Is Hong Kong Losing Its Shine? February 5, 2020

At the time of this article, the Hong Kong protests are still ongoing. The Hong Kong Protests have sparked fears and uncertainty about the future of Hong Kong. My colleagues have received countless calls from worried clients asking about the future, relevance and viability of investing in Hong Kong. People are wondering what will happen to Hong Kong’s relevance and autonomy after the basic law expires in 2047. To add salt to wound, rising giants such as Shanghai and Shenzhen now threaten Hong Kong’s financial hub status.

The question is: will Hong Kong fade into obscurity and irrelevance?

In this article, let us investigate whether Hong Kong will lose its relevance and standing as an international financial and business hub.

Hong Kong’s role in the Greater Bay Area

Due to rising labor costs and the US China Trade war, manufacturers seeking cheaper labour have shifted their operations to countries like Vietnam. The exodus of low end manufacturing may be an advantage for China in the Long Run. According to Li Keabo, the executive secretary general of the Center for China in World Economics (CCWE) at Tsinghua University’s School of Economics and Management, states that the loss of low end manufacturing may be advantageous to China, as this forces the manufacturing sector to move up the value chain.1 This is a transition that Beijing approves of. Part of China’s long term plan is the Made in China 2025 plan. China’s Made in China 2025 plan long term goals is to produce 40% of the semiconductors it uses by 2020 and 70% of it by 2025.2

This is where China’s Greater Bay Area Plan initiative comes in.

China plans to link Hong Kong with Macau and the Guangdong provinces. China plans to tap onto the strengths of each individual city and link these urbanized areas to form a major economic and technological belt that will rival that of Silicon Valley or Wall Street.

Instead of isolating Hong Kong and leaving it to fade into obscurity, China is planning to include Hong Kong in its Greater Bay Area Plan initiative.

Source: HSBC Research3

The Greater Bay Area accounts for 12% of the total GDP of China although it takes up less than 1% of the total land mass of China.

The question is: What role will Hong Kong play in this initiative?

Hong Kong is reputed to be an international financial centre and enhancements will be made for her to transform into the global offshore Renminbi hub, acting as both an international financial hub and asset management centre for the Greater Bay Area.4 Hong Kong’s green bond market is already the largest in the world. In 2018, Green bond, valued at more than $11 billion, was arranged and issued in Hong Kong. This figure was triple of that in 2017.5

Hong Kong’s already established transportation and logistics sector will also be further enhanced by the Greater Bay initiative. Currently, the Hong Kong International airport ranks as one of the world’s busiest airports in terms of international passenger and cargo throughput. Hong Kong is approximately 4 hours away from Asia’s key financial markets by plane and a 5 hour flight away from half of the world’s population.4 As at 2019, Hong Kong’s container port currently ranks 7th in the world (With Shanghai being first and Singapore second).6

Find out more about the Greater Bay Area Initiative.

Hong Kong: China’s Bridge to the World?

