Investor Portfolio: Hedging Products September 2, 2016

When Billionaire hedge fund manager Seth Klarman was asked about what it takes to be a successful investor, he replied, “The conviction to concentrate your portfolio in your very best ideas, and the common sense to nevertheless diversify your holdings.”

One of the most common mistakes I encounter among investors is: buying too much within the same asset class. Although it may create a wide diversification within a class but it is too narrow as an investment portfolio.

An ideal portfolio could hold:

- Cash in SGD and USD

- Hedging products

- Bonds

- Inflation-sensitive assets

- Stocks and exchange trade funds

My hope for retail investors is a resilient approach towards your stocks portfolio. Steward what you own well, as it will help safeguard the things in life that are important to you.

Hedging a position is basically making use of various investment means to reduce the impact of volatile price movements of a stock/sector/country in a portfolio. A few such examples are listed below. However, do note that this is purely educational and I am not in any way suggesting a buy/sell call. Please speak to your trading representative for more information.

Gold ETFs

Gold ETFs are widely considered as a protection against a volatile currency or negative stock market shocks. A common trend in the world now is countries devaluing their currencies, which has sometimes produced unexpected results. This in turn would lead to capital inflows into safe haven assets.

| Advantages | Disadvantages |

|---|---|

| Hedge against volatile currency or negative stock market shocks | Arbitrary Value – Sentiment Driven |

| Hedge against inflation | No generation of intrinsic value |

| Not so correlated with broader market |

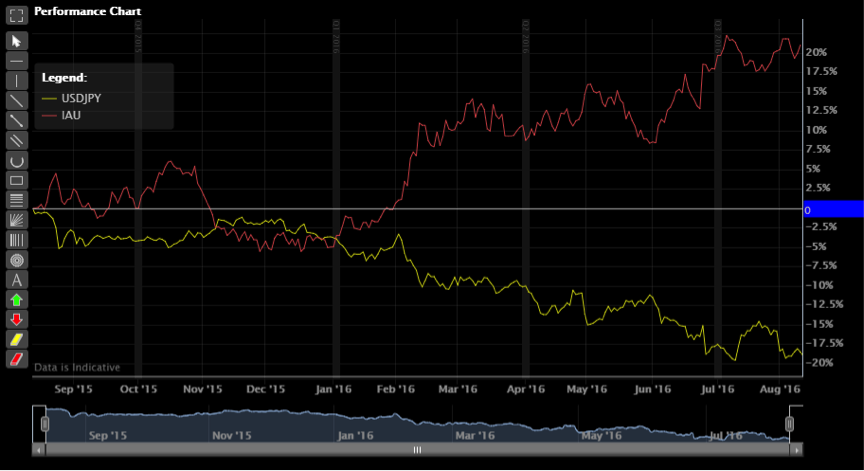

The months of Feb to Apr 2016 showed a weakening Dollar as investors lower their expectations of the pace and frequency of rate hikes against a stronger Yen. This in turn led to an increased demand for gold ETF, so you do see some inverse correlation there.

