Trading off the Gold-Silver Ratio May 19, 2022

Updated and republished on 19 May 2022

Strategise gold and silver investments to your advantage.

Key Points

- The gold-silver ratio is the measure of current gold price divided by current silver price, which shows how much more expensive gold is in comparison to silver.

- When the ratio is abnormal, we can read the trends to decide if we should enter into a long trade or short our gold and silver stocks.

- When the ratio is normal, we can study recent trends to choose whether to trade in these commodities or not.

- For smaller risks, investing in alternatives like gold and silver ETFs and CFDs can also be a good strategy.

Precious metals are referred to as “crisis commodities” owing to their ability to retain value even in times of economic strain – or crises such as a pandemic. Since these two commodities are so valuable and often work in tandem with each other, investors and traders alike follow a measure, called the ‘gold-silver’ ratio, to determine the most profitable buying or selling actions.

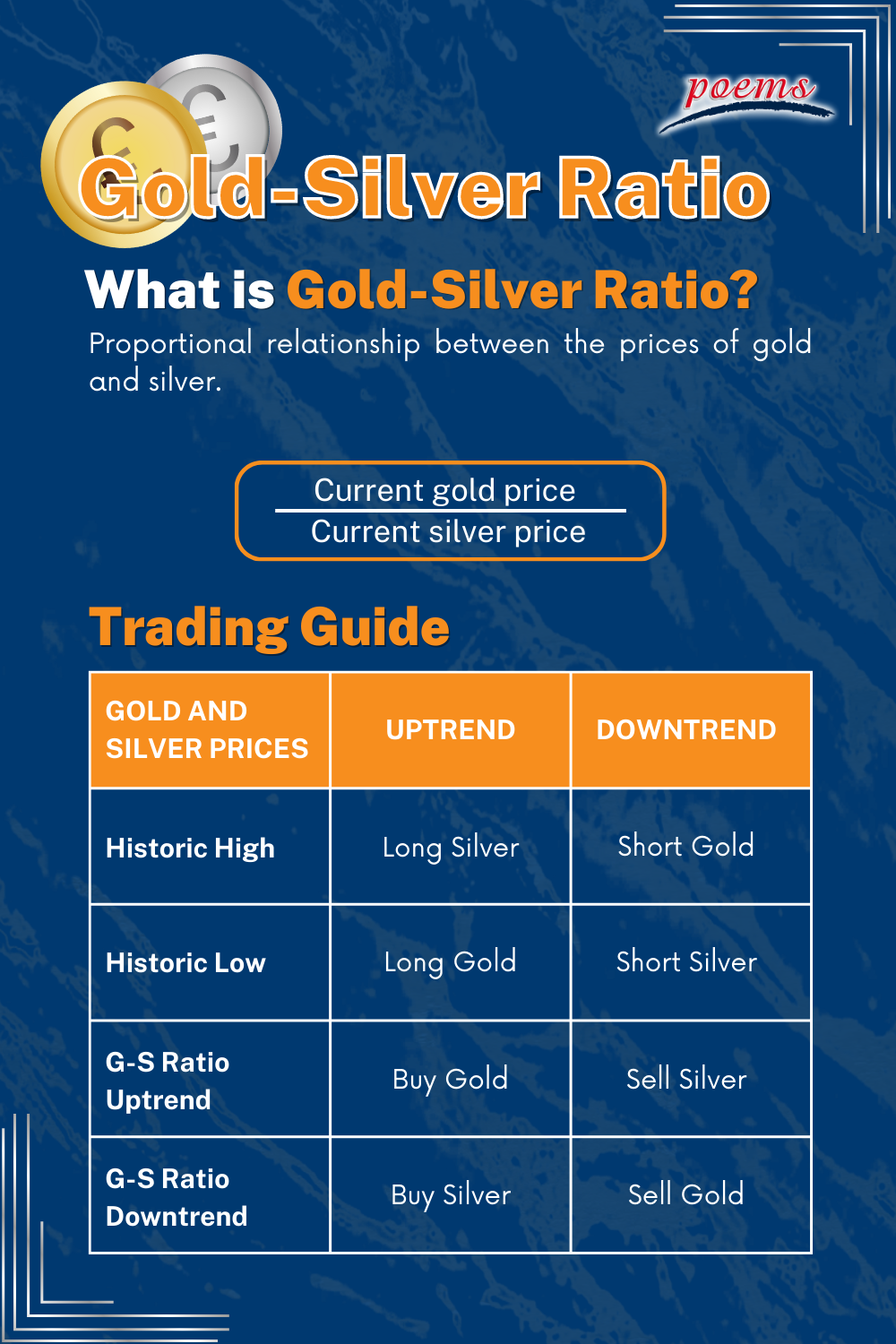

What is the gold-silver ratio?

