Sassy Sexy SaaS: The Next Big Thing? July 22, 2021

What this report is about:

- Software as a service (SaaS) has grown by leaps and bounds since the outbreak of the pandemic

- Demand for SaaS is set to balloon further in the new normal

- Framework to find winning SaaS company (Rule of 40)

- Gain exposure to this exciting new industry through CFDs

“It was the best of times, it was the worst of times.”

Charles Dickens.

Good day readers!

It has been over a year since the COVID-19 pandemic hit our shores in sunny Singapore.

COVID-19 has been described as the first global pandemic of the information age, with a record 158mn global infections to date. Many countries have been forced into lockdowns to contain the pandemic. This has driven many venerable brands and iconic retailers into bankruptcy, including stalwarts JC Penny, Hertz and Gold’s Gym.

COVID-19 has also radically altered our lifestyles and what we define as normal. Facebook is now allowing employees to work from home permanently. The founder of Twitter and Square Inc, Jack Dorsey, has given the greenlight for his employees to work from home indefinitely. [1]

But as the old adage goes, one man’s crisis is another man’s opportunity. This pandemic has serendipitously fast-forwarded the prospects of SaaS companies.

What is SaaS?

SaaS is a business model of distributing applications as a service over the internet and cloud. Instead of downloading and managing software, users access whatever application they want through the Internet, eliminating the need for complicated software and hardware installations.

SaaS solutions range from sales management to customer relationship management (CRM), financial management, human resource management billing and collaboration

Source: POEMS

Source: POEMS

SaaS in the new normal

Customers won’t care about any particular technology unless it solves a particular problem in a superior way.

Peter Thiel, co-founder of PayPal, Palantir Technologies and Founders Fund

In the new normal, SaaS providers are expected to assist organisations in their thrust towards digitalisation and remotization. This is because most SaaS solutions are designed for and are hosted in cloud space rather than on premises. Remote workers are able to access their companies’ documents via virtual private networks (VPNs) and stay in touch with one another in meetings via remote connection software.

