National Day Special : Singapore Sectors worth Investing August 5, 2021

As Singapore marks her 56th birthday, let us remember our past struggles and rally together as a nation and overcome the seismic changes that continue to disrupt our lives and economy since the pandemic broke out in 2020.

Singapore market performance

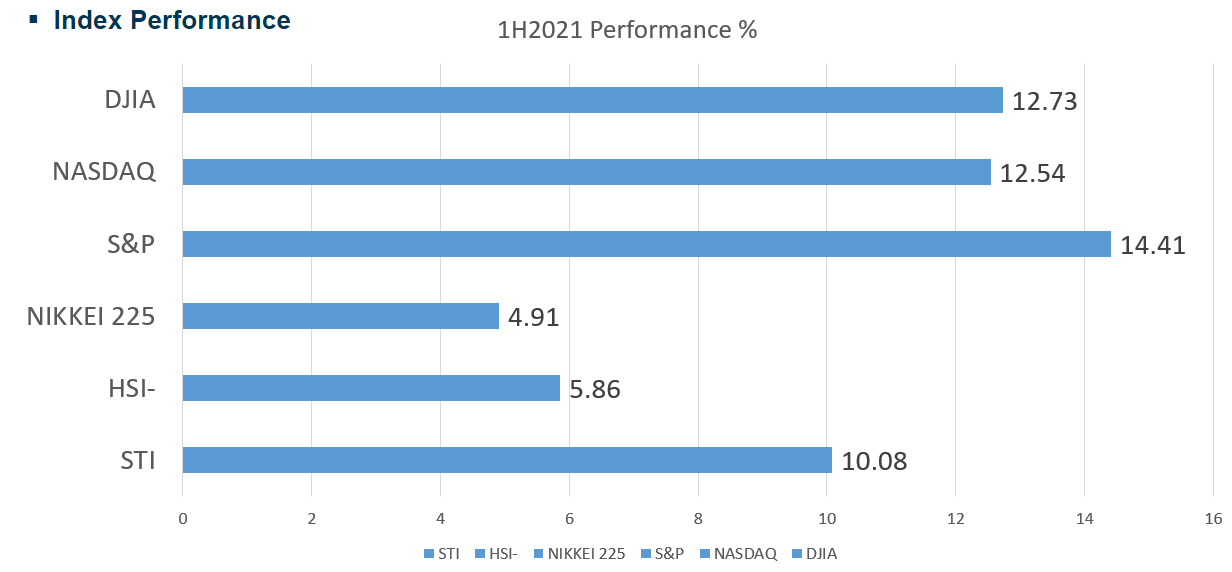

The FTSE STI might have underperformed US stock indices in the first half of the year but against the region, it has done pretty well. It has fared better than the Nikkei 225, Shanghai Composite Index and Hang Seng Index.

[Calculated based on Index prices of 30 June 2021 vs 31 Dec 2020]

[Calculated based on Index prices of 30 June 2021 vs 31 Dec 2020]

Singapore government have been active in supporting the economy recovery through various stimulus packages. In the recent heightened alert phases, attention was also given to stallholders for food and markets which were affected due to the clusters.

Though the pandemic is lingering on with repeated resurgences in the country and the region and the virus continues to mutate, the impact on economies should get progressively milder as vaccination rates increase and countries learn to contain the spread.

Dividend yields attractive

In the current environment of low interest rates, bond yields are generally lackluster. This compels investors to seek out alternative asset classes or investment sectors for yields. Compared to unpredictable capital gains, dividend yields are more stable and predictable in certain industries.

Some Singapore sectors are still able to generate attractive returns for investors through dividend yields.

With no capital-gain or dividend tax for retail investors in Singapore, dividends are a preferred way of securing a steady stream of income and cash flow from investments. Dividend yields from overseas investments might be subject to withholding taxes or fees.

The following formula can help you calculate the annual returns of equities, derived from both dividends and capital gains.

Sectors to look out for

In Singapore, the finance and real-estate sectors, particularly real-estate investment trusts or REITs, are known to reward investors with stable and relatively high yields.

Banks

Since last July, local banks have been observing a dividend cap implemented by the MAS. This limited their dividends in FY20 to 60% of their 2019 payouts. The purpose was to ensure that the banks had sufficient capital buffers for lending and absorbing further economic shocks during the pandemic.

On 30 June this year, the MAS said it was assessing the possibility of lifting this cap in the near future. It is currently running financial stress tests on banks. If the cap is lifted, the dividend yields of bank stocks could rise.

