Complete Guide to Wholesale Corporate Bonds in Singapore June 22, 2022

Corporate bonds are a dominant source of funding for companies around the world. Companies sell bonds to raise a sum of money, and investors buy them. The amount stands as a loan and bondholders act as creditors to these companies, lending to them in exchange for regular streams of coupon or interest payments, and ultimately their principal back on a specified maturity date.

There are different types of bonds available, which means they also differ in how you invest, trade, and get returns from them. The risk of default, which is when the company is unable to repay the amount owed to a bondholder, also differs for different types of bonds.

What are corporate bonds?

A corporate bond is essentially a loan to a company by the bondholder; a loan that the company can use for general day-to-day running of its business, acquisitions, or for execution of its growth strategies. At their most basic level, corporate bonds have the following features:

- A maturity date where the original amount, called the principal, is repaid

- A coupon rate which is the interest rate paid on the bond at par

- A coupon payment frequency, which is the number of times a year your coupons are paid

Corporate bonds in Singapore usually pay coupons semi-annually meaning twice a year.

Why invest in corporate bonds?

Many investors seek a safe way to make their money work for them. Popular ways to do so include fixed deposits, endowments and Singapore government bonds (SGS) for a predictable income stream. While these may be popular and largely risk-free, we, as well as institutional investors, believe corporate bonds are a more efficient way to create a fixed income stream for your cash.

1. Corporate bonds pay a higher yield

In exchange for the absence of a guarantee, you can easily find a corporate bond paying double the fixed deposit rate. Fixed deposit rates in Singaporean banks range from 0.6% to 2% p.a. Government bonds yield between 1.43% to 2.5% for tenors of 1 to 10 years, as at June 2022. As a comparison, the recently launched Astrea 7 Class B bonds have a coupon rate of 4.125%. With due diligence, corporate bonds can provide much healthier yields than other fixed income assets.

2. Lower risk and volatility

Corporate bonds are generally considered safer than stocks by promising regular coupon payments and principal at maturity. In addition, in an event of default, bondholders will be paid first before shareholders as well. As such, bond prices tend to be more stable than stock prices, and act as hedges in investment portfolios.

3. High cash flow visibility

Corporate bonds allow for precise cash flow planning for various stages in life. Whether it is for covering your car loan while making sure you receive your principal back before your child enters university, or simply ensuring enough passive income for a comfortable retirement, fixed income is one of the best ways for achieving predictable cash flows.

4. Secondary market liquidity

When it comes to fixed income products, corporate bonds are one of the most liquid, with secondary market trading. In addition, there are no exit penalties unlike some fixed deposits or endowments with pre-termination clauses. Corporate bond liquidity is based on market forces and readily available buyers and sellers.

Are there different types of bonds?

There are two ways bonds are traded in Singapore, wholesale and retail. Wholesale bonds trade in minimum denominations of S$250,000 and make up the majority of the bond market segments in SGD-denominated bonds. Retail bonds, on the other hand, trade in smaller lot sizes with a minimum of S$1,000.

A key difference between wholesale and retail bonds is that wholesale bonds are traded Over-The-Counter (OTC), while retail bonds are traded on the stock exchange. This means that the retail bond’s prices are affected by market forces of demand and supply, as well as extraneous factors like government policies. Investors familiar with stock trading will understand the mechanics involved in trading retail bonds.

However, the wholesale OTC markets are traded differently. OTC trades are done directly between two parties rather than through an exchange. When assets are traded OTC, the transaction is not recorded on a universal exchange, and the bid and offer quotes made cannot be seen unless a counterparty relationship is established. In other words, more groundwork and networking are in play. This step is where a broker, such as PhillipCapital Bond Desk, fulfils the process for bond investors.

What different structures do bonds have?

The three most common structures of bonds in Singapore are the straight bond, callable bond, and perpetual bond. Understanding their key differences will help you pick the right one for your investment portfolio.

1. Straight/Bullet bonds

The most basic bond is the straight or bullet bond which features a fixed coupon rate over a specified tenor with a specified maturity date when principal is returned. Straight bonds are usually senior in ranking.