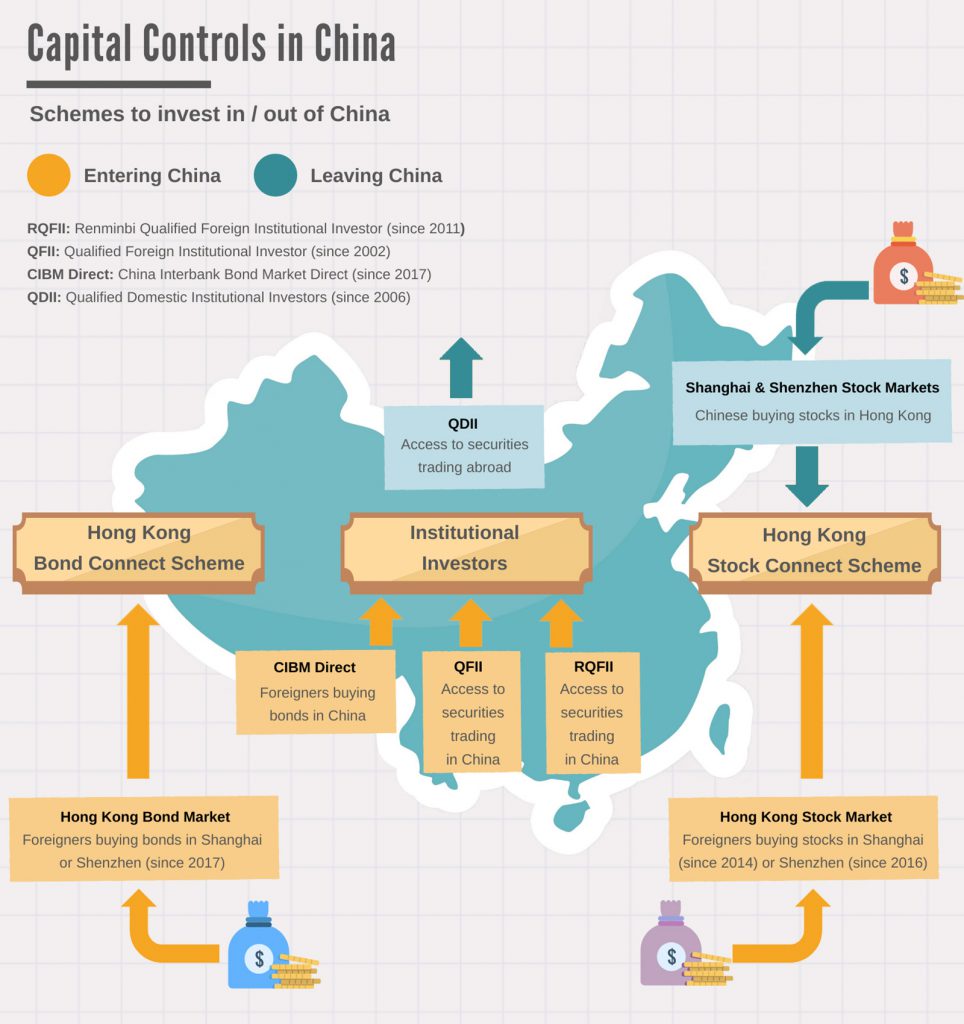

Unlike Hong Kong, China has capital controls. China does not have capital account liberalization (as of end 2019). This means that capital may not move freely in and out of the country. Foreigners wanting to invest in China or Chinese nationals wanting to invest outside of China can only do so through a myriad of schemes.

Secondly, China has heavy internet control and censorship. The precursor of an international financial centre (besides convenient time zones from other major markets) is that capital and information must be allowed to flow freely with little or no restrictions. Hong Kong does not have capital controls, which differentiates Hong Kong from the other mainland cities.

