新加坡旅游业2017 August 14, 2017

新加坡拥有世界最好的机场之一,也是在东南亚一个著名的贸易中心。旅游业因此对新加坡一向都是一个重要领域,直接与间接影响着多个市场领域。

新加坡目前通过航空连接了380个城市,90个国家。众多的航线造成了繁忙的航空,这导致新加坡平均每90秒就有一个起飞或抵达的飞机。

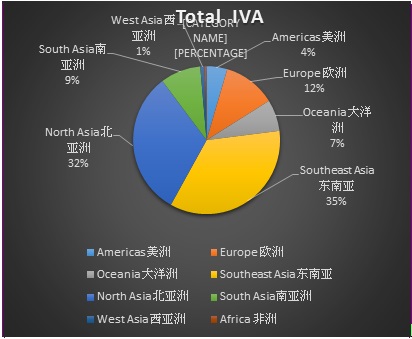

在2017年1月至5月之间 ,国际游客抵达(IVA)总数增加3.6%到约716万。近期增加最多的国家是韩国与印度,分别在五月增加了17.4%和21.7%。香港和泰国则下降最多,分别在2017年前五个月下降16.3%与7.4%。

了解新加坡的旅游业的走势可以提供对航空,、旅店,、饮食与购物领域的一些资讯。比如,通过第一季度的旅游数据,可以观察到新加坡旅游收入前三个国家是中国,印尼和印度。这三个国家与马来西亚在新加坡的主要花费普遍是购物。但是,除了印度之外,可以看见其它三国的入境人数减少。因此,可以预期第二季度的零售业,尤其是较依靠旅客花费为收入的公司可能会受到影响。(例如: Starhill Global REIT 和 SPH REIT)

此外,也能够通过对比旅店与旅客的数据来从中寻找关联。从新加坡旅游局所公布的数据,可以看到豪华和经济的客房的成绩对比2016年的数据时是有小幅度的增长。中等和普通高端的客房对比2016年时反而有所下滑。这可能从较多的美洲与欧洲的旅客有关。因为普遍而言,成熟经济国家的旅客较多的花费在于享受,包括住宿与消遣活动。发展中国家却普遍花费在购物或其他方面。从这方面可以看到,旅店领域在第二季度的成绩可能会受到影响而下滑。(例如:CDL HTrust 和 OUE HTrust)

旅游业的数据公布的比较慢,通常至少需要几个月的时间才在新加坡旅游局上公布,所以可以选择看樟宜机场网站每个月所公布的一些数据,。虽然只会有航空部分的数据,但是通过航空抵达新加坡的旅客超过77%的数据来看,也可以当作代表性的一个数据了。通过分析这些数据,我们能够做出一些不同领域成绩的评估。直接受到影响的是航空公司(例如:SIA 新加坡航空),物流业(例如:SATS和SIA Engineering)与旅店等服务业。当然,间接受到影响的也有娱乐业(例如:Genting Sing)和饮食领域,尤其是比较依靠旅客花费的生意。

我个人认为,旅游业在近期会好转,新加坡樟宜第4机场也已经准备开始运作。新的机场能够增加旅客的流量,带动更多航线的可能性也可保持新加坡樟宜机场的排名与重要性。随着网购的增加,我也预期物流业应该有所改善,因而受到市场压力的应该就是零售业了。

(IVA – International Visitor Arrival 国际游客入境)(来源:新加坡旅游局)

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

张桓滋(Teo Huan Zi)

POEMS交易团队交易员

张桓滋(Teo Huan Zi)毕业于南洋理工大学(NTU),主修银行和金融系。他于2015 年加入辉立证券(Phillip Securities Pte Ltd),任职POEMS交易团队交易员。他目前为超过 一万个顾客提供交易服务。 张先生致力于基本面分析,也相信利用市场与个股的基本面分析来比较个股的投资价值。 他也经常举办英语和华语的投资讲座。也希望通过这些讲座来赋予顾客更多的投资知识。 张先生擅长基本分析。他相信透过了解顾客的投资方向与需求,方能为投资者提供更适合的市场分析与建议。他希望透过分享的交易经验与知识,能够协助投资者做出更适当的投资选择也符合投资者能承担的风险。

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?