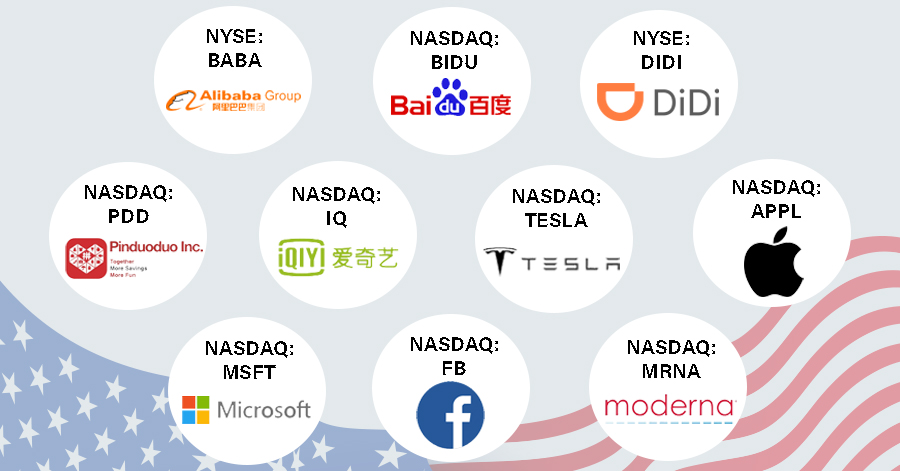

Popular US Stocks Traded on POEMS in July 2021 August 23, 2021

The following list showcases some of the most popular stocks – not in any order of ranking – traded by our POEMS clients in July, along with major news announcements on the stocks during the month.

At a glance:

- All three major indices plummeted on 19 July due to COVID-19 variant concerns, before rebounding to break new records.

- The Fed is adamant that inflation is transitory and will only start tightening monetary policy when employment picks up.

- China’s regulatory interventions precipitated a sell-off of Chinese education and technology stocks.

The three US major indices – the Dow, S&P 500 and Nasdaq – touched new highs in July. The Dow reached 35,171.52, S&P 500, 4,429.97 and Nasdaq, 14,863.65. Multiple events happened during the month but the market was able to shake off fears and remain bullish.

19 July was the worst day on record since October 2020. The Dow gave up 725.81 points to end the day at 33,962.04. All 11 sectors of the S&P 500 dropped, causing the index to retreat 68.67 points to 4258.49. The Nasdaq Composite gave up 152.25 to settle at 14,274.98. The main trigger was anxiety over the Delta variant as even highly-vaccinated countries fell prey to its rapid transmission. If unchecked, investors feared they would be forced to reduce their growth expectations.

The second important event was the Federal Open Market Committee’s (FOMC) meeting on 27-28 July. Chairman Jerome Powell said the central bank is nowhere near raising interest rates. Although U.S. weekly jobless claims reached a 16-month low in mid-July, the Fed’s main concern is unemployment. July’s unemployment was 5.8%, higher than pre-pandemic’s 4.4%1. In addition, inflation is still deemed to be transitory by the Fed. The Fed wants to see more hiring before it begins tapering, and any tapering will be gradual. The market did not react much to the FOMC meeting.

The third major event was the Chinese government’s crackdowns. Chinese stocks across the board were affected, some more than others. Most severely hit was the education sector. China wants to restrain the country’s booming after-school tutoring industry, citing reasons such as making education and raising children more affordable, given an ageing population and declining birth rates. The other industry that was slammed hard was tech. Regulators ordered the large tech companies to fix their data-security issues and anti-competitive practices. Although the three US indices were not affected much by the crackdowns, about US$400bn was wiped off U.S. listed Chinese stocks.

In this issue, we profile five US stocks and five US-listed Chinese stocks such as Alibaba, Baidu and Didi, which shows a marked divergence in their performances.

As usual, we’ve included technical charts for all our 10 counters. These are based on 1-hourly and 4-hourly time frames over 60 days. The charts are for your information only and the support and resistance levels discussed are solely based on our dealers’ views. None of the charts should be constituted as buy or sell recommendations and investors/traders are advised to do their own due diligence before making any trade.

Alibaba Group Holding Ltd – ADR (NYSE: BABA)

Alibaba made headlines frequently this month due to China’s antitrust probe. The last time it ran into trouble with regulators was on 24 December 2020, when it was investigated for forcing merchants to sell exclusively on its platform2. Alibaba’s stock tumbled 13% then, from US$256.18 to US$222. Though China’s latest clampdown was not aimed specifically at Alibaba, it still caused the stock to lose 9%, from US$206.56 to US$186.07. Alibaba traded at US$228.85 at its peak and US$179.67 at its trough in July.