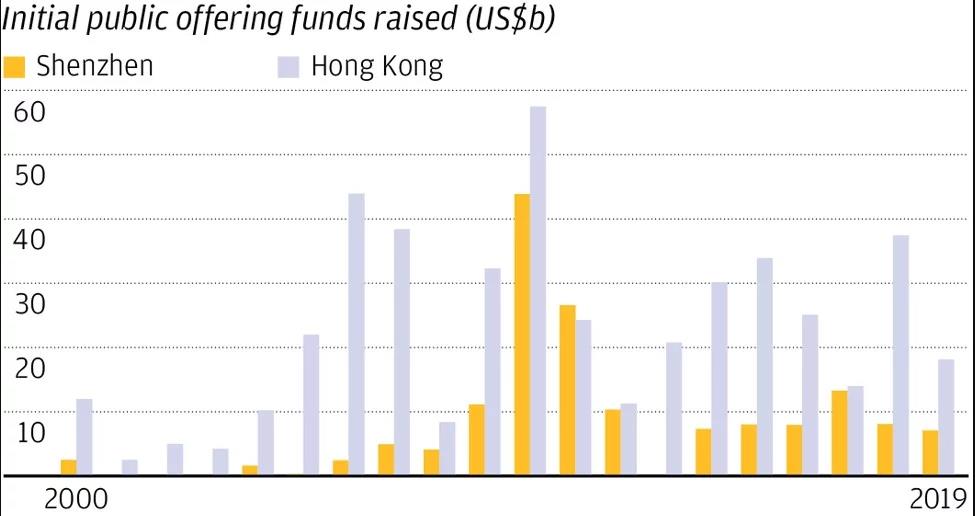

Article 112 of the Basic Law of the Hong Kong Special Administrative region states that “No foreign exchange control policies shall be applied in the Hong Kong Special Administrative Region. The Hong Kong dollar shall be freely convertible.” Hong Kong’s liberal financial system is the reason why Chinese and foreign firms prefer to list in Hong Kong to access global capital. According to Refinitiv, in 2018, Chinese companies raised US$64.2 billion globally via IPOs. However, US$19.7 billion came from listings from Shanghai and Shenzhen. The remaining US$35 billion came from Hong Kong. Chinese tech giants like Alibaba Group Holdings and Tencent Holdings are listed on the Hong Kong stock exchange.7

Source: Refinitiv3

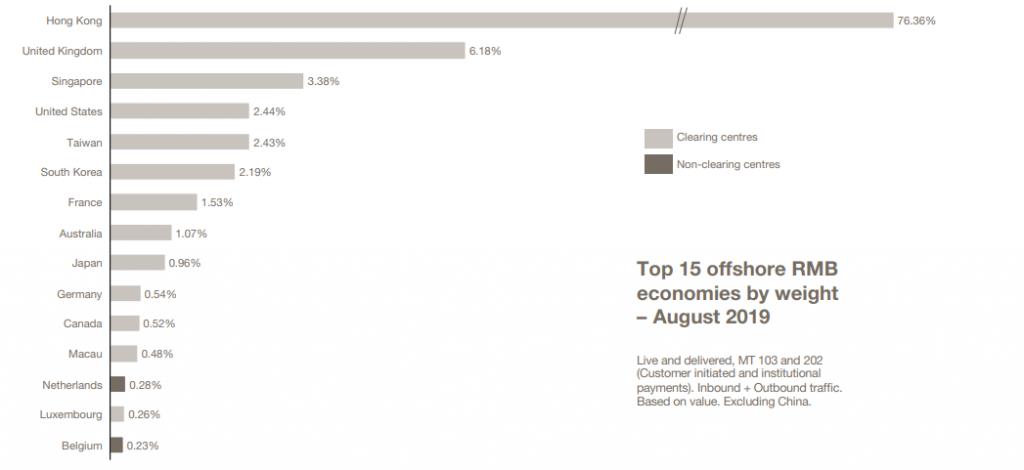

According to Swift, as of August 2019, Hong Kong offshore yuan (CNH) amount amounted to 76.36% of the total volume of global CNH transactions. Based on the total transacted volume in Hong Kong, China can use Hong Kong for its capital controls and to internationalise renminbi.8

Total volume (%) of global CNH transactions8

Peter Wong Tung-shun, Asia-Pacific head at HSBC, said Hong Kong and Shenzhen’s strengths complement each other and that they both have a crucial role to play in the internationalization of the Renminbi.

Wong quotes: “Shenzhen is a global center for innovation and advanced manufacturing in the heart of the ‘Silicon Delta’. It plays a prominent role in driving greater use of the yuan in trade settlement and in the use of new technology. Since the launch of the Shenzhen-Hong Kong Stock Connect in 2016, the two cities have worked together to bring more global investment into China’s domestic capital markets, enabling new economy hi-tech companies to be included in global benchmark indices.”7

Hong Kong’s USD Fixed Peg

On 24 September 1983, throngs of people stood outside the supermarket to grab whatever groceries they could get as they were uncertain about the future of Hong Kong when it returns to Chinese rule.