Source: POEMS 2.0

Inverse ETFs

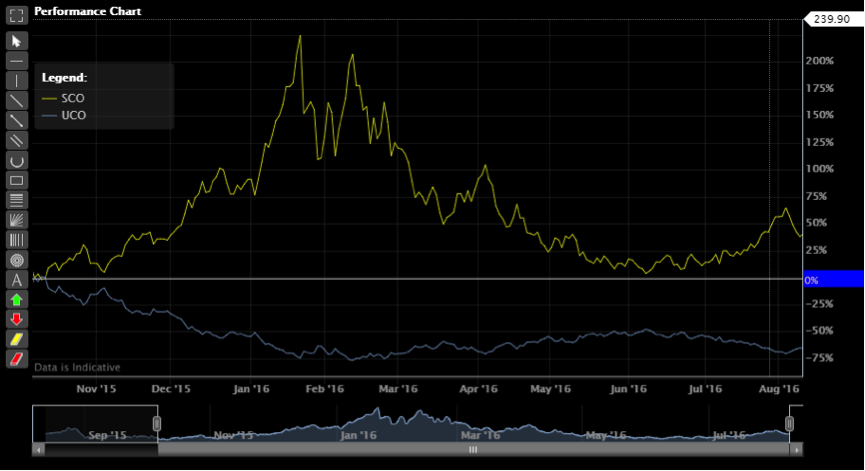

Alternatively, there are inverse Exchange Traded Funds (ETFs) that track the opposite price of our underlying asset classes via short-selling or futures contracts, for example, UCO Bloomberg Ultra Crude Oil (Long – Blue) vs SCO Bloomberg Ultrashort Crude Oil (Short – Yellow). Inverse ETFs are popular in a bear market because of their increase in value and the convenience of buying and trading. SCO has been rising for the past one to two years due to declining oil prices.

| Advantages | Disadvantages |

|---|---|

| Market Liquidity | Returns vary drastically in the long run |

| Ease of trade – Useful in the short run | Higher expense Ratio |

| Hedge against down side exposure |

Source: POEMS 2.0

Diversification – Various Industries

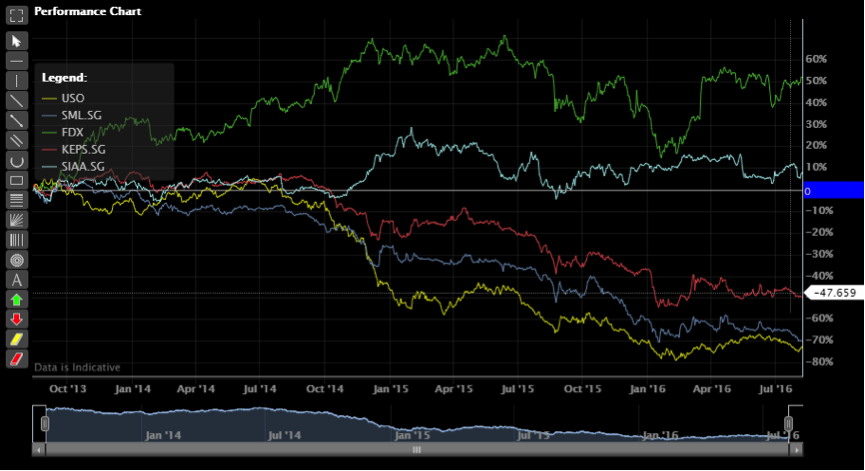

Perhaps you are hesitant to explore complex derivatives – a loose hedge could be made. Continuing with the topic on oil, assuming you have oil exposed counters and you do not wish to exit the position. You may hedge with companies that generally benefit from a low oil price scenario. An example listed below, airline and transport sectors like SIA (teal) or FedEx (green) are some good examples of such companies which can hedge against Keppel (red) or Sembcorp Ind (blue).

Source: POEMS 2.0

| Advantages | Disadvantages |

|---|---|

| Simple – No complex derivatives | Not a “perfect” hedge |

There are also other trading products which can work as a hedge. Contract for Difference (CFD) is another possible hedging instrument to consider. All strategies mentioned in this article have tradeoffs – whether it is in terms of cost or systematic risk, a successful hedge can never be guaranteed.

In conclusion, whether there is a bull or bear market, there would be opportunities to hedge and to gain. The main question is whether you allow your portfolio to adapt or choose to succumb to market forces and accept the current state of your portfolio. Steward your portfolio with our help today. Talk to a dealer at your nearest Phillip Investor Centre.

All ETFs used in the charts are proxies to a selective sector or industry and purely used for educational purposes.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them. The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

About the author

Sky Kwah Wen Yao

Dealing Manager

Raffles Place Dealing Team

Sky Kwah is part of the POEMS Equity Dealing Team that provides dealing services to over 17,000 trading account customers. Sky gives talks in tertiary institutions like NYP & SIM and he often conducts seminars on Fundamental Analysis, most recent was at the Investfair 2016. He particularly focuses on value stocks in Singapore and the US with a top-down macro approach. He is frequently interviewed by Media Corp News 938Live radio station as a market commenter and he hopes to help clients become better stewards of wealth and believes in succeeding in what truly matters – the fullness of life.Sky holds a Bachelor Degree of Commerce with a triple major in Financial Accounting, Investment Finance, and Corporate Finance, from the University of Western Australia.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?