What You Should Know about the South Korea Market November 16, 2018

Did you know that South Korea’s economy currently ranks 12th in the world by nominal gross domestic product (GDP)? As an economic powerhouse, South Korea is a stable high-income developed country and a member of the Next Eleven countries, also known as N-11. This is a term coined by Goldman Sachs to represent eleven countries that have the potential to rival G7 nations; possessing promising prospects for growth in the coming years1.

Despite having little in terms of natural resources, the country has consistently been one of the world’s fastest growing economies and is now the seventh largest exporter and tenth largest importer in the world. The majority of these exports hail from the automotive industry. South Korea has home-grown, instantly-recognizable conglomerates like the Hyundai Kia Automotive Group and the Consumer Electronics Samsung Group.

“The Age of Northeast Asia is fast approaching.” Roh Moo-hyun

The 9th President of South Korea perhaps best-summarized South Korea’s potential with the above quote. This is evident from the country’s per capita income and GDP growth between the 1980s and 2010, growing from $2,300 to $30,000, and $88 billion to over $1.46 trillion respectively.2

Macroeconomic Overview of South Korea

South Korea has a very attractive economy for international investors, given the rapid growth that has been experienced. However, there are several macroeconomic factors that investors should consider before investing in the East Asian nation.

-

South Korea’s Promising Traits:

- Growth Prospects

- South Korea’s economy is expected to grow at a rate of 3.9% to 4.2% per year between 2011 and 2030, along with most Next Eleven countries.

- Stable Economy

- South Korea is a member of the G20 as an OECD nation, with per capita income of more than $30,000, which affirms the stability of the economy.

-

South Korea’s Challenges:

- Geopolitical Risk

- South Korea is situated in one of the most militarized regions in the world, with Communist North Korea as its next-door neighbour.

- Reliance on Exports

- South Korea’s economy relies heavily on exports, which can be detrimental when the global economy contracts.2

Economics of Korean Unification Compelling, Even if Prospects are Bleak

The prospects of reunification of the two Koreas occurring in the near to medium term appears dim, even with thawing relations on the peninsula. Politics aside, the economic case for reunification is compelling. This can be seen from the reunification of East and West Germany, where short-term costs were hefty but long-term gains a boon for the German economy, overall.

Combining North Korea’s population of about 25 million with South Korea’s roughly 50 million people would create a country with a population about the size of Germany. Given North Korea’s relatively younger populace, the unification could potentially help address South Korea’s demographic challenges.

South Korea’s government values the net benefits of unification at 14.5 quadrillion won (USD13 trillion), with the benefits being spread out over 45 years; while the estimated cost for this range from USD50 billion to USD5 trillion.

(Source: Bloomberg)

Why is the South Korea Stock Market Attractive?

