Learning lesson from Evergrande October 4, 2021

What this report is about:

- Understanding Evergrande’s business developments.

- Diving into earning financial result.

- Learning lesson from Evergrande

In recent weeks, we have seen countless news headlines on Evergrande’s crisis. The share price has collapsed through this year from HKD$14.14 on 4 January 2021 to a year low of HKD$2.06 on 21 September 2021. Although the share price has rebounced from the low, investors still holding on to their Evergrande shares anticipate a loss of more than 70%. It is beneficial for us to learn from their experience and avoid making these mistakes ourselves.

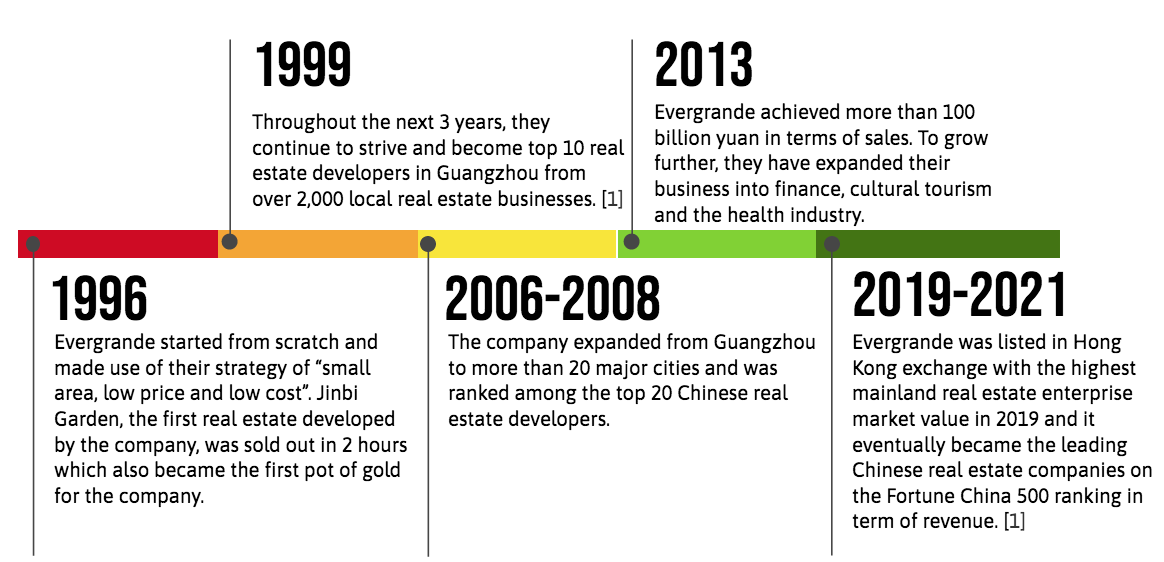

Let’s explore Evergrande’s business developments over the years:

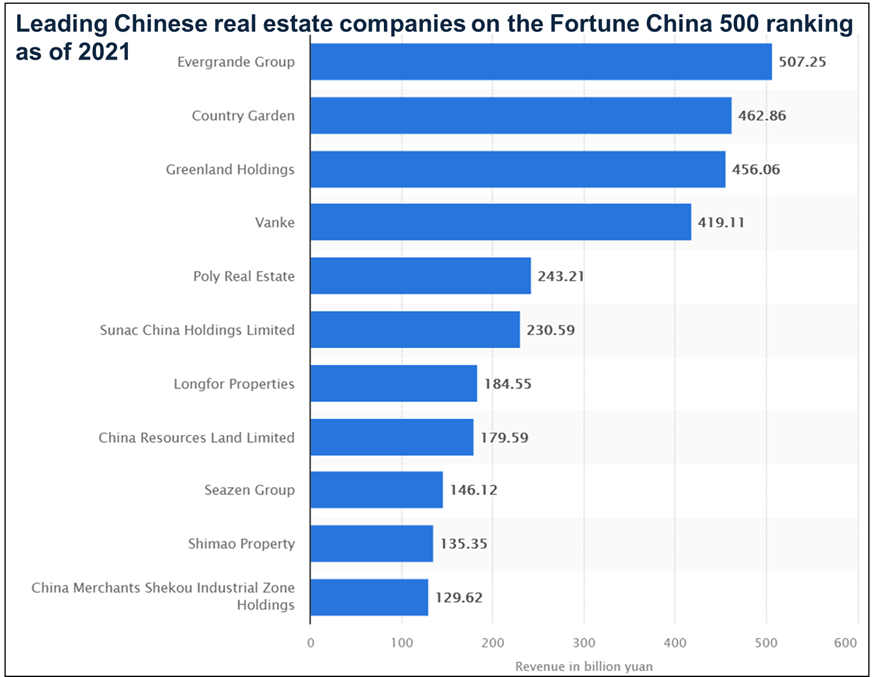

As the leading Chinese real estate company with the highest revenue, how did Evergrande get into a debt crisis

To understand better, we would need to dive into Evergrande’s earning financial results.

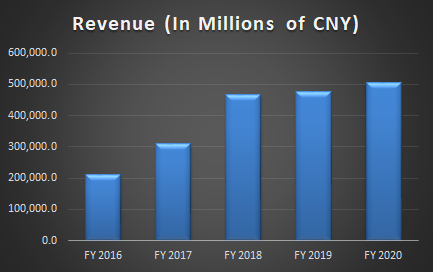

One of the first things we would examine is the revenue of a company. Revenue is the total amount of income generated by the company’s primary operation, through the sales of their goods or services. We also refer to revenue as the top line as it is located at the top of the income statement.

Looking at Evergrande’s revenue in the past 5 years, we can see that it has been able to grow its revenue despite slowing down in the last 2 years. With the revenue growing well, we would anticipate high net income.

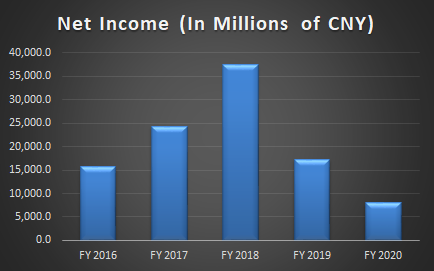

From the chart, we can see that the net income has been growing initially but has been on a downward trend for the last 2 years. We can see that there is a clear disconnect between revenue and net income. Furthermore, net income can be subjected to accounting manipulation and fraud, therefore it is essential for us to also consider their net cash flow.

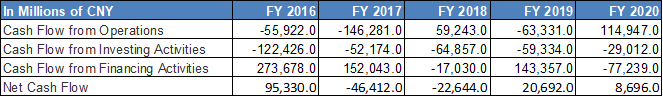

Cash flow from the operation is an important indicator for us to determine how successful a company is for core business activities. From figure 4, we can see that Evergrande’s cash flow from their operations has been red for 3 (out of 5) years. This is a red flag that their main businesses are not generating sufficient cash flow to keep their operations afloat.

Moving on to cash flow from investing activities, they are generated or spent on non-current assets that are intended to produce a profit in the future. It is quite common for the property sector to experience negative cash flow from investing activities due to common expenditures such as land purchases.

In order to support both operating and investing activities, they can only do it through financing activities. This includes sources of cash from investors or banks, as well as the uses of cash paid to bondholders and shareholders.

Evergrande has been trying to borrow from banks, issuing bonds and selling wealth management products through China Evergrande group. Reuter has reported that more than 80,000 people including employees, their families and friends as well as owners of Evergrande properties, were lured by the promise of yields approaching 12%. As a result, they bought wealth management products with more than 100 billion yuan in the past 5 five years[3]. Such high yield products are too good to be true for investors and unsustainable for Evergrande.

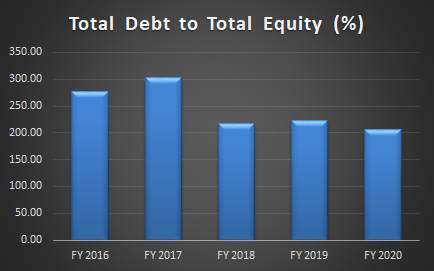

From the total debt to total equity ratio, it has consistently been above 100% for the past few years. This is above the three red lines guidance that the Chinese government set last year.[4]

1. a 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract

2. a 100% cap on net debt to equity ratio

3. a cash to short-term borrowing ratio of at least one

If developers fail to meet a minimum of at least one of the “three red lines’, regulators would place restrictions on the extent to which they can grow their debt. Evergrande is not the only property developer that has been using debt to grow their business however this is unsustainable in the long run. This has led to the housing price bubble in China. In our previous article, China has also highlighted that sustainable growth is one of the key areas to focus in their 14th five-year plan.

From the Wall Street Journal, Chinese authorities are asking local governments to prepare for the potential downfall of China Evergrande Group[5]. There is also a number of China developers in similar situations. Has the worst scenario of the Evergrande Saga played out yet?

Learning lesson from Evergrande

In our recent article on “how to prepare your portfolio for rising interest rate environment”, I have pointed out and zoomed in on companies that are heavily dependent on debt, and would be negatively affected when the interest rate starts to go up. They would have to shoulder higher interest expenses which would affect their profitability or dividend payouts. They could also be forced to raise equity to lower their debt. This would lead to dilution for existing shareholders. We should therefore:

• Look beyond the revenue and net income as the company might be heavily depend on debt for growth

• Observe the trend of cash flow from their operations

• Observe their net cash flow

• Observe their trend debt ratio

Hence, it is important for us to dive deeper into a company’s financial result, rather than the mere scraping of their revenue and net income. This would paint a clearer picture for our investment journey.

How to gain exposure?

Investors and traders with a bigger risk appetite may consider using Contracts for Differences (CFDs) to gain exposure to these stocks.

CFDs are versatile tools for investors, particularly those who take an active approach to investing. They can be used for hedging, short-selling and leveraged trading. CFDs are traded on margin, which means you would only need to put up a fraction of the full value of your trade upfront.

CFDs are also ideal tools for people with less capital but wish to capitalise on the growth potential of certain industries. Or they could simply wish to take advantage of the latest market movements regardless of its direction.

Both your potential profits and losses are amplified when you trade CFDs. Hence, CFDs may not be suitable for investors whose investment objective revolves around capital perseverance and/or whose risk tolerance is low.

To understand more, refer to our article on “Understanding Contracts for Differences”.

Thank you for staying with us till the end of this lengthy read! We sincerely hope that you’ve found value in reading our article.

If you do not have a POEMS account, you can check out this link or scan the QR code below to open one with us today!

Reference:

- [1] https://mobilesite.evergrande.com/en/about.aspx?tags=5

- [2] https://www.statista.com/statistics/454494/china-fortune-500-leading-chinese-real-estate-companies/

- [3] https://www.reuters.com/world/china/chinas-mom-and-pop-investors-builders-homebuyers-caught-evergrande-debt-crisis-2021-09-23/

- [4] https://www.bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake

- [5] https://www.wsj.com/articles/china-makes-preparations-for-evergrandes-demise-11632391852

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mike Ong

Assistant Manager, Dealing

Mike is a member of the largest dealing team that specialises in Equities, ETFs, CFDs & Bonds, and manages >50,000 client accounts in Phillip Securities. He believes in investing long-term for passive income and evaluates stocks using fundamentals.

He is currently the chief editor of the HQ education series that aims to equip clients with tools and skill sets to make better investing and trading decisions.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It