2. Callable bonds

Callable bonds are similar to straight bonds; however, they include a call feature that gives the bond issuer the option to redeem the bond at an earlier call date. At times, callable bonds will include a coupon step up provision that will increase the bond’s coupon rate should the issuer opt not to call the bond on the call date. Callable bonds are usually ranked senior as well.

3. Perpetual bonds

Perpetual bonds have no maturity dates, only call dates. As such, they can theoretically last forever if the issuer never calls back the bond and repays the principal. Due to the absence of a maturity date, perpetual bonds are usually accounted as equity in a company’s balance sheet, which brings some benefits in terms of improving gearing ratios. However, these bonds are usually subordinated in ranking and thus will cost the company in terms of higher coupon rates required by bond investors.

How do I invest in wholesale corporate bonds?

Most brokers and bank platforms in Singapore provide access to corporate bonds. However, due to the OTC nature of trading, having strong access to counterparties is key to finding the best platform for your investment needs.

At PhillipCapital Bond Desk, we leverage our global offices’ access to over 70 counterparties for bond price discovery and liquidity. Moreover, we are aware that wholesale bonds, with a minimum $250,000 sizes, are pricey for some investors thereby difficult for the public to invest in. With this in mind, we have launched Bonds50, which trades in lot sizes of S$50,000. The lower price allows you to easily invest in wholesale corporate bonds without locking in a large amount of money, and help to diversify your bond portfolio.

Here is a step-by-step guide to OTC trading of wholesale bonds in Singapore:

1. Opening a trading account

A trading account is required in order to view bond quotes and place bond orders. When deciding on the type of trading account to open, note that a custodian account, where bonds are held with the broker, will provide better ease of trading compared to a Central Depository-linked (CDP) account, where bonds are held in CDP. This is due to the transfer process required if your bonds are held in CDP. If you don’t have one already, you can open a trading account here.

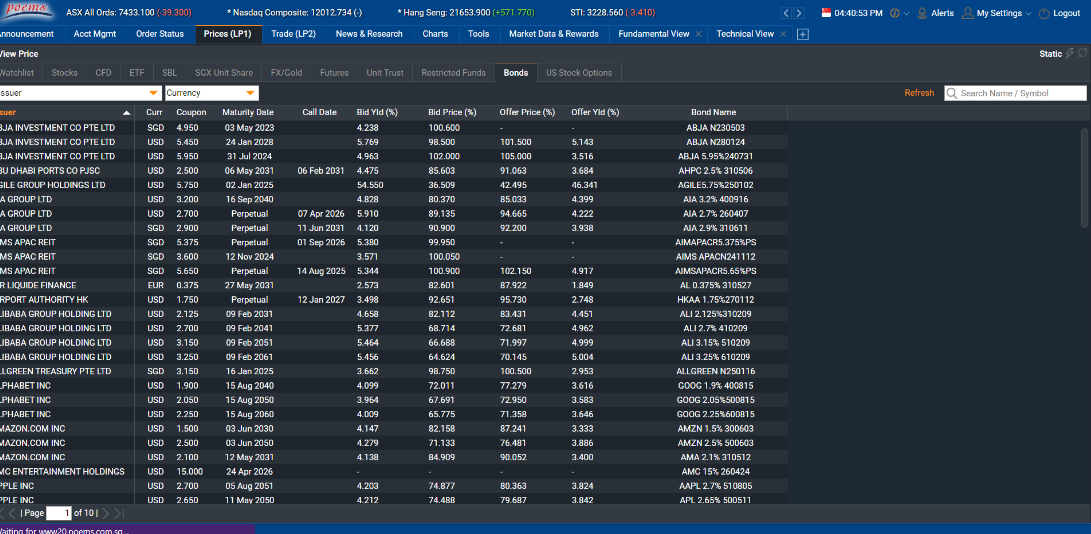

2. Viewing bond quotes

After your account is opened, you can click on the ‘Bonds’ tab on the ribbon at the top of the page. You will now be able to view all bond available and their quotes, on a screen similar to the one below.

3. Placing bond orders

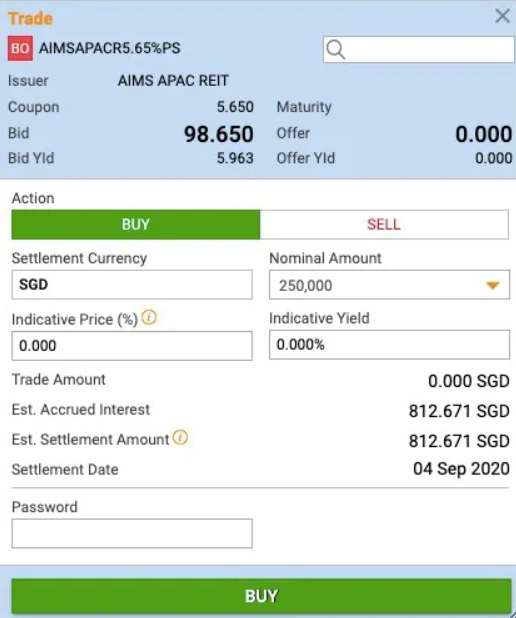

Your bond orders can then be placed online or through a financial adviser representative either as a market order or a limit order indicating a maximum price or minimum yield at your preference, through a window as shown below.

Our bond specialists will then execute the order with our counterparties to find the best buyer or seller based on your order. You will receive a confirmation of your order when it is done, followed by the order settlement.

4. Bond trade settlement

The key thing to note when thinking of bond trade settlement is the accrued interest. Accrued interest is any unpaid interest based on the days to the next coupon payment date that is due from the buyer to the seller of the bond. The seller is never shortchanged of their coupons regardless, unlike stocks which have ex-dividend and cum-dividend dates. When you place your bond order, the accrued interest amount will be indicated to you. Upon settlement, total payment due to purchases will include the accrued interest amount.

Are there risks in investing in corporate bonds?

1. Interest rate risk

Interest rates play a key role in the fixed income market performance. Specifically, bonds underperform during periods of rising interest rates, and outperform when interest rates fall. The technical term for a bond’s price sensitivity to interest rates is called duration risk.

2. Reinvestment risk

When a bond matures or is redeemed earlier than maturity, a replacement bond with similar or better investment returns may not be readily available to reinvest your funds in. As such, reinvestment risk may lead to relatively poorer bond investments in the future, depending on market conditions then.

3. Call risk/non-call risk

If a bond is called/redeemed earlier than maturity, future returns from the bond may be lost as the bond investor may not be able to find an equal or better replacement bond. Conversely, if a callable bond is not called on its first call date, bondholders may be forced to hold the bond with their existing or lower coupon rate for a longer time.

4. Default risk

This is the greatest risk to bondholders where they may lose all of their principal should the liquidation processes yield little cash back in the event of a company default. However, in such circumstances, bondholders can be assured that they are structurally ranked higher than equity holders and will be paid out earlier. Doing your due diligence on the company and consulting financial advisors are great ways to mitigate this risk.

5. Inflation risk

Inflation stands for the rise in prices of goods in the economy, which leads to erosion of the purchasing power of existing cash and of the real returns of investments. This erosion of real returns is particularly emphasised on fixed income assets as returns are fixed and do not compensate for rising inflation.

Bottom Line

We hope that you’ve attained useful information about corporate bonds to help you begin leveraging fixed income for your investment and lifestyle needs.

Should you have any queries, please send them to us at bonds@phillip.com.sg and we’ll get back to you. PhillipCapital Bond Desk is a leading wholesale bond platform in Singapore, offering over 200,000 global bonds in 9 currencies and access to over 70 counterparties. Visit https://bonds.poems.com.sg/ to explore our offerings.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Timothy Ang

Timothy covers fixed income analyses in the Asian bond markets. Starting his career as an equity specialist, he has over 5 years' experience in investments. He believes that value investments are important, always available, and add valuable returns.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It