For the quarter ended June 2021, Alibaba reported revenue of RMB205.74bn. This missed the market’s estimate of RMB209bn3. Operating margins plunged from 23% to 15%. Net profits were down 8%. The reason cited was investments in new businesses to fend off rivals.

To improve its competitiveness, Alibaba will be deploying its multi-app to expand into China’s rural area and capture more of the spending by China’s growing middle class. However, it will focus on value creation rather than the price discounts that its competitors still follow. Alibaba has also vowed to provide the fastest deliveries from China to any part of the world within 72 hours4, in a clear salvo to Amazon. In its cloud business, it has also pledged to spend US$1bn to support cloud infrastructure across APAC countries5. Alibaba’s multiple plans are intended to provide the company with moats against future regulatory crackdowns.

Technical Analysis:

Status: Neutral

Support: US$190.00

Resistance: US$204.00

Range-bound

Baidu Inc (NASDAQ: BIDU)

Baidu traded at a high of US$205.41 and a low of US$153.14 in July. The Google of China is shaking off its dependence on advertising because of tough competition from the likes of TikTok. It is diversifying to areas with better prospects such as artificial intelligence and cloud services.

Recently, it announced plans to enter the automobile industry. Plans include the launch of self-driving vehicles and smart cars in the next 2-3 years6. Additionally, Baidu has introduced an autonomous excavator system7 for the mining and construction industries. Given their poor and hazardous working conditions, these two industries perennially find it hard to attract workers. Baidu is betting that its autonomous system will prove popular and scalable to meet China’s expanding economy and goal of self-reliance in raw materials.

Although Baidu was not spared in the recent crackdown, it is likely to fare better than most of the other targets, as it remains critical to China’s infrastructure development. China wants to dominate the AI field8 and Baidu is one of the market leaders in AI in China. The current crackdown, it is safe to assume, is unlikely to affect Baidu’s ability to research and develop technologies as they are key to China’s future AI and cloud computing economy.

Technical Analysis:

Status: Neutral

Support: US$162.00

Resistance: US$169.00

Range-bound.

DiDi Global Inc – ADR (NYSE: DIDI)

Didi raised US$4.4bn at US$14 per share in a highly anticipated IPO on 30 June. This IPO was the second-largest listing by a Chinese company in the US after Alibaba. At its debut price, Didi was worth US$5.22bn. Its highest price reached in July was US$16.90 while it hit a low of US$7.16.

Its low came about as Didi was blocked in China from adding new users because of cybersecurity concerns, just days after its IPO9. The timing of the clampdown shocked investors, sending the stock down more than 5%. The motivation was ostensibly national security. Didi had gone ahead with its listing despite China’s request to delay its IPO back in April 2021.10 For this, its investigation was the first to be published by China’s Cybersecurity Review Office11.

Though Didi has about 90% of the ride-hailing market in China13, investors have to consider how the crackdown will affect its future market share, which would limit its growth.

Technical Analysis:

Status: Neutral

Support: US$8.00

Resistance: US$10.60

Range-bound

Pinduoduo Inc (NASDAQ: PDD)

Pinduoduo, the largest online grocer in China, managed to hit US$133.81 before sliding gradually because of regulatory actions. Its lowest in the month was US$77.66, while it rebounded to the US$90 range when regulatory risks had been priced in.

Cathie Wood, CIO of Ark Investment Management, offloaded Pinduoduo shares because of the regulatory scare and straining relations between the US and China14. Ark Investment Management sold 116,153 shares on 26 July 2021, sparking a contagion sell-off.

Regulatory threats aside, Pinduoduo’s Q1 surpassed analysts’ expectations15. Revenue increased 239% and monthly active users, 49%. This testifies to management’s ability to withstand the tough competition in China’s e-commerce. Q2 earnings are due on 20 August. The market is expecting sales of US$4.10bn and a loss per share of US$0.20.

Technical Analysis:

Status: Neutral

Support: US$87.00

Resistance: US$95.45

Range-bound

iQIYI Inc – ADR (NASDAQ: IQ)

Chinese online video platform iQIYI hit a high of US$15.69 and a low of US$10.33 in July. Started in 2010, iQIYI has been described as the No. 2 player in China’s video streaming market, with 104.8mn subscribers as of September 2020. The company provides movies, television dramas, variety shows and other video content. Notwithstanding the Chinese crackdown, iQIYI plans to forge ahead to become the go-to-platform for Asian content. To that end, it has already formed partnerships with Tsinghua University, to enhance video-streaming quality with adaptive bitrate algorithms16. It is also collaborating with GHY Culture & Media to bring stage musical content to its viewers17.

On top of that, it has managed to secure four years of digital broadcasting rights for the English Premier League in China.18 The EPL is the second most prominent sports property after the NBA or National Basketball Association in China. iQIYI has also partnered Dolby for international app access to Dolby Vision and Dolby Atmos in 191 countries19.

China’s video-streaming market volume is forecast to reach US$22.1bn by 202520. Having said that, iQIYI is still unprofitable and this may put off some investors. On 12 August 202121, IQiYi released their June 2021 quarter results. Their reported Earnings per share (EPS) of US$-0.27 came out to be better than forecasted. The market was expecting an EPS of US$0.30. Sales outperformed investors’ expectations too. The reported revenue was US$1.2 billion, US$0.5 billion higher than what was expected.

Technical Analysis:

Status: Neutral

Support: US$10.50

Resistance: US$11.60

Range-bound

Tesla Inc (NASDAQ: TSLA)

Tesla, the maker of electric vehicles with the largest market cap in the auto industry, fell 9.28% from its opening price of US$683.92 to a low of US$620.46. The drop was triggered by its recall of Model 3 and Model Y in China due to software flaws. In total, more than 285,000 vehicles were affected.22

Earnings released on 26 July 2021 showed revenue beating estimates, at US$12bn vs. US$11.4bn. Of this, only US$354mn or 3.5% came from the sale of regulatory credits23, lower than any other quarter. This was also the first time Tesla managed to earn a profit without counting regulatory credits – a milestone for the company24. EPS was US$1.45, beating estimates of US$0.99 by 46%. Revenue growth of 230% YoY comfortably exceeded forecasts. Vehicle deliveries also rose 122% YoY to 201,250 during the quarter25. As deliveries form the core of Tesla’s revenue, investors were cheered and sent its shares up 10.76% from a low of US$620.46 to US$687.20.

Technical Analysis:

Status: Bullish market structure

Support: US$697.80

Resistance: US$724.10

Immediate resistance has to be broken for more upside

Apple Inc (NASDAQ: AAPL)

Apple, one of the largest companies in the world, rallied 9.80% from its opening price of US$136.60 to an all-time high of US$150.00 in July. This signalled investors’ approval of its plan to ship 90mn of its newest iPhone this year, a 20% increase from 2020 shipments of roughly 75mn26. The new phone will be Apple’s second 5G phone. Debuting in September this year, the phone will feature upgraded processors, displays, and cameras to entice consumers to upgrade27.

Earnings released on 27 July crushed Wall Street expectations. EPS was US$1.30 vs estimates of US$1.01. Revenue was US$81.41bn vs estimates of US$73.30bn, up 36% YoY29. Even then, Apple dropped 2.76% from its month-high to close at US$145.86. This may be due to its warning that Mac and iPad sales have been affected by a global shortage of chips. This may either lead to higher chip costs or lower production of Mac and iPad. Apple is countering this by turning more self-reliant and making its own chips. Over the long term, this could make its supply chain more immune to shocks.

Technical Analysis:

Status: Neutral

Support: US$144.00

Resistance: US$149.62

Range-bound

Microsoft Corporation (NASDAQ: MSFT)

Microsoft’s IT products can be found in practically every home and office. The stock rose 5% from its opening price of US$269.61 to a closing price of US$284.91 during the month. Potential reasons were a deal with AT&T (NYSE:T) to use its cloud for software development and other tasks31. This could result in another revenue stream for Microsoft.

As the pandemic worsens with the Delta variant, companies have been pushed to think hard on enterprise solutions for better efficiency. Microsoft provides enterprise solutions. It is developing a new Windows, Windows 365, a cloud version of its operating system. Announced in July, Windows 365 was rolled out to business users on 2 August 2021. This service will allow employees to work from anywhere using a browser, providing greater flexibility.32 When bundled with services such as “Teams”, it can also improve efficiency and productivity, which Microsoft expects to appeal to many organisations.

Cloud services contribute to 52% of its revenue. This towers above contributions from consumer products such as LinkedIn, gaming and devices, at only 16.45% of revenue33.

Technical Analysis:

Status: Bullish market structure

Support: US$283.40

Resistance: US$290.00

Immediate resistance has to be broken for more upside

Facebook Inc (NASDAQ: FB)

The king of social media showed some volatility in July. In the first half of the month, its stock dropped 3.55% from its opening price of US$346.82, to a low of US$334.50.

One reason was due to the antitrust complaint from the U.S. lawmakers36. The Federal Trade Commission (FTC) deemed that Facebook is too “big” and they are abusing user privacy and eliminating competitions. The FTC is considering bills to limit Tech mega caps companies to expand via acquisition and may force Facebook to sell some businesses to scale down. Thus, if such bill were to go through, Facebook’s growth will be limited.

Facebook quickly recovered from the sell-off to gain 12.87%. It hit a new high of US$377.55 from its month-low, as reported revenue of US$29.1bn beat estimates of US$27.9bn. EPS was US$3.61 vs. US$2.99. Revenue was up 55.6% YoY, with monthly active users up 7.4% YoY to US$2.9bn. These results gave investors confidence since its revenue comes mostly from advertisements, which are influenced by monthly active users.

Facebook did warn that revenue growth could slow down significantly in the third quarter. One reason cited was Apple’s (AAPL.O) recent update of its iOS operating system which could affect Facebook’s ability to target ads due to privacy settings. This could dent advertisement revenue in the third quarter. The stock closed at US$356.30, a 5.6% drop from its month-high.

Technical Analysis:

Status: Neutral

Support: US$358.20

Resistance: US$375.50

Range-bound

Moderna Inc (NASDAQ: MRNA)

Moderna, one of the early pharmaceutical and biotechnology companies to create COVID-19 vaccines, soared by 49.64% from its opening price of US$236.30 to US$353.60. One reason was its development of a new respiratory vaccine that has entered Phase 1/2 testing and administered to the first participants. The vaccine aims to prevent influenzas such as Influenza A H1N1, H3N2 and Influenza B Yamagata and Victoria38. In the US, the estimated economic burden of flu is US$11bn per year.

Another reason behind the surge was its replacement of Alexion Pharmaceuticals Inc (NASD: ALXN) in the S&P 50039, having met the index’s criterion of positive earnings in its most recent quarter as well as the sum of its earnings in the previous four quarters.

Technical Analysis:

Status: Bullish market structure

Support: US$325.00

Resistance: US$444.00

All-time high, price has to hold at immediate support level

Bloomberg analyst recommendations

The table below shows the consensus ratings and average ratings of all analysts updated by Bloomberg on our 10 stocks in the last 12 months. The consensus ratings are computed by standardising analysts’ ratings on a scale of 1 (Strong Sell) to 5 (Strong Buy). The table also shows the number of analyst recommendations to buy, hold or sell the stocks as well as the average target prices for the stocks.

| Security | Consensus Rating | BUY | HOLD | SELL | Target Price (US$) |

| Alibaba Group Holding Ltd – ADR (NYSE: BABA) | 4.82 | 58(93.5%) | 3(4.8%) | 1(1.6%) | 273.1 |

| Baidu Inc (NASDAQ: BIDU) | 4.53 | 39(83%) | 6(12.8%) | 2(4.3%) | 295.43 |

| DiDi Global Inc – ADR (NYSE: DIDI) | 4.33 | 2(66.7%) | 1(33.3%) | 0(0%) | 21.9 |

| Pinduoduo Inc (NASDAQ: PDD) | 4.43 | 42(77.8%) | 9(16.7%) | 3(5.6%) | 163.09 |

| iQIYI Inc – ADR (NASDAQ: IQ) | 4 | 18(58.1%) | 12(38.7%) | 1(3.2%) | 19.78 |

| Tesla Inc (NASDAQ: TSLA) | 3.56 | 22(48.9%) | 14(31.1%) | 9(20%) | 669.61 |

| Apple Inc (NASDAQ: AAPL) | 4.39 | 35(76.1%) | 8(17.4%) | 3(6.5%) | 164.35 |

| Microsoft Corporation (NASDAQ: MSFT) | 4.86 | 40(93%) | 3(7%) | 0(0%) | 326.11 |

| Facebook Inc (NASDAQ: FB) | 4.53 | 47(82.5%) | 7(12.3%) | 3(5.3%) | 416.42 |

| Moderna Inc (NASDAQ: MRNA) | 3.24 | 6(35.3%) | 7(41.2%) | 4(23.5%) | 277.07 |

Conclusion

Most US tech stocks have warned that growth will be slower in the next quarter as they face challenges in their industry. These include stronger competitors, global chip shortages and creating better software.

As for the US-listed Chinese stocks, they are all affected by China’s clampdown. Still, investors can look out for trading opportunities from any short-term sell-offs, based on the analysis and recommendations of the analysts polled by Bloomberg.

Like what you have read? Join our Global Markets Investment Community on Telegram today to share your thoughts with us and other like-minded investors!

Open a POEMS account to start trading or chat with one of our licensed representatives to find out more.

References:

1. https://www.cbsnews.com/news/unemployment-rate-jobs-report-may-2021/

2. https://www.wsj.com/amp/articles/beijing-sends-alibaba-an-unwelcome-christmas-present-11608806388

3. https://asia.nikkei.com/Business/China-tech/Alibaba-earnings-drop-on-increased-investment-in-new-businesses

4. https://themorningnews.com/news/2021/07/09/alibaba-challenges-amazon-on-fast-global-shipping/

6. https://www.globaltimes.cn/page/202107/1228142.shtml

7. https://www.marktechpost.com/2021/07/09/baidu-ai-researchers-introduce-an-autonomous-excavator-system-aes-to-perform-material-loading-tasks-without-any-human-intervention/

8. https://www.forbes.com/sites/bernardmarr/2021/03/15/china-poised-to-dominate-the-artificial-intelligence-ai-market/

9. https://www.wsj.com/articles/chinas-internet-regulator-finds-serious-problems-with-didi-china-units-app-11625402263

10. https://www.bloomberg.com/news/articles/2021-07-06/china-s-cyber-watchdog-asked-didi-to-delay-ipo-on-data-concerns

11. https://www.wsj.com/articles/chinas-internet-regulator-finds-serious-problems-with-didi-china-units-app-11625402263

13. https://www.globaltimes.cn/page/202107/1229125.shtml

14. https://markets.businessinsider.com/news/etf/cathie-wood-further-trims-stakes-in-alibaba-jd-pinduoduo-amid-heightened-concerns-over-us-china-relations-1030648732

15. https://www.forbes.com/sites/brendanahern/2021/05/26/pinduoduo-smashes-analyst-expectations-as-revenue-goes-vertical/

16. https://www.prnewswire.com/news-releases/iqiyi-partners-with-tsinghua-university-to-further-enhance-video-streaming-quality-with-adaptive-bitrate-algorithms-301340254.html

17. https://www.theedgesingapore.com/capital/company-news/ghy-beijing-iqiyi-jointly-invest-co-production-stage-musical

18. https://www.sportspromedia.com/news/premier-league-china-digital-streaming-tv-rights-iqiyi-2021-pp-sports

19. https://www.prnewswire.com/news-releases/iqiyi-deepens-international-partnership-with-dolby-301341775.html

20. https://www.statista.com/outlook/dmo/digital-media/video-on-demand/video-streaming-svod/china

21. https://ir.iqiyi.com/news-releases/news-release-details/iqiyi-announces-second-quarter-2021-financial-results

22. https://www.bloomberg.com/news/features/2021-07-05/tesla-s-fall-from-grace-in-china-shows-perils-of-betting-on-beijing

23. https://www.cnbc.com/2021/07/26/tesla-tsla-earnings-q2-2021.html

24. https://www.theverge.com/2021/7/26/22594778/tesla-q2-2021-earnings-revenue-profit-credits-emissions-bitcoin

25. https://www.investopedia.com/tesla-q2-fy2021-earnings-report-recap-5194181

26. https://sg.finance.yahoo.com/news/apple-aapl-raises-iphone-production-151203309.html

27. https://www.businesstimes.com.sg/technology/apple-seeks-up-to-20-increase-in-new-iphone-production-for-2021-sources

29. https://www.cnbc.com/2021/07/27/apple-aapl-earnings-q3-2021.html

31. https://finance.yahoo.com/news/t-run-core-5g-network-150401678.html

32. https://www.investopedia.com/microsoft-msft-to-launch-windows-365-5192905

33. https://businessquant.com/microsoft-revenue-by-product

36. https://www.barrons.com/articles/facebook-ftc-antitrust-case-51625267920

38. https://www.zacks.com/stock/news/1759354/moderna-mrna-begins-dosing-in-study-on-mrna-flu-vaccine

39. https://finance.yahoo.com/news/moderna-set-join-p-500-230100007.html

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Jonah Sim Hong Chee (Dealer) & Lee Ying Jie (Dealer) & Chan Zi Quan (Dealer)

Jonah Sim is a US Equity Dealer in the Global Markets Team and specializing in US and Canadian markets. He graduated from University of Essex with a Bachelor Degree in Banking and Finance.

Ying Jie is a US Equity executive in the Global Markets Team and specializing in US and Canadian markets. He is proficient in trading using Technical Analysis, placing emphasis on supply and demand, and price action.

Zi Quan is a US Equity executive in the Global Markets Team and specializes in the US and Canadian markets. He is an avid crypto fan and is adept in macro analysis.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile