Most Active US Stocks on POEMS in May 2021 June 16, 2021

The following list comprises some of the most active US stocks – not in any order of ranking – on the POEMS platform in May, based on gross market value traded.

At a glance:

- After smashing new records in April, all three major indices moved sharply down in the first half of May. They trended higher in the second half to close the month off their record highs.

- Inflation has jumped the fastest since 2008. This poses the risk of the Fed revisiting its dovish monetary policy sooner than expected.

- Sentiment may be affected, leading to near-term market volatility.

The three US major indices – Dow Jones, S&P 500 and Nasdaq Composite – turned down sharply from their April highs during the first half of May, on rising inflation fears. The Dow opened at 34,113 and dropped to its month low of 33,588, down 1.5%. It closed slightly higher at 34,529 at month-end.

S&P opened at 4,193 and shed 3% to a month low of 4,063, before recovering to 4,204. The tech-heavy Nasdaq opened at 13,895 and lost more than 6% to 13,031. It managed to pare some losses to close at 13,749. Though all three indices had a volatile month, two still closed near their record levels. Only the Nasdaq was more than 3% off its record high. This suggests still-bullish market sentiment.

April’s consumer prices rose 4.2%, the fastest since 2008. Inflationary pressure has been building up in recent months, which might challenge the Fed to review its monetary policy. Investors fear the Fed may raise rates sooner than later to rein in inflation. June’s FOMC meeting will provide a clearer picture on the Fed’s stance. Though it is highly unlikely that the Fed would start tampering with rates, markets are still nervous.

We have included technical charts for the 10 counters. These are based on 1-hourly and 4-hourly time frames over 60 days. The charts are for your information only and the support and resistance levels discussed are solely based on our dealers’ views. They should not be construed as buy or sell recommendations and investors and traders are advised to do their own due diligence before making any trade.

Palantir Technologies Inc (NYSE: PLTR)

Palantir, a maker of analytics software for the government, released quarterly results on 11 May. Revenue grew 49% YoY to US$341mn, beating analysts’ estimate of US$332.2mn. Earnings per share of 4 cents was in line1. After dropping more than 20% on inflation fears, the stock closed 9% higher following its results announcement.

The company’s US commercial and US government revenue grew 72% and 83% YoY respectively2. The growth in commercial revenue was important as the company previously relied heavily on the government sector. The inroads made with commercial customers were a function of the US’ economic recovery as well as successful diversification by Palantir. The latter would lower its revenue-concentration risks. Palantir also provided a better-than-expected revenue forecast of US$360mn for the coming quarter vs. market expectations of US$344.3mn. This is expected to sustain bullish sentiment.

Along with the broader market, Palantir traded down and bottomed at US$17 on 11 May. It recovered for the rest of the month after the market digested its earnings beat. The stock closed at US$22.95, up 35% from its low during the month.

Technical Analysis:

Status: Technical Sell below US$24.00

Support: US$21.93 – US$22.20

Resistance: US$24.05 – US$24.30

Bullish market structure into resistance, more potential up move once above.

Sea Ltd (NYSE: SE)

Owner of e-commerce platform, Shopee and game developer Garena, Sea reported earnings on 18 May. Revenue was US$1.76bn, up 146% YoY on the back of aggressive expansion. With the money spent on expansion, net loss also worsened 50% YoY to US$422mn. EBITDA similarly suffered from the aggressive growth, coming in at US$88mn and missing market estimate of US$172.9mn by more than 50%. As a result, investors sent the company’s shares down 5.6%.

Sea is typical of a growth company chasing after revenue and market shares. This comes at a cost. Thankfully, its main digital entertainment and e-commerce sectors are growing exponentially, by 111% and 250% YoY respectively. These growth rates are expected to make up for the company’s widening losses3.

The company was also included in the MSCI Singapore Index on 27 May. Its initial weighting in the index is 1.85%. As it is listed on the NYSE, its inclusion is expected to bring the MSCI Singapore in line with other global indices that already have exposure to New Economy sectors.

Technical Analysis:

Status: Technical Sell below US$261.35

Support: US$238.10 – US$241.20

Resistance: US$ 258.55 – US$259.65

Range-bound.

Microsoft Corporation (NASDAQ: MSFT)

One of the world’s most valuable companies, Microsoft’s Q1 2021 earnings exceeded estimates. Earnings per share was US$1.95 vs a US$1.78 estimate. Revenue topped estimate at US$41.71bn vs US$41.03bn. Revenue growth was the highest at 19% since 20184. This was thanks to a continued surge in PC demand on the back of the pandemic as well as the long-term trend towards cloud services. Microsoft is now the second-largest player in cloud services, with Azure, its cloud division enjoying double-digit revenue growth of 50%.5

Microsoft forayed into the China market in May, by partnering a Chinese retail tech company to develop cloud-based solutions for omni-channel retailing. The partnership includes grocery deliveries, which have understandably spiked during the pandemic6. Penetration of the Chinese cloud market could provide a much-needed boost for the tech giant as its cloud business recently flattened due to competition and saturation in its home country. That said, entering China has risks as its government has been reining in foreign companies’ share of the local market. Microsoft will also find itself squaring off local cloud giants like Alibaba, with its substantial share of the market.

Microsoft trended down from its high of US$263 in April, as investors took profits amid fears that inflation could hurt the tech sector the most. However, with the company’s past record of consistent earnings beats, investors may find value in the stock after its pull-back. It closed at US$249, 5% off its record high.

Technical Analysis:

Status: Technical Buy above US$247.50

Support: US$243.85

Resistance: US$252.65 – US$254.35

Strong rejection off key level at US$243.80. Incoming bullish momentum

NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA reported its first-quarter earnings on 26 May. Both revenue and earnings per share outperformed, at US$5.66bn vs estimate of US$5.41bn and US$3.66 vs US$3.28 respectively. Revenue growth of 62% YoY came from a surge in demand for chips for PC games, AI development and crypto mining.7

The current global semiconductor shortage is expected to persist as demand for chips continues to escalate from numerous applications. Nvidia’s revenue could ramp up as well since its graphic processors are important components of many industries. Although a recent clamp-down on crypto mining in many countries, especially China, could affect demand for its crypto mining chips, this is expected to have minimal impact on Nvidia as it is concentrated on the gaming and data-centre businesses.

Nvidia also announced a stock split of 4-for-1 on 24 May. This gave investors an opportunity to take profits without reducing their holdings in the company substantially. It also makes the stock more investable for retail clients, now that its share price is lower. The market cheered the news and sent the stock up more than 10% following the announcement. The stock opened at US$605 before bottoming with the broader market at US$547. It closed at US$650, up 20% from its bottom.

Technical Analysis:

Status: Technical Buy above US$690.55

Support: US$660.60 – US$662.55

Resistance: US$690.40

Bullish market structure moving out of all-time high

Alibaba Group Holding Ltd (NYSE: BABA)

May was an eventful month for the largest Chinese e-commerce company, Alibaba. Reported earnings were way off estimates due to a RMB18.23bn regulatory fine in April. This contradicted the company’s earlier statement that the fine would not have a material impact on its financials. Alibaba reported its first operating loss of RMB5.47bn vs expectations of a RMB6.95bn profit for the quarter. Although revenue came in better than expected at RMB187.39bn vs RMB180.41bn8, Alibaba’s share price tanked close to 8% to a day low of US$204 due to its unexpected loss.

The earnings announcement closed the chapter on its brush with the Chinese regulators that started last year with a probe into – and eventual cancellation of – Ant Financial’s IPO. The anti-monopoly investigation has wiped off more than US$240bn from its market value. Chinese regulators now allow the Ant Group to operate as a consumer finance company, as part of a restructuring required from the group following its scrunity. Ant can also provide personal finance and other services such as bond issuances etc9. This may bring Ant one step closer to its long-awaited public listing.

Alibaba continued its momentum from the previous month, opening at US$231. After its results announcement, it sank to a low of US$204. It recovered to US$213 at month’s end, as investors believed the worst could be over for the company.

Technical Analysis:

Status: Neutral

Support: US$213.15 – US$214.00

Resistance: US$220.30 – US$221.31

Range-bound

Pinterest Inc (NYSE: PINS)

Pinterest’s shares dropped 5.42% to a low of US$62.42 in May from its opening price of US$66.00, although earnings beat expectations. The reason was disappointment with its user growth, an important metric for social-media platforms. Growth was flat in Q110.