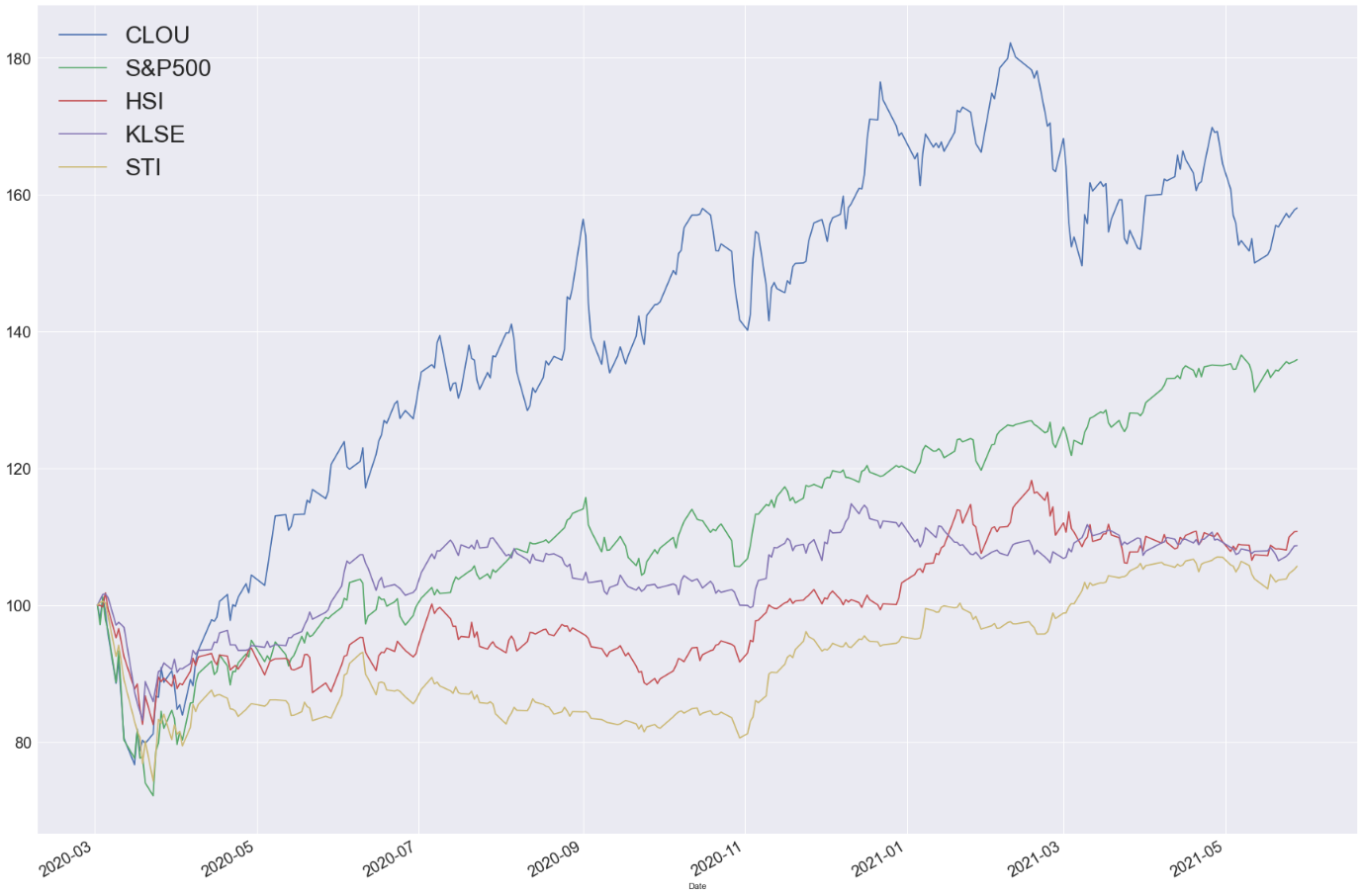

Curious to see whether this industry growth has so far translated into growth in returns in financial markets, we plotted the normalised returns of the Global X Cloud Computing ETF (CLOU) alongside those of the S&P 500, Hang Seng Index, FTSE Straits Times Index and FTSE Bursa Malaysia KLCI from 1 March 2020 to 1 June 2021.

[2] CLOU holds companies that generate 50% or more of their revenue from one of five business models:

- Licensing and delivery of software through online subscriptions, known as software as a service (SaaS)

- Provide a platform for creating online software apps, known as platform as a service (PaaS)

- Providing online, virtual computing infrastructure, known as infrastructure as a service (IaaS)

- Owning and managing data and server storage facilities, including datacentre REITs

- Manufacture or distribute infrastructure and hardware components used in cloud and edge computing

CLOU ETF invests in many notable SaaS/PaaS companies such as Salesforce (CRM), Dropbox (DBX), Zscaler (ZS), Zoom Video (ZM) and Akamai Technologies (AKAM).

Figure 1

Figure 1

Source: Yahoo Finance

As shown in Figure 1, CLOU has outperformed the four indices!

Finding the next winning SaaS company

Finding the next 10 bagger investment is the pipe dream of many investors.

The question is, given limited time and energy, how does one sift through the entire haystack to find the golden nugget?

Not to worry, the Rule of 40 can help you spot winning growth companies!

The Rule of 40 refers to:

Generally, tech start-ups will not be profitable in their gestation phase. Think PayPal or Tesla in their early stages. This is because start-ups prioritise market share over margins in the short term. Much of their capital as a percentage of revenue has to be spent on marketing to capture market share and R&D to produce new innovative products. This is to stay ahead of the game. In this phase, they typically have high revenue growth but negative operating margins (EBIT or EBITDA margins).

At a certain point, their high revenue growth outpaces their operating expenses. This is when they turn profitable.

The above implies that if their revenue growth rate + their EBITDA margins exceed 40%, even if their EBIT or EBITDA margins are negative, the company is growing at a high rate. Financial markets, being forward-looking, will price that information into their stock prices. Which explains why their stock prices surge even though they are not yet profitable or are constantly in need for new capital.

Now comes the next question: sustainability

Picture this. You own a digital payment company. Your platform charges merchants a service fee of 1%.

To entice customers to use your platform, you run a campaign offering a S$5 cash deposit for every user referred to your platform.

Assuming that on average, a customer only uses your platform to pay for services amounting to S$50. Your customer acquisition cost is S$5 + marketing fees and average service fee of S$0.5 per customer collected from merchant.

Your expenses in the long run will grow at a rate greater than your revenue, cost spent on acquiring customer (S$5) is greater than service fee collected from merchant (S$0.5). Your company will be unprofitable and you will need to raise more capital from shareholders. There will come a time when you will be unable to raise more capital via debt and/or equity.

Therefore, it is crucial to watch the rate of increase in revenue for start-ups or growth companies with respect to their operating expenses. It is also very important to break down their revenue and analyse the niche they are expanding into to ascertain their business sustainability. For instance, PayPal started by being a niche service payment provider to eBay while Alipay started being a niche service payment provider to Alibaba which pave the way ahead to achieve sustainability.

We recommend investors to use the Rule of 40 as a first-principle for analysing SaaS or new listings of growth stocks, before diving into the drivers of their margins and revenue. This framework is applicable to both fundamental and technical analysis.

