? ETFs are useful to geographic exposure. For example, assuming that you wish to have exposure in the US stock market due to the size of the economy and liquidity, SPDR DJIA (Blue in Figure 1) and SPDR S&P500 (Yellow) are 2 ETFs that give you such exposure and are useful for long-term passive investors.

Source: POEMS 2.0

Figure 1: SPDR DJIA (Blue) and SPDR S&P500 (Yellow).

Sectors/Industry

Perhaps, there is a macro outlook trend you would wish to take advantage of but you do not know which stock to choose. ETFs are a good tool that allows you to get such an exposure.

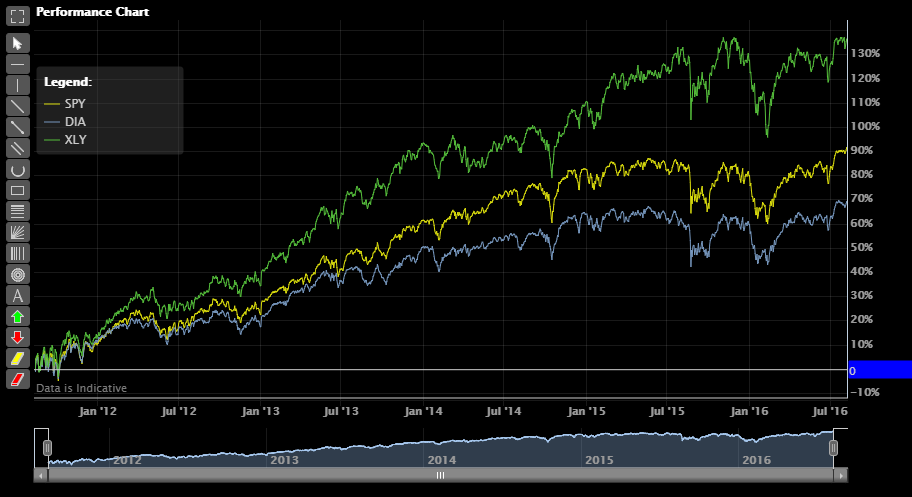

An example would be the consumer discretionary sector, which sells elastic goods and services covering retail, leisure & entertainment etc. In the last 3-5 years, this industry has caught the eye of many investors because of the improving job market in the US; when the employment rate is low, lower commodity costs and low federal funds rates encourage consumer spending. Consumer Discretionary SPDR ETF (XLY – green in Figure 2) which provided a higher 5-year return in comparison to the run-of-the-mill Geographic ETFs (yellow and blue).

Source: POEMS 2.0

Figure 2: Comparison of Consumer Discretionary SPDR ETF with Geographic ETFs.

Leveraged ETFs

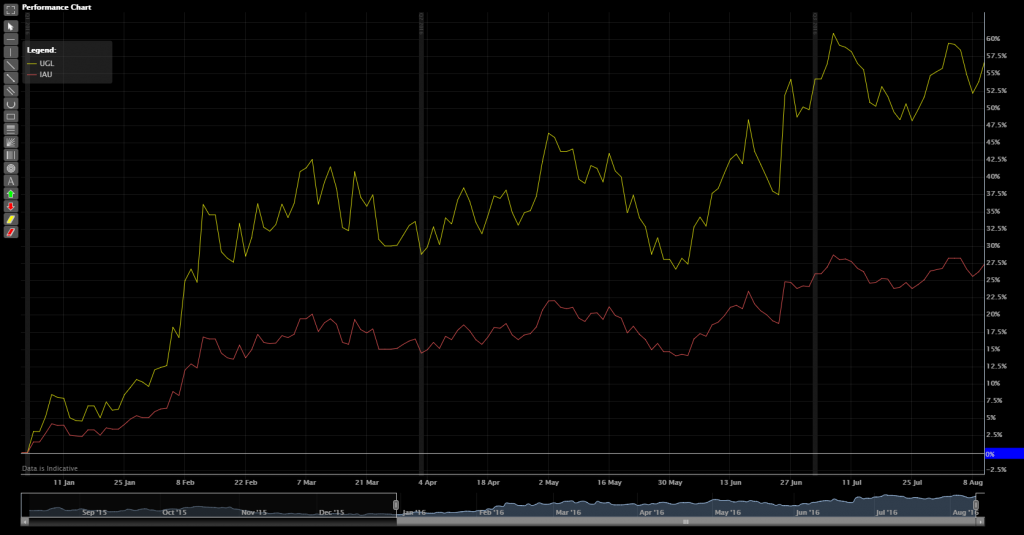

With volatile negative events in the world such as Brexit, the growth outlook remains dim in a low interest rate environment. Let’s assume that you as a trader were spot-on in anticipating these trends and confident that there will be a capital re-allocation from the riskier assets to safer haven assets like gold. How can you further monetise that view?

You can consider leveraged ETFs. Figure 3 below is an example of a 2X Leveraged ETF on Gold (yellow) in comparison to a Non-leveraged gold ETF (red). Returns are estimated to be double with the 2X leveraged ETF. However, there are risks to it as well as it can work both ways to either gains/losses. Hence, the reverse can happen with a negative 2X loss. Speak to your local dealer for further clarification on the risks involved.

Source: POEMS 2.0

Figure 3: 2X Leveraged ETF on gold vs. Non-leveraged gold ETF.

There are many strategies that can be used with this financial product that has a huge list of underlying asset to choose from which why it is so useful for investors. What is most important in determining which ETF to pick from would be your needs, investment objectives, risk profile and your current portfolio.

Drop by your nearest Phillip Investor Centre to find out more. Remember, an investment made in knowledge pays the best dividends, I will touch more on ETFs in the subsequent months ahead.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Sky Kwah Wen Yao

Dealing Manager

Raffles Place Dealing Team

Sky Kwah is part of the POEMS Equity Dealing Team that provides dealing services to over 17,000 trading account customers. Sky gives talks in tertiary institutions like NYP & SIM and he often conducts seminars on Fundamental Analysis, most recent was at the Investfair 2016. He particularly focuses on value stocks in Singapore and the US with a top-down macro approach. He is frequently interviewed by Media Corp News 938Live radio station as a market commenter and he hopes to help clients become better stewards of wealth and believes in succeeding in what truly matters – the fullness of life. Sky holds a Bachelor Degree of Commerce with a triple major in Financial Accounting, Investment Finance, and Corporate Finance, from the University of Western Australia.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?