Banks are usually negatively affected by low interest rates, as lower interest rates mean lower net interest margins which in turn reduces their earnings from net interest income segment.

However, with the Singapore and regional economies slowly on the mend, banks are expected to report better earnings in the coming quarters, from higher loan growth, wealth management fees, and trading income.

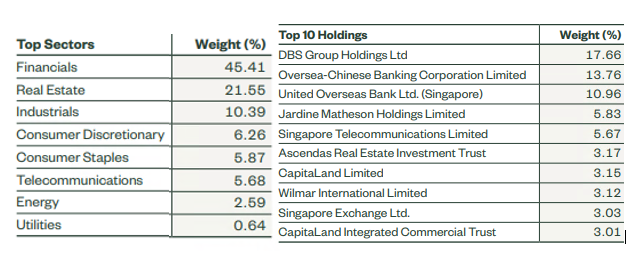

Banks’ stock performances are usually correlated with the FTSE STI. This is because the financial sector forms more than 45% of the index, with the three local banks alone making up more than 42% as of 30 June 2021. Given the index’s high exposure to banks, banks are usually regarded as a proxy for the STI.

REITs

Another sector which is holding its ground is REITs. Firstly, though the pandemic has affected sub-sectors such as hospitality and retail REITs, REITs typically pay higher dividends yields and are sought after by investors. Secondly, current low interest rates benefit the REITS, through lower debt-servicing. REITs tend to borrow heavily to finance and operate their properties. Lower interest rates reduce their cost of operations and debt-financing.

With the pandemic triggering a growth spurt in e-commerce, a particular sub-sector of REITs is having its moment in the sun. Logistics and warehousing REITs have been benefitting from higher demand for warehousing facilities. Their rental performance and occupancy rates have been stronger than those of retail REITs.

Meanwhile, industry consolidation could possibly eliminate or lead to delisting for the weaker firms such as, Perennial Real Estate Holdings and LCT Holdings in 2020. This year, Fragrance group limit also has an offer to bring the company private as well. This might in turn leave a larger piece of the pie for the investors to select the remaining firms with the fundamental strength to ride through the storm. After the pandemic, the real-estate sector is expected to recover strongly. As the sector contributes more than 20% to the STI, this makes it another good proxy for the index.

Below is a breakdown by sector of the STI, based on the STI ETF (ES3), which tracks the index by component and exposure.

Source: https://www.ssga.com/library-content/products/factsheets/etfs/apac/factsheet-sg-en-es3.pdf

Source: https://www.ssga.com/library-content/products/factsheets/etfs/apac/factsheet-sg-en-es3.pdf

To wrap it up

The Singapore market does not normally excite investors, as can be seen in more news coverage given to overseas markets such as the US tech sector.

However, it still has sectors that could provide a strong foundation for a diversified portfolio for Singapore investors.

For those of you who prefer not to manage individual stocks, there are ETFs that track the STI’s performance. There are also unit trusts which invest in dividend-yielding stocks in the Singapore market that you can consider.

Chat with your trading representative or financial advisor today to find out more.

| Name | Asset class | Sector |

| DBS (D05) | Equity | Finance |

| CapitaLand (C31) | Equity | Real estate |

| STI ETF (ES3) | Equity (ETF) | Straits Times Index |

| Lion-Phillip S-REIT ETF (CLR) | Equity (ETF) | S-REITs |

| Nikko AM Shenton Horizon Singapore Dividend Equity Fund (S$) | Unit trust | Dividend stocks, primarily in Singapore |

| Phillip Singapore Real Estate Income Fund | Unit trust | S-REITs |

We wish Singapore a Happy Birthday!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Teo Huan Zi

Branch Manager, Phillip Investor Centres

Teo Huan Zi graduated from Nanyang Technological University (NTU) in 2014 with a bachelor’s degree in Business, majoring in Banking and Finance. Having been with Phillip Securities since 2015, he currently manages a portfolio of over 10,000 trading accounts as a Branch Manager. Prior to his current role, Huan Zi was also a senior equity specialist and senior investment specialist in the company. He also frequently conducts seminars and webinars to empower his clients with financial and investment knowledge such as fundamental analysis and technical analysis.

He regularly contributes and features in different media platforms such as 958 radio and provides market commentary for various newspaper like LianHeZaoBao (联合早报), The Edge, and Business Times.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It