Take Advantage of Volatility! Embrace it, Don’t Fear It! November 16, 2020

What this report is about:

- 2020 has been an eventful year that has led to spikes in volatility. Two major triggers were COVID-19 and the US elections

- Volatility can be measured by VIX, average true range (ATR) and Bollinger Band

- What can cause further volatility? One is news flow on vaccine discoveries. Another event that may jeopardise a smooth transition of power in the US.

Introduction

As we enter the last leg of the year, it is a good time to reflect not only on our personal goals and achievements but also, financial management. No financial review would be complete without an assessment of our investment portfolios.

Through the rear view mirror

2020 to lesser mortals is what 1992 was to the Queen of England: annus horribilis.

Just a couple of days into the new year, we were jolted by news that the US had conducted a drone strike on Major-General Qassem Soleimani. Major-Gen Soleimani led the foreign operations arm of Iran’s Islamic Revolutionary Guard Corps. Iran retaliated by firing more than a dozen missiles at two US bases in Iraq and threatening revenge. [1] This ratcheted up tensions. The US stood its ground, fanning fears of a war between the old foes.

Before the dust settled in the Middle East, another conflict was stirring in the US, this time at the White House. For only the third time in history, an American president was on trial after being impeached, although he was eventually acquitted by the Senate.[2]

Not long after, a mysterious virus that had its roots in Wuhan, China, began spreading like wild fire. It brought global economies to a standstill and global markets to their knees. The World Bank forecasts that the global economy will shrink by 5.2% in 2020. This would be the deepest recession since the Second World War. [3]

A common thread running through these events was spikes in volatility.

But what is volatility? How is it measured and how can we take advantage of it?

What is volatility?

Mathematically, volatility represents how large an asset’s price swings around its mean price, in either direction. [4] Higher volatility means the price can change dramatically in either direction. Lower volatility implies a steadier price.

How is it measured?

A popular measure that traders use is the Volatility Index (VIX). This is an index compiled by the Chicago Board Options Exchange to capture the market’s expectation of 30-day forward-looking volatility. It is derived from the price inputs of the S&P 500’s index options. [5] The VIX is commonly known as the “fear index” as its rise is associated with falling markets and growing fear among investors.

Other technical tools used to measure volatility include the average true range (ATR) and Bollinger Band.

The ATR measures market volatility by decomposing the entire range of an asset price for a specified period. [6] It is typically calculated over a 14-day period. An asset experiencing a high level of volatility has a higher ATR. Conversely, a lower level of volatility impliesa lower ATR.

The Bollinger Band is a technical-analysis tool defined by a set of trendlines plotted two standard deviations from a simple moving average of an asset’s price. [7] The standard deviations can be adjusted according to user preferences. Narrowing Bollinger Bands indicate easing volatility but this is also considered a sign of future increased volatility.

Trading with volatility

Contracts for Differences or CFDs can be a great trading tool when volatility rises. CFDs allow investors to go long and short on an underlying asset to take advantage of sudden bouts of market volatility.

Here are some assets that are readily available for trading long and short on CFDs:

|

CFDs are commonly used by investors who want to short stocks. Most markets generally impose restrictions on the short-selling of stocks – and it is inconvenient to initiate an equity short in the market. Investors would have to inform their brokers of their intention to short and procure shares. They would have to inform their brokers again when they have bought back the shares to settle their shorts.CFDs circumvent all of these troublesome issues as all you would need to do is to focus on initiating your long or short trade. We’ll settle the rest for you. Another benefit of trading Equity CFDs is you can go long and short on more than 5,000 contracts in one account. |

Indices are a great way to participate in the market if you do not want the hassle of researching individual stocks. An extremely popular CFD in Singapore is the Straits Times Index SGD5 CFD (STI CFD), as the Straits Times Index is the benchmark equity index in the Singapore market.World indices CFDs are useful as they tend to react quickly to major economic news. Additionally, from a diversification standpoint, indices are less risky than individual stocks which have non-systemic risks – these risks can be largely eliminated if you purchase an index. |

|

Commonly traded commodities are gold, silver and oil. While most commodities are traded on futures markets, there are some benefits to trading them via CFDs. Unlike CFDs where you trade just on the price of a commodity, both parties in a futures contract must fulfil the conditions of the contract.If you are not familiar with futures contracts and choose physical settlement instead of cash, you might end up with a truckload of oil barrels at your doorstep! |

Forex (FX) is the largest & most liquid financial market in the world. The largest volume of trades comes from traders who trade currency pairs. The FX market is open 24 hours a day, 5 days a week.Check out our newly launched FX CFDs where we offer very competitive spreads for some of the major currency pairs. To find out more about FX CFD trading, be sure to read our latest FX CFD article. Best of all? No commissions and finance charges for opening your FX CFD positions with us! |

You may refer to our website for more information on the above mentioned CFDs.

Contrary to popular opinion, CFDs are not just for technical traders. Long-term investors can utilise them to hedge against unforeseen events and uncertainties effectively.

World Indices CFDs and Commodity CFDs are hedging tools for equities amid rising volatility in markets. This is due to their correlations.