Still, Pinterest’s monthly active users had ballooned from 265mn to 478mn between 2018 and Q1 2021. In tandem, revenue went from US$755.9mn to US$1.9bn11. As the continuous growth in its monthly active users may translate into future revenue growth, the drop in its share price may present buying opportunities for long-term investors.

Technical Analysis:

Status: Neutral

Support: US$59.90 – US$60.55

Resistance: US$66.70 – US$68.40

Range-bound

Plug Power Inc (NASDAQ: PLUG)

In early May, Plug’s share price dropped 35.38% from its opening price of US$28.54 to a low of US$18.47. This was in reaction to a class-action lawsuit filed against Plug by US investors, for allegedly making misleading statements as well as failure to disclose its 2020 annual report on time12.

After it restated its results, Plug managed to close the month at US$30.70, up 66.21% from its low of US$18.47. Investors also harboured hopes that Plug, a hydrogen and fuel cell system company, may benefit from President Biden’s US$2tr infrastructure plan to provide clean energy14.

Technical Analysis:

Status: Technical Sell below US$10.45

Support: US$9.30 – US$9.70

Resistance: US$10.63 – US$10.85

Bullish market structure into resistance, more potential up move once above

Zoom Video Communications (NASDAQ: ZM)

Zoom cascaded from its US$320.24 opening to a low of US$273.20, down 14.69% as fears of inflation and potential tax hikes15 loomed. The stock, however, rallied back to US$331.53 by the end of the month, up 21.35% from its month low. This was spearheaded by the launch of its new platform, Zoom Events, which allows event organisers to provide ticket and live events for audiences of any size.16 Zoom’s collaboration with event companies might provide new revenue opportunities.

Zoom also announced earnings on 2 June. Backed by revenue growth of 191% YoY to US$956mn from US$910.2mn, earnings per share outperformed analysts’ expectations at US$1.32 vs US$0.99.17 Its share price, however, slipped 4% due to higher-than-expected cloud-computing costs, which squeezed gross margins to 68.4% from 82.7% the previous quarter18.

Zoom did say that it had 497000 business customers, each with at least 10 employees. This was an 87% increase from a year ago.19 It may lead to revenue growth in the near future for Zoom.

Technical Analysis:

Status: Neutral

Support: US$313.07 – US$314.64

Resistance: US$330.29 – US$334.70

Range-bound

Advanced Micro Devices (NASDAQ: AMD)

Advanced Micro Devices, a semiconductor company that develops computer processors for business and consumer markets, fell to a low of US$72.50 from its opening price of US$81.97. That constituted an 11.55% drop but it managed to claw back some of the losses to close at US$80.08, up 10.46% from its low in May. This was notably aided by the company’s US$4bn stock buyback, equivalent to 4% of its market value.20

Later in early June, the comapny also launched its RX 6000M series GPUs, including three flagship chips: RX 6800M, RX 6700M and RX 6600M. AMD says these can compete with Nvidia’s RTX 3080.21 With growing technological needs, semiconductors are in heavy demand but supply just can’t seem to catch up.22 With the launch of its new chips, AMD could be one stock to look out for.

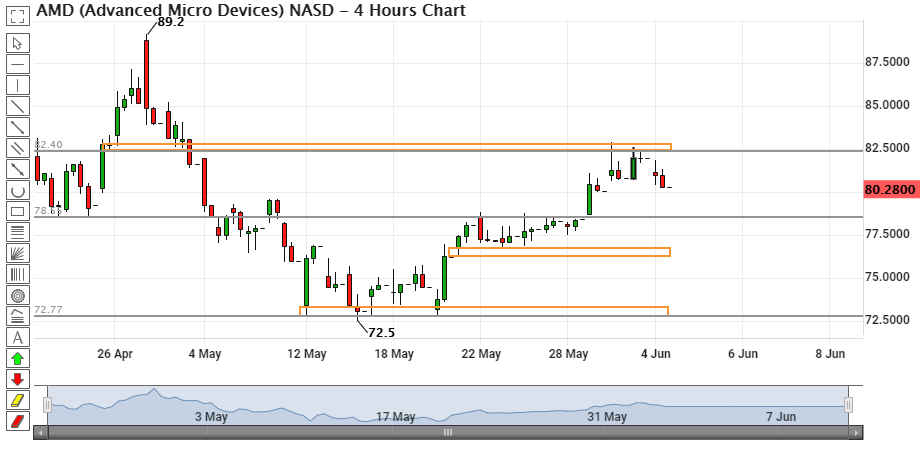

Technical Analysis:

Status: Technical Buy above US$82.50

Support: US$76.25 – US$76.76

Resistance: US$82.44 – US$82.76

Bullish market structure into resistance, more potential up move once above

CrowdStrike Holdings (NASDAQ: CRWD)

Together with all the other tech stocks, CRWD lost 15.17% in May, from its opening price of US$209.00 to US$177.29. It managed to close at US$222.15, up 25.30% from its month low. The recovery came about after it said it has extended its strategic partnership with Google to provide defence-in-depth protection to customers across hybrid cloud environments.23 This might increase demand for Crowdstrike’s services as cyber-attacks increase in frequency and scale.

To top it all, Crowdstrike reported earnings per share of US$0.10, a 400% leap from the previous quarter as it added 1,524 new subscribers. Revenue shot up 70% to US$302.8mn from the previous year.24 With its earnings and revenue beating Street estimates together with its constant upgrade of security and new demand, Crowdstrike could be another stock in your watchlist.

Technical Analysis:

Status: Neutral

Support: US$209.36 – US$212.44

Resistance: US$223.23 – US$224.99

Bullish market structure into resistance, more potential up move once above

Have a view on the above? Join our global investment community on Telegram and share your thoughts/views with us!

You may also follow our past series for more insights on the US market

References:

1. https://www.cnbc.com/2021/05/11/palantir-pltr-q1-2021-earnings.html

2. https://www.businesswire.com/news/home/20210511005389/en/

3. https://www.businesstimes.com.sg/companies-markets/sea-to-replace-suntec-reit-on-msci-singapore-index

4. https://www.cnbc.com/2021/04/27/microsoft-msft-earnings-q3-2021.html

5. https://www.sdxcentral.com/articles/news/microsoft-cloud-revenue-growth-rate-flatlines-at-50/2021/04/

6. https://www.cnbc.com/2021/05/21/microsoft-pushes-into-grocery-tech-market-in-deal-with-chinas-hanshow.html

7. https://www.cnbc.com/2021/05/26/nvidia-nvda-earnings-q1-2022.html

8. https://www.cnbc.com/2021/05/13/alibaba-earnings-q4-net-loss-after-2point8-billion-antitrust-fine.html

9. https://www.cnbc.com/2021/06/03/china-approves-jack-mas-ant-group-to-operate-consumer-finance-firm.html

10. https://www.fool.com/investing/2021/04/30/pinterest-continues-growing-revenue-and-users/

11. https://www.fool.com/investing/2021/05/29/better-buy-facebook-vs-pinterest/

12. https://finance.yahoo.com/news/7-day-deadline-alert-schall-153100055.html

14. https://joebiden.com/clean-energy/

15. https://www.fool.com/investing/2021/05/04/why-zoom-video-fastly-and-square-stocks-all-fell-s/

16. https://finance.yahoo.com/news/zoom-launches-zoom-events-platform-132442496.html

17. https://www.marketwatch.com/story/zoom-video-stock-slips-after-earnings-beat-outlook-hike-11622578603

18. https://www.cnbc.com/2020/06/02/zoom-zm-earnings-q1-2021.html

19. https://www.investors.com/news/technology/zoom-stock-zoom-earnings-zm-news-q12021/

20. https://finance.yahoo.com/news/amd-unveils-4-billion-stock-172826500.html

21. https://finance.yahoo.com/news/amd-rolls-radeon-rx-6000m-145802288.html

22. https://www.cnbc.com/2021/05/07/chip-shortage-is-starting-to-have-major-real-world-consequences.html

23. https://finance.yahoo.com/news/crowdstrike-google-cloud-extend-strategic-120000354.html

24. https://finance.yahoo.com/news/crowdstrike-posts-400-earnings-growth-145323584.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng (Dealer), Jonah Sim Hong Chee (Dealer) & Lee Ying Jie (Dealer)

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Jonah Sim is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He graduated from University of Essex with a Bachelor Degree in Banking and Finance.

Ying Jie is a US Equity executive in the Global Markets Team and specializing in US and Canadian markets. He is proficient in trading using Technical Analysis, placing emphasis on supply and demand, and price action.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!