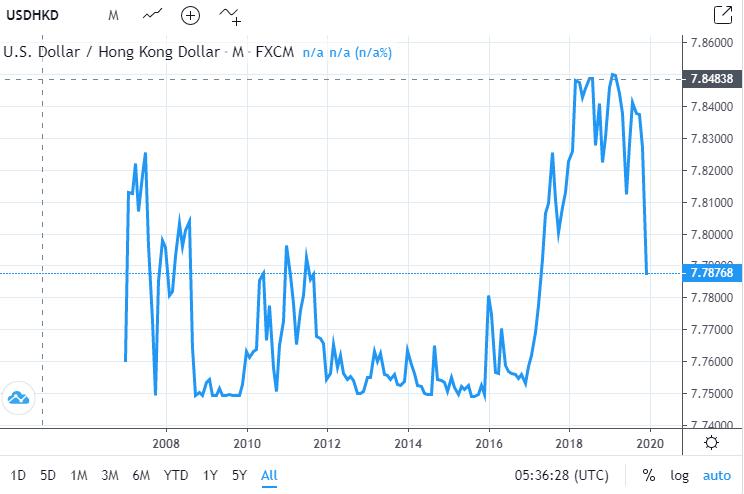

That day was known as Black Saturday, where panic selling under the floating peg drove the currency from 9.6 per USD to 6.5 per USD. Shops began to charge in US dollars instead of Hong Kong dollars out of fear for hyperinflation. To curb this fear, financial secretary of British Hong Kong Sir John Henry Bremridge introduced the US dollar fix peg to the Hong Kong dollar. It was originally set at a rate of 7.8 per USD and is now allowed to trade at a fixed range between 7.75-7.85 per USD. The fixed peg to the USD re-established confidence amongst its citizens and investors.

USD/HKD exchange rate since 20089

So how does a fixed peg work?

Fixed exchange rate allows the currency to trade within a certain range band with another pair. It is different from the float exchange rate which is based solely upon the supply and demand of the currency. Hong Kong keeps the range between 7.75-7.85 per USD. When money flows out of Hong Kong depressing its currency, the Hong Kong monetary authority buys back currency. Conversely, when the currency strengthens to 7.75 per USD, the Hong Kong monetary authority will sell Hong Kong dollars to put downward pressure upon its currency. Hong Kong is able to do this as the Hong Kong monetary authority has US$432.8 billion foreign exchange reserves and 7 times the currency circulation. (As of end August 2019)10

Why is this fixed peg crucial for Hong Kong?

The fixed peg allows Hong Kong to maintain exclusivity from mainland China. Fusing that with its traditions of being governed by the rule of law cements Hong Kong’s unique position as an international financial hub in the heart of China.

In this information age, we are constantly bombarded with new information from the news and social media. In investing or trading, it is crucial to be able to filter out information from noise by using data and fundamentals.

Given Hong Kong’s geographical location, its unique role as an international financial hub governed by the rule of law and China’s vision of the Greater Bay Area, I believe that Hong Kong will not fade into obscurity and irrelevance. In contrast, Hong Kong would play a vital role in China’s Greater Bay Area initiative and complement China.

My main agenda in this article is to filter out the wheat from the chaff using data and fundamentals to give you a clearer picture about Hong Kong. With this information, you can further decide about whether it is still viable to invest in Hong Kong in the long run.

That’s all for now folks!

References:

[1]https://fortune.com/2019/06/07/us-china-trade-war-manufacturers-leaving/

[2]https://www.cnbc.com/2019/06/04/china-ramps-up-own-semiconductor-industry-amid-the-trade-war.html

[3]https://www.bbc.com/news/business-47287387

[4]https://www.bayarea.gov.hk/en/about/hongkong.html

[5]https://www.scmp.com/native/economy/china-economy/topics/great-powerhouse/article/3002844/greater-bay-area-10-facts-put

[6]http://www.worldshipping.org/about-the-industry/global-trade/top-50-world-container-ports

[7]https://www.scmp.com/business/companies/article/3032199/unconvertible-yuan-drag-shenzhens-race-supplant-hong-kongs

[8]https://www.swift.com/our-solutions/compliance-and-shared-services/business-intelligence/renminbi/rmb-tracker/document-centre

[9]https://tradingeconomics.com/hong-kong/currency

[10]https://www.hkma.gov.hk/eng/news-and-media/press-releases/2019/09/20190906-4/

About the author

Contract for Differences (CFD) Team

Phillip CFD offers more than 5000 CFD contracts and provides the largest number of Singapore CFDs available for shorting with round-the-clock trade support. Visit our CFD website to find out more.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?