One can use CFDs as a hedge in the following two scenarios:

1) When the prices of your existing positions have already moved or are moving against you.

2) When you anticipate future gains in your existing positions to be marginal due to increasingly negative market sentiment.

Check out our example on how to use CFDs for hedging at the bottom of this article.

Before you decide, it is important to know which assets to use to hedge.

Assets that have a positive correlation with your positions are used as an opposing hedge (short).

Assets with a negative correlation with your positions are used as a same-side hedge (long).

You need to select the right assets to hedge your existing positions. However, do note that it is not possible to perform a perfect hedge due to correlational factors and positional sizes.

Events That May Cause Volatility to Spike

COVID-19

As news of the coronavirus spread around the world in February, Chinese economic data showed a dramatic slowdown in manufacturing and investments. Global financial markets began to price in the new reality. We saw the greatest correction in history since the financial depression, with US$39tr wiped out from global equities. Indices like the S&P 500, Nasdaq and Dow Jones dropped more than 30% from the high in February 2020 to the low in March 2020.

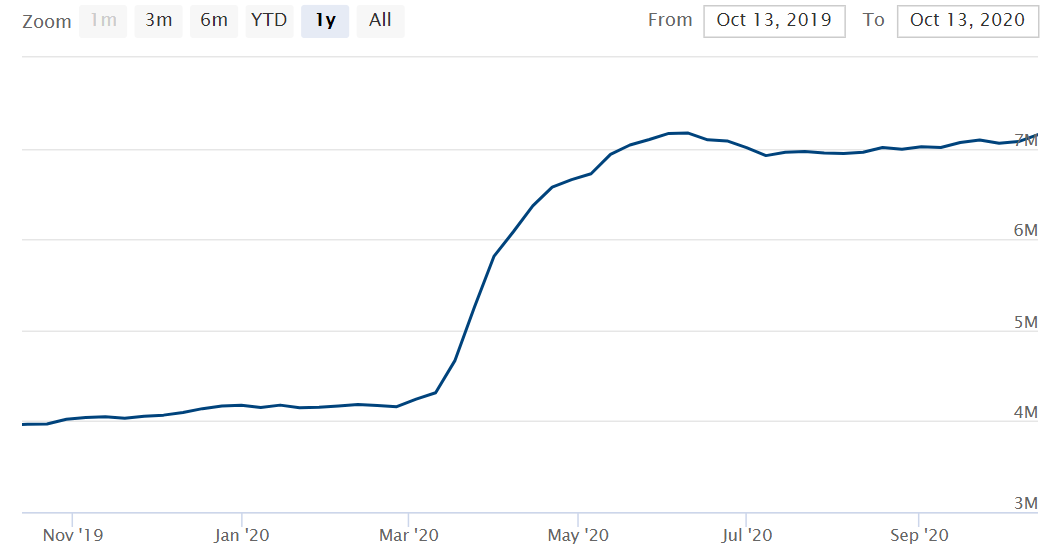

During the pandemic, the VIX, as measured by the ProShares VIX Short-Term Futures ETF (VIXY), increased by almost six times, from 10.8 to 64.6. This was in a matter of weeks due to the highly-uncertain environment.

Source: VIXY Poems CFD Chart

Source: VIXY Poems CFD Chart

Since then, we have witnessed the greatest and fastest amounts of liquidity injection in history as central banks scramble to rescue the global economy. The Fed expanded its balance sheet to a record US$3tr in a span of several months. It rolled out a massive stimulus plan in just two weeks, compared to the two years it took to introduce Barack Obama’s Recovery Act when the housing bubble burst in 2009.