Rule of 40 scorecard

We were very curious to see how popular SaaS companies stack up using the Rule of 40. For our analysis, we used their 3-year average YoY revenue growth rates plus their latest EBITDA margins.

| Stock | 3year average YoY revenue growth rate | Latest EBITDA margin | Rule of 40 |

| Twilio Inc (NYSE: TWLO) | 62.23% | -16.8% | 45.43 |

| Salesforce.com Inc (NYSE: CRM) | 25.2% | 25.2% | 50.4 |

| Crowd strike (NASDAQ: CRWD) | 83.87% | -3.6% | 80.26 |

| Zoom (NASDAQ: ZM) | 236.63% | 30.3% | 266.93 |

| Zscaler Inc (NASDAQ:ZS) | 51.77% | -24.6% | 27.16 |

| Akamai Technologies (NASDAQ: AKAM) | 9.37% | 37.9% | 47.27 |

In our opinion, companies that have high revenue growth rates and high operating margins will have the majority of their future information priced into the financial markets. If one believes in their long term sustainability and fundamentals, then it would be ideal to buy at the dips.

Trading SaaS with Contracts for Differences (CFDs)

Contracts for Differences (CFDs) are versatile investment tools. They are particularly ideal for people who wish to take a more active approach to investing. CFDs can be used for hedging, short-selling or leveraged trading. They only require a minimum sum upfront, which is known as the margin requirement.

CFDs are also ideal tools for investors without much capital outlay but who wish to capitalise on the growth potential of thematic investing.

Example 1 illustrates how CFDs can amplify returns with an initial margin paid upfront.

Example 1

| Equity trading | CFD trading |

| On 16 June 2021, Mike initiated two open positions on Stock X, an SaaS company | |

| Stock x share price = S$1.00Share quantity = 10,000Total value of shares = S$1.00 x 10,000 = S$10,000 | Stock x share price = S$1.00CFD contract quantity = 10,000Total CFD contract value = S$1.00 x 10,000 = S$10,000Assuming that the margin requirement for Stock X is 10%,the required margin would be = S$1,000 (S$10,000 * 10%) |

| Total capital commitment = S$10,000 | Total capital commitment = S$1,000 |

We illustrate with two scenarios for Mike on 17 June 2021.

Scenario A: Stock X increased by 10%

| Equity trading | CFD trading |

| Stock x share price = S$1.10*Gross profit/loss = (S$1.10 – S$1) * 10,000 = S$1,000 | Stock x share price = S$1.10^Gross profit/loss = (S$1.10 – S$1)*10,000 = S$1,000 |

| *Return on investment = S$1,000/S$10,000= 10% | ^Return on investment = S$1,000/S$1,000= 100% |

Scenario B: Stock X decreased by 10%, Mike decided to cut losses on both his positions.

| Equity trading | CFD trading |

| Stock x share price = S$0.90*Gross profit/loss = (S$0.90 – S$1) * 10,000 = -S$1,000 | Stock x share price = S$0.90^Gross profit/loss = (S$0.90 – S$1)*10,000 = -S$1,000 |

| *Return on investment = S$1,000/S$10,000= -10% | ^Return on investment = S$1,000/S$1,000= -100% |

* Calculations omit commissions, clearing fees and other trading fees in share trading. Actual ROIs will be lower than the ROIs calculated.

^ Calculations omit commissions and finance charges for CFD trading. Actual ROIs will be lower than the ROIs calculated.

A word of caution, though leverage is a double-edged sword.

Although CFDs can magnify your gains through leverage, losses will also be amplified! Therefore, it is always crucial to use leverage responsibly, manage risks effectively and cut losses promptly when you feel that the market is turning against you.

SaaS is the new normal!

Based on current economic and social trends, SaaS platforms could be here to stay and be part of the new normal. In fact, they appear destined to play an increasingly critical role, given that the pandemic is likely to become endemic.

POEMS offers myriad investment instruments – equities, CFDs, ETFs – that you can use to capitalise on this exciting growth industry.

Be sure to check out our other articles and courses on fundamental and technical analysis, thematic investing and how to utilise CFDs. To explore further, email us at cfd@phillip.com.sg or speak to our consultants today.

Reference:

- [1]https://www.nytimes.com/2020/05/21/technology/facebook-remote-work-coronavirus.html

- [2]https://www.etf.com/sections/features-and-news/best-2020-cloud-computing-etfs-going-sky-high?nopaging=1

- [3]https://www.bain.com/insights/hacking-softwares-rule-of-40/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Edwin Chin

Dealer

Prior to joining PhillipCapital, Edwin Chin was from the banking sector. Combining his working experience as a banker and current position as a dealer from the largest dealing team in Phillip Securities, he has extensive experience in various financial instruments, and enjoys keeping up to date with the latest Tech and Saas developments in the market.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?