The gold-silver ratio can be determined by dividing the current gold price by the current silver price. In other words, it is the proportional relationship between the prices of gold and silver – that is, how many ounces of silver can be bought with one ounce of gold. Of course, gold is always more expensive than silver, but the ratio helps us determine exactly how much more expensive it is. As we can see from the table below, the gold-silver ratio usually ranges between 50 to 80.

Figure 1. Gold-silver ratio over the past 30 years

But then… What happens when the ratio is abnormal?

These sharp points, as circled in red in the table, are known as historic highs or historic lows. As the name suggests, this is because the gold-silver ratio is usually stable, and extremes are only reached in times of economic crisis, such as recessions, when people begin to panic buy safer commodities like gold. In such cases, a historical high is reached, when gold is much more expensive compared to silver.

Historical lows are the opposite: it means gold is not as expensive compared to silver (but it will still be more expensive in absolute terms!)

These historical trends signal buyers to undertake some investment actions, since we assume that the ratio will stabilize again. However, these trading actions are not based solely on the ratio itself, but also the individual price trends of gold and silver. In the table below are usual buying actions: ‘long’ indicates that you might want to hold onto the commodities to build up your portfolio over time.

| Gold/Silver Ratio | Gold and Silver Price | Investing Signal |

| Historic high | Upward | Long Silver | Historic high | Downward | Short Gold |

| Historic low | Upward | Long Gold |

| Historic low | Downward | Short Silver |

The ratio is rarely abnormal. What if I want to start investing now?

The ratio fluctuates on a daily basis too, independent of the free market. This was not always the case, since the old system of gold standard currency meant governments would fix the ratio. However, now we can still study the ratio and individual trends to gain an understanding of what would be the best decision for us.

In the same way we determined the actions for the historic trends, we can do so for smaller trends by reducing the timeframe to a few months – ideally you should observe the past four to six months. Once you know the current ratio as well as individual gold and silver prices, go ahead and use the following chart to trade.

| Gold/Silver Ratio | Gold and Silver Price | Trading Signal |

| Uptrend | Uptrend | Buy Gold | Uptrend | Downtrend | Sell Silver |

| Downtrend | Uptrend | Buy Silver |

| Downtrend | Downtrend | Sell Gold |

Not sure how to adjust the timeframe to view trends? You can click here to read a guide on how to invest using ChartView on the POEMS platform.

I’m still unsure about investing… What do I do?

It’s perfectly normal to be skeptical about trading or investing, even if you are a seasoned trader. The markets for gold and silver are prone to volatility, and they fluctuate depending on demand. Moreover, relying on the ratio to stabilisze during historic trends is considered risky for some;: there is a chance that the ratio might just keep expanding or contracting, and then the investor is stuck.

The good news is that safer alternatives do exist! A Contract for Difference (CFD) allows you to exchange only the difference in value of a product and not the underlying asset itself. You can trade at various index points, with Gold USD1 CFD and USD100 CFD, or Silver US50 CFDs on POEMS.

Investors also prefer to play the gold-silver ratio and trade on it using an Exchange-Traded Fund or ETF. An ETF is a basket of various securities that trades just like a stock does. One can simply invest or trade in gold ETFs or silver ETFs instead, at the same trends mentioned in the above table. Some common gold ETFs are SPDR Gold Shares and SPDR Gold Mini-Shares, which trade on the New York Stock Exchange (NYSE), Singapore Exchange (SGX) and Hong Kong Exchange (HKEX).

You can trade on all these exchanges using the POEMS platform, as well as invest in other gold ETFs. You can find more information about gold products here. If you don’t have a POEMS account already, you can also open a free account to start trading now!

Too much to remember? Here is a handy infographic to help you on your gold-silver investment journey.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Alefiya

Alefiya is an intern with the POEMS team. She is currently completing her undergraduate studies in Psychology and English Literature at NUS.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?