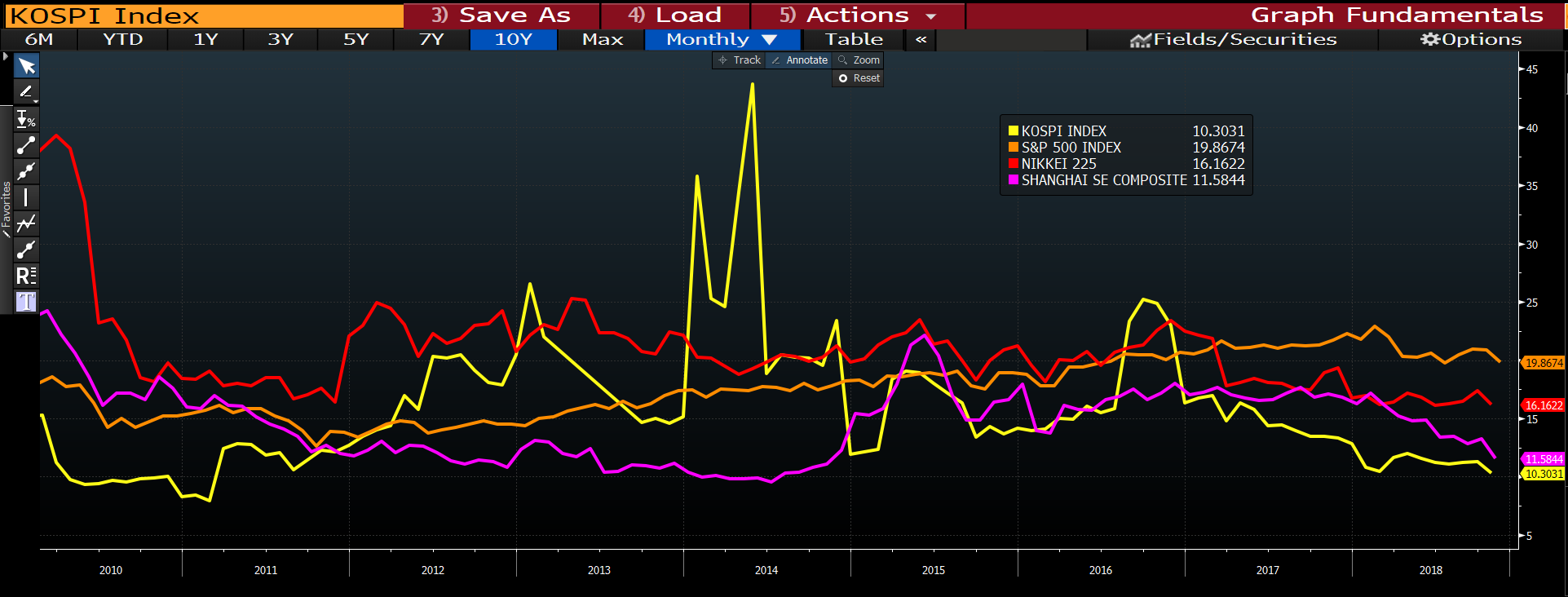

Discounted valuation

If you look at the Korean stock market, also known as the KOSPI, the Price-to-Book (P/B) ratio is slightly below book value (<1), and the Price-Earnings (P/E) ratio is around 10x.

(Source : Bloomberg)

Fiscal Strength

South Korea has one of the lowest levels of sovereign debt, amounting to approximately 38% of its GDP which is considerably low when compared to other developed economies. This indicates that the government is in a good position to deal with any future market or banking liquidity problems due to its low national debt and could easily borrow more to resolve problems faced by the economy.3

Increasing South Korean Brand Power

South Korea’s economy and markets are dominated by export-oriented companies, with many of those being famous global brands that are now household names like Samsung Electronics, LG Electronics, Hyundai Motors and Kia Motors.

The country’s export sector does not just comprise of the Consumer Electronics, Information Technology and Automobile conglomerates, but is also dependent on Materials and Industrial Goods exports. Some of the biggest companies within this industry are:

- Posco (005490 KS) – a steelmaker

- LG Chemical (051910 KS) – a chemicals manufacturer

- Hyundai Heavy Industries (009540 KS) – a machinery maker.

Furthermore, South Korea’s music and culture have also gained popularity across the world, with companies like SM Entertainment Co Ltd (041510 KS) being one of the major players in this industry.

These companies have time and again reinforced their global presence through their product offerings that give customers quality goods at competitive prices. Beyond the penetration of developed countries like the United States and Europe, South Korean exporters have also managed to enter emerging markets like China, India and Brazil that many analysts expect will continue to fuel the Korean growth story.4

South Korea Largest business groups

Here is an overview of some of the largest business groups in South Korea:

| Ticker | 005930 KS | 005380 KS | 000660 KS |

| Name | SAMSUNG ELECTRONICS CO LTD | HYUNDAI MOTOR CO | SK HYNIX INC |

| Last Price (KRW) | 44,950 | 122,000 | 71,200 |

| Market Cap (USD) | 254.093B | 22.954B | 45.644B |

| P/E | 6.71 | 10.08 | 3.66 |

| P/B | 1.19 | 0.36 | 1.24 |

| ROE | 19.15 | 3.66 | 40.06 |

| Div Yield % | 2.53 | 3.28 | 1.40 |

| Op Margin % | 22.39 | 4.75 | 45.57 |

| Net Profit Margin % | 17.26 | 4.18 | 35.34 |

(Source : Bloomberg)

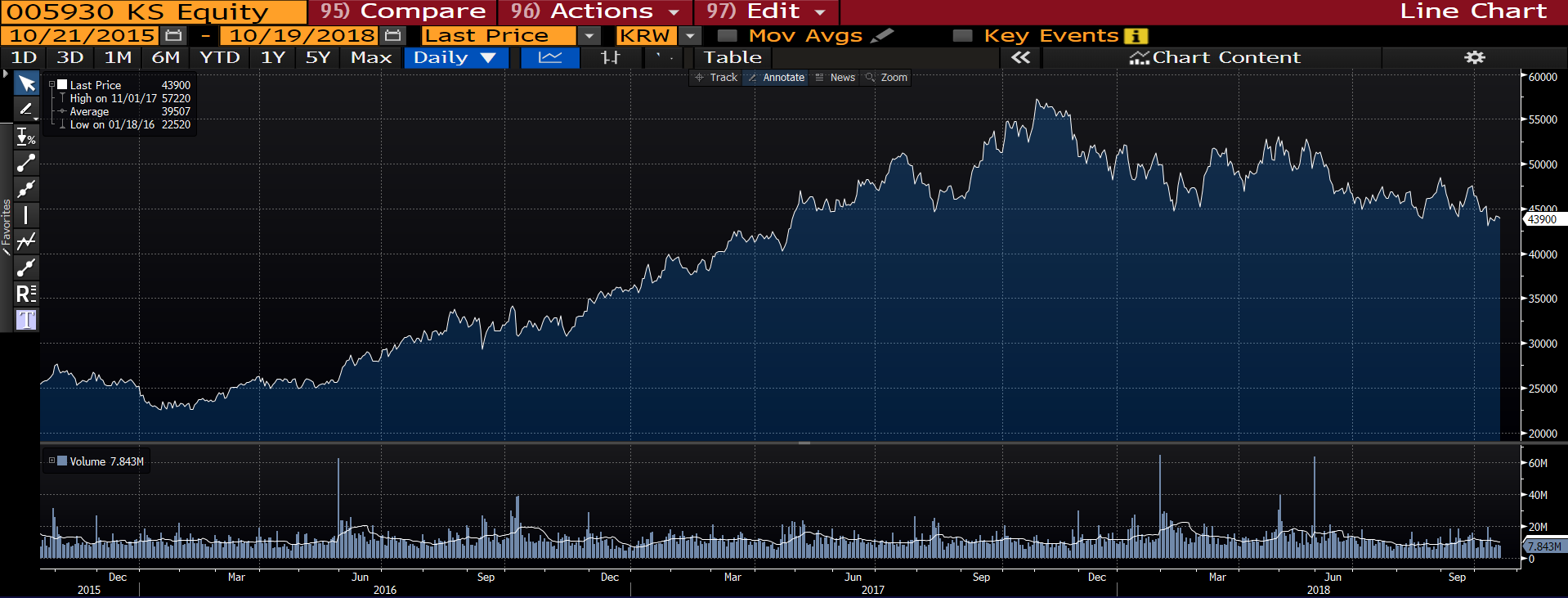

Samsung Electronics (005930 KS)

Founded in 1969, Samsung Electronics is the world’s biggest technology firm by revenue, and by far the largest listed company in South Korea. Its market capitalisation is more than three times greater than its closest rival – Hyundai Motor.

The technology firm is currently also the world’s biggest maker of memory chips, smartphones and televisions.

Samsung Electronics is the flagship subsidiary of South Korea’s biggest business conglomerate — Samsung Group — comprising nearly 80 affiliates. The family-run group has a significant impact on South Korea’s economy, accounting for about one fifth of the country’s GDP.5

Samsung Group is looking to invest around 25 trillion Korean won (USD22 billion) over the next three years into new growth areas, predominantly led by Samsung Electronics.

Those investments would be made in four key areas, namely: artificial intelligence (AI), fifth-generation mobile network technology, electronic components for future cars and bio-pharmaceuticals.6

Hyundai Motor Company (005380 KS)

The Hyundai Motor Company is a South Korean multinational automotive manufacturer headquartered in Seoul, South Korea. Founded in 1967, the company, alongside its 32.8% owned subsidiary, Kia Motors, and its 100% owned luxury subsidiary Genesis Motors, altogether comprise the Hyundai Motor Group.

Under its core values, Hyundai Motor Company recognizes the importance and impact that automobiles have on society and mankind. It strives to play a role that extends beyond being a simple car manufacturer to becoming customers’ lifetime companion.7

Hyundai Motor Group plans to invest around 23 trillion won (USD21.56 Billion) over the next five years in areas such as electric cars, self-driving automobiles and artificial intelligence; South Korea’s finance ministry has said.

The announcement comes as South Korea’s second-largest conglomerate is looking to venture into newer growth areas after its sales declined last year due to an inadequate product line-up in the United States and diplomatic tensions with China.8

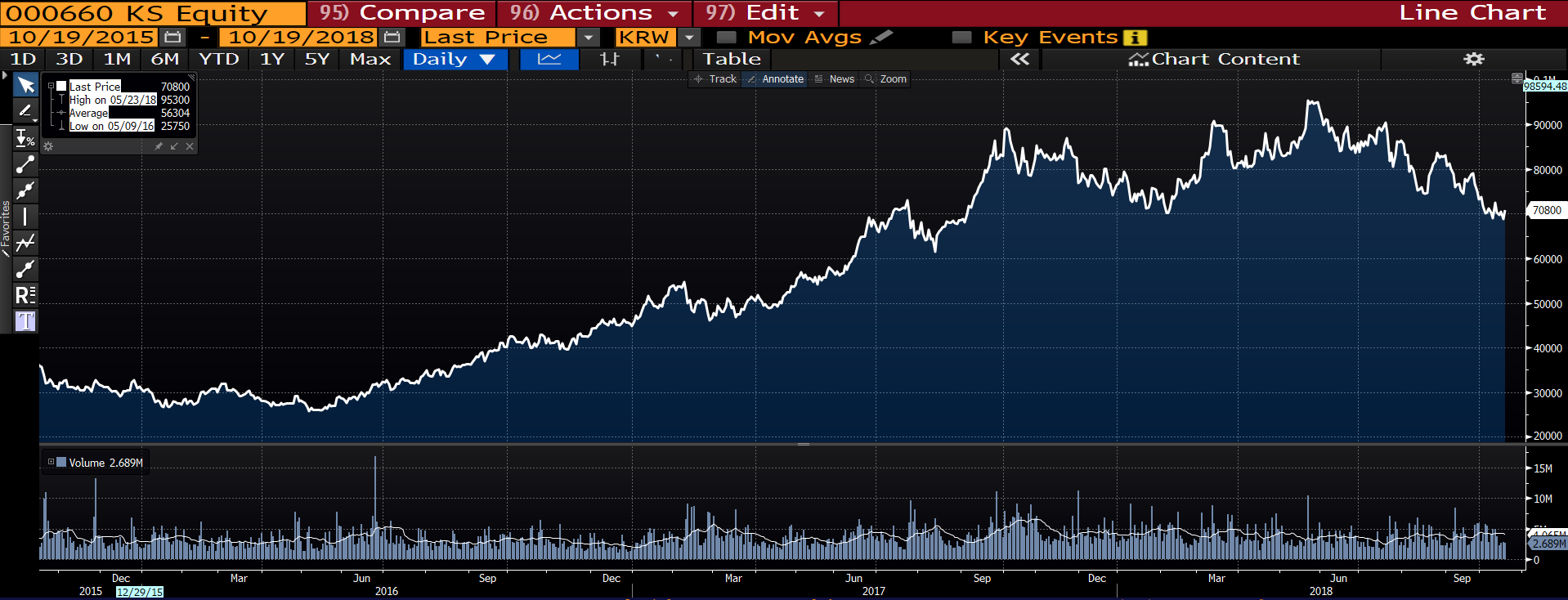

SK hynix Inc (000660 KS) SK hynix Inc. – the second largest DRAM manufacturer in the world behind Samsung – is a South Korean semiconductor memory-chip maker and supplier of dynamic random-access memory chips and flash memory chips. Founded as Hyundai Electronic Industrial Co., Ltd. in 1983 and known as Hyundai Electronics, the company has since grown; with its operations located all around the world from the United States to Belarus. It went public in 1996, with Hyundai completely spinning it off in 2001. By then its name was Hynix – from “Hy” in Hyundai and “nix” from “nics” in electronics. In 2012, when SK Telecom became its major shareholder, Hynix merged with SK Group – the third largest conglomerate in South Korea – and was renamed SK hynix.9 With 30 years of expertise in semiconductor production and operations, SK hynix is dedicated to continuous R&D and investment to achieve cost competitiveness and technological leadership in the global semiconductor market.10 SK hynix products can be found in some Apple products like the iMacs and MacBooks. If you are looking for instant diversification into the South Korea market, you may consider the SAMSUNG KODEX 200 (005930KS) Exchange Traded Fund (ETF) as shown below: This ETF allows you to gain exposure to a broad selection of South Korean companies by tracking the country’s broad-based market index – the KOSPI 200 Index. The index – with 200 constituents under its holdings, account for around 93% of the South Korean equity market, and is designed to gauge the performance of large and mid-cap companies.

Trade in the South Korea Market with Phillip Securities We are pleased to announce that we have reduced our South Korea commission rates to 0.4% and minimum brokerage to KRW20,000 for customers. Continuous trading for the Korea market is from 8:00am to 2:30pm daily. Refer to South Korea Rates for more information.

Information is accurate as of 19 October 2018

Ticker

069500 K Equity

Name

SAMSUNG KODEX 200 ETF

Last Price

27,840

AUM (USD)

5,000mil

Total No of Holdings

117

Div Frequency

3 Times a Year

Div Yield

1.98%

Expense ratio

0.15%

Reference:

About the author

Global Markets Team

Phillip Global Markets offers you access to more than 23 global stock exchanges with just a single account. More information about our offerings.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It