Source : Federalreserve.gov

Source : Federalreserve.gov

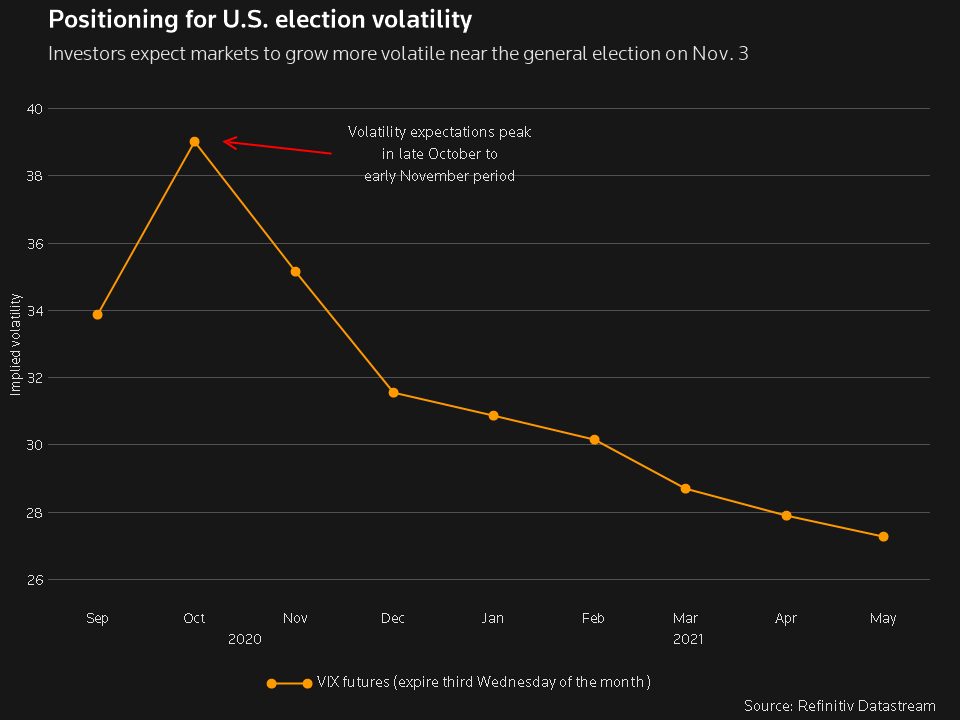

US Election 2020

How will the election of Joe Biden as the next President affect global markets?

Although the overhang on elections has been removed, markets may be more volatile with the worsening COVID-19 situation in the US. The VIX might climb so long as there is no medical solution.

Back in 2016, the presidential election caused a spectacular jump in market volatility. The black-swan event was Trump’s surprise victory, which set off huge swings in the stock market. Futures on the S&P 500 tumbled as much as 5% as investors digested the result, before closing higher at the end of the trading day on 8 November 2016.

If investors think Joe Biden will implement policies that will benefit stocks and the economy, markets would rally. Judging by the positive reactions since election week, it seems that they are expecting Biden to be market-friendly.

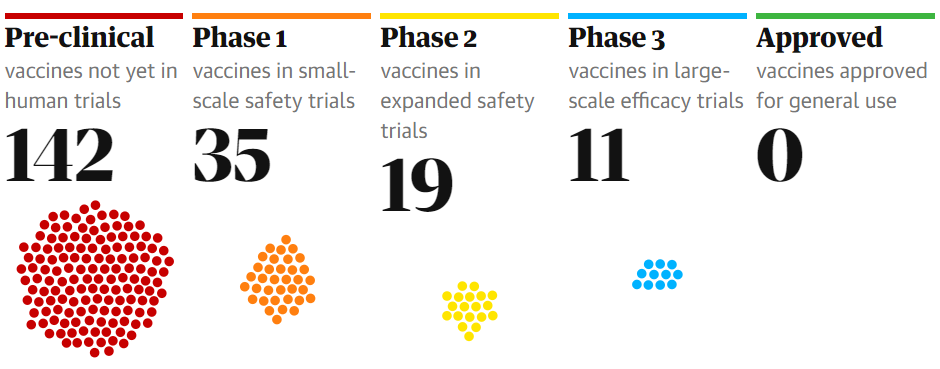

Vaccine approvals

Though there are more than a hundred vaccine candidates in the developmental stage, it is not a foregone conclusion that a vaccine is the be-all and end-all. Early vaccines will probably be only partly effective. Flu vaccines are only 50% effective, and not everyone can be vaccinated.

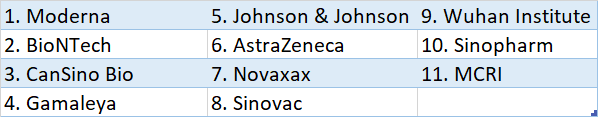

A vaccine normally takes years, if not decades, to develop. However, with huge government funding and schemes like Operation Warp Speed in the US, companies are more comfortable doing vaccine research. We have now 11 vaccine candidates under Phase 3 trials, involving thousands of volunteers. Any good news on vaccine approval can be expected to be positive for equity markets.

Ride the wave of volatility with CFDs!

The speed and magnitude of market moves this year may have left some investors reeling. This brings us to the importance of portfolio hedging. It is where CFDs can come in useful.

For more information on how you can ride volatility with CFDs, please click here.

References:

1. https://www.aljazeera.com/news/2020/10/6/iran-trump-soleimani

2. https://www.bbc.com/news/world-us-canada-50813696

3. https://www.worldbank.org/en/news/press-release/2020/06/08/covid-19-to-plunge-global-economy-into-worst-recession-since-world-war-ii

4. https://www.investopedia.com/terms/v/volatility.asp

5. https://www.investopedia.com/terms/v/vix.asp

6. https://www.investopedia.com/terms/a/atr.asp

7. https://www.investopedia.com/terms/b/bollingerbands.asp

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Khoo Gek Han (Dealer) & Jonathan Wijaya (Dealer)

Gek Han is a securities dealer in the largest dealing team in Phillip Securities, specialising in Equities, ETFs and CFDs. As a securities dealer, he provides equity-related advisory for clients. He looks at securities from a technical and fundamental perspective, and wants to explore managing investments using a portfolio approach. Gek Han holds a Bachelor of Science (Economics) degree with double majors in Economics and Finance from Singapore Management University. Jonathan graduated from Nanyang Technological University with a Bachelor's Degree in Mechanical Engineering. Prior joining the company, he was an ex-engineer in one of the largest semiconductor firm. Combining with his industry knowledge and finance knowledge, he firmly believes in technology stocks and value stocks.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap