Renewable ETFs and Green Bonds: Are they for me? October 31, 2022

Read the related article about Renewable Energy and Investment Options here!

What is renewable energy ETF?

Investors may also consider investing in renewable energy via Exchange Traded Funds (ETFs), as they are more diversified and involve lower risks. With the rise of investment interest in this sector, investors can avoid the risk of inaccurate stock picking. The main advantage of ETFs is that they are a hybrid between stocks and unit trusts. Investors can trade the fund like a stock on the exchange with the advantage of a professional picking the right stocks for them.

What to invest in?

- iShares Global Clean Energy ETF

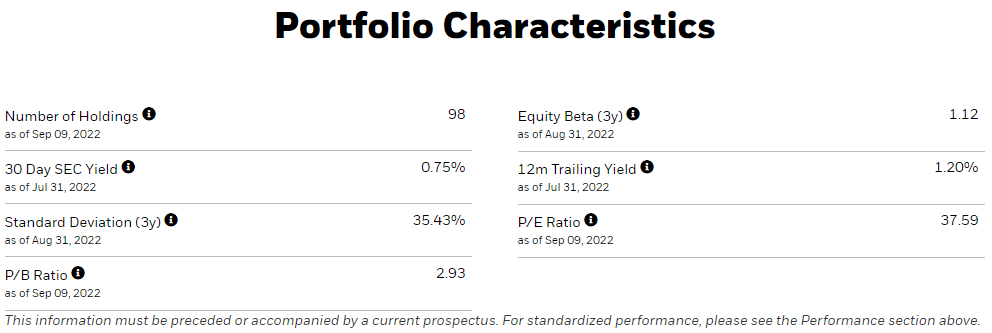

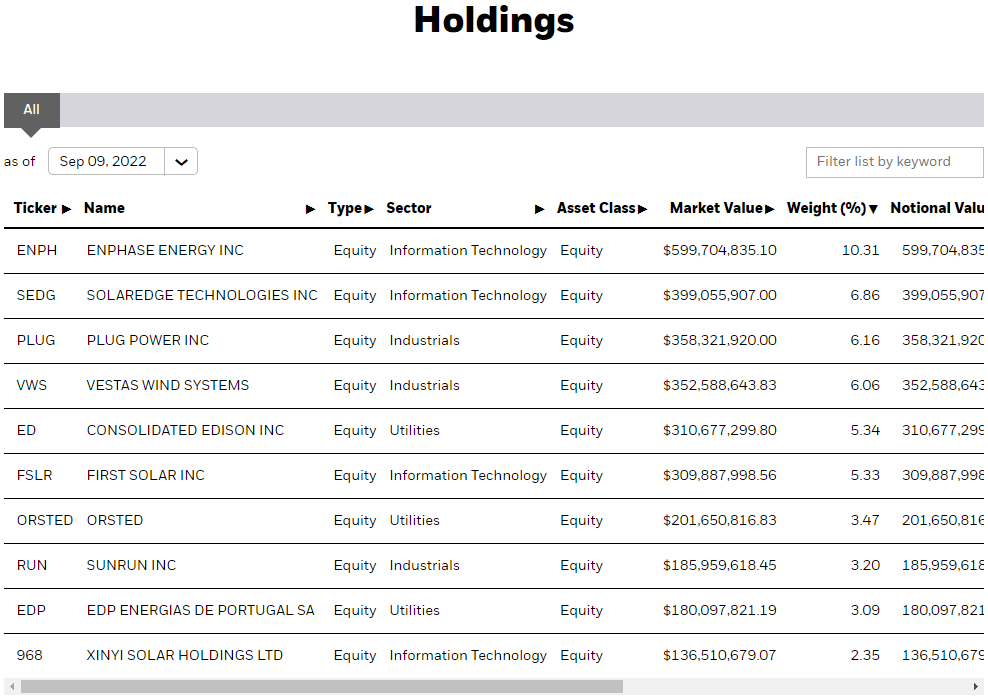

The fund’s objective is to track the investment results of global equities in the clean energy sector through the S&P Global Clean Energy Index. Hence, the fund seeks to gain exposure to companies in solar, wind, and other renewable sources. According to the key facts of the fund, its net assets as of 12 Sep 2022 were at USD 5.86B, making it the largest clean energy ETF by BlackRock. As of September, the fund had 98 holdings in the clean energy sector across various listed clean energy companies with the top 10 holdings of the fund as shown below. [iShares Global Clean Energy ETF | ICLN. (n.d.)]

What are green bonds?

Another alternative to investing in renewable energy is through the purchase of green bonds. This financial instrument enables corporations to raise capital for new and existing projects that have environmental benefits. It is meant to encourage issuers who are developing environmentally sound and sustainable projects that result in a net-zero emissions economy. Due to the growing attention in climate change, green bonds have become a popular form of funding, bringing with it transparent green credentials and transparency on the use of proceeds. The bond may even come with a tax incentive which makes it attractive to investors.

In 2020, the value of green bonds issued amounted to almost USD 270 billion, as reported by the Climate Bond Initiate. Since 2015, the accumulated green bonds issued are worth more than USD 1 trillion. The largest issuer of green bonds internationally is the World Bank with close to USD 14.4 billion of green bonds issued, spread across renewable energy & efficiency, clean transportation and agriculture & land use.

Green bond issuers

The strong demand for green bonds is most evident in the recent issue by Frasers Property, a 5-year green note that pays a coupon rate of 4.49 percent. Initially issued and valued at SGD 420 million, the bond has been oversubscribed due to strong demand, at a rate of 1.64x, resulting in SGD 689.3 million worth of subscriptions. For the 6 days that it was open for subscription, it was 1.48x oversubscribed for its Initial Public Offer (IPO) and 2.04x oversubscribed for the initial placement. This prompted Frasers Property to increase the bond size from SGD 420 million to SGD 500 million. [Lim, J., & Ting, Y. H. (2022, September 16)]

As a show of strong commitment to fight climate change, the Monetary Authority of Singapore (MAS) announced in August, that it plans to issue a SGD 2.4 billion 50-year sovereign green bond with an effective yield of 3.04%. Close to 97.9% (SGD 2.35 billion) of the bond will be issued to institutional and accredited investors while the remaining 2.1% (SGD 0.05 billion) will be offered to individual investors. According to MAS, the use of green bonds or green financing is meant to act as an “enabler of global efforts to mitigate climate change”. [Singapore Prices S$2.4 billion 50-year Inaugural Sovereign Green Bond; Public Offer now Open for Individual Investors. (n.d.)]

Another noteworthy green bond is issued by Sembcorp Industries, priced at 2.45% yield with maturity in 2031 for an amount of SGD 400 million. In a scenario similar to most bond issues, more than 90% of the green bond is subscribed by institutional investors in the Asia-Pacific region and the net proceeds from the subscription are used to finance projects in the list of eligible green projects that meet the Climate Bonds Initiative (CBI) technical criteria. [Zhu, M. (2021, June 3)]

What to expect?

Considering the rising demand for green infrastructure, we expect the growing issuance of green bonds to support this movement. Hence, as smart investors, we have to take note of the changing needs of the world and invest in financial instruments that are relevant in the current economy.

| Issuer | Size | Yield | Maturity |

| Fraser Property | S$500M | 4.49% | 2027 | MAS | S$2.4B | 3.04% | 2072 | Sembcorp Industries | S$400M | 2.45% | 2031 |

Reference:

- [1] iShares Global Clean Energy ETF | ICLN. (n.d.). BlackRock. Retrieved October 10, 2022

- [2] Lim, J., & Ting, Y. H. (2022, September 16). Frasers Property upsizes green notes to S$500m following strong demand. Business Times.

- [3] Singapore Prices S$2.4 billion 50-year Inaugural Sovereign Green Bond; Public Offer now Open for Individual Investors. (n.d.). Retrieved October 10, 2022

- [4] Zhu, M. (2021, June 3). Sembcorp prices S$400m green bonds due 2031 at 2.45%. Business Times

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Tan Jun Sen

Jun Sen graduated from Nanyang Technological University with a Bachelor in Mechanical Engineering and has previously worked in finance related roles dealing with stock analysis. He is trained in SG equities fundamental analysis from past work experience. He believes in value investing and staying invested throughout the high and lows of market cycles.

All-in-One Guide to Investing in China via ETFs

All-in-One Guide to Investing in China via ETFs  Everything you need to know on Bitcoin ETFs

Everything you need to know on Bitcoin ETFs  Maximising your Tax Savings & Retirement Funds with SRS in Singapore

Maximising your Tax Savings & Retirement Funds with SRS in Singapore  Is There a “Fairest of Them All”?

Is There a “Fairest of Them All”?